Revealed on September ninth, 2025 by Bob Ciura

The S&P 500 is overvalued.

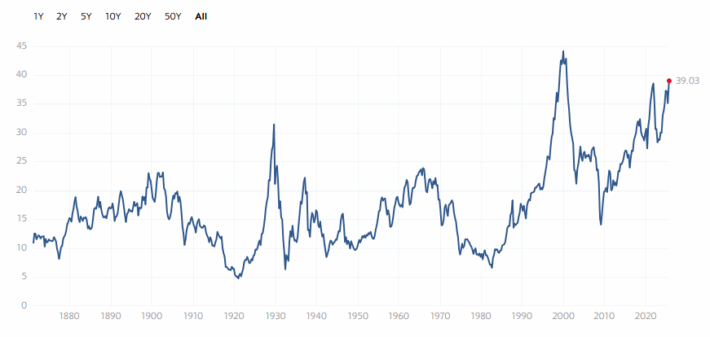

The picture under reveals the long-term pattern of the Shiller PE ratio for the S&P 500.

Supply: Multpl.com

The Shiller PE ratio “smooths” the PE ratio by utilizing 10-year inflation-adjusted common earnings for earnings, as a substitute of trailing-twelve-month earnings. This helps the ratio to be significant even when earnings are very low (like throughout recessions).

There’s no query the S&P 500 is overvalued from a historic perspective…

And it’s not “simply” the Shiller PE. The usual PE ratio is ~30 for the S&P 500 on the time of this writing – one of many highest non-recession (when the ‘E’ within the ratio falls, pushing up the ratio) ranges ever.

However one needn’t make investments broadly within the traditionally overvalued S&P 500…

For instance, the free excessive dividend shares listing spreadsheet under has our full listing of particular person securities (shares, REITs, MLPs, and so forth.) with with 5%+ dividend yields.

Shopping for overvalued dividend shares can jeopardize future returns. Even high quality corporations can quantity to mediocre or poor investments, if too excessive worth is paid.

Falling valuations can result in low (and even damaging) complete returns, even together with dividends.

Due to this fact, traders needs to be cautious in relation to overvalued dividend shares. The next 10 overvalued dividend shares needs to be prevented.

The listing is sorted by the extent of overvaluation.

Desk of Contents

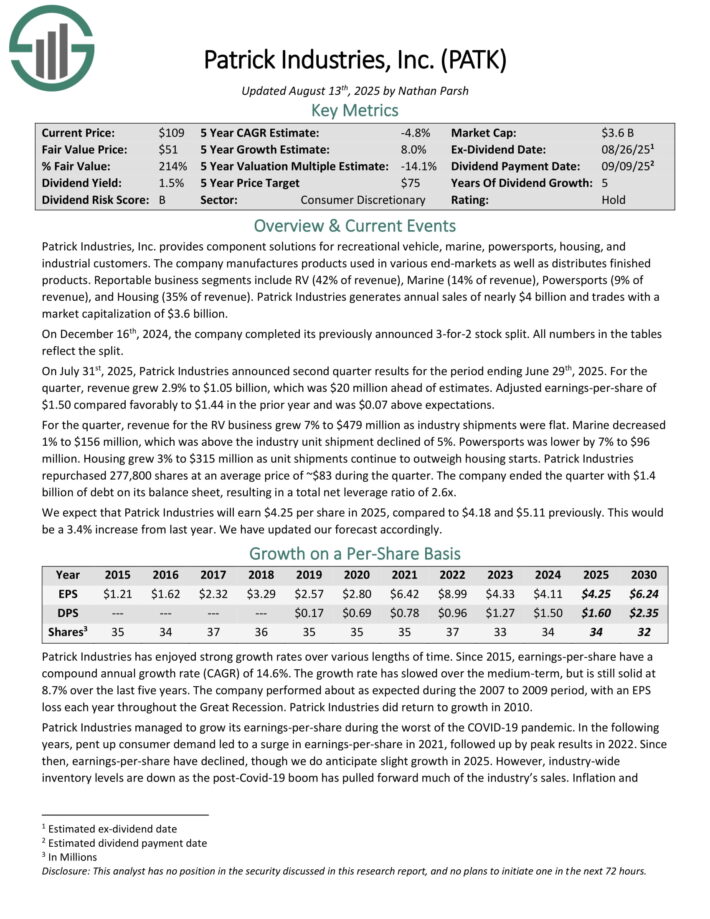

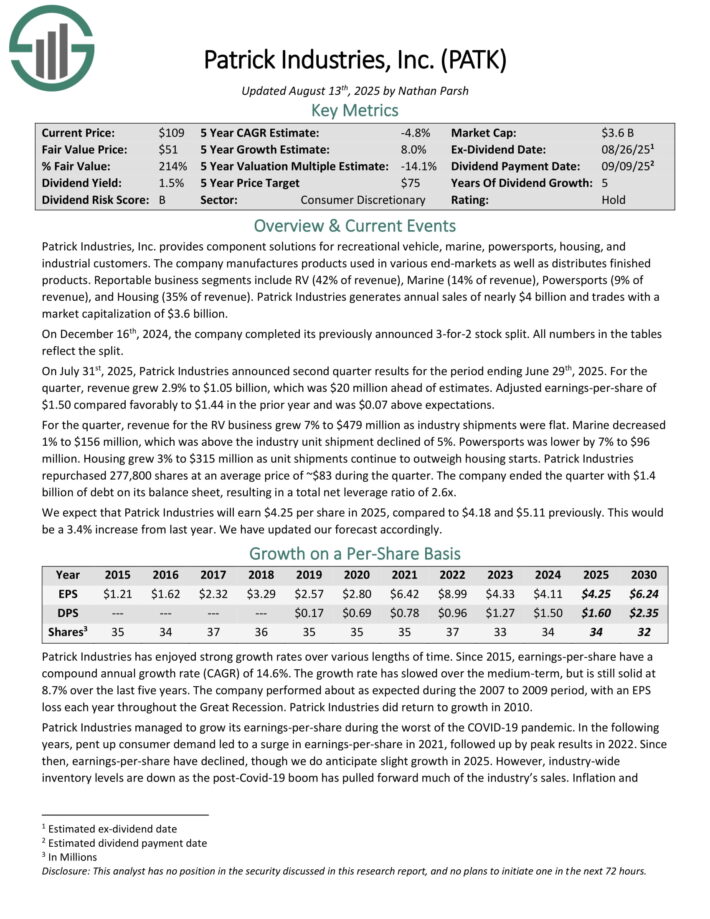

Overvalued Dividend Inventory #10: Patrick Industries (PATK)

