Revealed on September twenty second, 2025 by Bob Ciura

Compounding is what makes the stock market such a sturdy automobile for wealth creation.

The excellence over time between straightforward curiosity and compound curiosity is staggering:

- $100 at 9% straightforward curiosity is $190 after 20 years

- $100 at 9% compound curiosity is $560 after 20 years

That’s nearly a 3x distinction between straightforward and compound curiosity – and that distinction may be far more pronounced over longer time intervals or the following price of curiosity.

There are 3 components of compounding:

- The enlargement cost (or price of curiosity, cost of return, and so forth.)

- The scale of each interval

- The number of intervals

Investing returns are measured over time. It’s possible you’ll’t velocity up time; the dimensions of each interval is fixed.

This means compounding inside the stock market comes proper right down to the pace of return you receive on an funding and the number of intervals over which the funding compounds.

Clearly (and sadly), we don’t get to pick out the pace of return we receive from an funding. All we’ll do is tilt the odds in our favor by investing in prime quality shares extra more likely to develop earnings and dividends at cost.

Fortunately, eye-popping return numbers aren’t wished for long-term wealth creation. Consistently steady returns over longer intervals of time can create very satisfactory outcomes.

And that leads us to the third a part of compounding – the number of intervals over which your funding compounds.

Prolonged-term patrons should look to prime quality dividend shares such as a result of the Dividend Kings, which have elevated their dividends for over 50 consecutive years.

You may even see the entire downloadable spreadsheet of all 56 Dividend Kings (along with important financial metrics akin to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink below:

Due to this investing in firms which have endurance is so important. It leads to longer-holding intervals, and bigger compounding.

This article will rank 10 Dividend Kings with 50+ years of dividend improvement, with sturdy anticipated improvement for the long term.

Desk of Contents

The ten shares are ranked by annual anticipated improvement of earnings-per-share. It’s possible you’ll instantly soar to any specific a part of the article by clicking on the hyperlinks below:

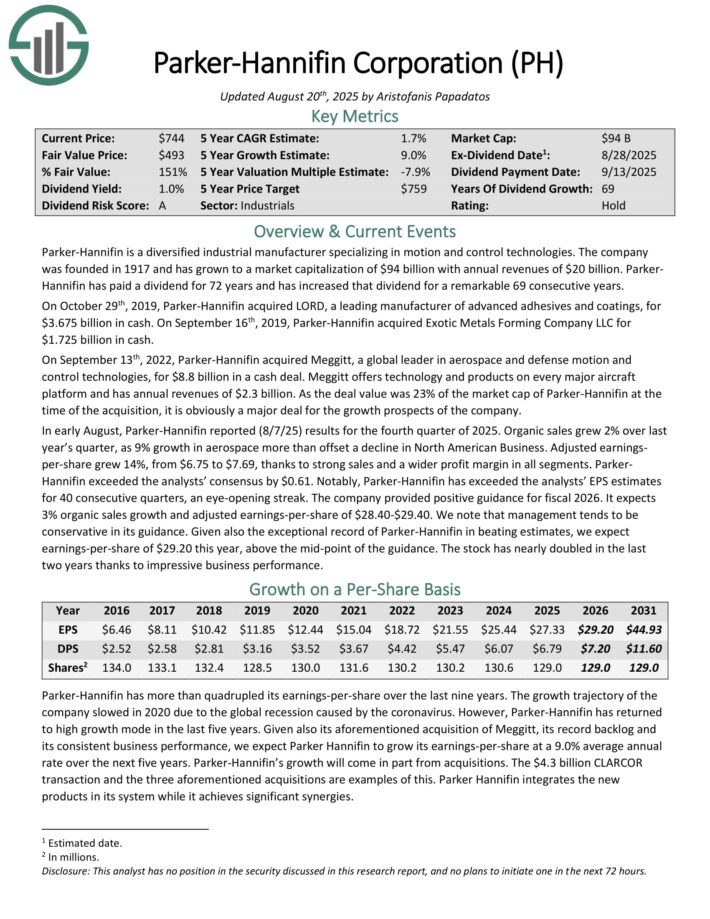

Prolonged-Time interval Dividend Compounder #10: Parker-Hannifin Corp. (PH)

- Anticipated Improvement Value: 9.0%

Parker-Hannifin is a diversified industrial producer specializing in motion and administration utilized sciences. The company generates annual revenues of $20 billion. Parker-Hannifin has elevated the dividend for 69 consecutive years.

In early August, Parker-Hannifin reported (8/7/25) outcomes for the fourth quarter of 2025. Pure product sales grew 2% over remaining 12 months’s quarter, as 9% improvement in aerospace larger than offset a decline in North American Enterprise. Adjusted earningsper-share grew 14%, from $6.75 to $7.69, on account of sturdy product sales and a wider income margin in all segments.

Parker-Hannifin exceeded the analysts’ consensus by $0.61. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 40 consecutive quarters, an eye-opening streak.

The company provided optimistic steering for fiscal 2026. It expects 3% pure product sales improvement and adjusted earnings-per-share of $28.40-$29.40. We phrase that administration tends to be conservative in its steering.

Click on on proper right here to acquire our latest Sure Analysis report on Parker-Hannifin (preview of net web page 1 of three confirmed below):

