Revealed on December eighth, 2025 by Bob Ciura

Often, excessive dividend yields are a superb factor. In any case, the higher the dividend yield, the extra revenue you’re paid in your funding.

Earnings investing, and explicit dividend reinvestment, permits traders to steadily develop their wealth over the long term.

With this in thoughts, we compiled an inventory of excessive dividend shares with dividend yields above 5%. You possibly can obtain your free copy of the excessive dividend shares checklist by clicking on the hyperlink under:

Excessive dividend shares are naturally interesting on the floor, resulting from their excessive dividend yields.

However revenue traders want to ensure they don’t fall right into a dividend ‘entice’, which means buying a inventory solely resulting from its excessive yield, solely to see the corporate minimize or get rid of the dividend payout.

Whereas there may be by no means a assure a inventory is not going to minimize its dividend, specializing in shares with robust underlying fundamentals and modest payout ratios can go a great distance.

The shares all have Dividend Threat Scores of ‘F’ (our lowest grades) within the Positive Evaluation Analysis Database, with payout ratios above 100%, indicating their dividends are too excessive and unsustainable at the moment ranges.

In consequence, all 10 shares have promote rankings from Positive Dividend. The checklist is sorted by present yield, from lowest to highest.

Desk of Contents

You possibly can immediately soar to any particular part of the article through the use of the hyperlinks under:

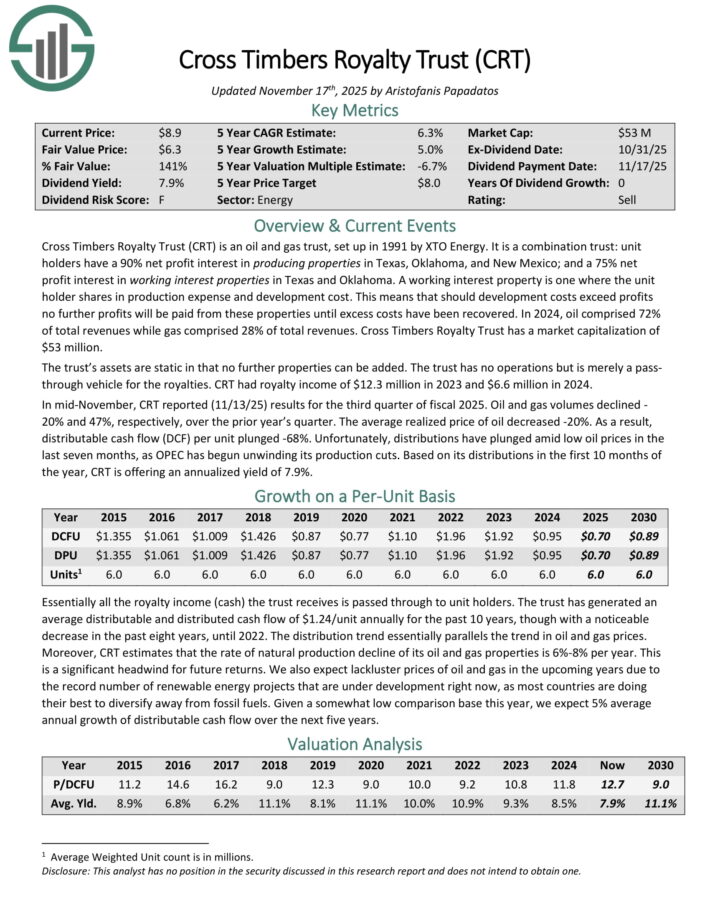

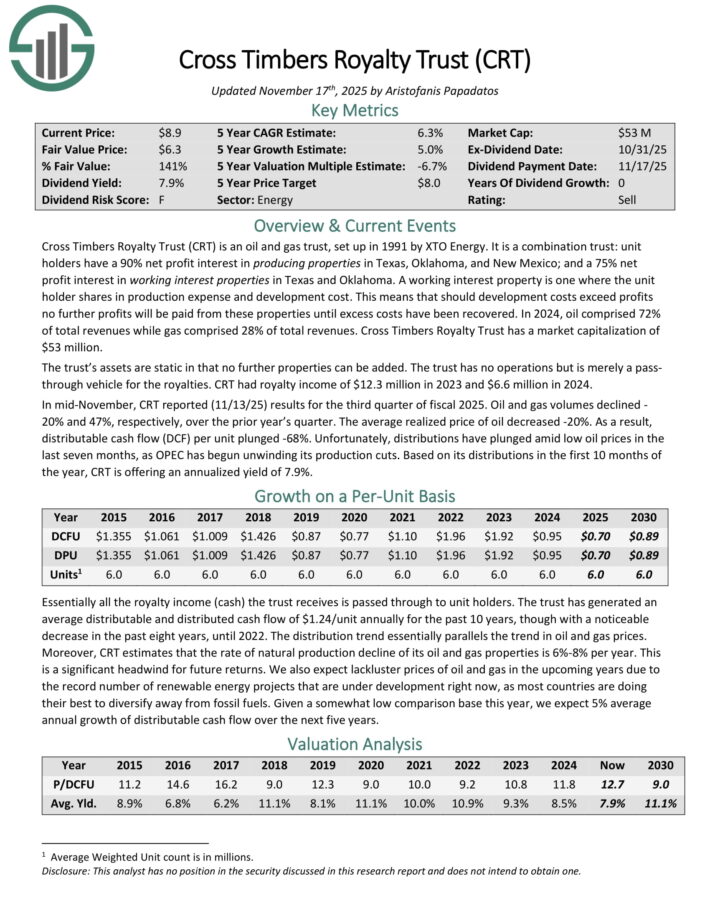

Too Excessive Dividend Yield #10: Cross Timbers Royalty Belief (CRT)

Cross Timbers Royalty Belief (CRT) is an oil and gasoline belief, arrange in 1991 by XTO Power. It’s a mixture belief: unit holders have a 90% internet revenue curiosity in producing properties in Texas, Oklahoma, and New Mexico; and a 75% internet revenue curiosity in working curiosity properties in Texas and Oklahoma.

