Revealed on August nineteenth, 2025 by Bob Ciura

Traders within the US shouldn’t overlook Canadian shares, a lot of which have excessive dividend yields than their U.S. counterparts.

There are numerous Canadian dividend shares which have considerably larger yields and decrease valuations than comparable U.S. friends.

The TSX 60 Index is a inventory market index of the 60 largest firms that commerce on the Toronto Inventory Alternate.

As a result of the Canadian inventory market is closely weighted in the direction of massive monetary establishments and vitality firms, the TSX is an affordable benchmark for Canadian equities efficiency. Additionally it is an excellent place to search for funding concepts.

You’ll be able to obtain a database of the businesses inside the TSX 60 (together with related monetary metrics corresponding to dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

The TSX 60 Shares Listing obtainable for obtain above comprises the next info for each safety inside the index:

- Inventory Worth

- Dividend Yield

- Market Capitalization

- Worth-to-Earnings Ratio

The entire monetary information within the database are listed in Canadian {dollars}.

Be aware: Canada imposes a 15% dividend withholding tax on U.S. traders. In lots of instances, investing in Canadian shares by way of a U.S. retirement account waives the dividend withholding tax from Canada, however examine together with your tax preparer or accountant for extra on this problem.

This text will rank the highest 10 Canadian dividend shares within the Positive Evaluation Analysis Database, ranked by their annual anticipated returns over the subsequent 5 years.

Desk of Contents

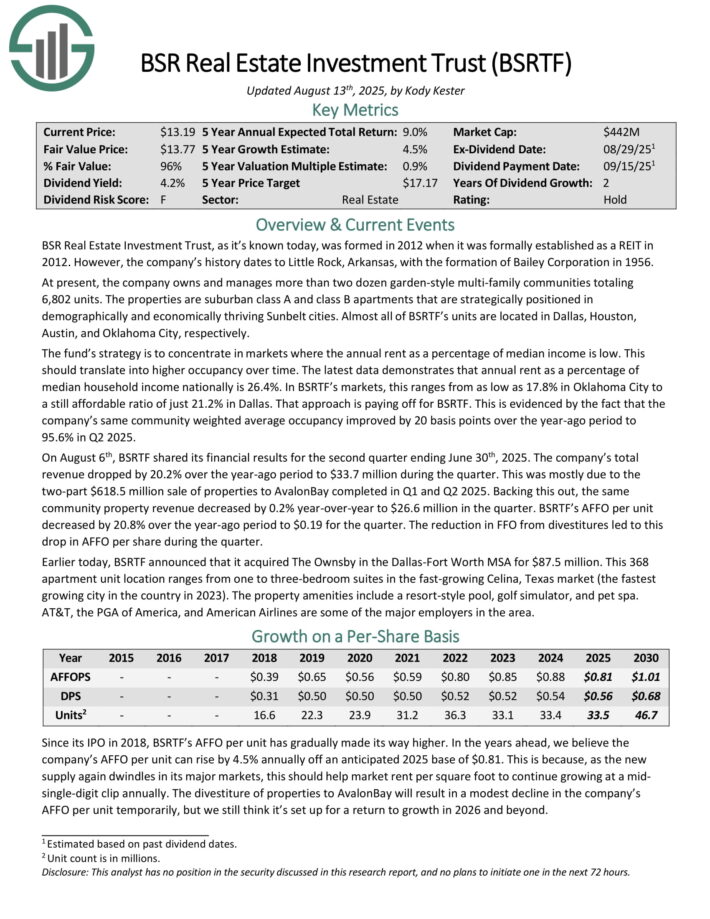

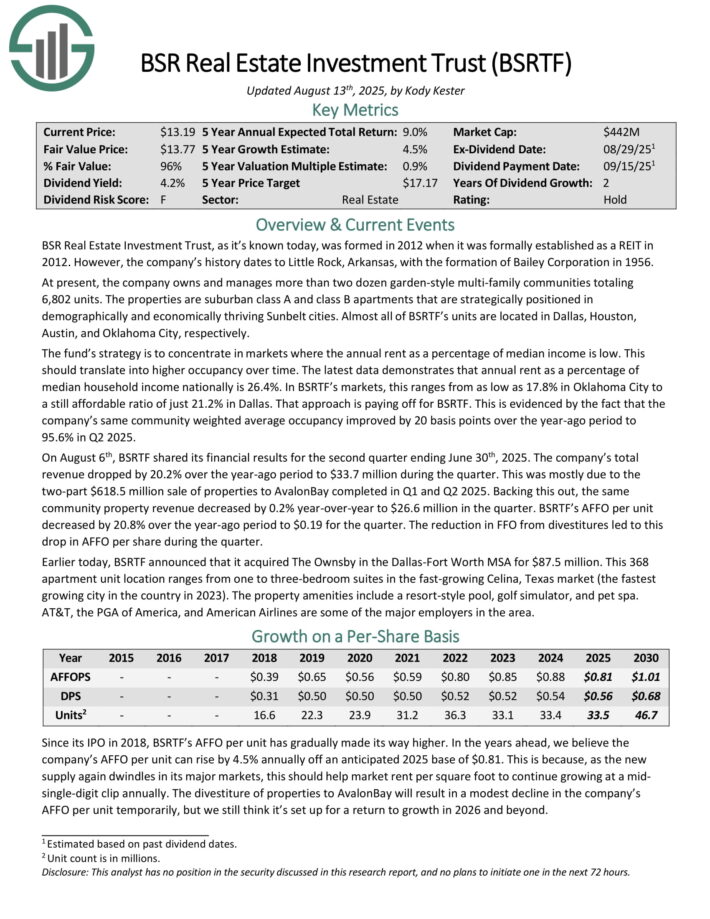

Finest Canadian Dividend Inventory #10: BSR Actual Property Funding Belief (BSRTF)

- Annual Anticipated Returns: 10.6%

BSR Actual Property Funding Belief, because it’s identified at the moment, was fashioned in 2012 when it was formally established as a REIT in 2012. At current, the corporate owns and manages greater than two dozen garden-style multi-family communities totaling 6,802 models.