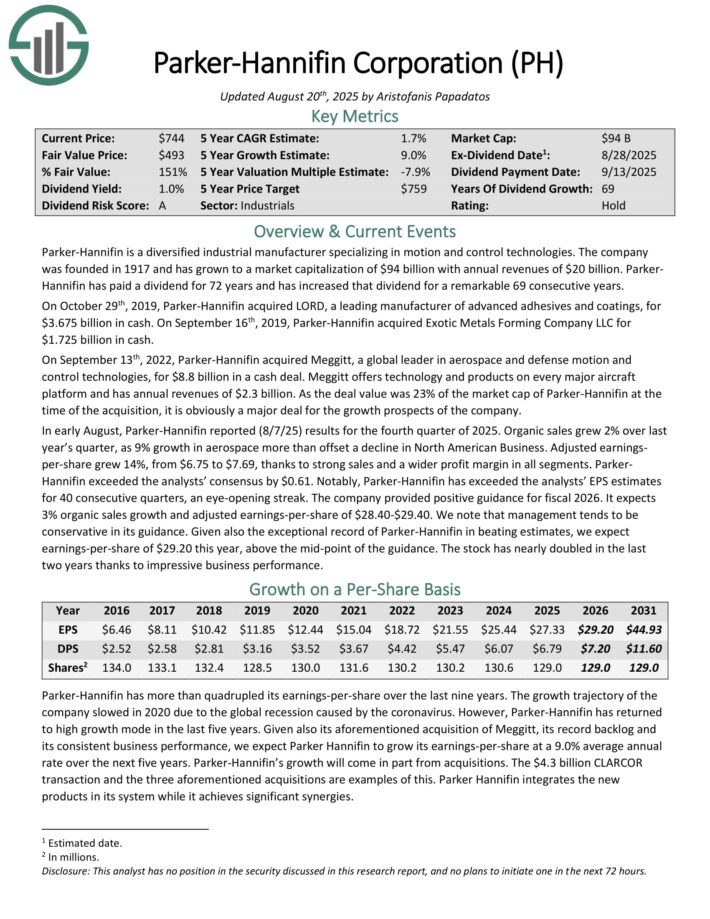

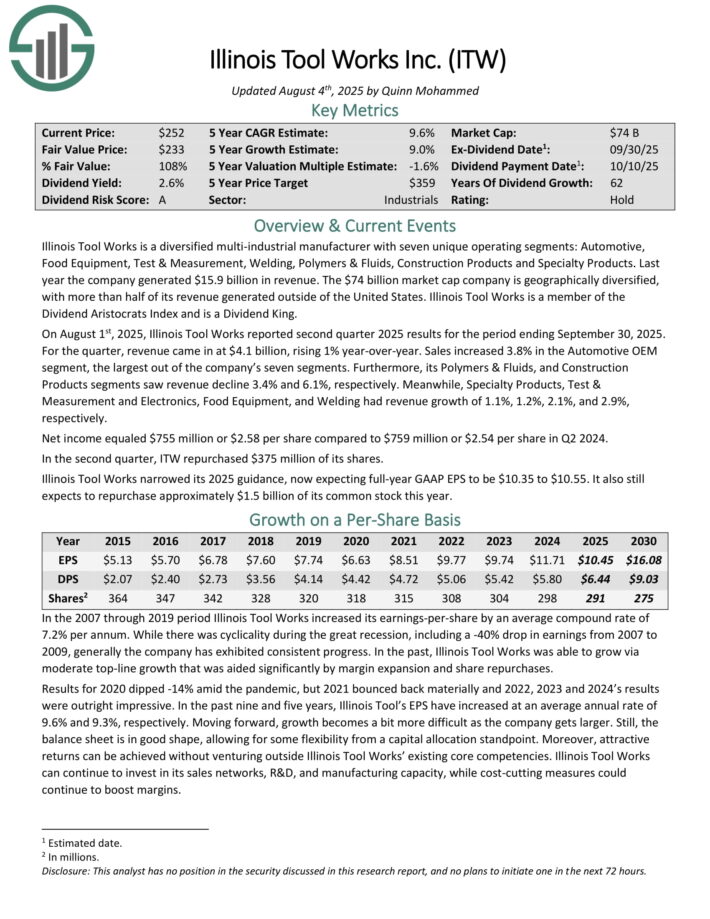

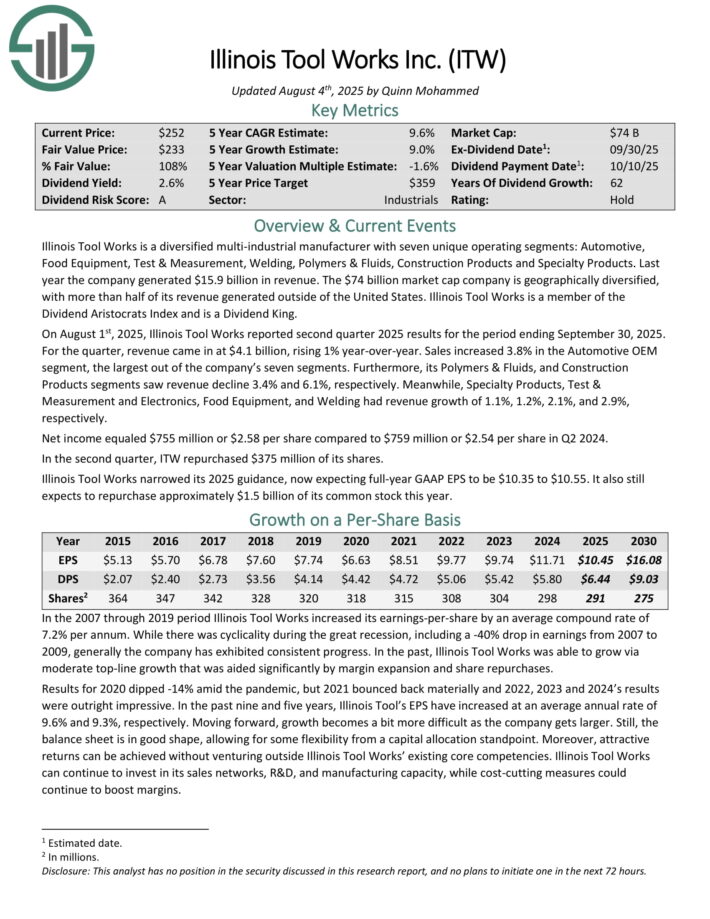

Prolonged-Time interval Dividend Compounder #9: Illinois Gadget Works (ITW)

- Anticipated Improvement Value: 9.0%

Illinois Gadget Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Instruments, Examine & Measurement, Welding, Polymers & Fluids, Constructing Merchandise and Specialty Merchandise.

Closing 12 months the company generated $15.9 billion in earnings. The company is geographically diversified, with larger than half of its earnings generated exterior of the US.

On August 1st, 2025, Illinois Gadget Works reported second quarter 2025 outcomes. For the quarter, earnings bought right here in at $4.1 billion, rising 1% year-over-year. Product sales elevated 3.8% inside the Automotive OEM part, the most important out of the company’s seven segments.

Furthermore, its Polymers & Fluids, and Constructing Merchandise segments seen earnings decline 3.4% and 6.1%, respectively.

Within the meantime, Specialty Merchandise, Examine & Measurement and Electronics, Meals Instruments, and Welding had earnings improvement of 1.1%, 1.2%, 2.1%, and a few.9%, respectively. Net earnings equaled $755 million or $2.58 per share compared with $759 million or $2.54 per share in Q2 2024.

Click on on proper right here to acquire our latest Sure Analysis report on ITW (preview of net web page 1 of three confirmed below):