- Annual Valuation Return: -14.7%

Patrick Industries offers part options for leisure automobile, marine, energy sports activities, housing, and industrial clients.

The corporate manufactures merchandise utilized in numerous end-markets in addition to distributes completed merchandise. Reportable enterprise segments embody RV (42% of income), Marine (14% of income), Energy sports activities (9% of income), and Housing (35% of income). Patrick Industries generates annual gross sales of almost $4 billion.

On July thirty first, 2025, Patrick Industries introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 2.9% to $1.05 billion, which was $20 million forward of estimates. Adjusted earnings-per-share of $1.50 in contrast favorably to $1.44 within the prior yr and was $0.07 above expectations.

For the quarter, income for the RV enterprise grew 7% to $479 million as business shipments had been flat. Marine decreased 1% to $156 million, which was above the business unit cargo declined of 5%. Energy sports activities was decrease by 7% to $96 million. Housing grew 3% to $315 million as unit shipments proceed to outweigh housing begins.

Patrick Industries repurchased 277,800 shares at a mean worth of ~$83 in the course of the quarter. The corporate ended the quarter with $1.4 billion of debt on its stability sheet, leading to a complete internet leverage ratio of two.6x.

Click on right here to obtain our most up-to-date Positive Evaluation report on PATK (preview of web page 1 of three proven under):

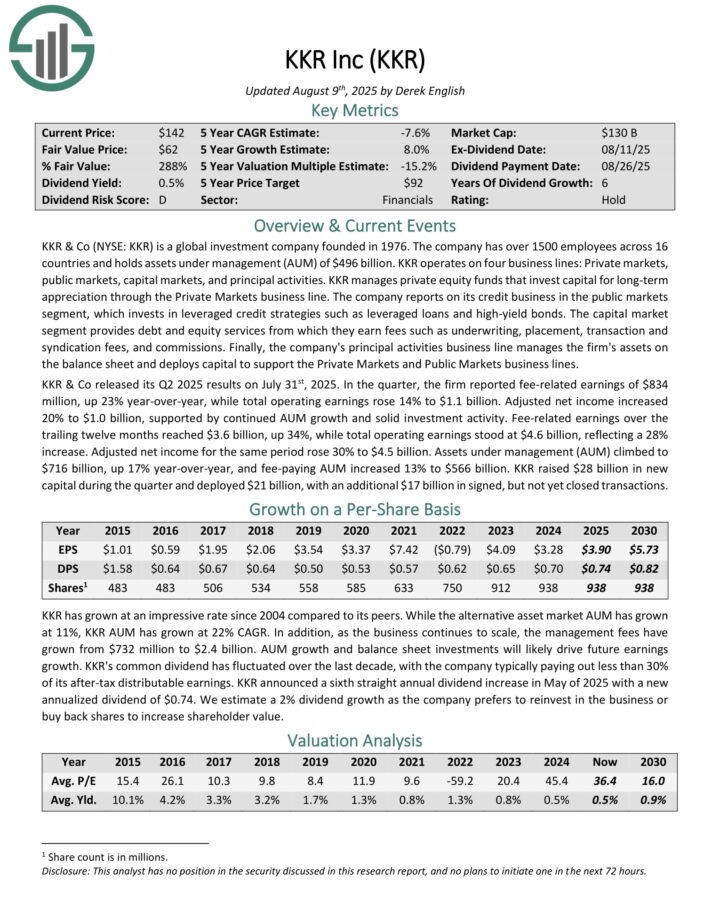

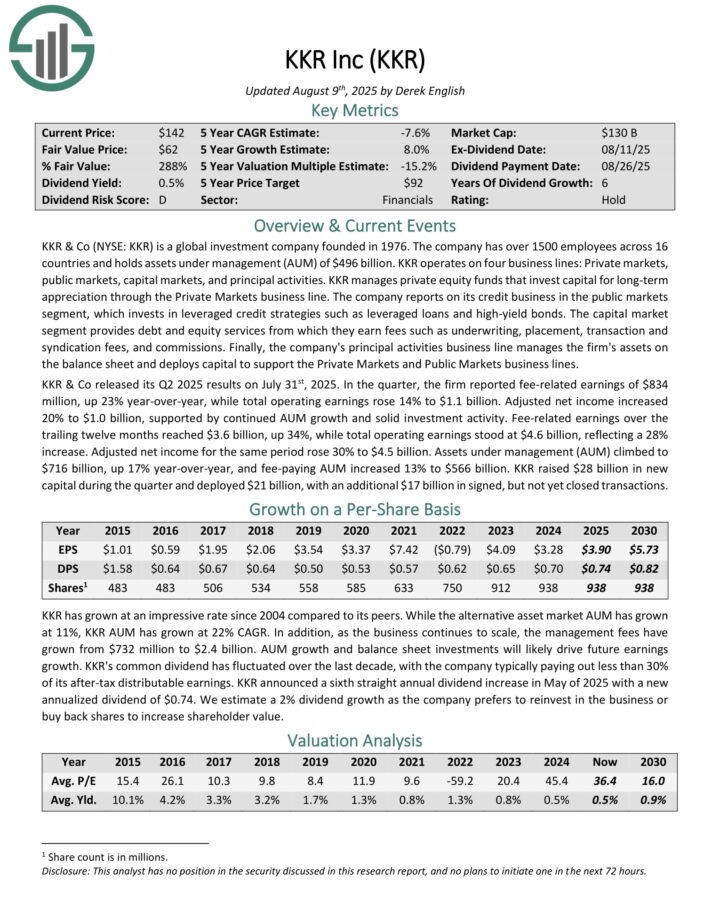

Overvalued Dividend Inventory #9: KKR & Co. (KKR)