A working curiosity property is one the place the unit holder shares in manufacturing expense and improvement value. Which means ought to improvement prices exceed earnings no additional earnings shall be paid from these properties till extra prices have been recovered.

In 2024, oil comprised 72% of whole revenues whereas gasoline comprised 28% of whole revenues. The belief’s belongings are static in that no additional properties could be added.

The belief has no operations however is merely a pass-through car for the royalties. CRT had royalty revenue of $12.3 million in 2023 and $6.6 million in 2024.

In mid-November, CRT reported (11/13/25) outcomes for the third quarter of fiscal 2025. Oil and gasoline volumes declined 20% and 47%, respectively, over the prior yr’s quarter. The common realized worth of oil decreased -20%.

In consequence, distributable money circulate (DCF) per unit plunged -68%. Sadly, distributions have plunged amid low oil costs within the final seven months, as OPEC has begun unwinding its manufacturing cuts.

Click on right here to obtain our most up-to-date Positive Evaluation report on CRT (preview of web page 1 of three proven under):

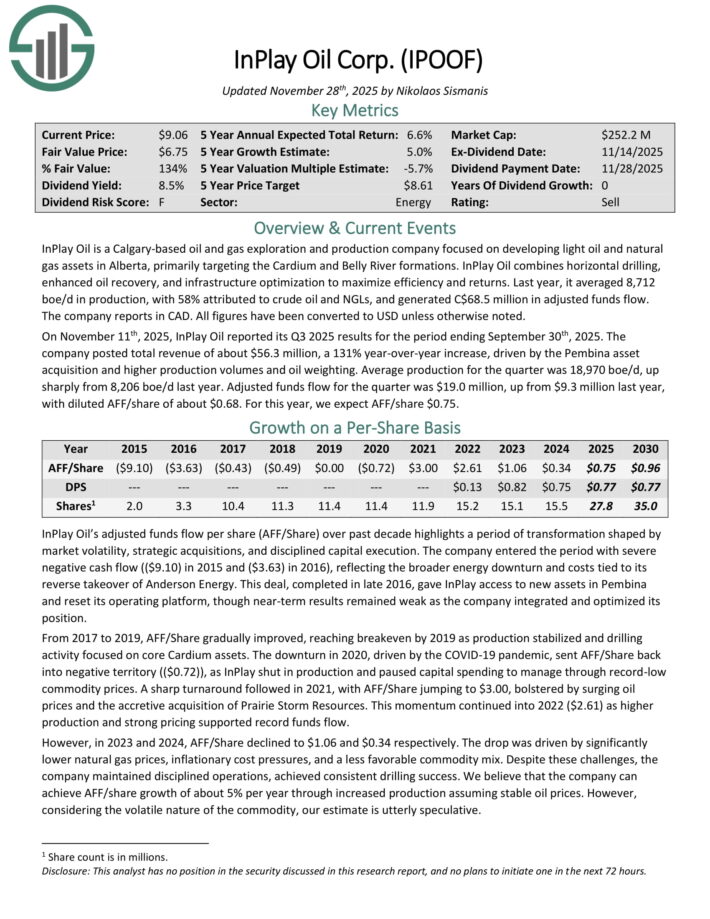

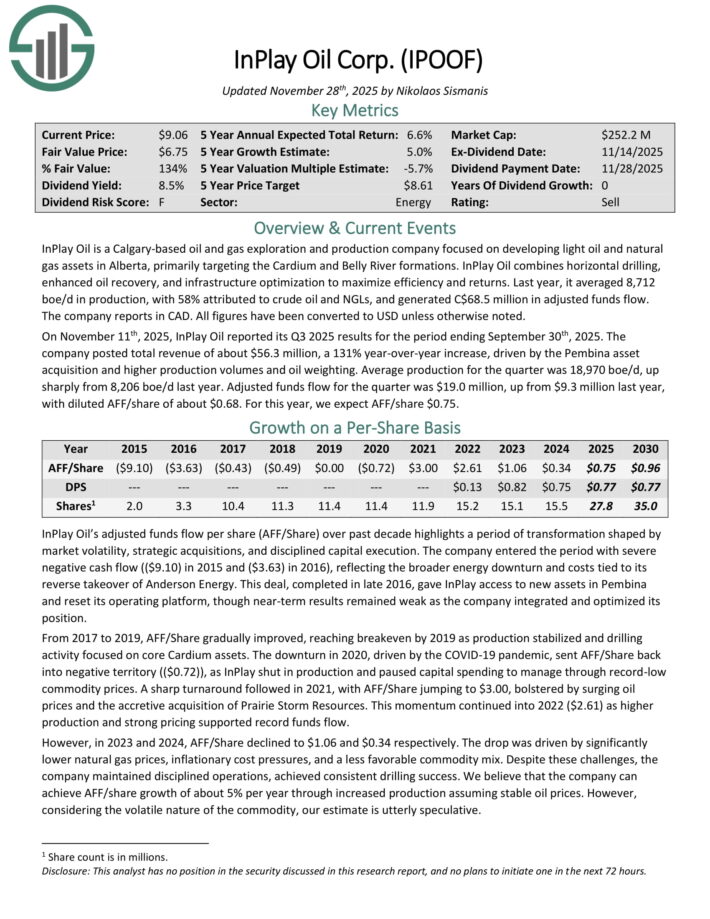

Too Excessive Dividend Yield #9: InPlay Oil Corp. (IPOOF)