The properties are suburban class A and sophistication B flats which might be strategically positioned in demographically and economically thriving Sunbelt cities. Nearly all of BSRTF’s models are positioned in Dallas, Houston, Austin, and Oklahoma Metropolis, respectively.

On August sixth, BSRTF shared its monetary outcomes for the second quarter ending June thirtieth, 2025. The corporate’s whole income dropped by 20.2% over the year-ago interval to $33.7 million in the course of the quarter. This was principally because of the two-part $618.5 million sale of properties to AvalonBay accomplished in Q1 and Q2 2025.

Backing this out, the identical group property income decreased by 0.2% year-over-year to $26.6 million within the quarter. BSRTF’s AFFO per unit decreased by 20.8% over the year-ago interval to $0.19 for the quarter. The discount in FFO from divestitures led to this drop in AFFO per share in the course of the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on BSRTF (preview of web page 1 of three proven under):

Finest Canadian Dividend Inventory #9: Solar Life Monetary (SLF)

- Annual Anticipated Returns: 10.6%

Solar Life Monetary is a monetary companies firm that provides insurances, wealth administration, group advantages and retirement companies. Solar Life Monetary has divisions that function within the US, in Canada, and in Asia. Solar Life Monetary was based in 1865, is headquartered in Toronto, Canada.

Solar Life Monetary reported its first quarter earnings ends in Could. Solar Life insurance coverage gross sales between the Group and Particular person franchises grew by 13% in comparison with one 12 months earlier, with particular person gross sales rising by 15% whereas group gross sales rose by 10%. Solar Life Monetary’s property below administration grew by 6% in comparison with one 12 months earlier.

Solar Life Monetary generated underlying internet income of CAD$1.82 on a per-share foundation in the course of the first quarter, which equates to $1.33 as soon as translated to USD. This earnings-per-share outcome was up by double-digits in comparison with the prior 12 months’s outcome.

Solar Life Monetary managed to generate an underlying return on fairness of 18% (annualized) in the course of the quarter, which was up barely in comparison with the earlier quarter. Solar Life Monetary generated earnings-per-share development of 5% in Canadian {Dollars} in fiscal 2024 (much less in US {Dollars}).

Click on right here to obtain our most up-to-date Positive Evaluation report on SLF (preview of web page 1 of three proven under):

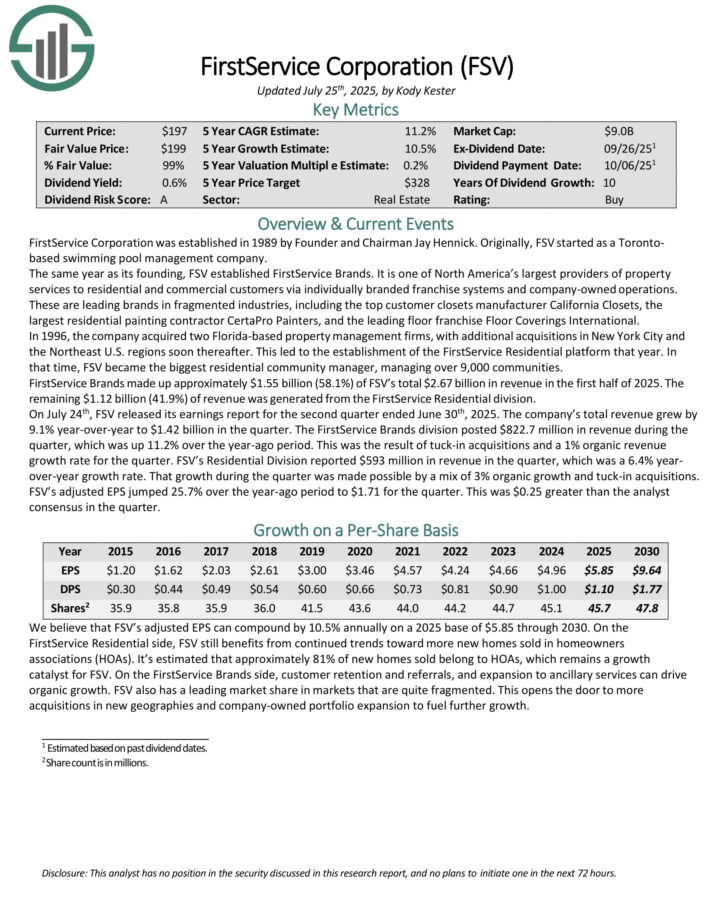

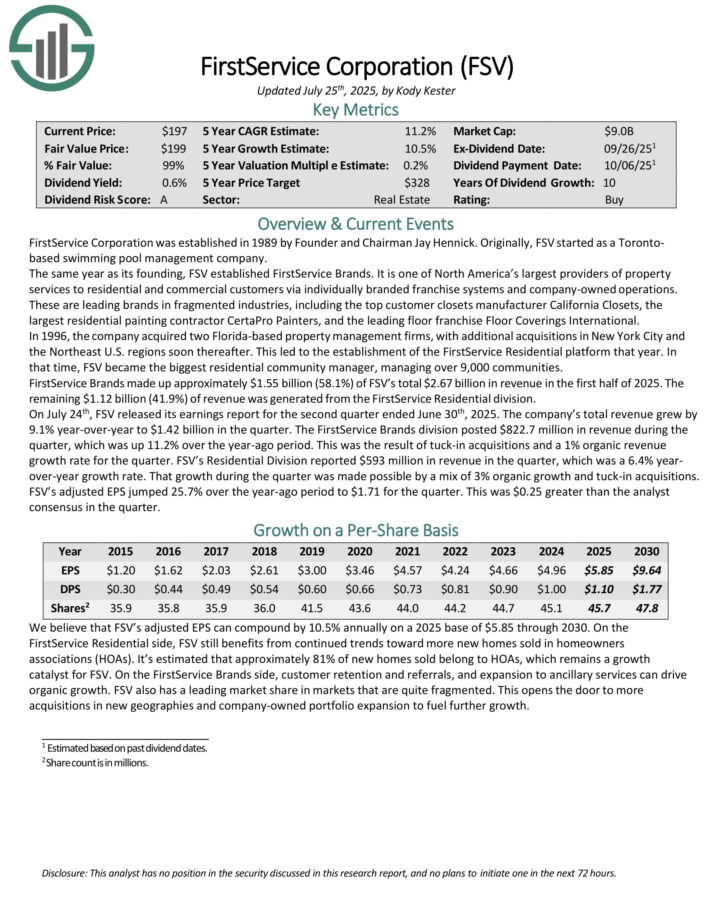

Finest Canadian Dividend Inventory #8: FirstService Corp. (FSV)