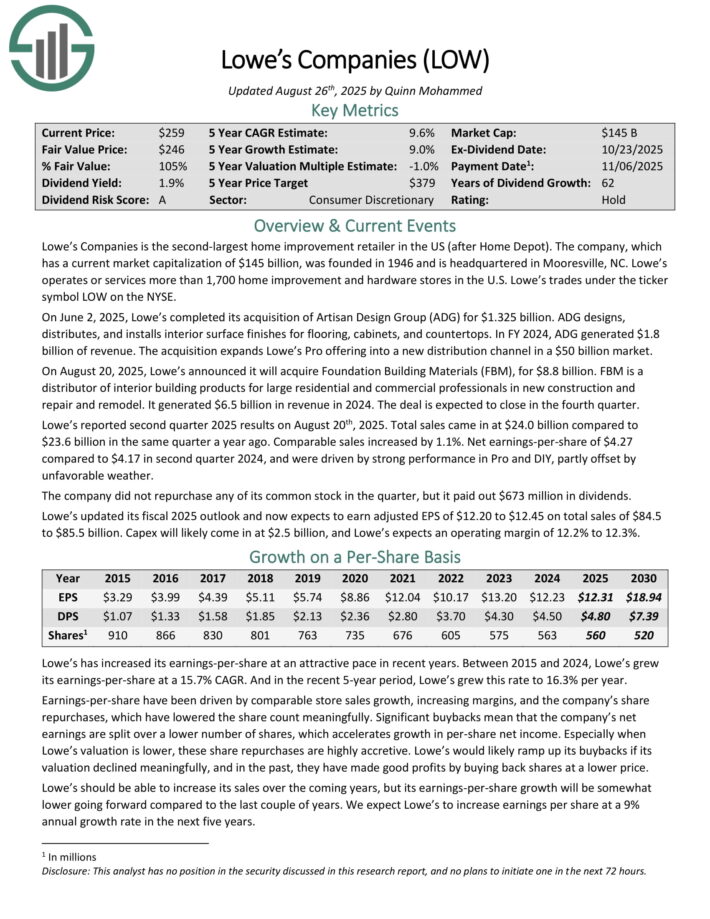

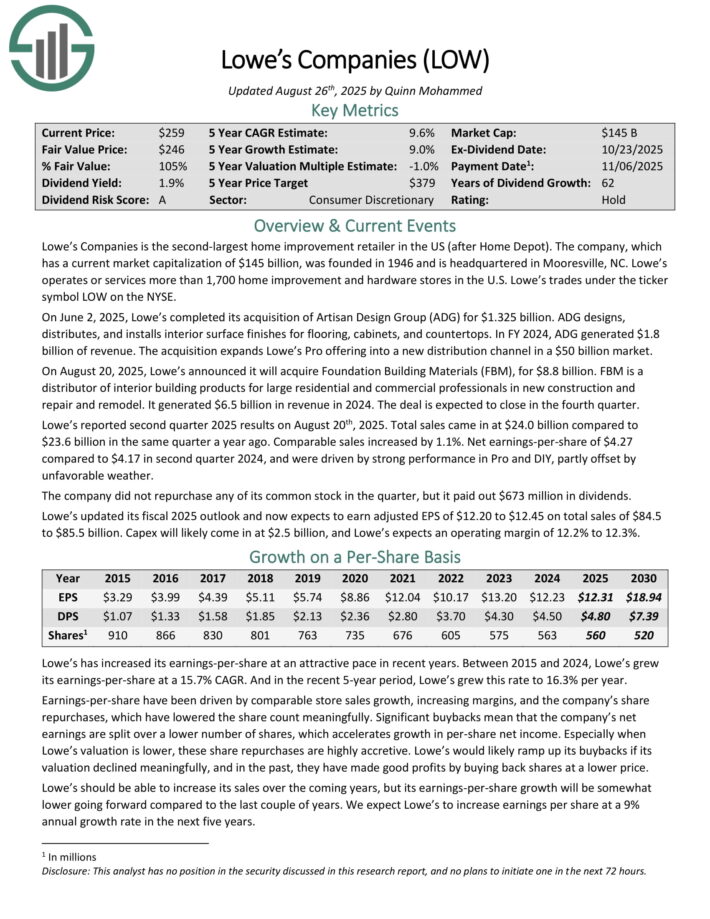

Prolonged-Time interval Dividend Compounder #8: Lowe’s Cos., Inc. (LOW)

- Anticipated Improvement Value: 9.0%

Lowe’s Companies is the second-largest home enchancment retailer inside the US (after Dwelling Depot). The company was based mostly in 1946 and is headquartered in Mooresville, NC. Lowe’s operates or suppliers larger than 1,700 home enchancment and {{hardware}} outlets inside the U.S.

On August 20, 2025, Lowe’s launched it will buy Foundation Setting up Provides (FBM), for $8.8 billion. FBM is a distributor of inside developing merchandise for large residential and industrial professionals in new improvement and restore and remodel. It generated $6.5 billion in earnings in 2024. The deal is anticipated to close inside the fourth quarter.

Lowe’s reported second quarter 2025 outcomes on August twentieth, 2025. Full product sales bought right here in at $24.0 billion compared with $23.6 billion within the an identical quarter a 12 months up to now. Comparable product sales elevated by 1.1%. Net earnings-per-share of $4.27 compared with $4.17 in second quarter 2024, and have been pushed by sturdy effectivity in Skilled and DIY, partly offset by

unfavorable local weather.

The company didn’t repurchase any of its widespread stock inside the quarter, however it paid out $673 million in dividends. Lowe’s updated its fiscal 2025 outlook and now expects to earn adjusted EPS of $12.20 to $12.45 on complete product sales of $84.5 to $85.5 billion.

Click on on proper right here to acquire our latest Sure Analysis report on LOW (preview of net web page 1 of three confirmed below):