InPlay Oil is a Calgary-based oil and gasoline exploration and manufacturing firm targeted on growing gentle oil and pure gasoline belongings in Alberta, primarily concentrating on the Cardium and Stomach River formations. InPlay Oil combines horizontal drilling, enhanced oil restoration, and infrastructure optimization to maximise effectivity and returns.

Final yr, it averaged 8,712 boe/d in manufacturing, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds circulate.

InPlay Oil is a Calgary-based oil and gasoline exploration and manufacturing firm targeted on growing gentle oil and pure gasoline belongings in Alberta, primarily concentrating on the Cardium and Stomach River formations.

InPlay Oil combines horizontal drilling, enhanced oil restoration, and infrastructure optimization to maximise effectivity and returns. Final yr, it averaged 8,712 boe/d in manufacturing, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds circulate.

On November eleventh, 2025, InPlay Oil reported its Q3 2025 outcomes. The corporate posted whole income of about $56.3 million, a 131% year-over-year improve, pushed by the Pembina asset acquisition and better manufacturing volumes and oil weighting.

Common manufacturing for the quarter was 18,970 boe/d, up sharply from 8,206 boe/d final yr. Adjusted funds circulate for the quarter was $19.0 million, up from $9.3 million final yr, with diluted AFF/share of about $0.68.

Click on right here to obtain our most up-to-date Positive Evaluation report on IPOOF (preview of web page 1 of three proven under):