- Annual Anticipated Returns: 11.1%

FirstService Company is considered one of North America’s largest suppliers of property companies to residential and industrial clients by way of individually branded franchise methods and company-owned operations.

These are main manufacturers in fragmented industries, together with the highest buyer closets producer California Closets, the most important residential portray contractor CertaPro Painters, and the main flooring franchise Ground Coverings Worldwide.

FirstService Manufacturers made up roughly $1.55 billion (58.1%) of FSV’s whole $2.67 billion in income within the first half of 2025. The remaining $1.12 billion (41.9%) of income was generated from the FirstService Residential division.

On July twenty fourth, FSV launched its earnings report for the second quarter ended June thirtieth, 2025. The corporate’s whole income grew by 9.1% year-over-year to $1.42 billion within the quarter. The FirstService Manufacturers division posted $822.7 million in income in the course of the quarter, which was up 11.2% over the year-ago interval.

This was the results of tuck-in acquisitions and a 1% natural income development price for the quarter. FSV’s Residential Division reported $593 million in income within the quarter, which was a 6.4% year-over-year development price.

That development in the course of the quarter was made attainable by a mixture of 3% natural development and tuck-in acquisitions. FSV’s adjusted EPS jumped 25.7% over the year-ago interval to $1.71 for the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on FSV (preview of web page 1 of three proven under):

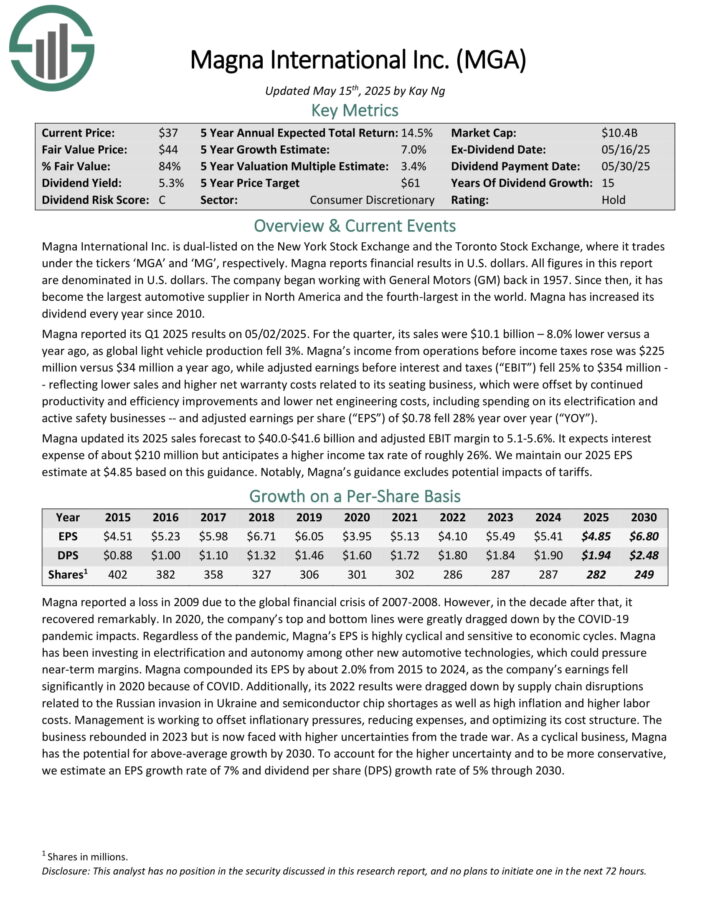

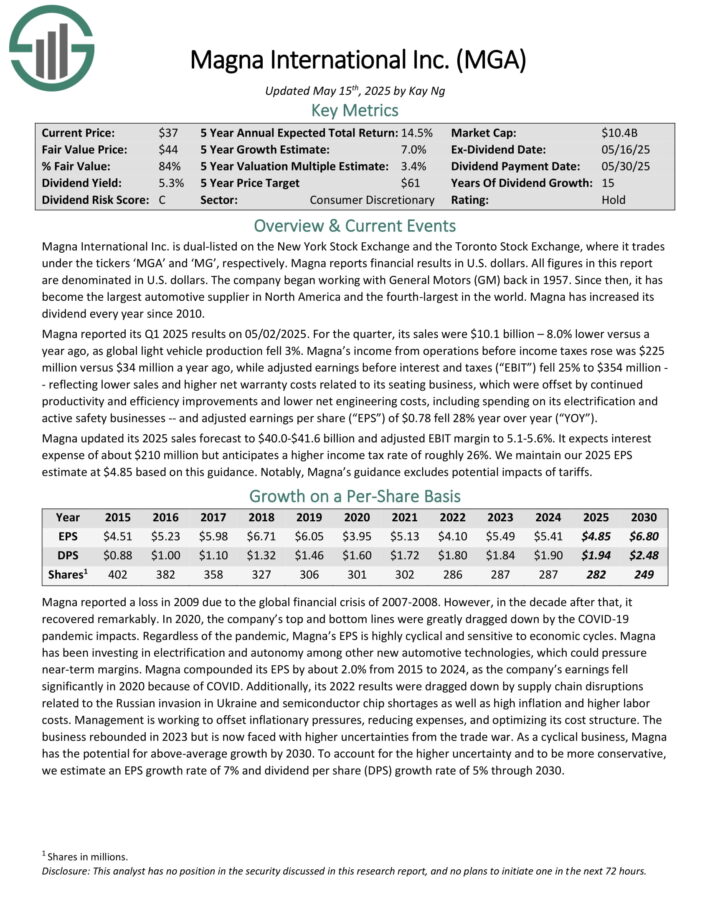

Finest Canadian Dividend Inventory #7: Magna Worldwide Inc. (MGA)

- Annual Anticipated Returns: 11.5%

Magna Worldwide Inc. is dual-listed on the New York Inventory Alternate and the Toronto Inventory Alternate, the place it trades below the tickers ‘MGA’ and ‘MG’, respectively.

