Printed on February seventeenth, 2026 by Bob Ciura

Passive earnings shares allow you to construct rising earnings for retirement and/or monetary freedom.

Passive earnings shares are supposed to be bought as soon as and by no means bought.

The fantastic thing about incomes passive earnings is that it permits buyers to generate earnings for doing virtually nothing.

The common dividend yield within the S&P 500 Index stays low at simply 1.1%.

Consequently, earnings buyers ought to give attention to higher-yielding securities, if they need extra earnings from their inventory portfolios.

With this in thoughts, we compiled an inventory of excessive dividend shares with dividend yields above 5%. You may obtain your free copy of the excessive dividend shares checklist by clicking on the hyperlink under:

This text will talk about 10 passive earnings shares with present yields over 6%.

Importantly, these 10 shares have sturdy aggressive benefits and robust underlying earnings, which assist their dividends.

These 10 passive earnings shares even have dividend payout ratios at or under 70%, which signifies a sustainable dividend proper now.

The checklist additionally excludes shares with a Dividend Danger rating of ‘F’ within the Certain Evaluation Analysis Database.

The ten passive earnings shares are listed under by present dividend yield, from lowest to highest.

Desk of Contents

You may immediately soar to any particular part of the article by utilizing the hyperlinks under:

Passive Earnings Inventory #10: Hormel Meals (HRL)

Hormel Meals was based in 1891 in Minnesota. Since that point, the corporate has grown right into a $13 billion market capitalization juggernaut within the meals merchandise trade with about $12 billion in annual income.

Hormel has stored its core competency as a processor of meat merchandise for effectively over 100 years however has additionally grown into different enterprise traces by means of acquisitions.

The corporate sells its merchandise in 80 nations worldwide, and its manufacturers embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

As well as, Hormel is a member of the Dividend Kings, having elevated its dividend for 60 consecutive years.

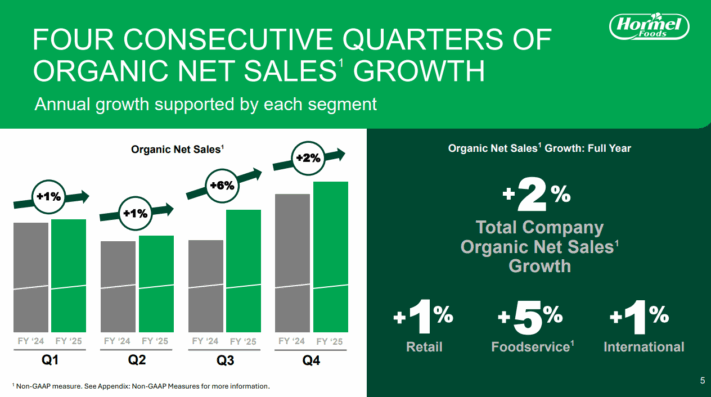

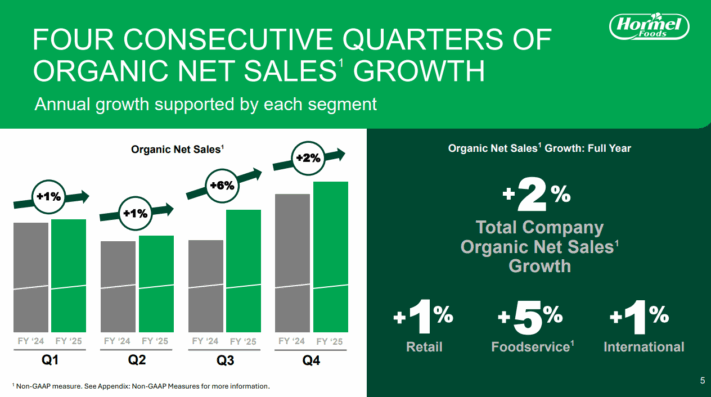

Hormel posted fourth quarter and full-year earnings on December 4th, 2025.

Supply: Investor Presentation

The corporate noticed 32 cents in adjusted earnings-per-share for the quarter, beating estimates by two cents. Income was up 1.6% year-over-year and missed estimates by $30 million, coming in at $3.19 billion.

Adjusted working margin was 7.7% of income, whereas money stream from operations was $323 million. Volumes within the fourth quarter have been flat within the retail section, down 5% in foodservice, and down 7% within the worldwide section.

Hormel raised its dividend for the sixtieth consecutive yr, this time including 0.9% to a brand new payout of $1.20 per share yearly. We begin 2026 with an estimate of $1.47 in adjusted earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven under):

Passive Earnings Inventory #9: United Bancorp (UBCP)