- Annual Valuation Return: -15.1%

KKR & Co is a world funding firm with belongings below administration (AUM) of $496 billion. KKR operates on 4 enterprise strains: Non-public markets, public markets, capital markets, and principal actions.

KKR manages personal fairness funds that make investments capital for long-term appreciation by the Non-public Markets enterprise line.

KKR & Co launched its Q2 2025 outcomes on July thirty first, 2025. Within the quarter, the agency reported fee-related earnings of $834 million, up 23% year-over-year, whereas complete working earnings rose 14% to $1.1 billion.

Adjusted internet earnings elevated 20% to $1.0 billion, supported by continued AUM progress and stable funding exercise.

Charge-related earnings over the trailing twelve months reached $3.6 billion, up 34%, whereas complete working earnings stood at $4.6 billion, reflecting a 28% improve. Adjusted internet earnings for a similar interval rose 30% to $4.5 billion.

Property below administration (AUM) climbed to $716 billion, up 17% year-over-year, and fee-paying AUM elevated 13% to $566 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on KKR (preview of web page 1 of three proven under):

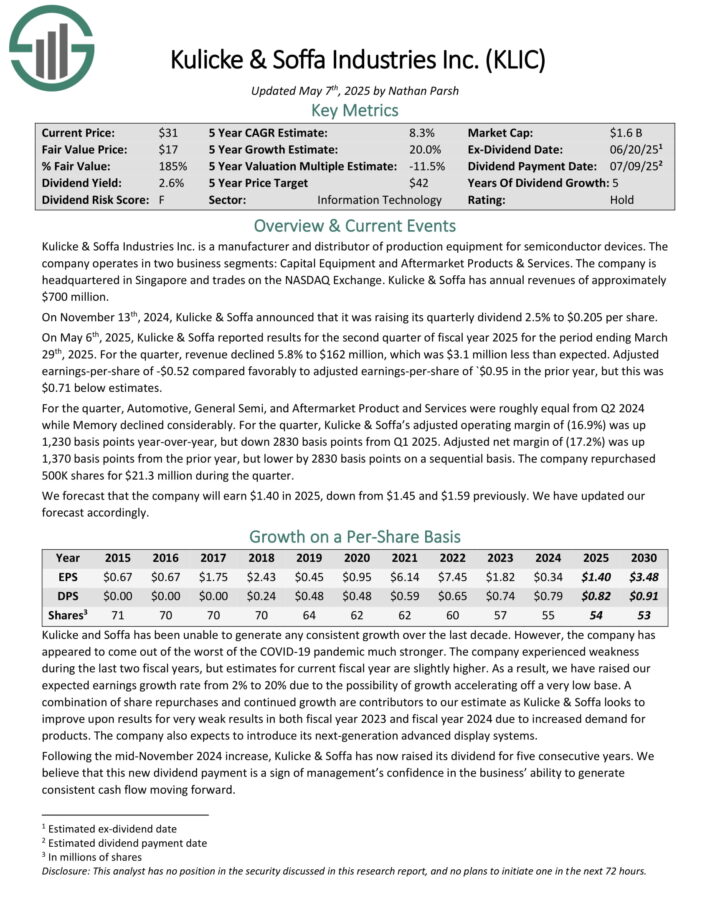

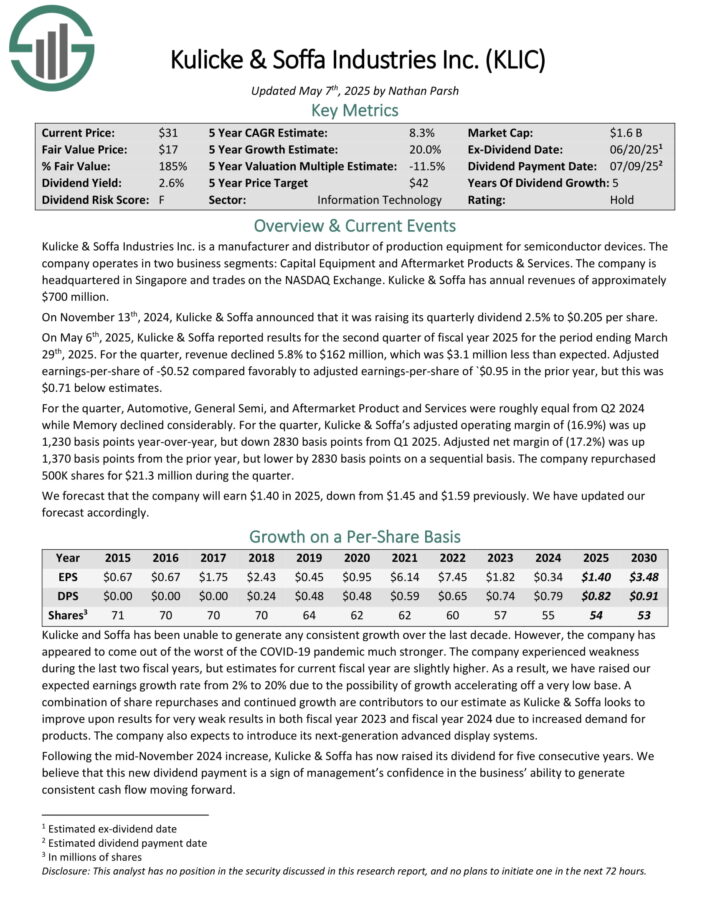

Overvalued Dividend Inventory #8: Kulicke & Soffa Industries (KLIC)

- Annual Valuation Return: -14.0%

Kulicke & Soffa Industries Inc. is a producer and distributor of manufacturing tools for semiconductor gadgets. The corporate operates in two enterprise segments: Capital Gear and Aftermarket Merchandise & Companies.