It has turn out to be the most important automotive provider in North America and the fourth-largest on the earth. Magna has elevated its dividend yearly since 2010.

Magna reported its Q1 2025 outcomes on 05/02/2025. For the quarter, its gross sales had been $10.1 billion – 8.0% decrease versus a 12 months in the past, as world gentle automobile manufacturing fell 3%. Magna’s revenue from operations earlier than revenue taxes rose was $225 million versus $34 million a 12 months in the past.

Adjusted earnings earlier than curiosity and taxes (“EBIT”) fell 25% to $354 million — reflecting decrease gross sales and better internet guarantee prices associated to its seating enterprise, which had been offset by continued productiveness and effectivity enhancements and decrease internet engineering prices, together with spending on its electrification and energetic security companies.

Adjusted earnings per share of $0.78 fell 28% year-over-year. Magna up to date its 2025 gross sales forecast to $40.0-$41.6 billion and adjusted EBIT margin to five.1-5.6%.

Click on right here to obtain our most up-to-date Positive Evaluation report on MGA (preview of web page 1 of three proven under):

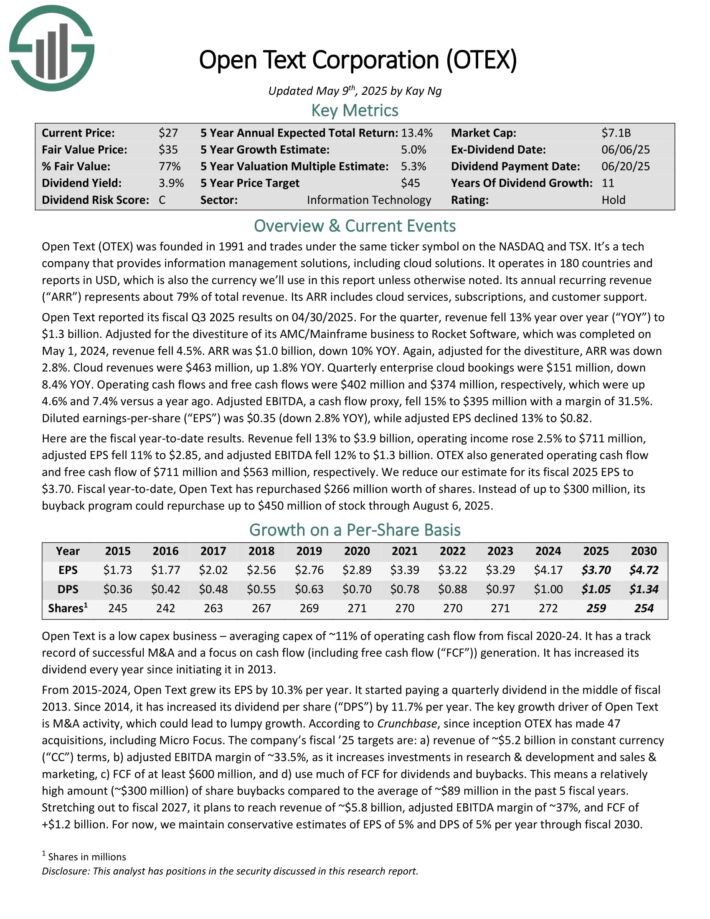

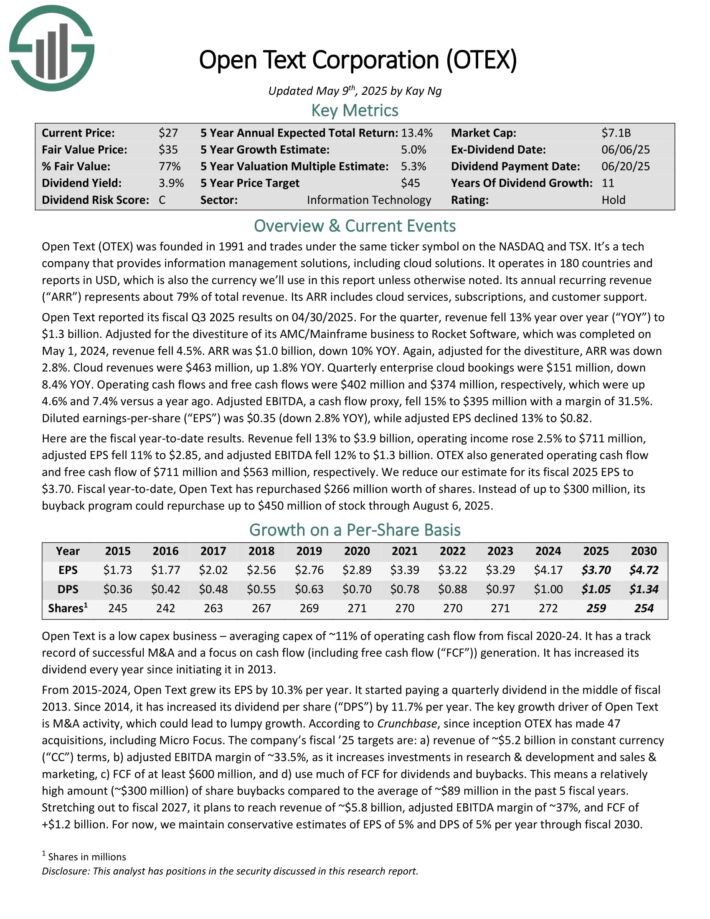

Finest Canadian Dividend Inventory #6: Open Textual content Corp. (OTEX)

- Annual Anticipated Returns: 11.5%

Open Textual content was based in 1991. It gives info administration options, together with cloud options. It operates in 180 international locations and its annual recurring income (“ARR”) represents about 79% of whole income.