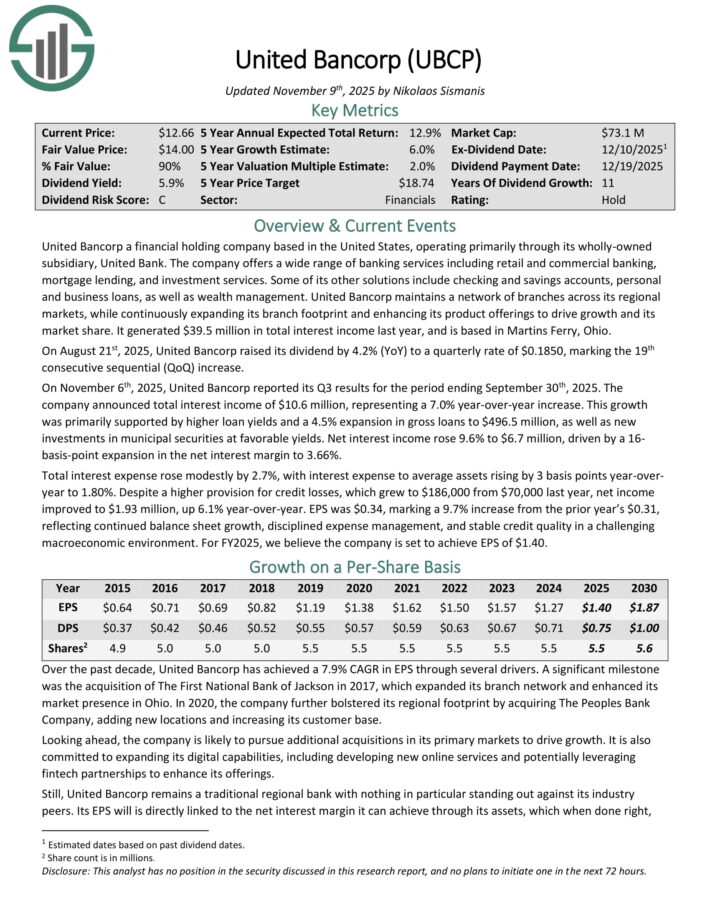

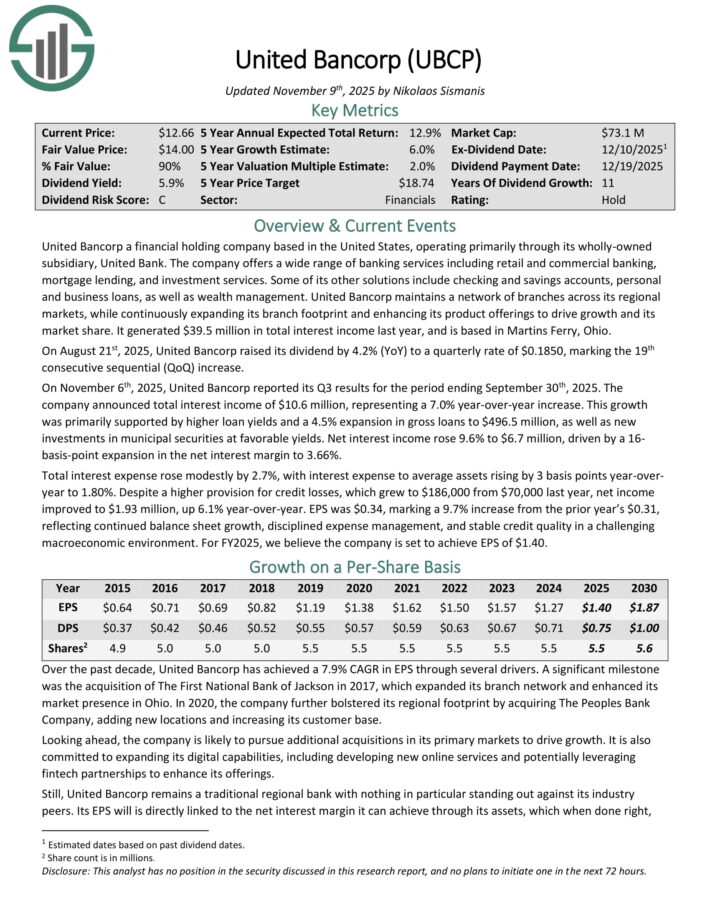

United Bancorp a monetary holding firm based mostly in the USA, working primarily by means of its wholly-owned subsidiary, United Financial institution.

The corporate gives a variety of banking companies together with retail and industrial banking, mortgage lending, and funding companies.

On August twenty first, 2025, United Bancorp raised its dividend by 4.2% (YoY) to a quarterly fee of $0.1850, marking the nineteenth consecutive sequential (QoQ) enhance.

On November sixth, 2025, United Bancorp reported its Q3 outcomes for the interval ending September thirtieth, 2025. The corporate introduced whole curiosity earnings of $10.6 million, representing a 7.0% year-over-year enhance.

This progress was primarily supported by greater mortgage yields and a 4.5% enlargement in gross loans to $496.5 million, in addition to new investments in municipal securities at favorable yields.

Internet curiosity earnings rose 9.6% to $6.7 million, pushed by a 16-basis-point enlargement within the web curiosity margin to three.66%.

EPS was $0.34, marking a 9.7% enhance from the prior yr’s $0.31, reflecting continued steadiness sheet progress, disciplined expense administration, and secure credit score high quality in a difficult macroeconomic atmosphere.

Click on right here to obtain our most up-to-date Certain Evaluation report on UBCP (preview of web page 1 of three proven under):

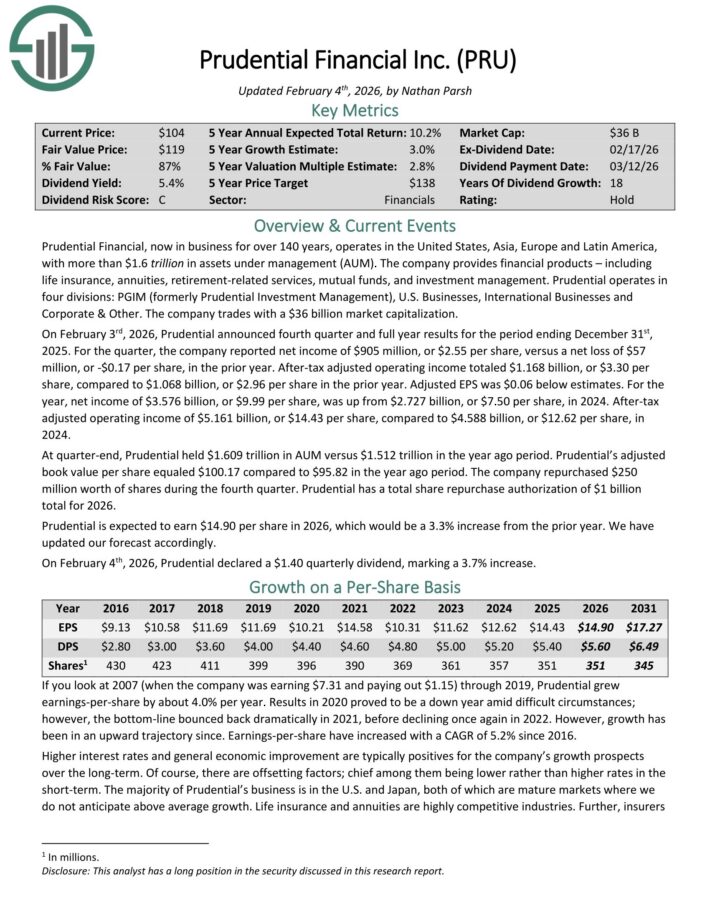

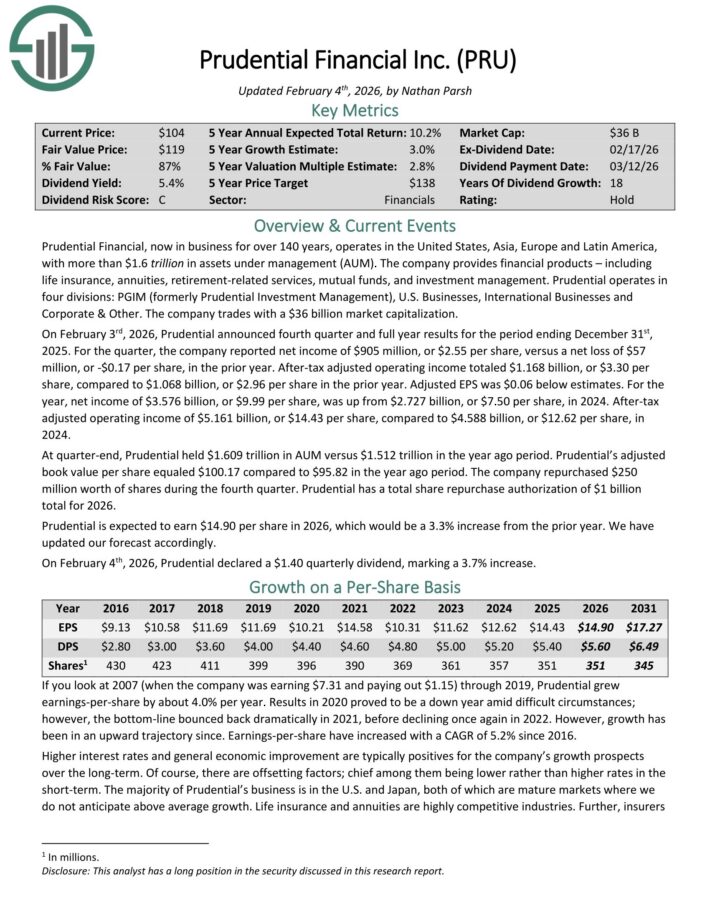

Passive Earnings Inventory #8: Prudential Monetary (PRU)

Prudential Monetary, now in enterprise for over 140 years, operates in the USA, Asia, Europe and Latin America, with greater than $1.6 trillion in property below administration (AUM).