It’s headquartered in Singapore and trades on the NASDAQ Trade. Kulicke & Soffa has annual revenues of roughly $700 million.

On Might sixth, 2025, Kulicke & Soffa reported outcomes for the second quarter of fiscal yr 2025. For the quarter, income declined 5.8% to $162 million, which was $3.1 million lower than anticipated.

Adjusted earnings-per-share of -$0.52 in contrast favorably to adjusted earnings-per-share of -$0.95 within the prior yr.

For the quarter, Automotive, Normal Semi, and Aftermarket Product and Companies had been roughly equal from Q2 2024 whereas Reminiscence declined significantly.

For the quarter, Kulicke & Soffa’s adjusted working margin of (16.9%) was up 1,230 foundation factors year-over-year, however down 2830 foundation factors from Q1 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on KLIC (preview of web page 1 of three proven under):

Overvalued Dividend Inventory #7: Blackstone Mortgage Belief (BXMT)

- Annual Valuation Return: -15.3%

On July 30, 2025, Blackstone Mortgage Belief, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted internet earnings of $7.0 million, or $0.04 per share, a return to profitability from a $0.00 EPS in Q1 2025 and a $61.1 million loss in Q2 2024.

Distributable EPS was $0.19, up from $0.17 in Q1, whereas Distributable EPS previous to charge-offs reached $0.45, in comparison with $0.42 beforehand. Dividends remained at $0.47 per share, yielding 9.7% annualized primarily based on the July 29 share worth of $19.36.

Whole revenues had been $133.9 million, with internet earnings from loans and investments at $94.8 million after $264.7 million in curiosity bills. The stability sheet confirmed complete belongings of $20.6 billion, together with $19.0 billion in internet loans receivable after CECL reserves.

Fairness stood at $3.6 billion, with e book worth per share declining to $21.04 from $21.42 in Q1, reflecting $4.39 per share in reserves. Liquidity was sturdy at $1.1 billion, with a 3.8x debt-to-equity ratio.

The portfolio grew to $18.4 billion throughout 144 loans, up $1.4 billion over two quarters, with 82% of Q2 originations in multifamily and industrial sectors, and 68% worldwide. Workplace publicity dropped to twenty-eight% from 36% year-over-year.

Impaired loans fell 55% from peak to $1.0 billion, with $0.2 billion resolved above carrying worth. CECL reserves held regular at $755 million (3.8% of principal), and portfolio efficiency was 94%.

Click on right here to obtain our most up-to-date Positive Evaluation report on BXMT (preview of web page 1 of three proven under):