Its ARR consists of cloud companies, subscriptions, and buyer assist. Open Textual content reported its fiscal Q3 2025 outcomes on 04/30/2025. For the quarter, income fell 13% year-over-year to $1.3 billion. Adjusted for the divestiture of its AMC/Mainframe enterprise to Rocket Software program, which was accomplished on Could 1, 2024, income fell 4.5%.

ARR was $1.0 billion, down 10% year-over-year. Once more, adjusted for the divestiture, ARR was down 2.8%. Cloud revenues had been $463 million, up 1.8% year-over-year.

Working money flows and free money flows had been $402 million and $374 million, respectively, which had been up 4.6% and seven.4% versus a 12 months in the past. Adjusted EBITDA, a money circulate proxy, fell 15% to $395 million with a margin of 31.5%.

OTEX additionally generated working money circulate and free money circulate of $711 million and $563 million, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on OTEX (preview of web page 1 of three proven under):

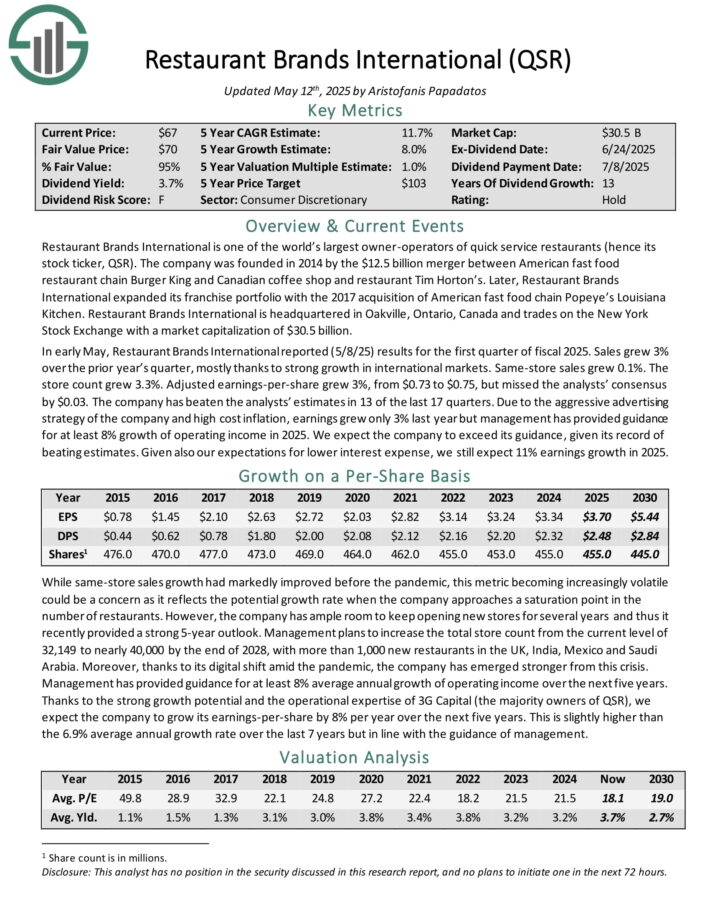

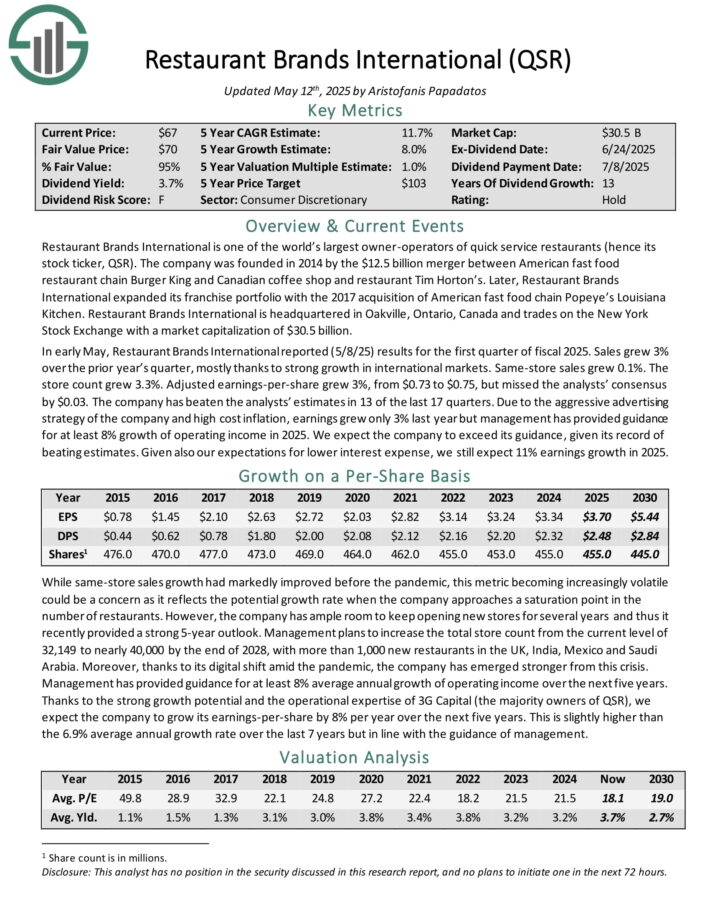

Finest Canadian Dividend Inventory #5: Restaurant Manufacturers Worldwide (QSR)

- Annual Anticipated Returns: 12.1%

Restaurant Manufacturers Worldwide is among the world’s largest owner-operators of fast service eating places. The corporate was based in 2014 by the $12.5 billion merger between American quick meals restaurant chain Burger King and Canadian espresso store and restaurant Tim Horton’s.