The corporate supplies monetary merchandise – together with life insurance coverage, annuities, retirement-related companies, mutual funds, and funding administration.

Prudential operates in 4 divisions: PGIM (previously Prudential Funding Administration), U.S. Companies, Worldwide Companies and Company & Different.

On February third, 2026, Prudential introduced fourth quarter and full yr outcomes. For the quarter, the corporate reported web earnings of $905 million, or $2.55 per share, versus a web lack of $57 million, or -$0.17 per share, within the prior yr.

After-tax adjusted working earnings totaled $1.168 billion, or $3.30 per share, in comparison with $1.068 billion, or $2.96 per share within the prior yr. Adjusted EPS was $0.06 under estimates.

For the yr, web earnings of $3.576 billion, or $9.99 per share, was up from $2.727 billion, or $7.50 per share, in 2024. Prudential is anticipated to earn $14.90 per share in 2026, which might be a 3.3% enhance from the prior yr.

On February 4th, 2026, Prudential declared a $1.40 quarterly dividend, marking a 3.7% enhance.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRU (preview of web page 1 of three proven under):

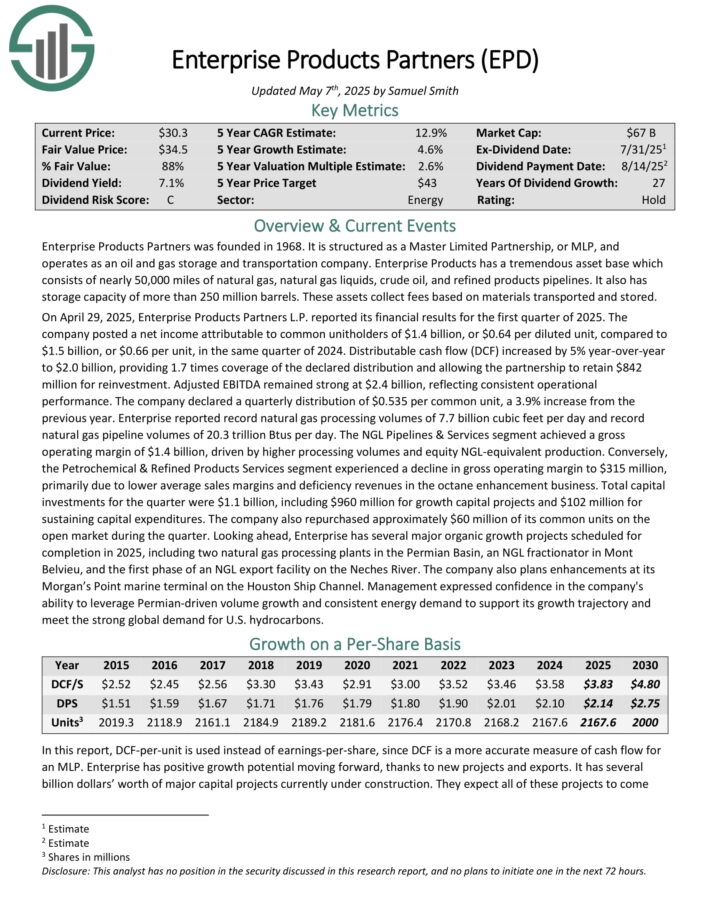

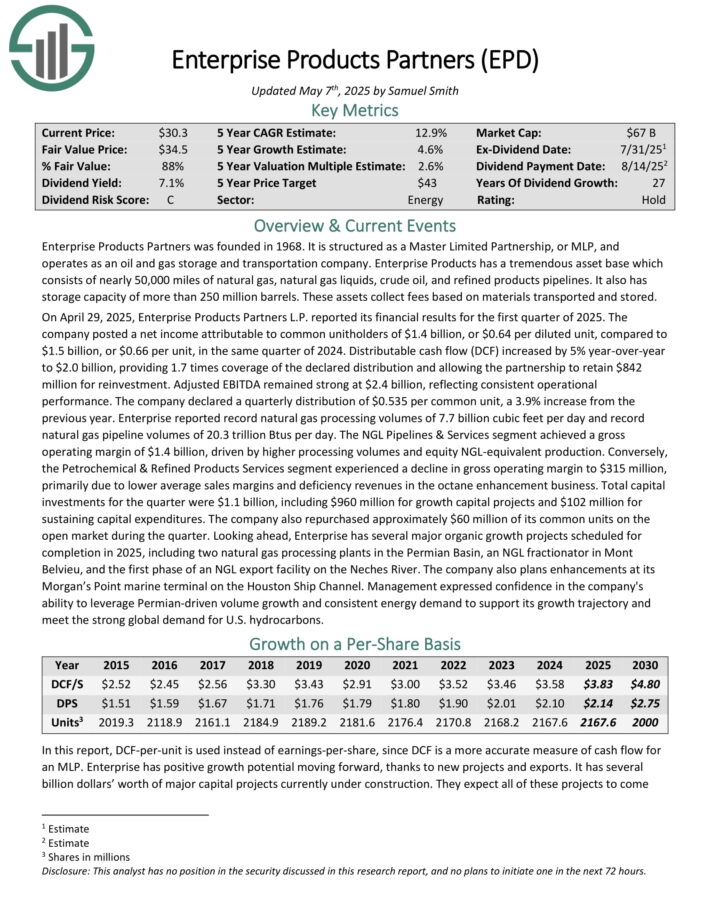

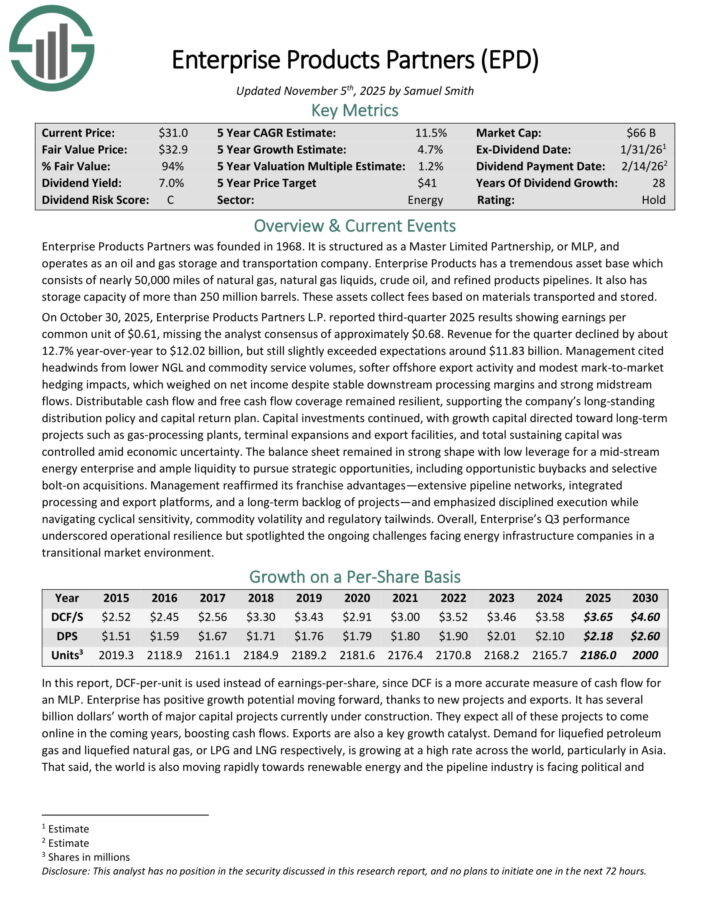

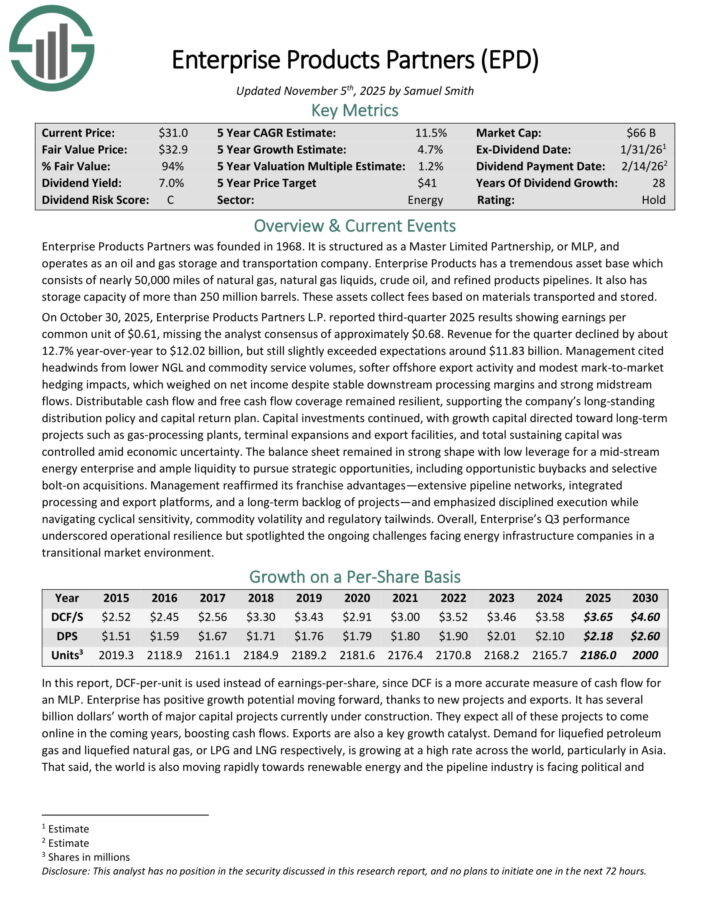

Passive Earnings Inventory #7: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property accumulate charges based mostly on volumes of supplies transported and saved.

Supply: Investor Presentation

On April 29, 2025, Enterprise Merchandise Companions L.P. reported its monetary outcomes for the primary quarter of 2025. The corporate posted a web earnings attributable to frequent unitholders of $1.4 billion, or $0.64 per diluted unit, in comparison with $1.5 billion, or $0.66 per unit, in the identical quarter of 2024.

Distributable money stream (DCF) elevated by 5% year-over-year to $2.0 billion, offering 1.7 occasions protection of the declared distribution and permitting the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained sturdy at $2.4 billion, reflecting constant operational efficiency. The corporate declared a quarterly distribution of $0.535 per frequent unit, a 3.9% enhance from the earlier yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPD (preview of web page 1 of three proven under):