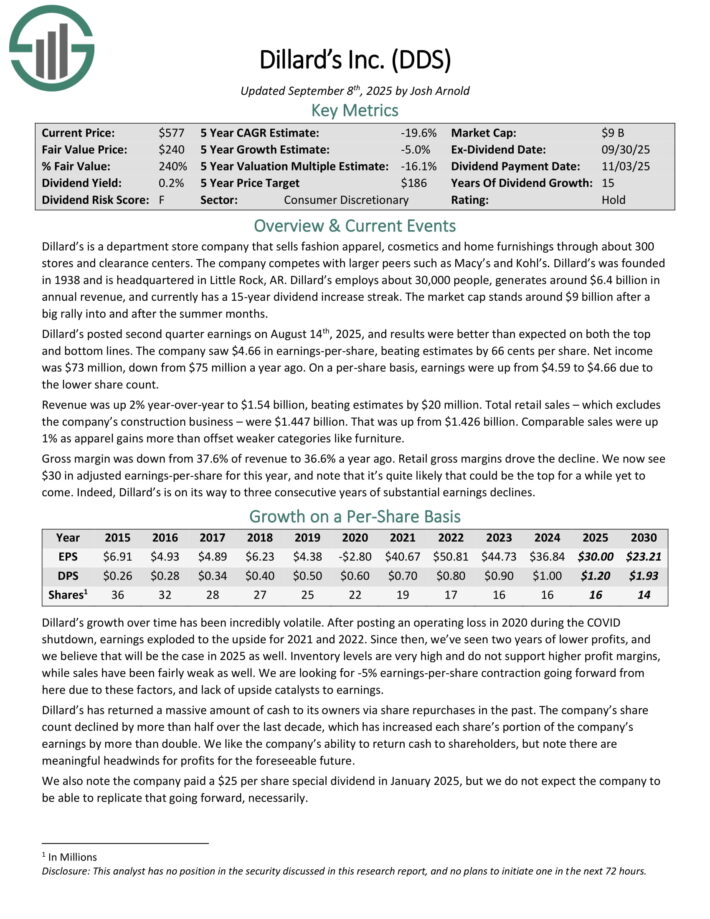

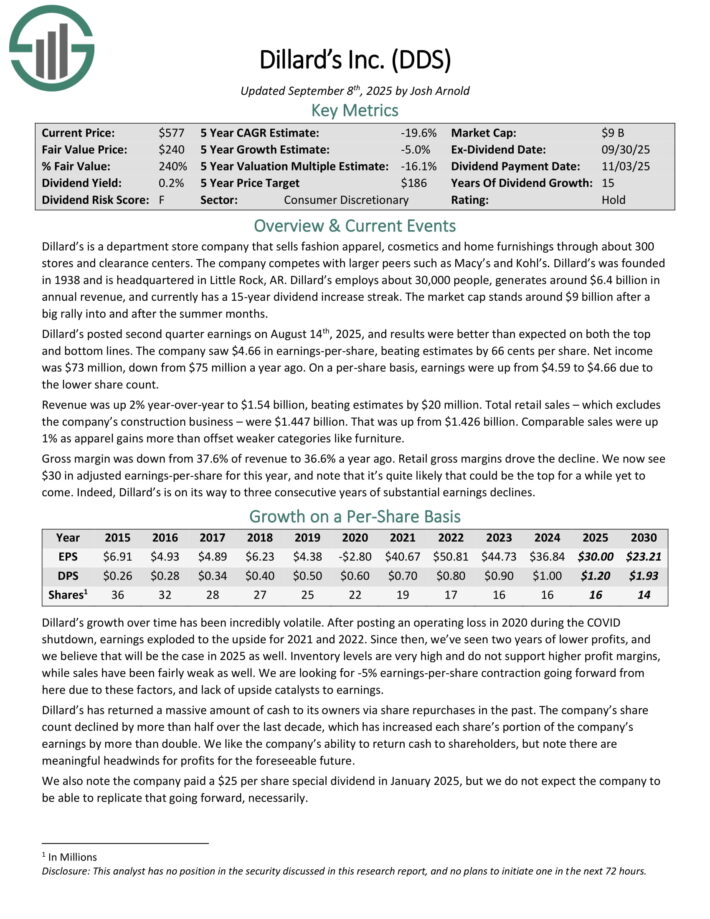

Overvalued Dividend Inventory #6: Dillard’s Inc. (DDS)

- Annual Valuation Return: -16.1%

Dillard’s is a division retailer firm that sells style attire, cosmetics and residential furnishings by about 300 shops and clearance facilities. The corporate competes with bigger friends akin to Macy’s and Kohl’s.

Dillard’s employs about 30,000 folks, generates round $6.4 billion in annual income, and presently has a 15-year dividend improve streak.

Dillard’s posted second quarter earnings on August 14th, 2025, and outcomes had been higher than anticipated on each the highest and backside strains. The corporate noticed $4.66 in earnings-per-share, beating estimates by 66 cents per share.

Web earnings was $73 million, down from $75 million a yr in the past. On a per-share foundation, earnings had been up from $4.59 to $4.66 because of the decrease share rely.

Income was up 2% year-over-year to $1.54 billion, beating estimates by $20 million. Whole retail gross sales – which excludes the corporate’s development enterprise – had been $1.447 billion. That was up from $1.426 billion. Comparable gross sales had been up 1% as attire features greater than offset weaker classes like furnishings.

Gross margin was down from 37.6% of income to 36.6% a yr in the past. Retail gross margins drove the decline.

We now see $30 in adjusted earnings-per-share for this yr, and word that it’s fairly possible that could possibly be the highest for some time but to return. Certainly, Dillard’s is on its technique to three consecutive years of considerable earnings declines.

Click on right here to obtain our most up-to-date Positive Evaluation report on DDS (preview of web page 1 of three proven under):