Later, Restaurant Manufacturers Worldwide expanded its franchise portfolio with the 2017 acquisition of American quick meals chain Popeye’s Louisiana Kitchen.

In early Could, Restaurant Manufacturers Worldwide reported (5/8/25) outcomes for the primary quarter of fiscal 2025. Gross sales grew 3% over the prior 12 months’s quarter, principally because of sturdy development in worldwide markets. Identical-store gross sales grew 0.1%.

The shop rely grew 3.3%. Adjusted earnings-per-share grew 3%, from $0.73 to $0.75, however missed the analysts’ consensus by $0.03. The corporate has crushed the analysts’ estimates in 13 of the final 17 quarters.

Because of the aggressive promoting technique of the corporate and excessive value inflation, earnings grew solely 3% final 12 months however administration has supplied steering for at the least 8% development of working revenue in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on QSR (preview of web page 1 of three proven under):

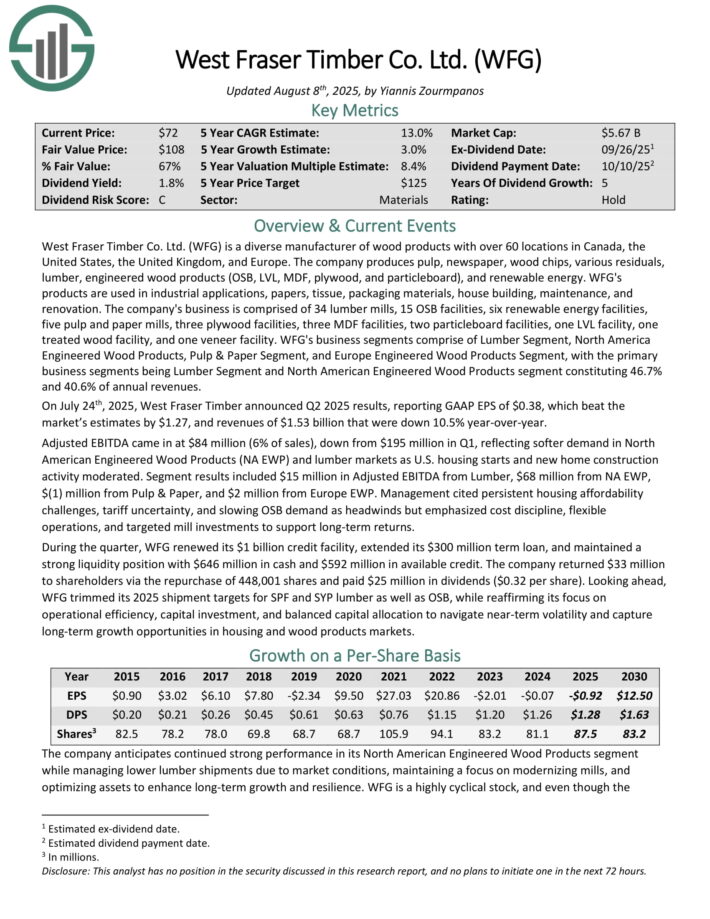

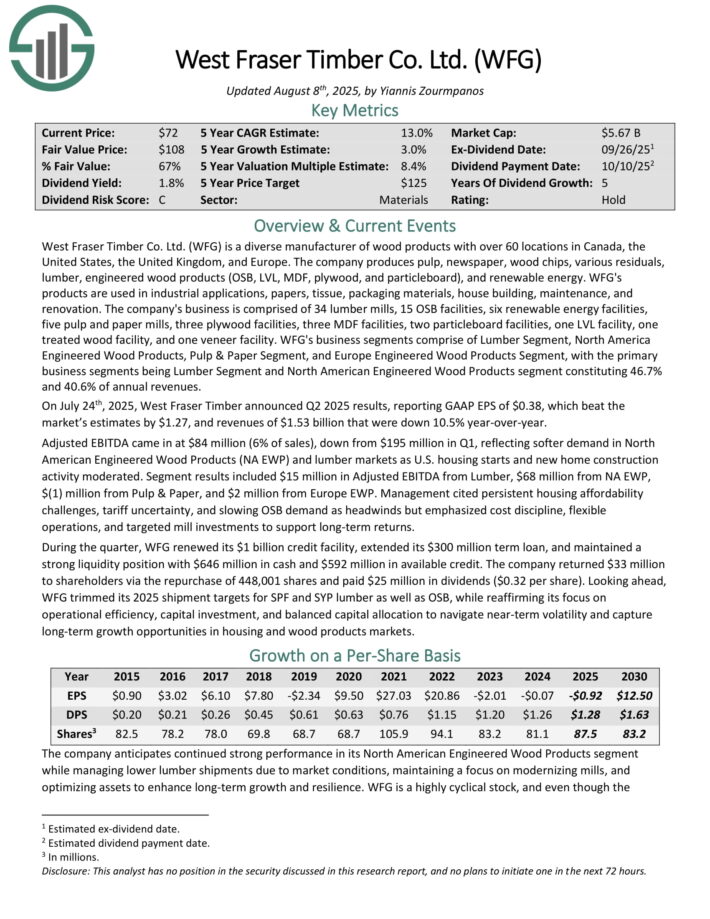

Finest Canadian Dividend Inventory #4: West Fraser Timber Co. (WFG)

- Annual Anticipated Returns: 12.5%

West Fraser Timber is a various producer of wooden merchandise with over 60 places in Canada, the USA, the UK, and Europe. The corporate produces pulp, newspaper, wooden chips, numerous residuals, lumber, engineered wooden merchandise (OSB, LVL, MDF, plywood, and particleboard), and renewable vitality.