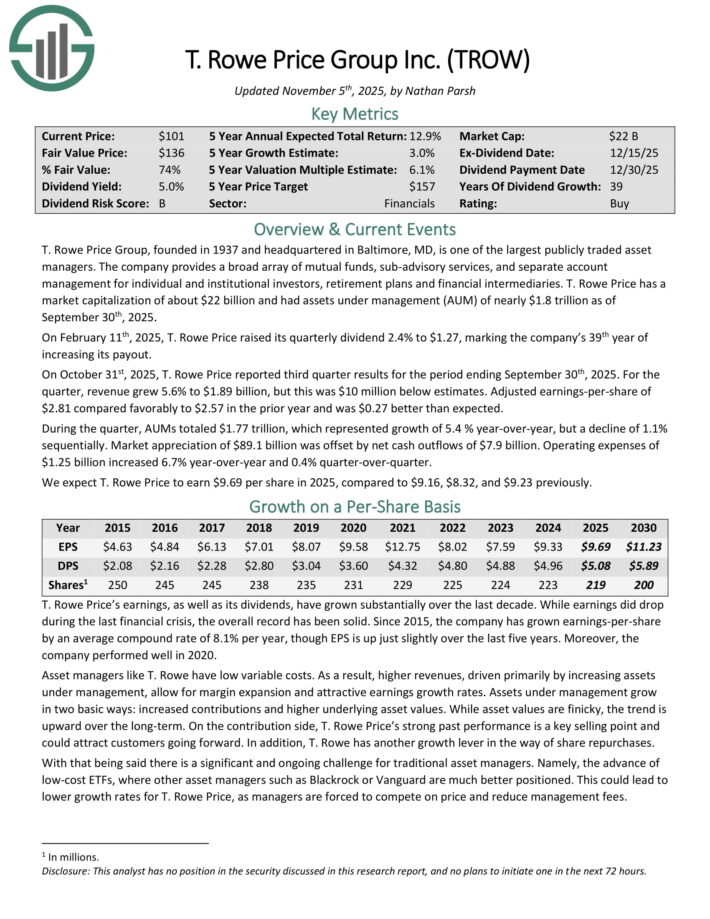

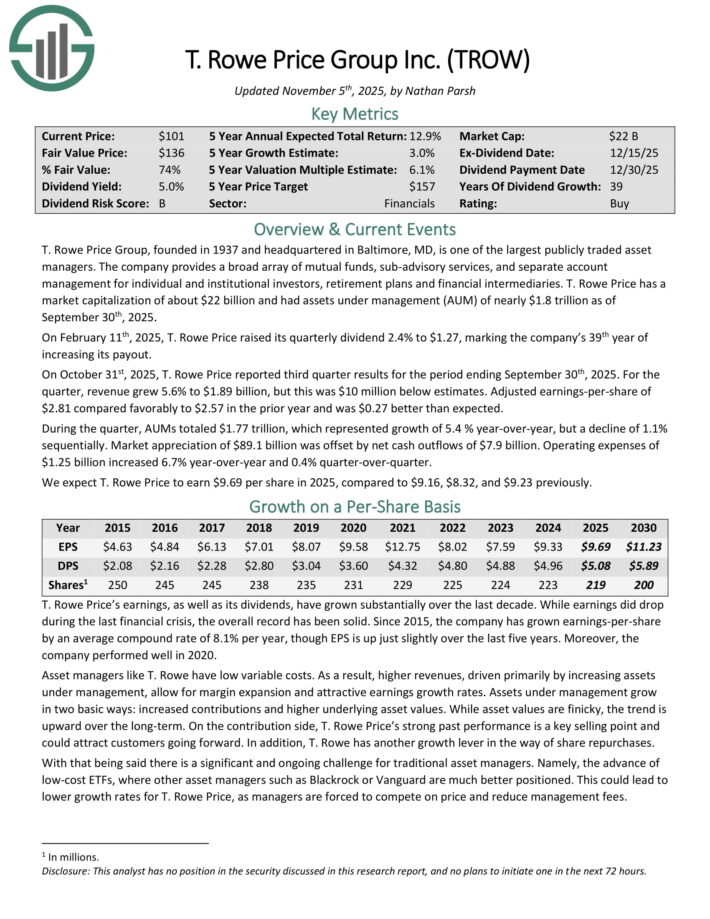

Passive Earnings Inventory #6: T. Rowe Value Group (TROW)

T. Rowe Value Group, based in 1937 and headquartered in Baltimore, MD, is without doubt one of the largest publicly traded asset managers.

The corporate supplies a broad array of mutual funds, sub-advisory companies, and separate account administration for particular person and institutional buyers, retirement plans, and monetary intermediaries.

T. Rowe Value had property below administration (AUM) of almost $1.8 trillion as of the top of Q3 2025.

T. Rowe Value introduced third-quarter outcomes on October 31st, 2025.

Supply: Investor Sources

Income for the quarter grew 5.6% to $1.89 billion, although this was $10 million lower than anticipated. Adjusted earnings-per-share of $2.81 in contrast favorably to $2.57 within the prior yr and was $0.27 above estimates.

Throughout the quarter, AUMs totaled $1.77 trillion, which represented progress of 5.4 % year-over-year, however a decline of 1.1% sequentially. Market appreciation of $89.1 billion was offset by web money outflows of $7.9 billion. Working bills of $1.25 billion elevated 6.7% year-over-year and 0.4% quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven under):