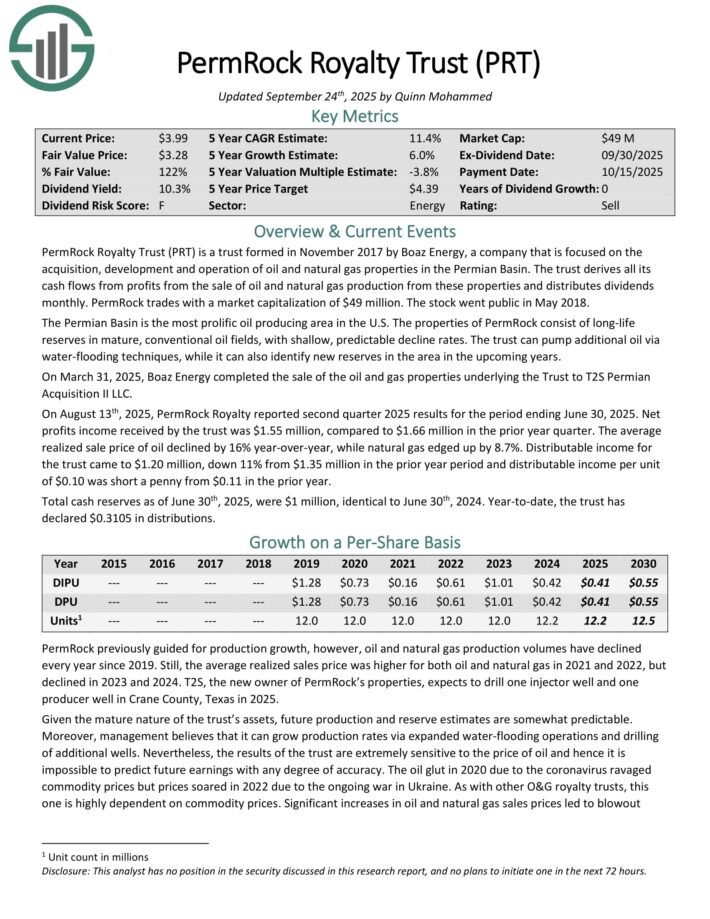

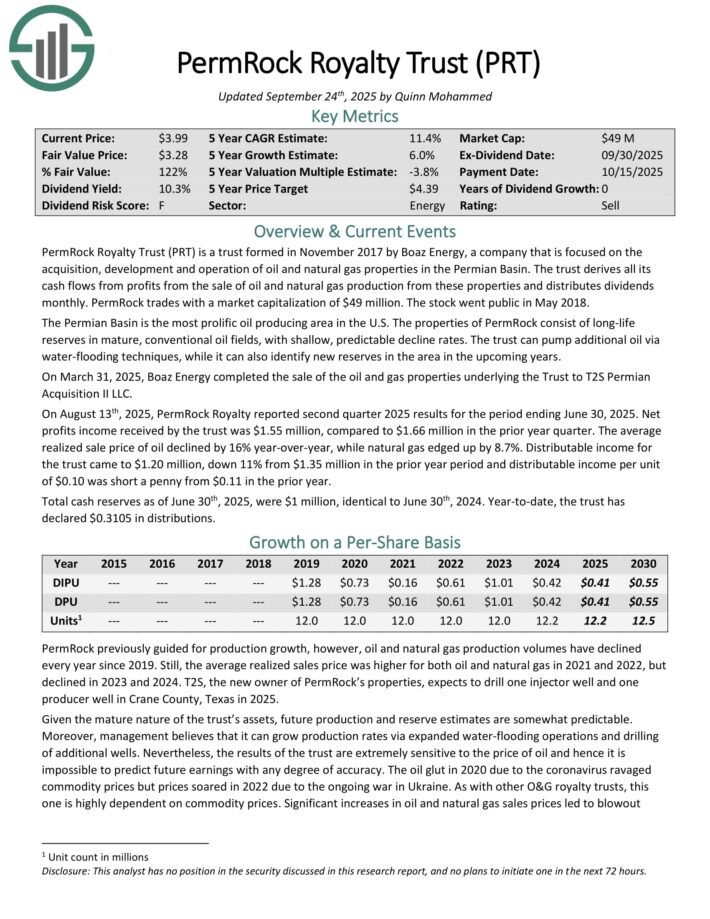

Too Excessive Dividend Yield #8: PermRock Royalty Belief (PRT)

PermRock Royalty Belief is a belief shaped in November 2017 by Boaz Power, an organization that’s targeted on the acquisition, improvement and operation of oil and pure gasoline properties within the Permian Basin.

The belief derives all its money flows from earnings from the sale of oil and pure gasoline manufacturing from these properties and distributes dividends month-to-month.

The Permian Basin is probably the most prolific oil producing space within the U.S. The properties of PermRock encompass long-life reserves in mature, standard oil fields, with shallow, predictable decline charges.

The belief can pump extra oil through water-flooding methods, whereas it might probably additionally determine new reserves within the space within the upcoming years.

On March 31, 2025, Boaz Power accomplished the sale of the oil and gasoline properties underlying the Belief to T2S Permian Acquisition II LLC.

On August thirteenth, 2025, PermRock Royalty reported second quarter 2025 outcomes for the interval ending June 30, 2025. Web earnings revenue acquired by the belief was $1.55 million, in comparison with $1.66 million within the prior yr quarter.

The common realized sale worth of oil declined by 16% year-over-year, whereas pure gasoline edged up by 8.7%.

Distributable revenue for the belief got here to $1.20 million, down 11% from $1.35 million within the prior yr interval and distributable revenue per unit of $0.10 was quick a penny from $0.11 within the prior yr.

Whole money reserves as of June thirtieth, 2025, had been $1 million, an identical to June thirtieth, 2024. Yr-to-date, the belief has declared $0.3105 in distributions.

Click on right here to obtain our most up-to-date Positive Evaluation report on PRT (preview of web page 1 of three proven under):