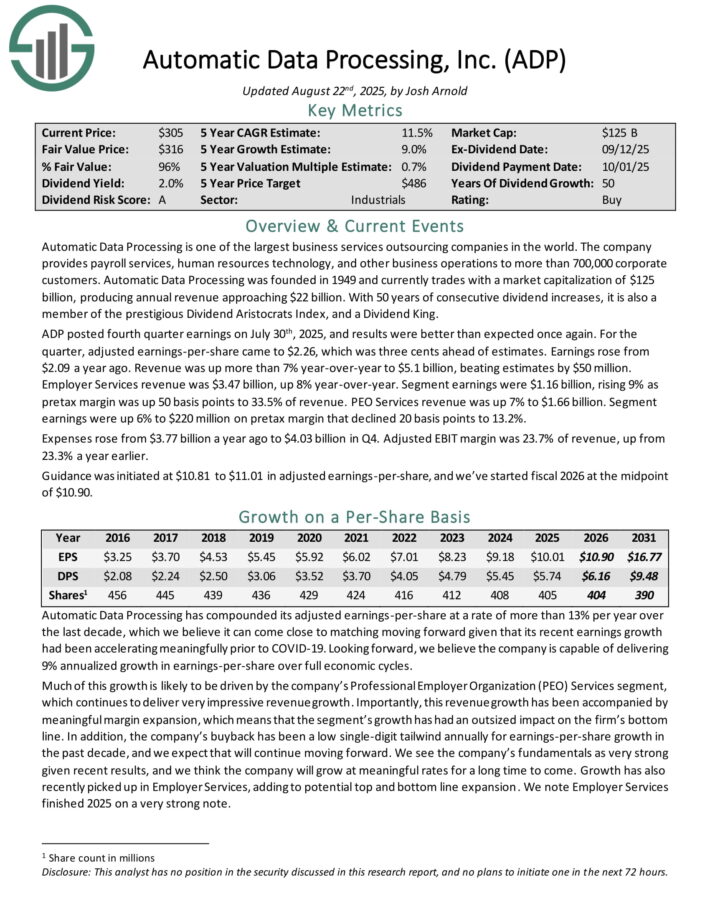

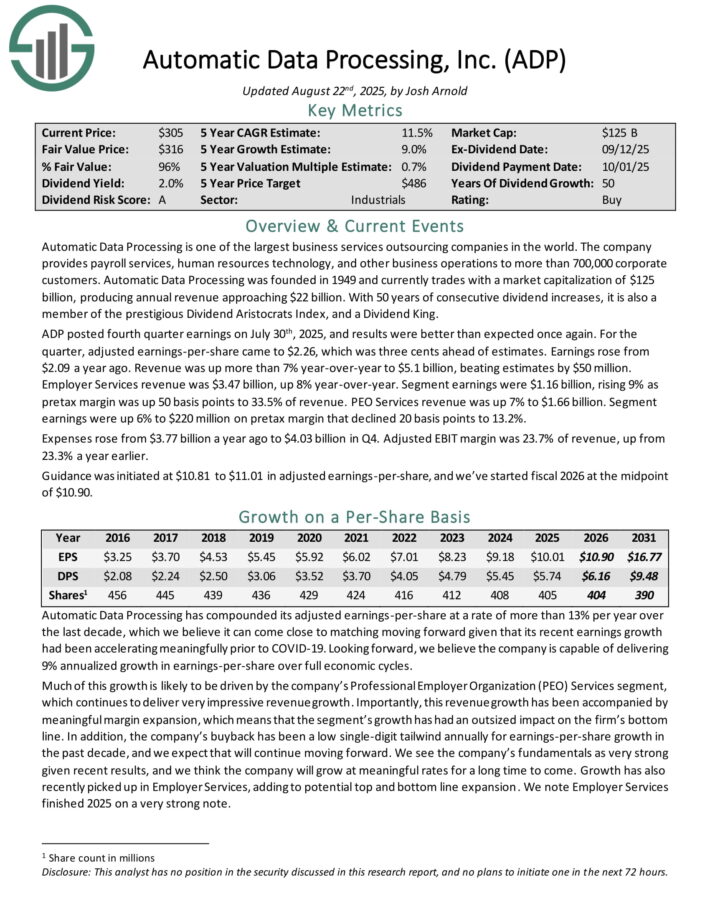

Prolonged-Time interval Dividend Compounder #7: Computerized Data Processing (ADP)

- Anticipated Improvement Value: 9.0%

Computerized Data Processing is probably going one of many largest enterprise suppliers outsourcing companies on the earth. The company provides payroll suppliers, human belongings know-how, and completely different enterprise operations to larger than 700,000 firm purchasers. Computerized Data Processing produces annual earnings of about $20 billion.

ADP posted fourth quarter earnings on July thirtieth, 2025, and outcomes have been greater than anticipated as quickly as as soon as extra. For the quarter, adjusted earnings-per-share bought right here to $2.26, which was three cents ahead of estimates. Earnings rose from $2.09 a 12 months up to now. Revenue was up larger than 7% year-over-year to $5.1 billion, beating estimates by $50 million.

Employer Suppliers earnings was $3.47 billion, up 8% year-over-year. Section earnings have been $1.16 billion, rising 9% as pretax margin was up 50 basis components to 33.5% of earnings. PEO Suppliers earnings was up 7% to $1.66 billion. Section earnings have been up 6% to $220 million on pretax margin that declined 20 basis components to 13.2%.

Payments rose from $3.77 billion a 12 months up to now to $4.03 billion in This fall. Adjusted EBIT margin was 23.7% of earnings, up from 23.3% a 12 months earlier. Steering was initiated at $10.81 to $11.01 in adjusted earnings-per-share.

Click on on proper right here to acquire our latest Sure Analysis report on ADP (preview of net web page 1 of three confirmed below):

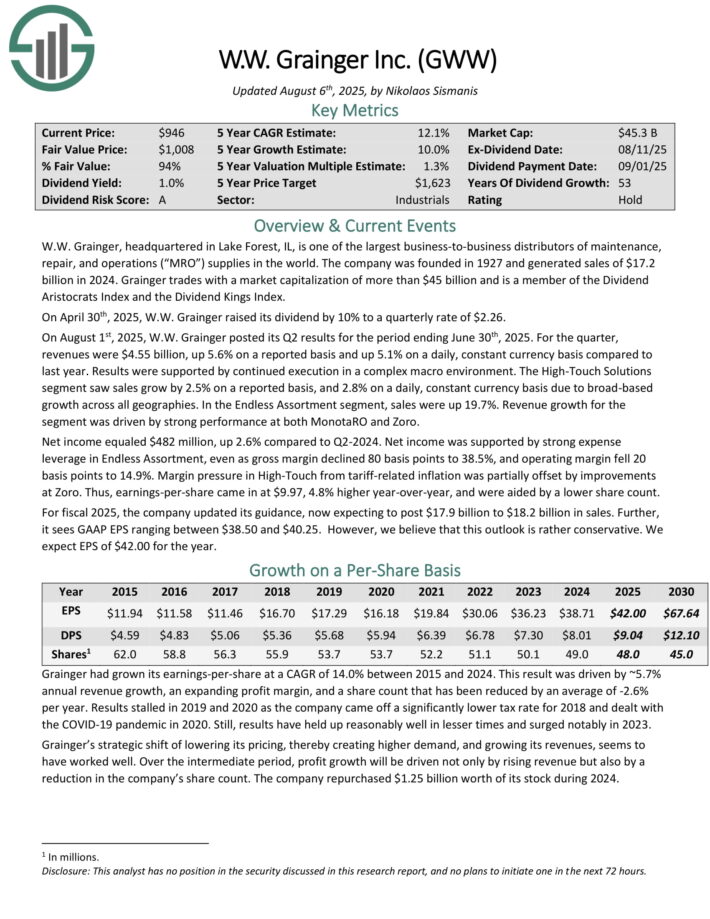

Prolonged-Time interval Dividend Compounder #6: W.W. Grainger Inc. (GWW)

- Anticipated Improvement Value: 10.0%

W.W. Grainger, headquartered in Lake Forest, IL, is probably going one of many largest business-to-business distributors of maintenance, restore, and operations (“MRO”) gives on the earth. The company was based mostly in 1927 and generated product sales of $17.2 billion in 2024.

On August 1st, 2025, W.W. Grainger posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, revenues have been $4.55 billion, up 5.6% on a reported basis and up 5.1% on a day by day, fastened foreign exchange basis compared with remaining 12 months.

The Extreme-Contact Choices part seen product sales develop by 2.5% on a reported basis, and a few.8% on a day by day, fastened foreign exchange basis due to broad-based improvement all through all geographies.

Throughout the Infinite Assortment part, product sales have been up 19.7%. Revenue improvement for the part was pushed by sturdy effectivity at every MonotaRO and Zoro.

Net earnings equaled $482 million, up 2.6% compared with Q2-2024. Net earnings was supported by sturdy expense leverage in Infinite Assortment, while gross margin declined 80 basis components to 38.5%, and dealing margin fell 20 basis components to 14.9%.

Margin stress in Extreme-Contact from tariff-related inflation was partially offset by enhancements at Zoro. Earnings-per-share bought right here in at $9.97, 4.8% bigger year-over-year, and have been aided by a lower share rely.