Passive Earnings Inventory #5: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property accumulate charges based mostly on volumes of supplies transported and saved.

On October 30, 2025, Enterprise Merchandise Companions L.P. reported third-quarter 2025 outcomes exhibiting earnings per frequent unit of $0.61, lacking the analyst consensus of roughly $0.68. Income for the quarter declined by about 12.7% year-over-year to $12.02 billion, however nonetheless barely exceeded expectations round $11.83 billion.

Administration cited headwinds from decrease NGL and commodity service volumes, softer offshore export exercise and modest mark-to-market hedging impacts, which weighed on web earnings regardless of secure downstream processing margins and robust midstream flows.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPD (preview of web page 1 of three proven under):

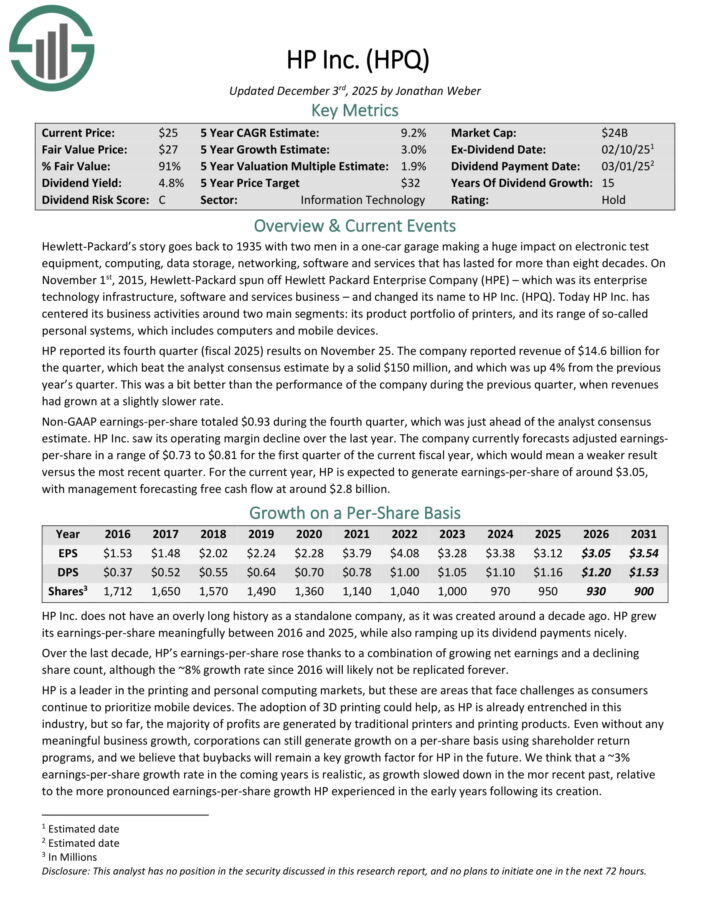

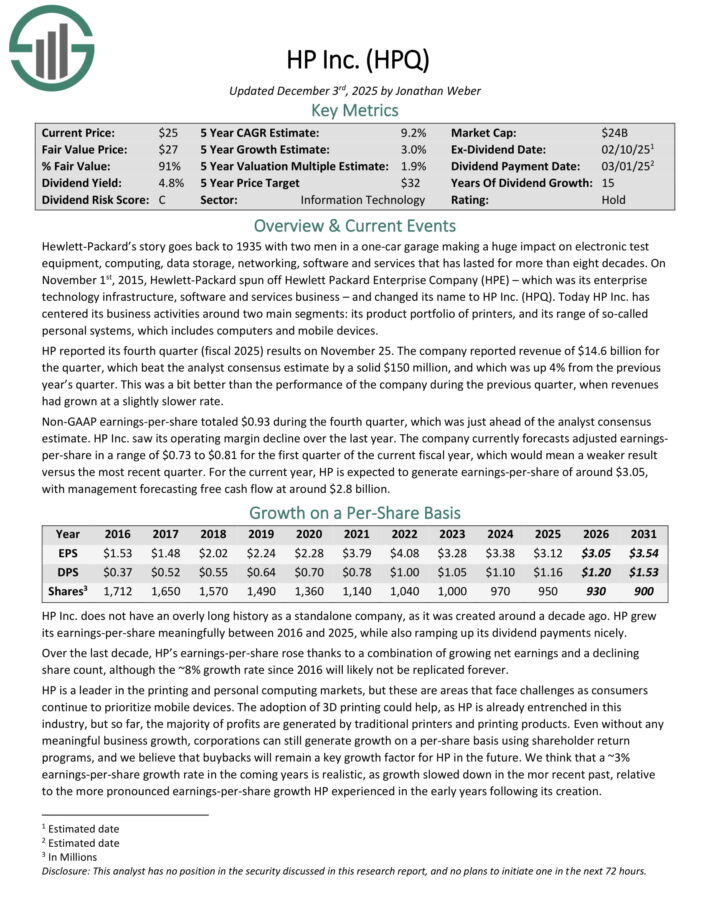

Passive Earnings Inventory #4: HP Inc. (HPQ)

Hewlett-Packard’s story dates again to 1935 with two males in a one-car storage making a big impact on digital check tools, computing, knowledge storage, networking, software program and companies that has lasted for greater than eight a long time.