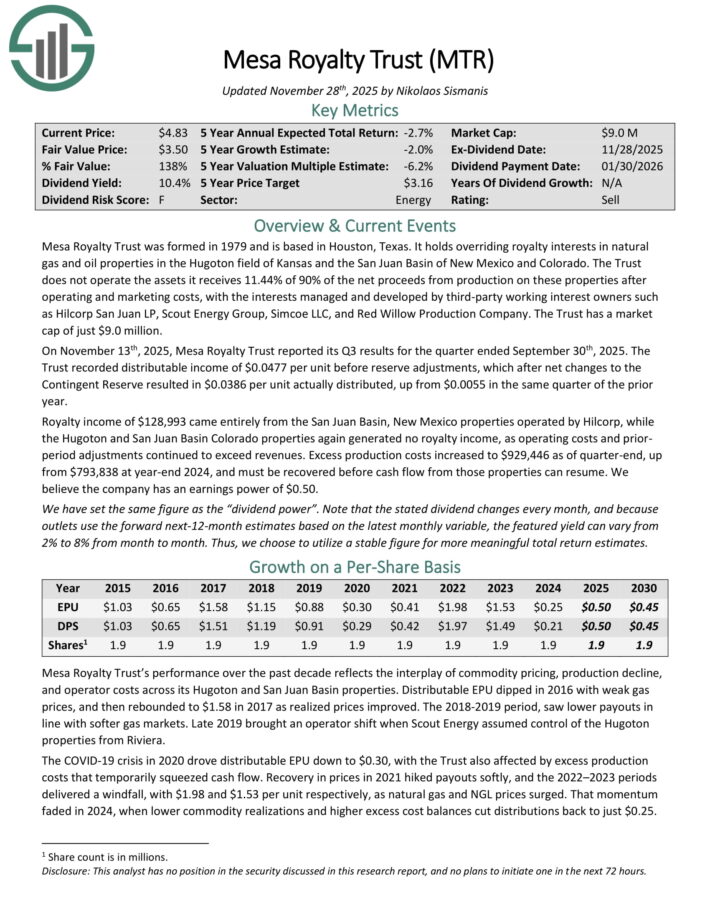

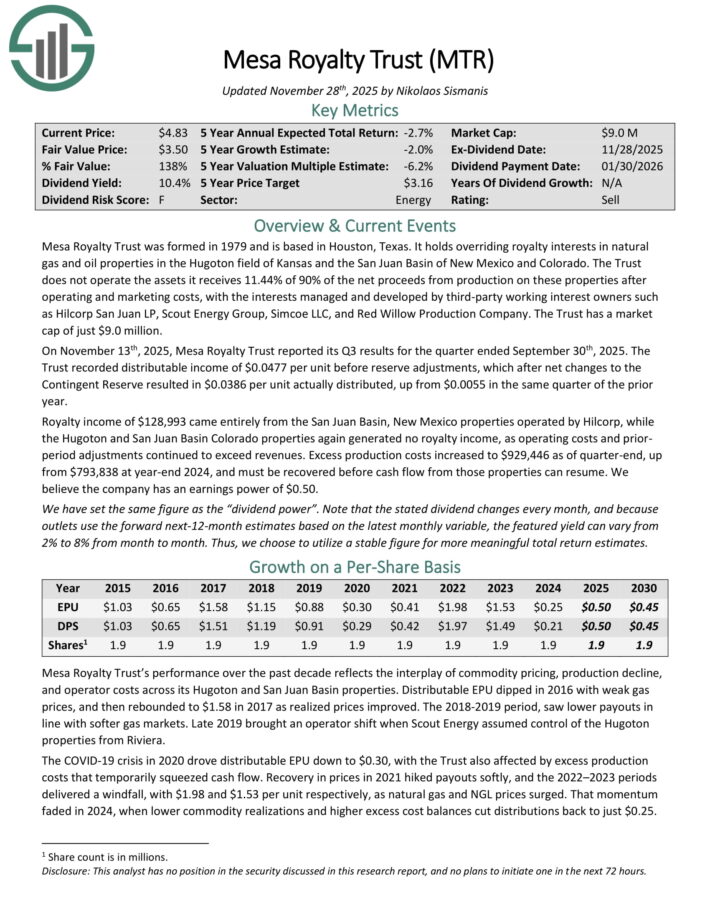

Too Excessive Dividend Yield #7: Mesa Royalty Belief (MTR)

Mesa Royalty Belief was shaped in 1979 and relies in Houston, Texas. It holds overriding royalty pursuits in pure gasoline and oil properties within the Hugoton area of Kansas and the San Juan Basin of New Mexico and Colorado.

The Belief doesn’t function the belongings it receives 11.44% of 90% of the online proceeds from manufacturing on these properties after working and advertising prices, with the pursuits managed and developed by third-party working curiosity homeowners corresponding to Hilcorp San Juan LP, Scout Power Group, Simcoe LLC, and Purple Willow Manufacturing Firm.

On November thirteenth, 2025, Mesa Royalty Belief reported its Q3 outcomes for the quarter ended September thirtieth, 2025. The Belief recorded distributable revenue of $0.0477 per unit earlier than reserve changes, which after internet adjustments to the Contingent Reserve resulted in $0.0386 per unit really distributed, up from $0.0055 in the identical quarter of the prior yr.

Royalty revenue of $128,993 got here completely from the San Juan Basin, New Mexico properties operated by Hilcorp, whereas the Hugoton and San Juan Basin Colorado properties once more generated no royalty revenue, as working prices and prior interval changes continued to exceed revenues.

Extra manufacturing prices elevated to $929,446 as of quarter-end, up from $793,838 at year-end 2024, and should be recovered earlier than money circulate from these properties can resume. We consider the corporate has an earnings energy of $0.50.

Click on right here to obtain our most up-to-date Positive Evaluation report on MTR (preview of web page 1 of three proven under):