Click on on proper right here to acquire our latest Sure Analysis report on GWW (preview of net web page 1 of three confirmed below):

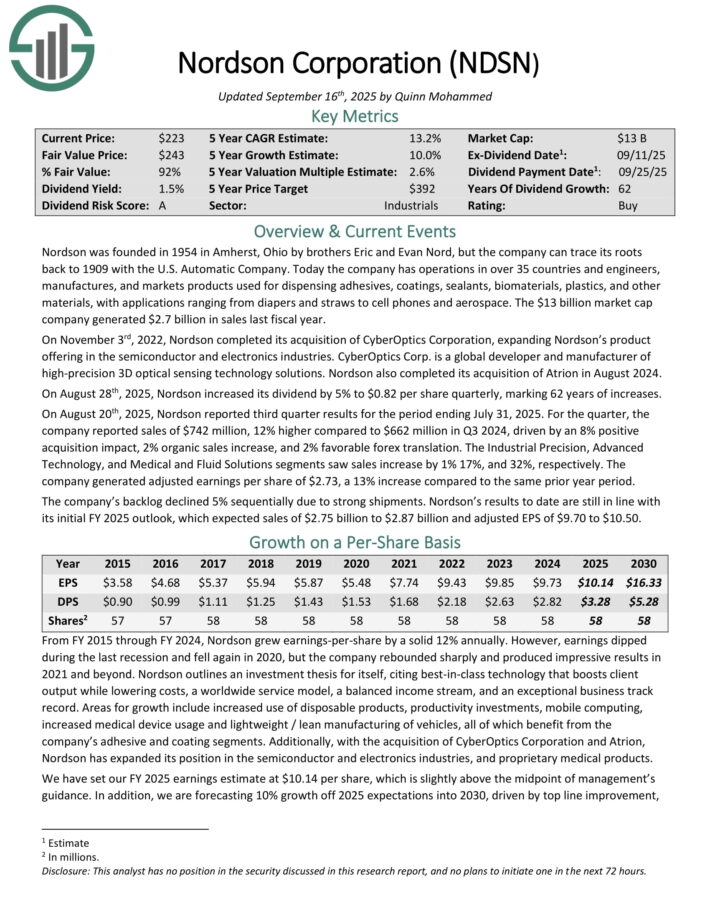

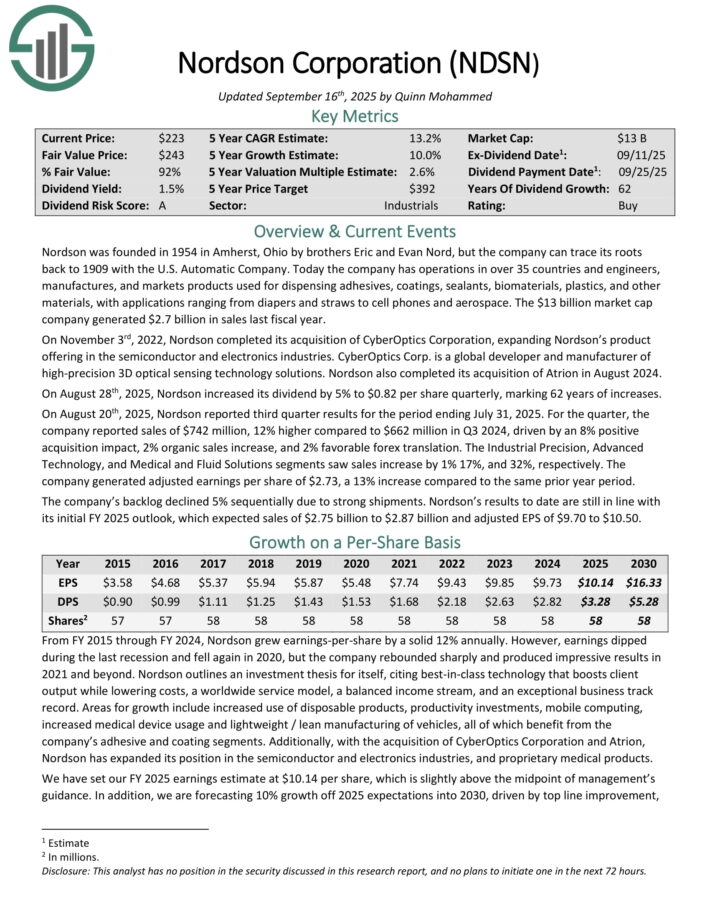

Prolonged-Time interval Dividend Compounder #5: Nordson Corp. (NDSN)

- Anticipated Improvement Value: 10.0%

Nordson has operations in over 35 nations and engineers, manufactures, and markets merchandise used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and completely different provides, with functions ranging from diapers and straws to cell telephones and aerospace. The company generated $2.7 billion in product sales remaining fiscal 12 months.

On August twentieth, 2025, Nordson reported third quarter outcomes for the interval ending July 31, 2025. For the quarter, the company reported product sales of $742 million, 12% bigger compared with $662 million in Q3 2024, pushed by an 8% optimistic acquisition affect, 2% pure product sales enhance, and a few% favorable overseas trade translation.

The Industrial Precision, Superior Know-how, and Medical and Fluid Choices segments seen product sales enhance by 1% 17%, and 32%, respectively.

The company generated adjusted earnings per share of $2.73, a 13% enhance compared with the an identical prior 12 months interval. The backlog declined 5% sequentially due to sturdy shipments.

On August twenty eighth, 2025, Nordson elevated its dividend by 5% to $0.82 per share quarterly, marking 62 years of will enhance.

Nordson’s outcomes to this point are nonetheless in line with its preliminary FY 2025 outlook, which anticipated product sales of $2.75 billion to $2.87 billion and adjusted EPS of $9.70 to $10.50.

Click on on proper right here to acquire our latest Sure Analysis report on NDSN (preview of net web page 1 of three confirmed below):