On November 1st, 2015, Hewlett-Packard spun off Hewlett Packard Enterprise Firm (HPE) and adjusted its title to HP Inc. (HPQ). Right this moment HP Inc. has centered its enterprise actions round two predominant segments: its product portfolio of printers, and its vary of so-called private programs, which incorporates computer systems and cell units.

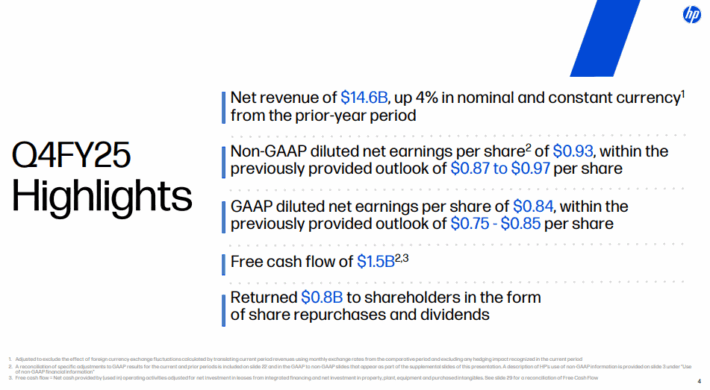

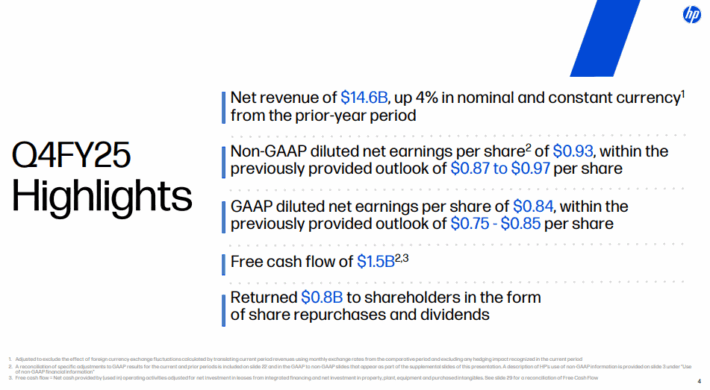

HP reported its fourth quarter (fiscal 2025) outcomes on November twenty fifth, 2025.

Supply: Investor Presentation

The corporate reported income of $14.6 billion for the quarter, which beat the analyst consensus estimate by a strong $150 million, and which was up 4% from the earlier yr’s quarter. This was a bit higher than the efficiency of the corporate through the earlier quarter, when revenues had grown at a barely slower fee.

Non-GAAP earnings-per-share totaled $0.93 through the fourth quarter, which was simply forward of the analyst consensus estimate. HP Inc. noticed its working margin decline during the last yr.

The corporate presently forecasts adjusted earnings-per-share in a variety of $0.73 to $0.81 for the primary quarter of the present fiscal yr, which might imply a weaker end result versus the latest quarter.

For the present yr, HP is anticipated to generate earnings-per-share of round $3.05, with administration forecasting free money stream at round $2.8 billion.

On November twenty sixth, 2025, HP introduced that it was elevating its quarterly dividend 3.7% to $0.30 per share, extending the corporate dividend progress streak to fifteen years.

Click on right here to obtain our most up-to-date Certain Evaluation report on HPQ (preview of web page 1 of three proven under):