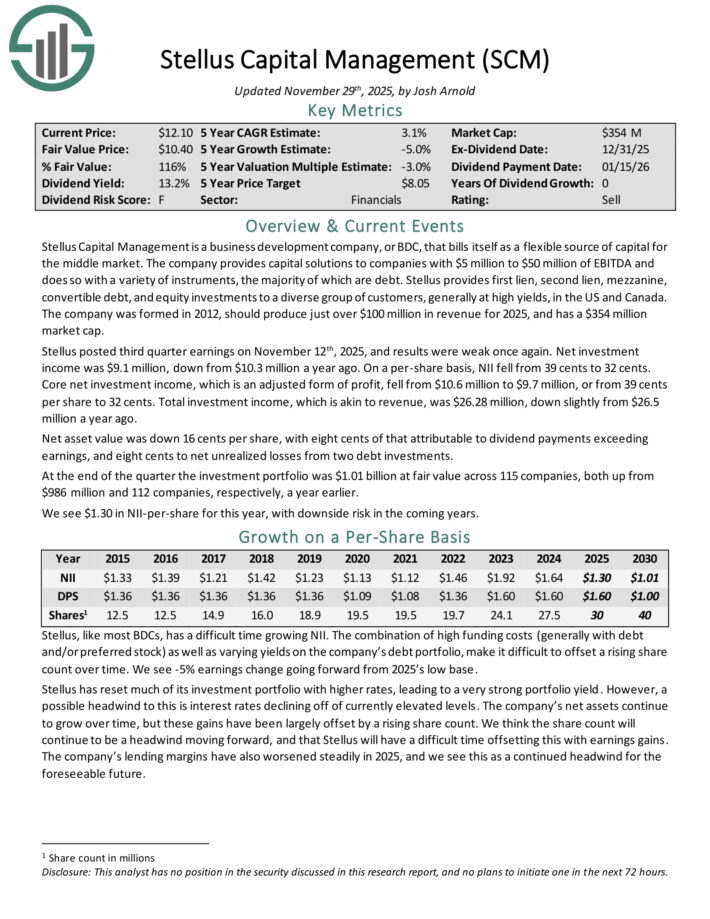

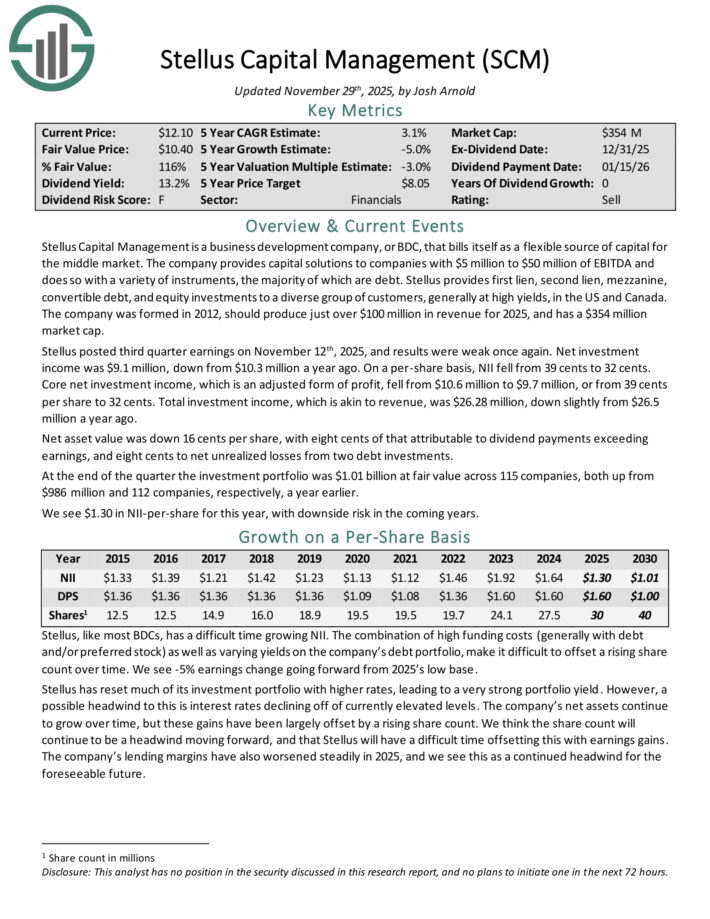

Too Excessive Dividend Yield #6: Stellus Capital (SCM)

Stellus Capital Administration is a enterprise improvement firm, or BDC, that payments itself as a versatile supply of capital for the center market.

The corporate gives capital options to firms with $5 million to $50 million of EBITDA and does so with a wide range of devices, the vast majority of that are debt.

Stellus gives first lien, second lien, mezzanine, convertible debt, and fairness investments to a various group of consumers, usually at excessive yields, within the US and Canada.

Stellus posted third quarter earnings on November twelfth, 2025, and outcomes had been weak as soon as once more. Web funding revenue was $9.1 million, down from $10.3 million a yr in the past. On a per-share foundation, NII fell from 39 cents to 32 cents.

Core internet funding revenue, which is an adjusted type of revenue, fell from $10.6 million to $9.7 million, or from 39 cents per share to 32 cents. Whole funding revenue, which is akin to income, was $26.28 million, down barely from $26.5 million a yr in the past.

Web asset worth was down 16 cents per share, with eight cents of that attributable to dividend funds exceeding earnings, and eight cents to internet unrealized losses from two debt investments.

On the finish of the quarter the funding portfolio was $1.01 billion at honest worth throughout 115 firms, each up from $986 million and 112 firms, respectively, a yr earlier.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCM (preview of web page 1 of three proven under):

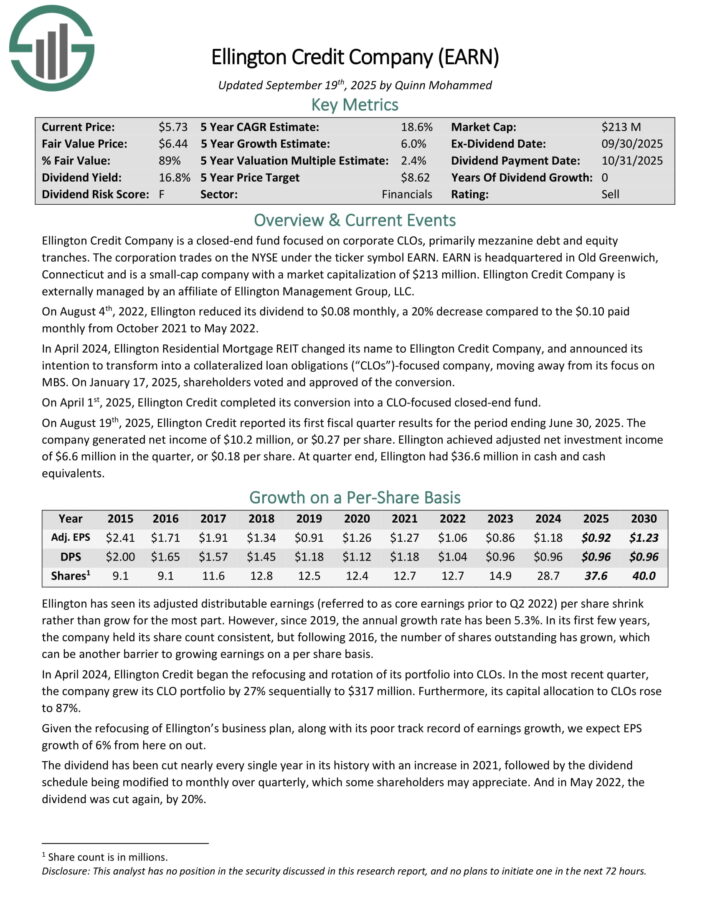

Too Excessive Dividend Yield #5: Ellington Credit score Co. (EARN)

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On August nineteenth, 2025, Ellington Credit score reported its first fiscal quarter outcomes for the interval ending June 30, 2025. The corporate generated internet revenue of $10.2 million, or $0.27 per share.