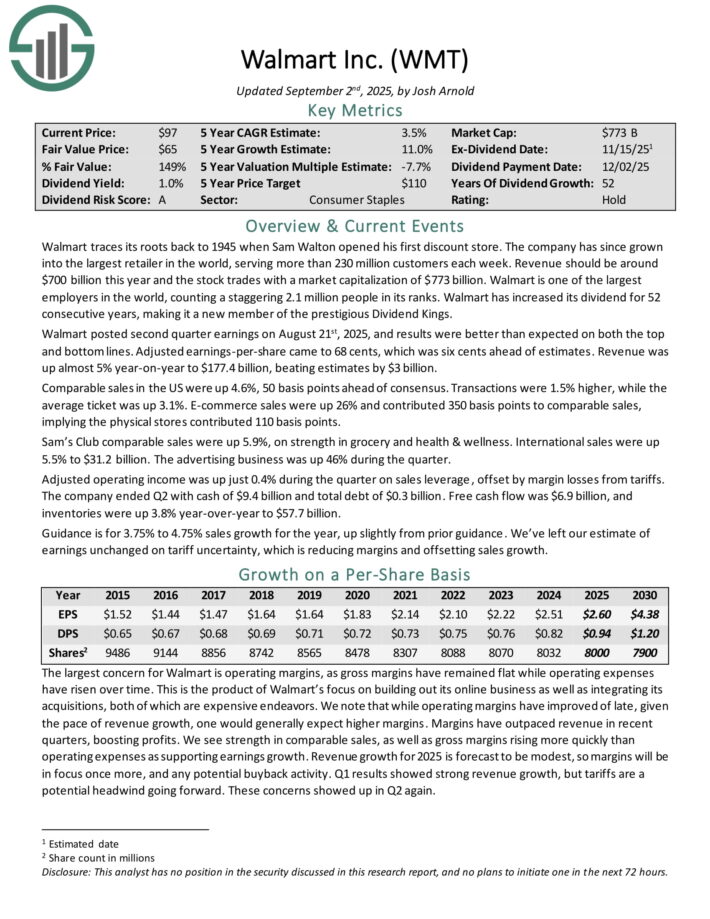

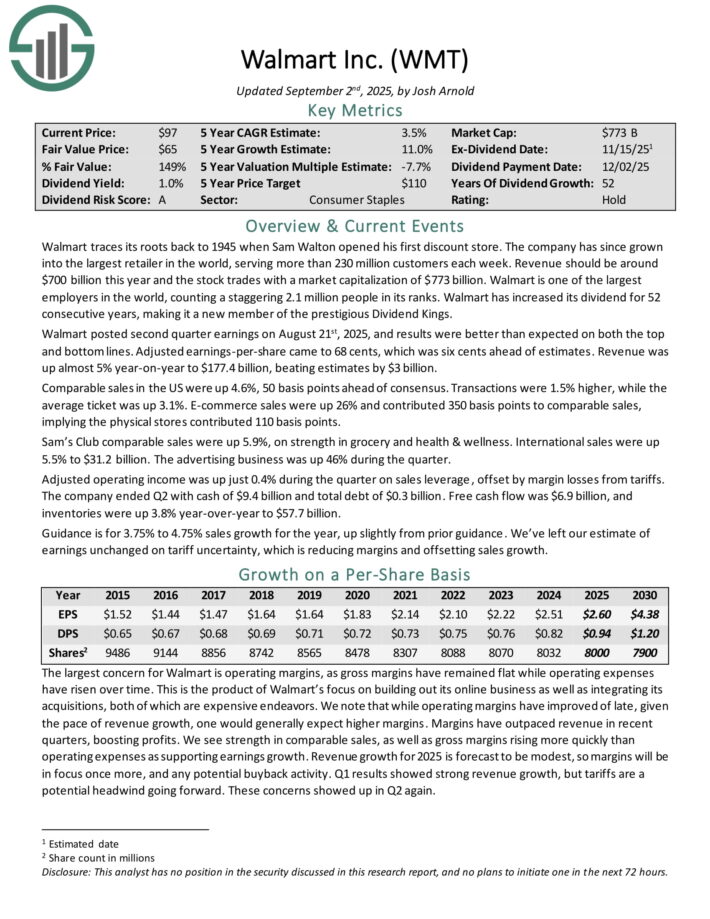

Prolonged-Time interval Dividend Compounder #4: Walmart Inc. (WMT)

- Anticipated Improvement Value: 11.0%

Walmart traces its roots once more to 1945 when Sam Walton opened his first low price retailer. The company has since grown into the most important retailer on the earth, serving larger than 230 million purchasers each week. Revenue have to be spherical $700 billion this 12 months.

Walmart posted second quarter earnings on August twenty first, 2025, and outcomes have been greater than anticipated on every the very best and bottom strains. Adjusted earnings-per-share bought right here to 68 cents, which was six cents ahead of estimates. Revenue was up practically 5% year-on-year to $177.4 billion, beating estimates by $3 billion.

Comparable product sales inside the US have been up 4.6%, 50 basis components ahead of consensus. Transactions have been 1.5% bigger, whereas the everyday ticket was up 3.1%. E-commerce product sales have been up 26% and contributed 350 basis components to comparable product sales, implying the bodily outlets contributed 110 basis components.

Sam’s Membership comparable product sales have been up 5.9%, on energy in grocery and properly being & wellness. Worldwide product sales have been up 5.5% to $31.2 billion. The selling enterprise was up 46% by means of the quarter.

Adjusted working earnings was up merely 0.4% by means of the quarter on product sales leverage, offset by margin losses from tariffs. The company ended Q2 with cash of $9.4 billion and complete debt of $0.3 billion. Free cash motion was $6.9 billion, and inventories have been up 3.8% year-over-year to $57.7 billion.

Steering is for 3.75% to 4.75% product sales improvement for the 12 months, up barely from prior steering.

Click on on proper right here to acquire our latest Sure Analysis report on WMT (preview of net web page 1 of three confirmed below):