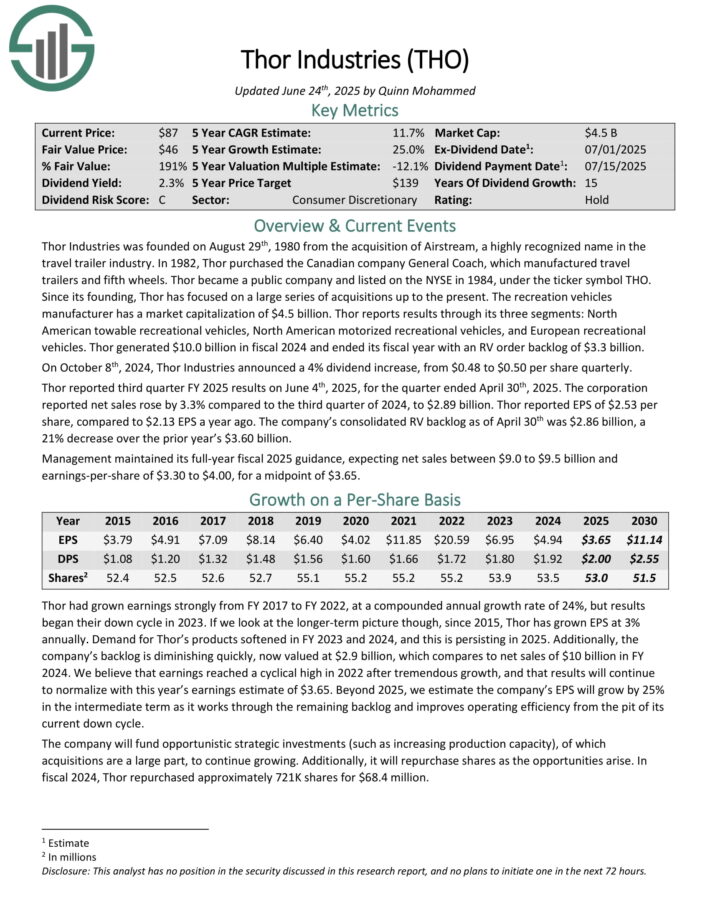

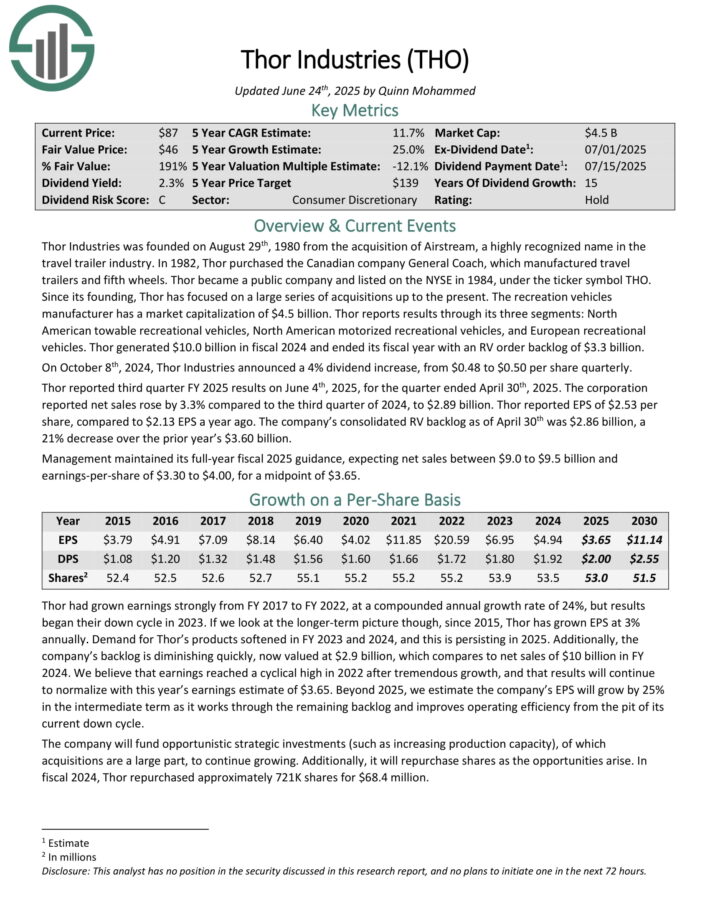

Overvalued Dividend Inventory #5: Thor Industries (THO)

- Annual Valuation Return: -16.4%

Thor Industries was based on August twenty ninth, 1980 from the acquisition of Airstream, a extremely acknowledged identify within the journey trailer business. Thor has targeted on a big sequence of acquisitions as much as the current.

Thor studies outcomes by its three segments: North American towable leisure automobiles, North American motorized leisure automobiles, and European leisure automobiles.

Thor generated $10.0 billion in fiscal 2024 and ended its fiscal yr with an RV order backlog of $3.3 billion.

Thor reported third quarter FY 2025 outcomes on June 4th, 2025, for the quarter ended April thirtieth, 2025. The company reported internet gross sales rose by 3.3% in comparison with the third quarter of 2024, to $2.89 billion.

Thor reported EPS of $2.53 per share, in comparison with $2.13 EPS a yr in the past. The corporate’s consolidated RV backlog as of April thirtieth was $2.86 billion, a 21% lower over the prior yr’s $3.60 billion.

Administration maintained its full-year fiscal 2025 steerage, anticipating internet gross sales between $9.0 to $9.5 billion and earnings-per-share of $3.30 to $4.00.

Click on right here to obtain our most up-to-date Positive Evaluation report on THO (preview of web page 1 of three proven under):