Ellington achieved adjusted internet funding revenue of $6.6 million within the quarter, or $0.18 per share. At quarter finish, Ellington had $36.6 million in money and money equivalents.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

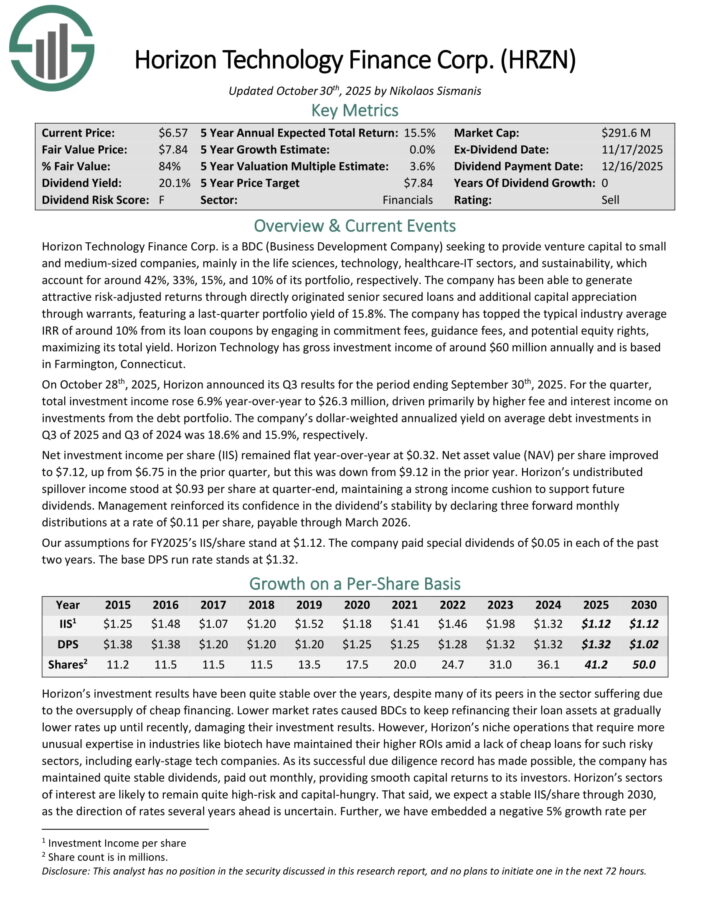

Too Excessive Dividend Yield #4: Horizon Expertise Finance (HRZN)

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the expertise, life sciences, and healthcare–IT sectors.

The corporate has generated engaging danger–adjusted returns via instantly originated senior secured loans and extra capital appreciation via warrants.

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the expertise, life sciences, and healthcare–IT sectors.

On October twenty eighth, 2025, Horizon introduced its Q3 outcomes. For the quarter, whole funding revenue rose 6.9% year-over-year to $26.3 million, pushed primarily by increased payment and curiosity revenue on investments from the debt portfolio.

The corporate’s dollar-weighted annualized yield on common debt investments in Q3 of 2025 and Q3 of 2024 was 18.6% and 15.9%, respectively.

Web funding revenue per share (IIS) remained flat year-over-year at $0.32. Web asset worth (NAV) per share improved to $7.12, up from $6.75 within the prior quarter, however this was down from $9.12 within the prior yr.

Horizon’s undistributed spillover revenue stood at $0.93 per share at quarter-end, sustaining a powerful revenue cushion to help future dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven under):

Too Excessive Dividend Yield #3: Orchid Island Capital (ORC)

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money circulate based mostly on residential loans corresponding to mortgages, subprime, and home-equity loans.

On October 23, 2025, Orchid Island Capital, Inc. reported estimated internet revenue of $0.53 per frequent share for Q3 2025, with ebook worth per share estimated at $7.33 as of September 30, 2025.

The corporate declared a month-to-month dividend of $0.12 per share for October, retaining according to its month-to-month payout technique.

The RMBS portfolio and derivatives portfolio developed as the corporate remained targeted on company residential mortgage-backed securities paired with hedging methods.

Orchid Island highlighted that the funding backdrop stays engaging with bettering spreads and prepayment danger manageable given the portfolio’s coupon distribution and hedges.

Prepayment exercise remained a focus, with administration noting the necessity for continued vigilance given increased coupon swimming pools and refinancing dynamics.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven under):