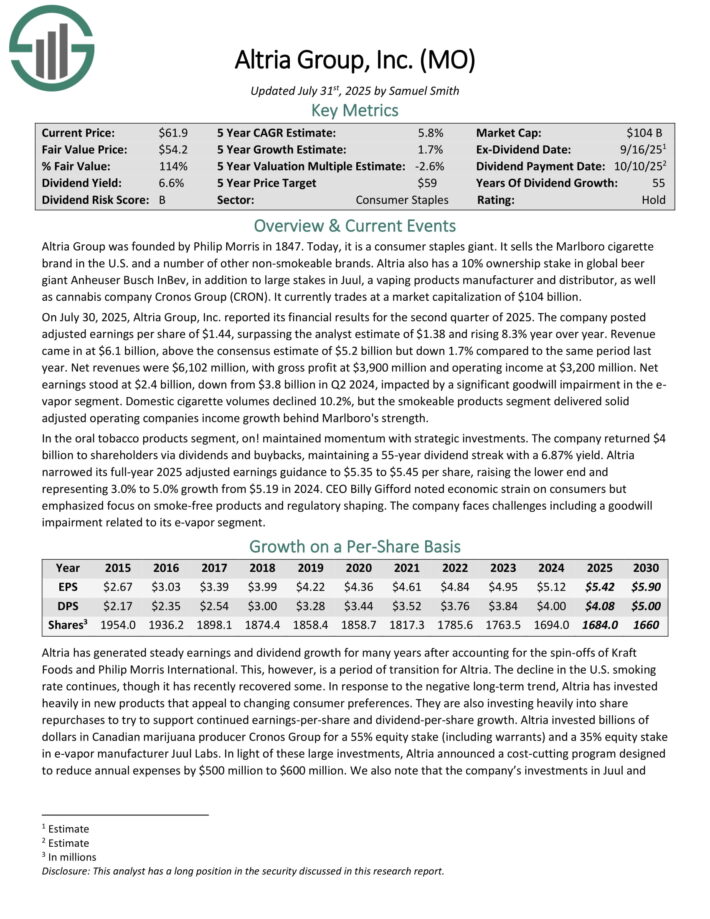

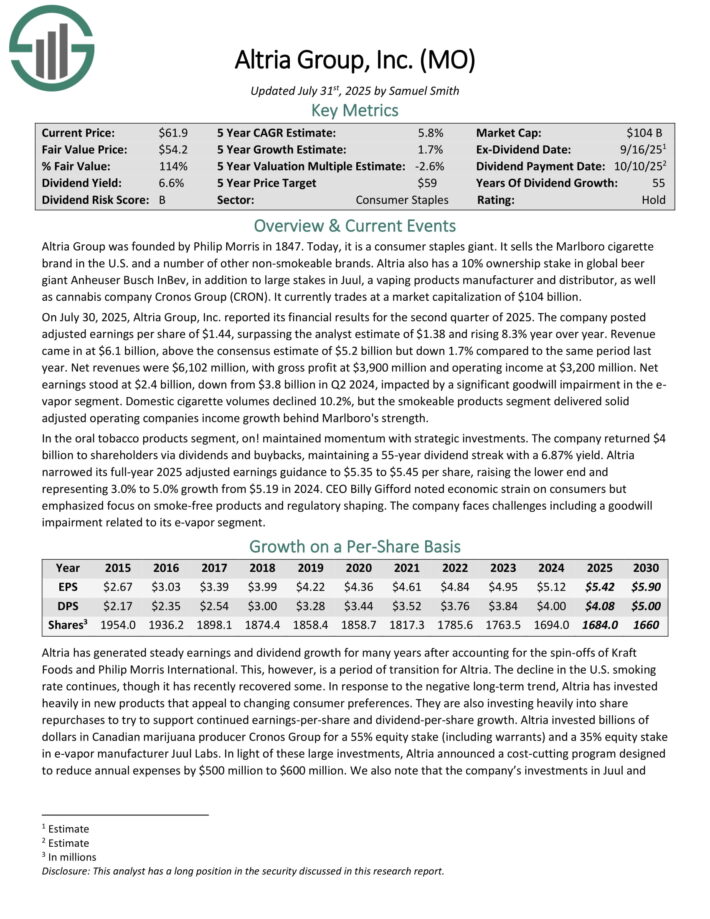

Passive Earnings Inventory #3: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra below quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

It is a interval of transition for Altria. The decline within the U.S. smoking fee continues. In response, Altria has invested closely in new merchandise that enchantment to altering shopper preferences, because the smoke-free class continues to develop.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% yr over yr.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final yr. Internet revenues have been $6,102 million, with gross revenue at $3,900 million and working earnings at $3,200 million.

Internet earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a big goodwill impairment within the e-vapor section.

Home cigarette volumes declined 10.2%, however the smokeable merchandise section delivered strong adjusted working firms earnings progress behind Marlboro’s energy.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven under):

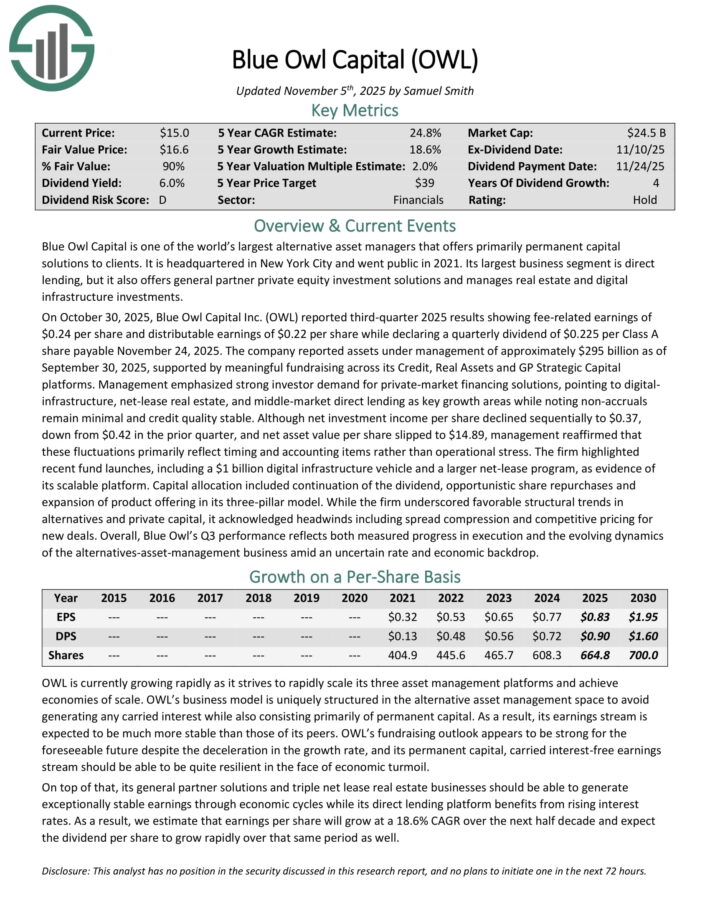

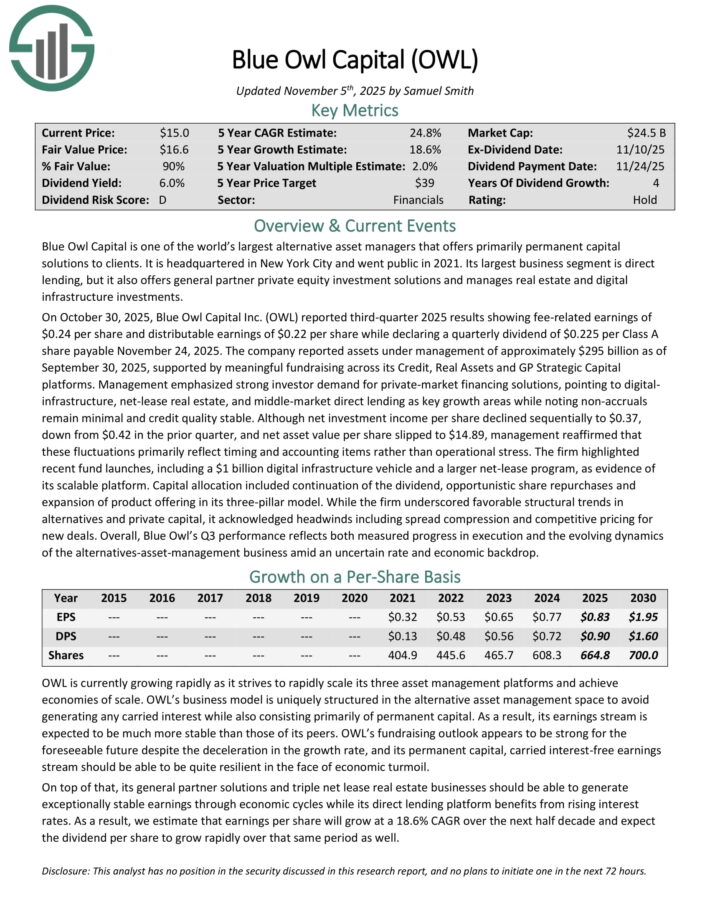

Passive Earnings Inventory #2: Blue Owl Capital (OWL)

Blue Owl Capital is without doubt one of the world’s largest different asset managers that gives primarily everlasting capital options to shoppers.

It’s headquartered in New York Metropolis and went public in 2021. Its largest enterprise section is direct lending, but it surely additionally gives common associate personal fairness funding options and manages actual property and digital infrastructure investments.

On October 30, 2025, Blue Owl Capital Inc. (OWL) reported third-quarter 2025 outcomes exhibiting fee-related earnings of $0.24 per share and distributable earnings of $0.22 per share whereas declaring a quarterly dividend of $0.225 per Class A share payable November 24, 2025.