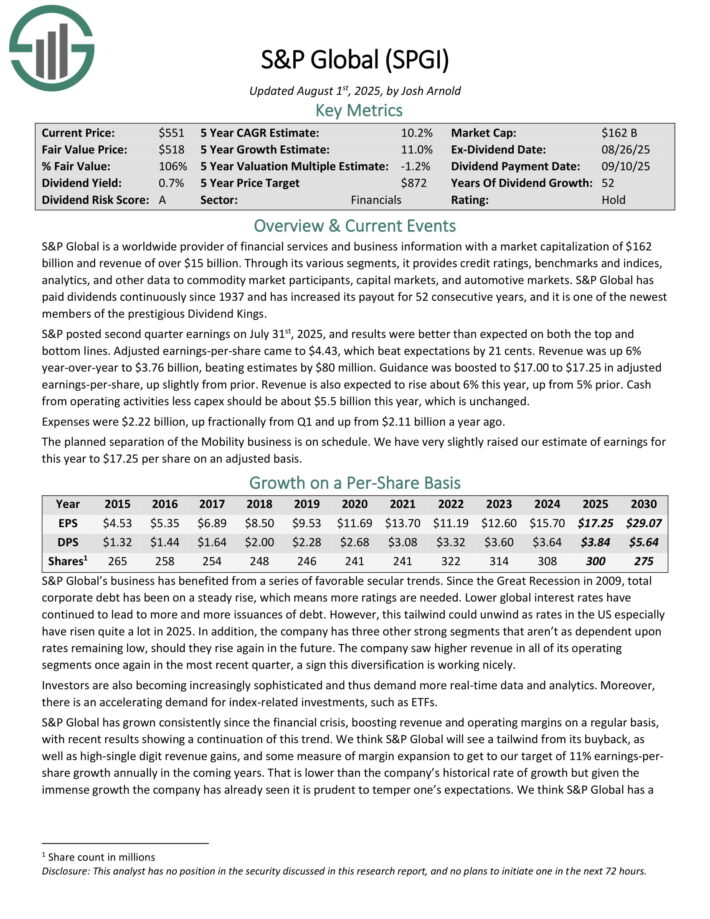

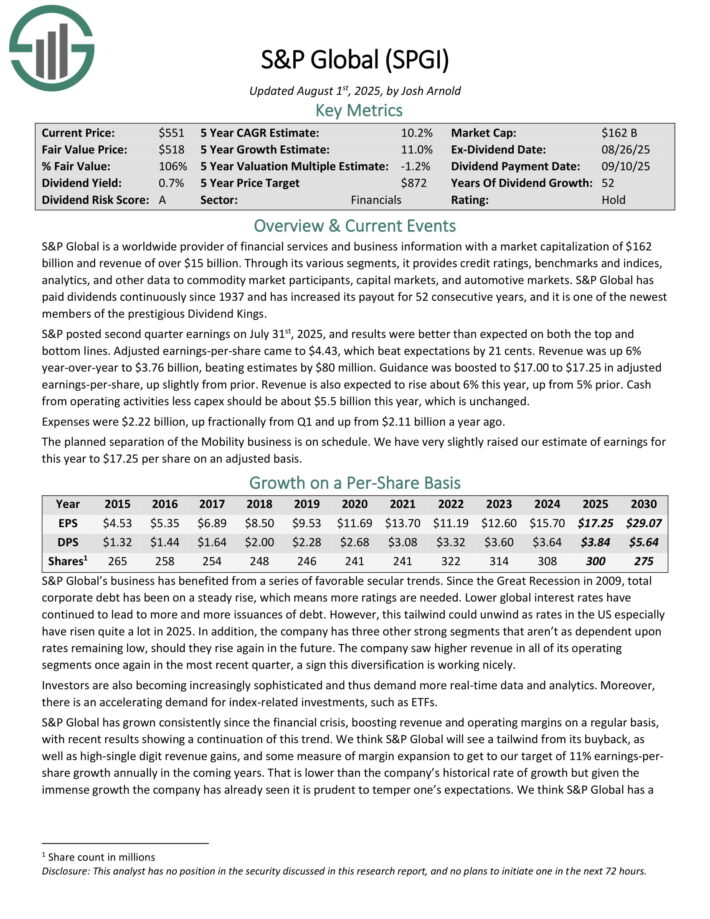

Prolonged-Time interval Dividend Compounder #3: S&P World Inc. (SPGI)

- Anticipated Improvement Value: 11.0%

S&P World is a worldwide provider of financial suppliers and enterprise knowledge and earnings of over $13 billion.

By its quite a few segments, it provides credit score rating scores, benchmarks and indices, analytics, and completely different info to commodity market members, capital markets, and automotive markets.

S&P World has paid dividends consistently since 1937 and has elevated its payout for 51 consecutive years.

S&P posted second quarter earnings on July thirty first, 2025, and outcomes have been greater than anticipated on every the very best and bottom strains. Adjusted earnings-per-share bought right here to $4.43, which beat expectations by 21 cents. Revenue was up 6% year-over-year to $3.76 billion, beating estimates by $80 million.

Steering was boosted to $17.00 to $17.25 in adjusted earnings-per-share, up barely from prior. Revenue may be anticipated to rise about 6% this 12 months, up from 5% prior.

Cash from working actions a lot much less capex have to be about $5.5 billion this 12 months, which is unchanged. Payments have been $2.22 billion, up fractionally from Q1 and up from $2.11 billion a 12 months up to now.

Click on on proper right here to acquire our latest Sure Analysis report on SPGI (preview of net web page 1 of three confirmed below):

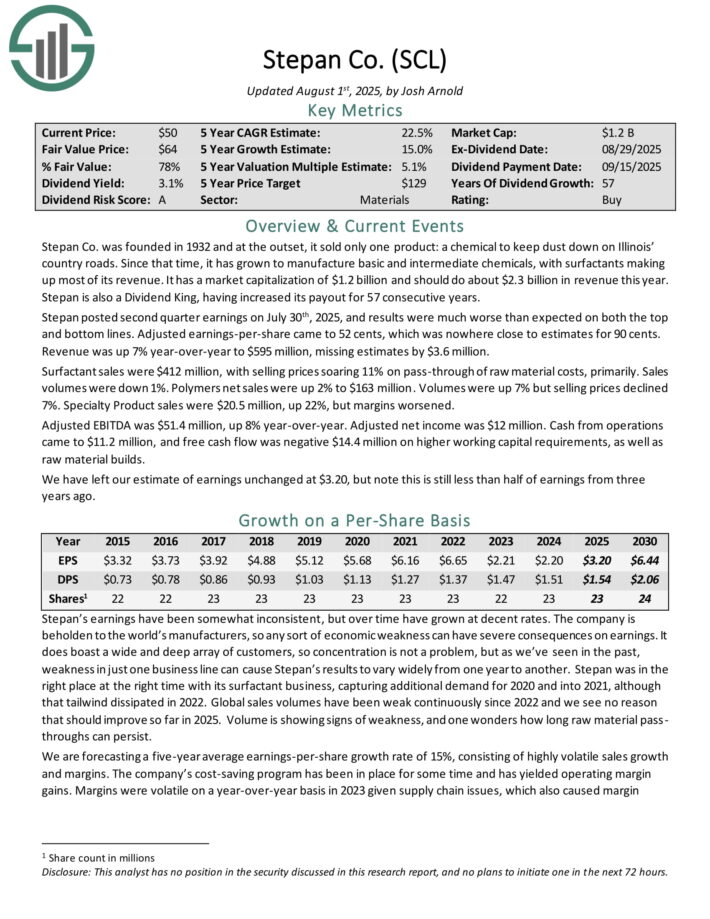

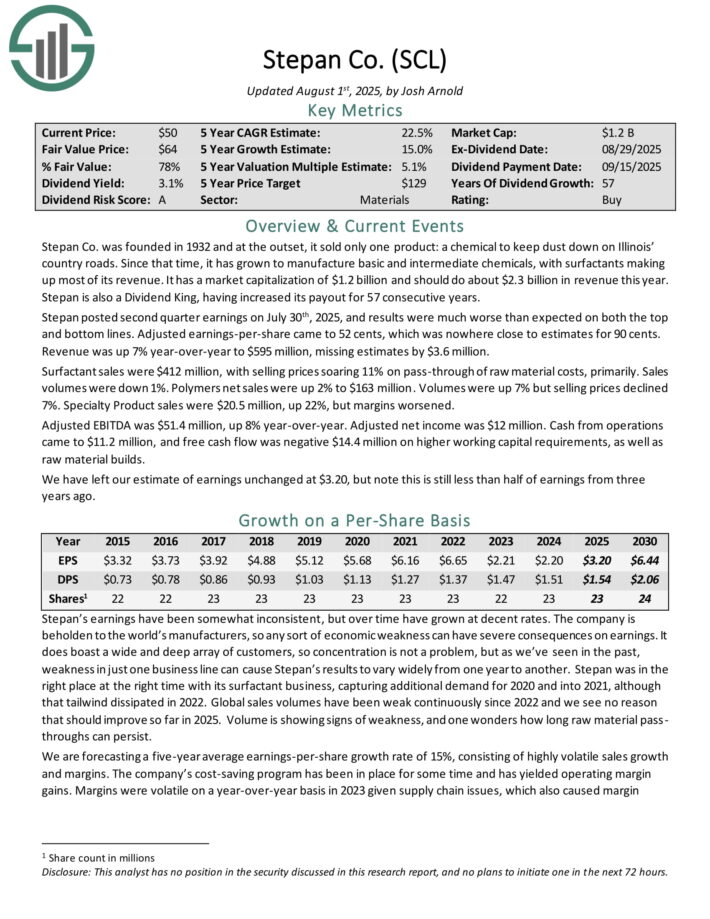

Prolonged-Time interval Dividend Compounder #2: Stepan Co. (SCL)

- Anticipated Improvement Value: 15.0%

Stepan manufactures major and intermediate chemical substances, along with surfactants, specialty merchandise, germicidal and materials softening quaternaries, phthalic anhydride, polyurethane polyols and specific elements for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise strains: surfactants, polymers, and specialty merchandise. These firms serve all types of end markets.