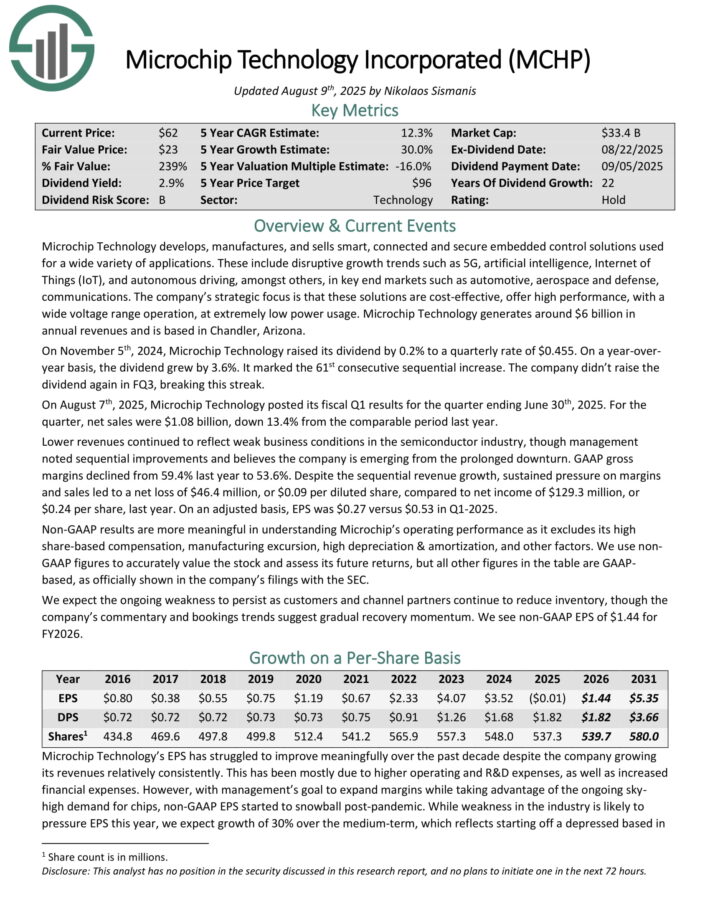

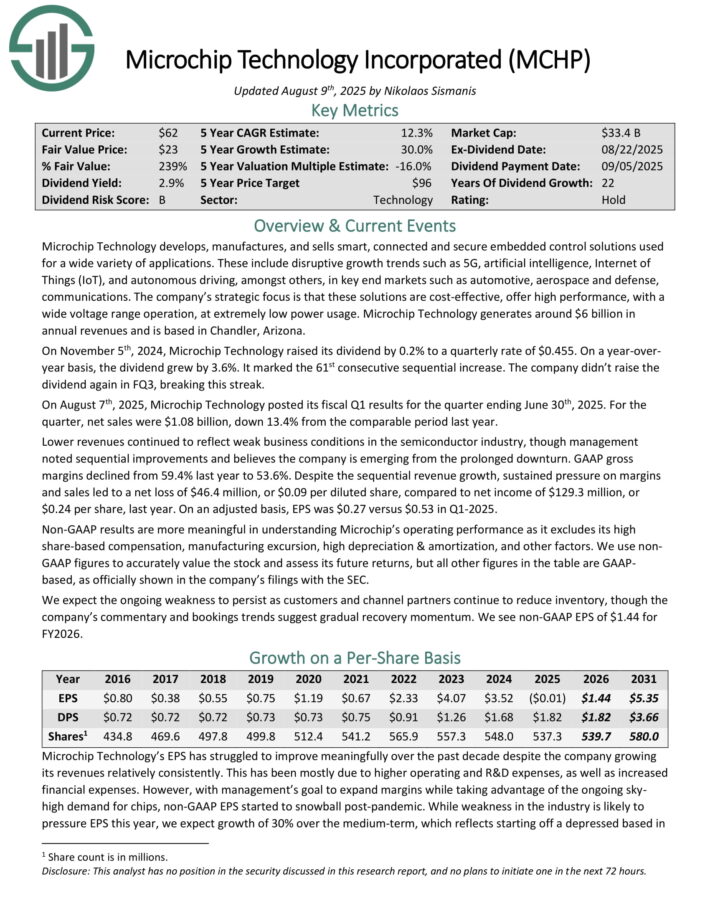

Overvalued Dividend Inventory #4: Microchip Know-how (MCHP)

- Annual Valuation Return: -16.9%

Microchip Know-how develops, manufactures, and sells sensible, related and safe embedded management options used for all kinds of purposes.

These embody disruptive progress tendencies akin to 5G, synthetic intelligence, Web of Issues (IoT), and autonomous driving, amongst others, in key finish markets akin to automotive, aerospace and protection, communications.

Microchip Know-how generates round $6 billion in annual revenues and relies in Chandler, Arizona.

On August seventh, 2025, Microchip Know-how posted its fiscal Q1 outcomes for the quarter ending June thirtieth, 2025. For the quarter, internet gross sales had been $1.08 billion, down 13.4% from the comparable interval final yr.

Decrease revenues continued to replicate weak enterprise situations within the semiconductor business, although administration famous sequential enhancements and believes the corporate is rising from the extended downturn.

GAAP gross margins declined from 59.4% final yr to 53.6%. Regardless of the sequential income progress, sustained stress on margins and gross sales led to a internet lack of $46.4 million, or $0.09 per diluted share, in comparison with internet earnings of $129.3 million, or $0.24 per share, final yr.

On an adjusted foundation, EPS was $0.27 versus $0.53 in Q1-2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on MCHP (preview of web page 1 of three proven under):

Overvalued Dividend Inventory #3: Fortitude Gold (FTCO)

- Annual Valuation Return: -17.3%

Fortitude Gold Company was spun-off from Gold Useful resource Company right into a separate public firm in December 2021. Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining pleasant jurisdictions.

The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or higher. Its property portfolio presently consists of 100% possession in seven high-grade gold properties.

All seven properties are inside an approximate 30-mile radius of each other inside the prolific Walker Lane Mineral Belt. The corporate generated $37.3 million in revenues final yr, the vast majority of which had been from gold, and relies in Colorado Springs, Colorado.

On April twenty ninth, 2025, Fortitude Gold launched its first-quarter 2025 outcomes for the interval ending March thirty first, 2025. For the quarter, revenues got here in at $6.5 million, marking a 20% decline in comparison with Q1 2024.

The lower in income was largely as a result of a 41% drop in gold gross sales quantity and a 26% lower in silver gross sales quantity. These declines had been partially offset by a 38% improve in gold costs and a 38% improve in silver costs.

Transferring to the underside line, Fortitude reported a mine gross revenue of $3.3 million in comparison with $4.2 million the earlier yr, reflecting the decrease internet gross sales.

The corporate additionally introduced a discount in its month-to-month dividend from $0.04 to $0.01 per share, efficient with the Might 2025 cost.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven under):