WFG’s merchandise are utilized in industrial functions, papers, tissue, packaging supplies, home constructing, upkeep, and renovation.

WFG’s enterprise segments comprise of Lumber Phase, North America Engineered Wooden Merchandise, Pulp & Paper Phase, and Europe Engineered Wooden Merchandise Phase, with the first enterprise segments being Lumber Phase and North American Engineered Wooden Merchandise section constituting 46.7% and 40.6% of annual revenues.

On July twenty fourth, 2025, West Fraser Timber introduced Q2 2025 outcomes, reporting GAAP EPS of $0.38, which beat the market’s estimates by $1.27, and revenues of $1.53 billion that had been down 10.5% year-over-year.

Adjusted EBITDA got here in at $84 million (6% of gross sales), down from $195 million in Q1, reflecting softer demand in North American Engineered Wooden Merchandise (NA EWP) and lumber markets as U.S. housing begins and new dwelling building exercise moderated.

Click on right here to obtain our most up-to-date Positive Evaluation report on WFG (preview of web page 1 of three proven under):

Finest Canadian Dividend Inventory #3: TFI Worldwide Inc. (TFII)

- Annual Anticipated Returns: 14.9%

TFI Worldwide Inc. is a number one North American transportation and logistics firm. The Canada-based firm’s 95-plus working firms and over 26,000 workers present a wide range of transportation and logistics companies to clients.

TFII’s clients function principally within the retail, manufactured items, automotive, constructing supplies, meals and beverage, metals and mining, and companies industries.

Roughly two-thirds of the corporate’s income is generated within the U.S., with the remaining third of income being derived in Canada.

TFII is organized into the next three working segments. The Much less-Than-Truckload section gives over-the-road and asset-light intermodal LTL companies. By way of the primary half of 2025, LTL accounted for the plurality (~41%) of the corporate’s $3.5 billion in whole income earlier than gasoline surcharges.

The Truckload section affords flatbed, tank, and container companies to clients. The section additionally carries full masses from the client to the vacation spot utilizing a closed van or specialised gear.

Lastly, the Logistics section gives asset-light logistics companies, corresponding to freight forwarding, transportation administration, and small bundle parcel supply.

On July twenty eighth, TFII shared its earnings report for the second quarter ended June thirtieth, 2025. The corporate’s whole income decreased by 10% over the year-ago interval to $2.04 billion within the quarter. This was because of diminished volumes stemming from weaker end-market demand in the course of the quarter.

TFII’s adjusted diluted EPS dropped by 21.6% year-over-year to $1.34 for the quarter. That beat the analyst consensus by $0.11 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on TFII (preview of web page 1 of three proven under):