The surfactants enterprise is Stepan’s largest by earnings. A surfactant is an pure compound that includes every water-soluble and water-insoluble components.

Stepan posted second quarter earnings on July thirtieth, 2025, and outcomes have been quite a bit worse than anticipated on every the very best and bottom strains. Adjusted earnings-per-share bought right here to 52 cents, which was nowhere close to estimates for 90 cents. Revenue was up 7% year-over-year to $595 million, missing estimates by $3.6 million.

Surfactant product sales have been $412 million, with selling prices hovering 11% on pass-through of raw supplies costs, primarily. Product sales volumes have been down 1%. Polymers net product sales have been up 2% to $163 million. Volumes have been up 7% nonetheless selling prices declined 7%. Specialty Product product sales have been $20.5 million, up 22%, nonetheless margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted net earnings was $12 million. Cash from operations bought right here to $11.2 million, and free cash motion was unfavourable $14.4 million on bigger working capital requirements, along with raw supplies builds.

Click on on proper right here to acquire our latest Sure Analysis report on SCL (preview of net web page 1 of three confirmed below):

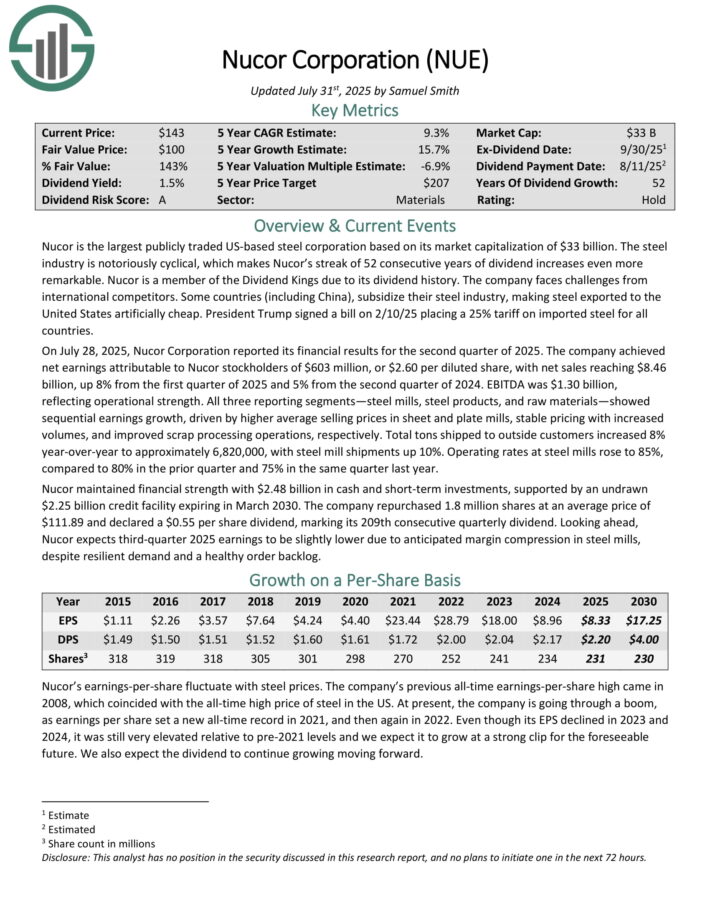

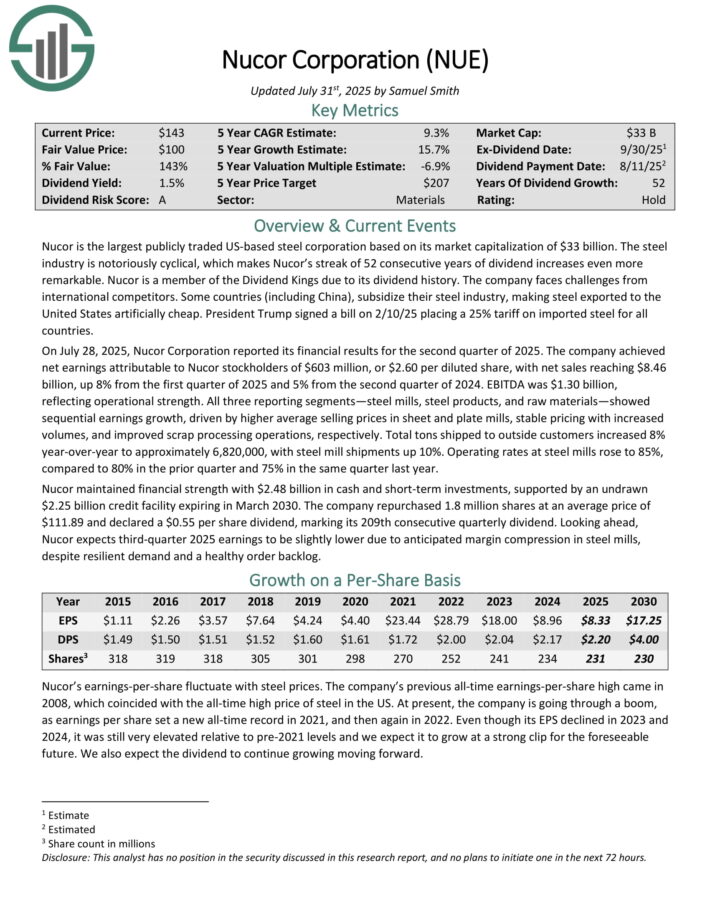

Prolonged-Time interval Dividend Compounder #1: Nucor Corp. (NUE)

- Anticipated Improvement Value: 15.7%

Nucor is the most important publicly traded US-based metallic firm based mostly totally on its market capitalization. The metallic enterprise is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend will enhance far more excellent.

On July 28, 2025, Nucor Firm reported its financial outcomes for the second quarter of 2025. The company achieved net earnings attributable to Nucor stockholders of $2.60 per diluted share, with net product sales reaching $8.46 billion, up 8% from the second quarter of 2024. EBITDA was $1.30 billion, reflecting operational energy.

All three reporting segments—metallic mills, metallic merchandise, and raw provides—confirmed sequential earnings improvement, pushed by bigger widespread selling prices in sheet and plate mills, safe pricing with elevated volumes, and improved scrap processing operations, respectively.

Full tons shipped to exterior purchasers elevated 8% year-over-year to roughly 6,820,000, with metallic mill shipments up 10%. Working expenses at metallic mills rose to 85%, compared with 80% inside the prior quarter and 75% within the an identical quarter remaining 12 months.

Click on on proper right here to acquire our latest Sure Analysis report on NUE (preview of net web page 1 of three confirmed below):

Further Finding out

The Dividend Kings document is not going to be the one choice to quickly show display screen for shares that recurrently pay rising dividends.

Thanks for learning this textual content. Please ship any strategies, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@kind":"Particular person","identify":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@kind":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/11/Dividend-Kings-e1667523911500.png","width":0,"peak":0},"writer":{"@kind":"Group","identify":"","url":"https://indexinvestingnews.com","emblem":{"@kind":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link