The corporate reported property below administration of roughly $295 billion as of September 30, 2025, supported by significant fundraising throughout its Credit score, Actual Belongings and GP Strategic Capital platforms.

Administration emphasised sturdy investor demand for private-market financing options, pointing to digital infrastructure, net-lease actual property, and middle-market direct lending as key progress areas whereas noting non-accruals stay minimal and credit score high quality secure.

Though web funding earnings per share declined sequentially to $0.37, down from $0.42 within the prior quarter, and web asset worth per share slipped to $14.89, administration reaffirmed that these fluctuations primarily replicate timing and accounting objects relatively than operational stress.

The agency highlighted latest fund launches, together with a $1 billion digital infrastructure car and a bigger net-lease program, as proof of its scalable platform.

Click on right here to obtain our most up-to-date Certain Evaluation report on OWL (preview of web page 1 of three proven under):

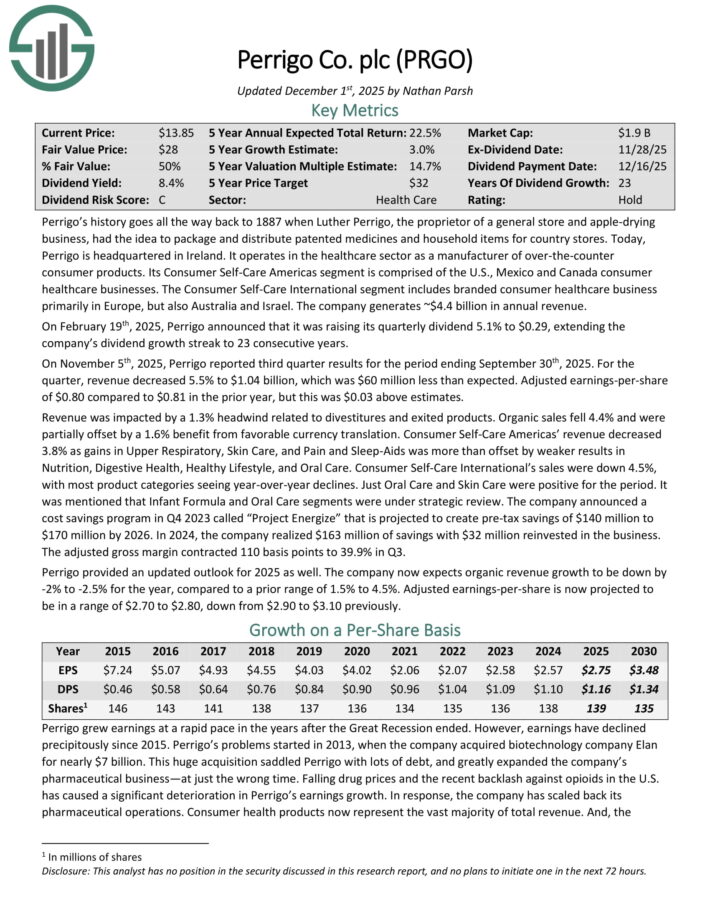

Passive Earnings Inventory #1: Perrigo plc (PRGO)

Perrigo’s historical past goes all the best way again to 1887 when Luther Perrigo, the proprietor of a common retailer and apple-drying enterprise, had the concept to package deal and distribute patented medicines and home goods for nation shops.

Right this moment, Perrigo is headquartered in Eire. It operates within the healthcare sector as a producer of over-the-counter shopper merchandise.

Its Shopper Self-Care Americas section is comprised of the U.S., Mexico and Canada shopper healthcare companies.

The Shopper Self-Care Worldwide section contains branded shopper healthcare enterprise primarily in Europe, but additionally Australia and Israel.

On February nineteenth, 2025, Perrigo introduced that it was elevating its quarterly dividend 5.1% to $0.29, extending the corporate’s dividend progress streak to 23 consecutive years.

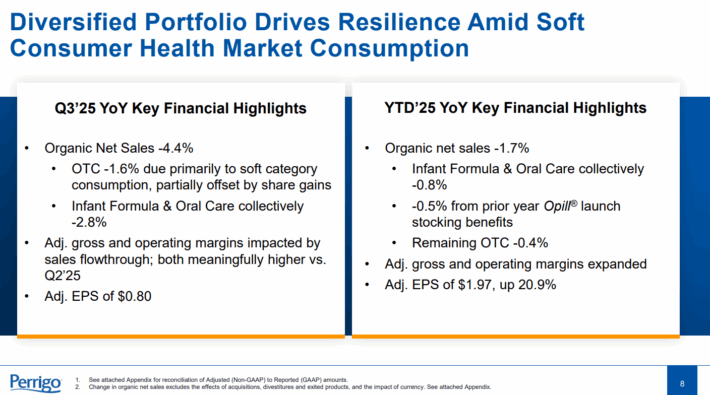

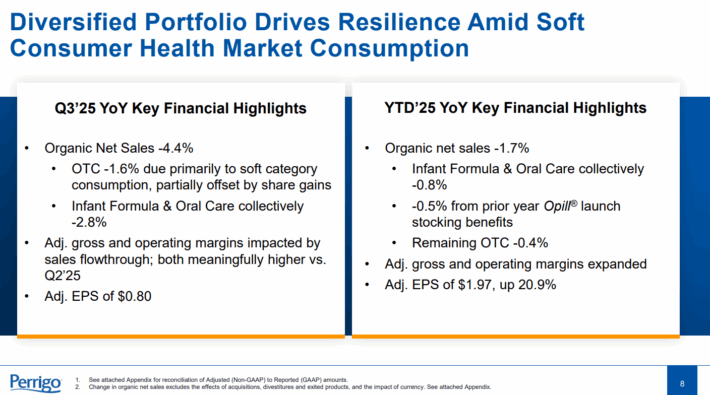

On November fifth, 2025, Perrigo reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income decreased 5.5% to $1.04 billion, which was $60 million lower than anticipated.

Adjusted earnings-per-share of $0.80 in comparison with $0.81 within the prior yr, however this was $0.03 above estimates.

Supply: Investor Presentation

Income was impacted by a 1.3% headwind associated to divestitures and exited merchandise. Natural gross sales fell 4.4% and have been partially offset by a 1.6% profit from favorable foreign money translation.

Shopper Self-Care Americas’ income decreased 3.8% as good points in Higher Respiratory, Pores and skin Care, and Ache and Sleep-Aids was greater than offset by weaker leads to Vitamin, Digestive Well being, Wholesome Life-style, and Oral Care.

Shopper Self-Care Worldwide’s gross sales have been down 4.5%, with most product classes seeing year-over-year declines. Simply Oral Care and Pores and skin Care have been optimistic for the interval. It was talked about that Toddler Method and Oral Care segments have been below strategic overview.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRGO (preview of web page 1 of three proven under):

Last Ideas & Extra Studying

In case you are fascinated by discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].