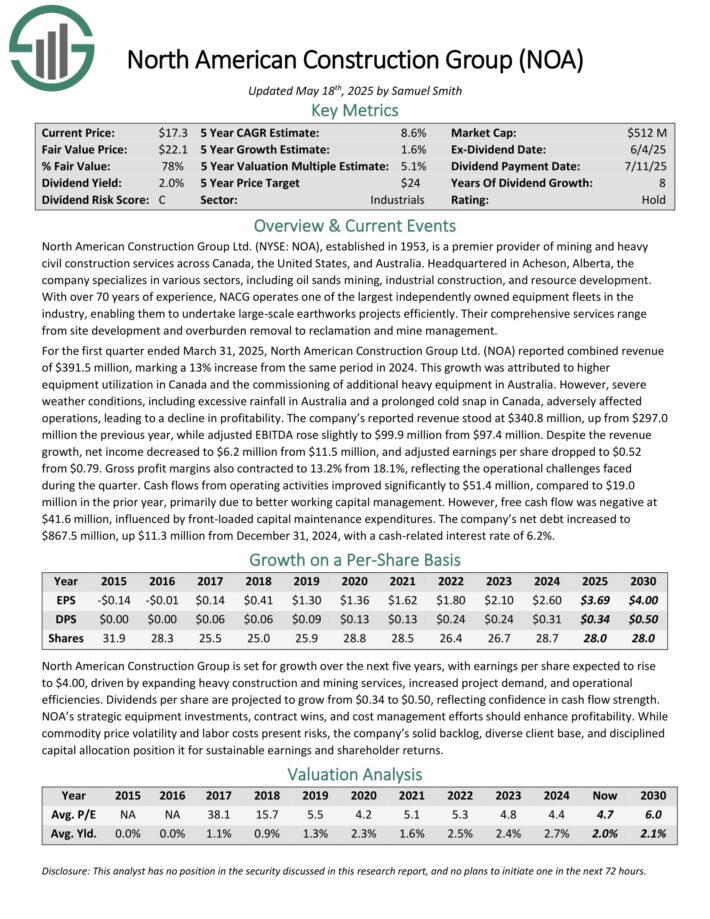

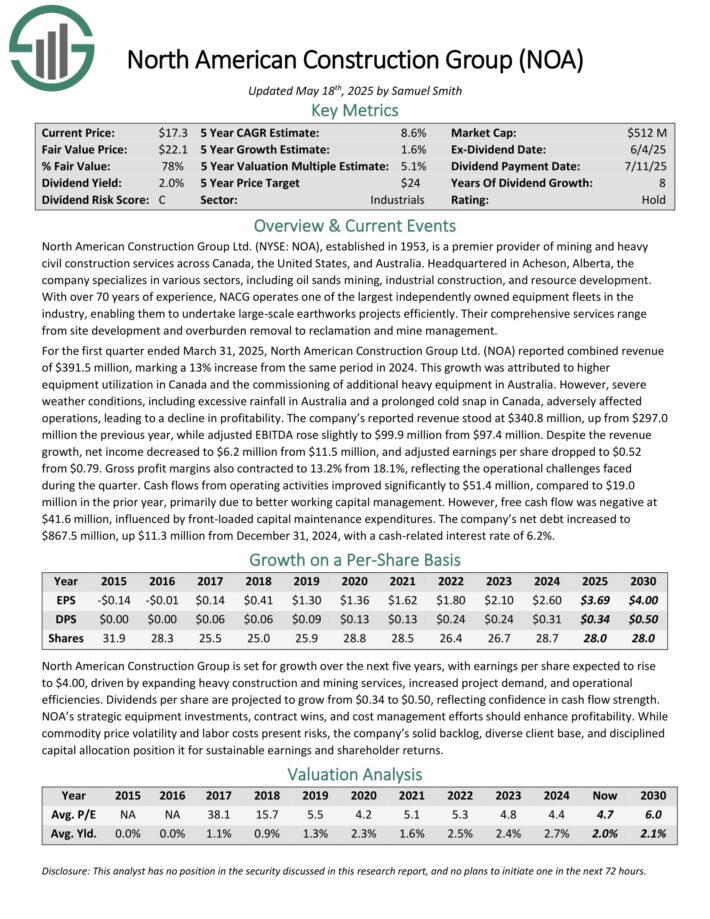

Finest Canadian Dividend Inventory #2: North American Development Group (NOA)

- Annual Anticipated Returns: 15.8%

North American Development Group, established in 1953, is a premier supplier of mining and heavy civil building companies throughout Canada, the USA, and Australia. Headquartered in Acheson, Alberta, the corporate makes a speciality of numerous sectors, together with oil sands mining, industrial building, and useful resource growth.

For the primary quarter ended March 31, 2025, North American Development Group reported mixed income of $391.5 million, marking a 13% improve from the identical interval in 2024. This development was attributed to larger gear utilization in Canada and the commissioning of extra heavy gear in Australia.

The corporate’s reported income stood at $340.8 million, up from $297.0 million the earlier 12 months, whereas adjusted EBITDA rose barely to $99.9 million from $97.4 million. Regardless of the income development, internet revenue decreased to $6.2 million from $11.5 million, and adjusted earnings per share dropped to $0.52 from $0.79.

Gross revenue margins additionally contracted to 13.2% from 18.1%, reflecting the operational challenges confronted in the course of the quarter. Money flows from working actions improved considerably to $51.4 million, in comparison with $19.0 million within the prior 12 months, primarily because of higher working capital administration.

Click on right here to obtain our most up-to-date Positive Evaluation report on NOA (preview of web page 1 of three proven under):

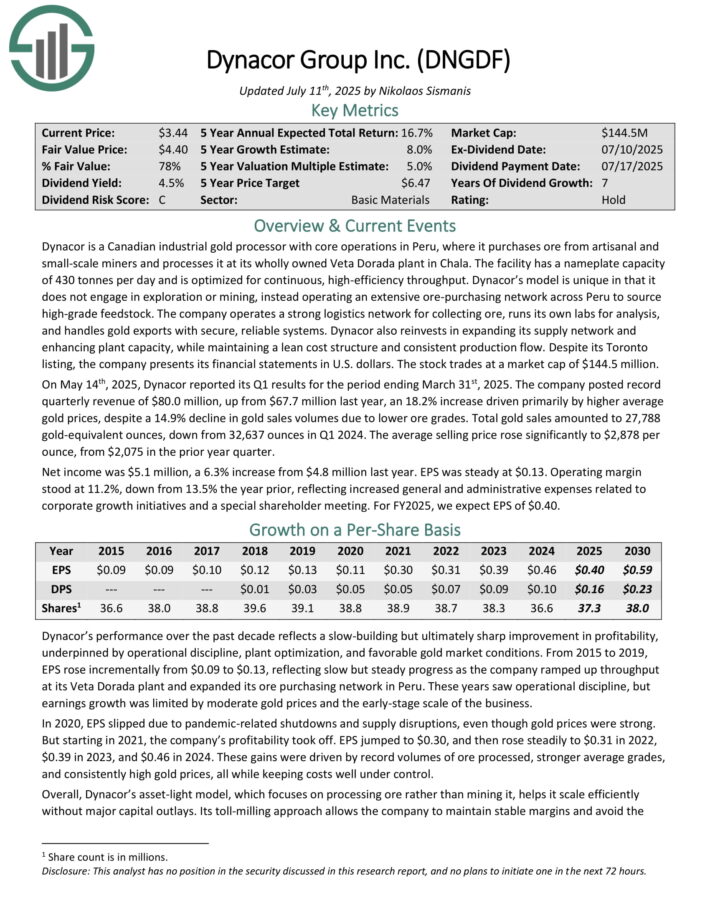

Finest Canadian Dividend Inventory #1: Dynacor Group Inc. (DNGDF)

- Annual Anticipated Returns: 16.6%

Dynacor is a Canadian industrial gold processor with core operations in Peru, the place it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The ability has a nameplate capability of 430 tonnes per day and is optimized for steady, high-efficiency throughput.

Dynacor’s mannequin is exclusive in that it doesn’t interact in exploration or mining, as a substitute working an intensive ore buying community throughout Peru to supply high-grade feedstock.

The corporate operates a powerful logistics community for accumulating ore, runs its personal labs for evaluation, and handles gold exports with safe, dependable methods.

Dynacor additionally reinvests in increasing its provide community and enhancing plant capability, whereas sustaining a lean value construction and constant manufacturing circulate. Regardless of its Toronto itemizing, the corporate presents its monetary statements in U.S. {dollars}.

On Could 14th, 2025, Dynacor reported its Q1 outcomes for the interval ending March thirty first, 2025. The corporate posted file quarterly income of $80.0 million, up from $67.7 million final 12 months, an 18.2% improve pushed primarily by larger common gold costs, regardless of a 14.9% decline in gold gross sales volumes because of decrease ore grades.

Complete gold gross sales amounted to 27,788 gold-equivalent ounces, down from 32,637 ounces in Q1 2024. The typical promoting worth rose considerably to $2,878 per ounce, from $2,075 within the prior 12 months quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on DNGDF (preview of web page 1 of three proven under):

Further Studying

If you’re excited about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets can be helpful:

Canadian Dividend Shares

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].