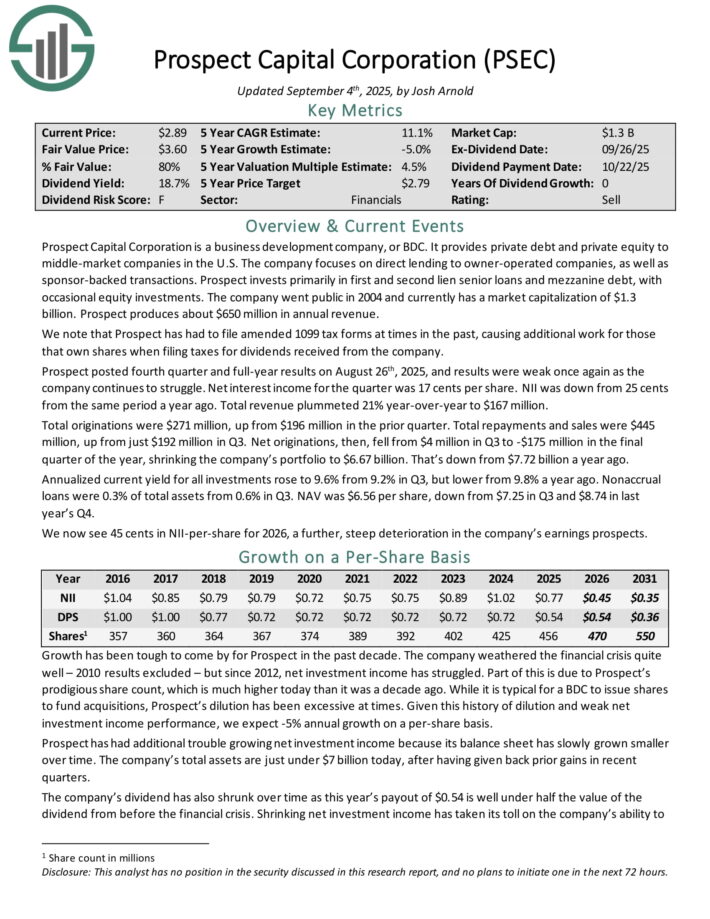

Too Excessive Dividend Yield #2: Prospect Capital (PSEC)

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives non-public debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Prospect posted fourth quarter and full-year outcomes on August twenty sixth, 2025, and outcomes had been weak as soon as once more as the corporate continues to battle. Web curiosity revenue for the quarter was 17 cents per share. NII was down from 25 cents from the identical interval a yr in the past. Whole income plummeted 21% year-over-year to $167 million.

Whole originations had been $271 million, up from $196 million within the prior quarter. Whole repayments and gross sales had been $445 million, up from simply $192 million in Q3. Web originations, then, fell from $4 million in Q3 to -$175 million within the remaining quarter of the yr, shrinking the corporate’s portfolio to $6.67 billion. That’s down from $7.72 billion a yr in the past.

Annualized present yield for all investments rose to 9.6% from 9.2% in Q3, however decrease from 9.8% a yr in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven under):

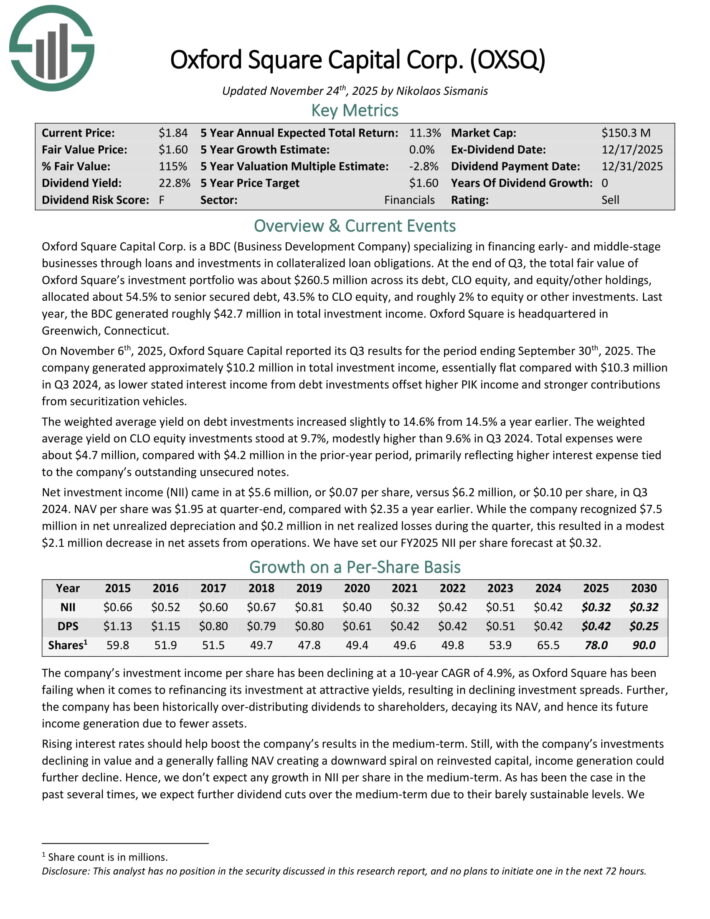

Too Excessive Dividend Yield #1: Oxford Sq. Capital (OXSQ)

Oxford Sq. Capital Corp. is a BDC (Enterprise Growth Firm) specializing in financing early- and middle-stage companies via loans and investments in collateralized mortgage obligations.

On the finish of Q3, the whole honest worth of Oxford Sq.’s funding portfolio was about $260.5 million throughout its debt, CLO fairness, and fairness/different holdings, allotted about 54.5% to senior secured debt, 43.5% to CLO fairness, and roughly 2% to fairness or different investments. Final yr, the BDC generated roughly $42.7 million in whole funding revenue.

On November sixth, 2025, Oxford Sq. Capital reported its Q3. The corporate generated roughly $10.2 million in whole funding revenue, basically flat in contrast with $10.3 million in Q3 2024, as decrease acknowledged curiosity revenue from debt investments offset increased PIK revenue and stronger contributions from securitization autos.

The weighted common yield on debt investments elevated barely to 14.6% from 14.5% a yr earlier. The weighted common yield on CLO fairness investments stood at 9.7%, modestly increased than 9.6% in Q3 2024.

Whole bills had been about $4.7 million, in contrast with $4.2 million within the prior-year interval, primarily reflecting increased curiosity expense tied to the corporate’s excellent unsecured notes.

Web funding revenue (NII) got here in at $5.6 million, or $0.07 per share, versus $6.2 million, or $0.10 per share, in Q3 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on OXSQ (preview of web page 1 of three proven under):

Further Studying

In case you are thinking about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].