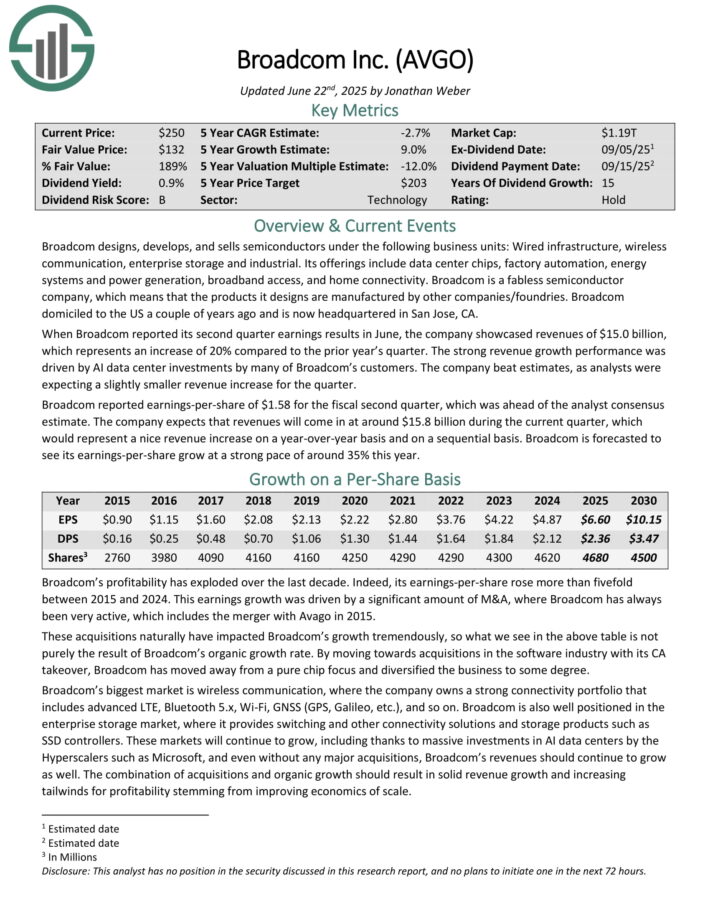

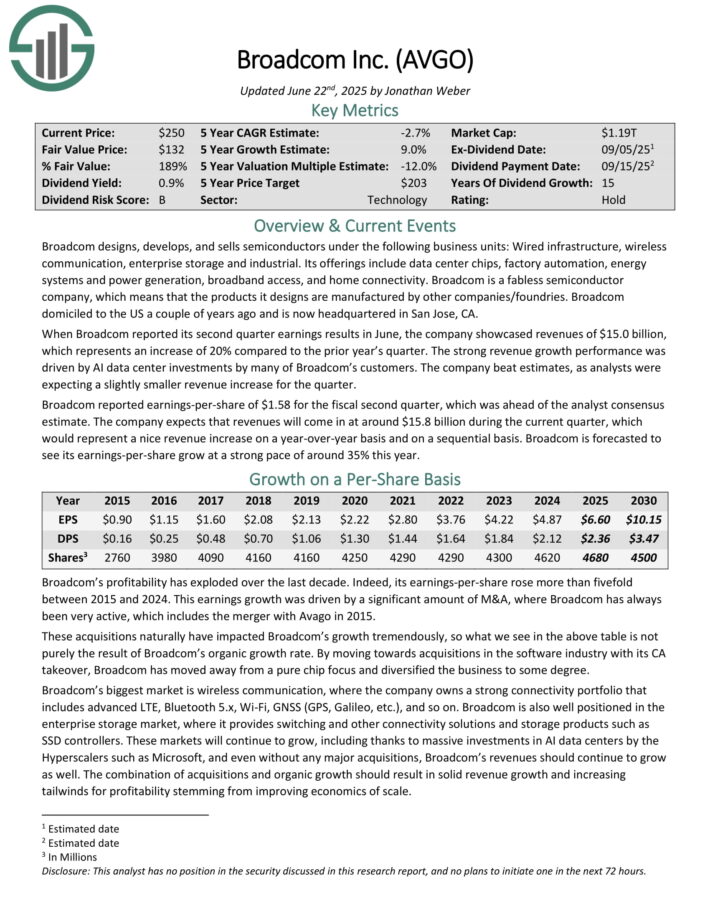

Overvalued Dividend Inventory #2: Broadcom Inc. (AVGO)

- Annual Valuation Return: -17.7%

Broadcom designs, develops, and sells semiconductors below the next enterprise models: Wired infrastructure, wi-fi communication, enterprise storage and industrial. Its choices embody knowledge middle chips, manufacturing unit automation, power programs and energy technology, broadband entry, and residential connectivity.

Broadcom is a fabless semiconductor firm, which signifies that the merchandise it designs are manufactured by different corporations/foundries. Broadcom domiciled to the US a few years in the past and is now headquartered in San Jose, CA.

When Broadcom reported its second quarter earnings ends in June, the corporate showcased revenues of $15.0 billion, which represents a rise of 20% in comparison with the prior yr’s quarter.

The sturdy income progress efficiency was pushed by AI knowledge middle investments by lots of Broadcom’s clients. The corporate beat estimates, as analysts had been anticipating a barely smaller income improve for the quarter.

Broadcom reported earnings-per-share of $1.58 for the fiscal second quarter, which was forward of the analyst consensus estimate. The corporate expects that revenues will are available in at round $15.8 billion in the course of the present quarter, which might signify a pleasant income improve on a year-over-year foundation and on a sequential foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on AVGO (preview of web page 1 of three proven under):

Overvalued Dividend Inventory #1: Hyster Yale (HY)

- Annual Valuation Return: -24.8%

Hyster-Yale Supplies Dealing with was based in 1985 and has since turn into a outstanding world participant within the supplies dealing with business.

The corporate designs, manufactures, and sells a complete vary of carry vans and aftermarket components, serving numerous clients throughout numerous sectors, together with manufacturing, warehousing, and logistics.

The corporate segments its income primarily into three classes: new tools gross sales, components gross sales, and repair revenues.

On Might sixth, 2025, the corporate introduced outcomes for the primary quarter of 2025. The corporate reported Q1 non-GAAP EPS of $0.49, in-line with analysts’ estimates, and produced income of $910.4 million, which was down 14.1% year-over-year.

Hyster-Yale opened the yr with Q1 2025 consolidated revenues of $910 million, down 14% from final yr, as softer carry truck demand carried over from late 2024.

Web earnings dipped to $8.6 million in comparison with $51.5 million a yr in the past, as decrease manufacturing volumes and price pressures weighed on margins. Stock ranges improved, down $69 million versus Q1 2024, exhibiting early progress in aligning manufacturing with present demand tendencies.

Encouragingly, the carry truck phase noticed a notable rebound in bookings, up 13% year-over-year and 48% sequentially, pushed by power within the Americas and EMEA.

Click on right here to obtain our most up-to-date Positive Evaluation report on HY (preview of web page 1 of three proven under):

Last Ideas

The inventory market has been on a virtually uninterrupted rally because the Nice Recession. After a short downturn in the course of the coronavirus pandemic, the inventory market has as soon as once more raced to report highs.

In consequence, the S&P 500 is now markedly overvalued in accordance with a number of valuation metrics, such because the Shiller P/E ratio.

Due to this fact, risk-averse earnings traders needs to be cautious of overvalued dividend shares akin to the ten on this article.

If you’re concerned with discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].