Printed on November seventeenth, 2025 by Bob Ciura

Volatility is a proxy for danger; extra volatility usually means a riskier portfolio. The volatility of a safety or portfolio in opposition to the imply known as commonplace deviation.

Briefly, commonplace deviation is an investing metric that calculates the magnitude of a safety’s dispersion from its common worth over a given time interval.

In consequence, we imagine commonplace deviation is a crucial monetary metric that buyers ought to familiarize themselves with, when buying particular person shares.

On the similar time, buyers can concentrate on shares with low volatility as measured by commonplace deviation, that even have excessive dividend yields.

This creates a beautiful mixture of stability and earnings.

With this in thoughts, we have now created a spreadsheet of over 200 shares with dividend yields of 5% or extra…

You’ll be able to obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with vital monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink under:

Why this issues is as a result of buyers can make the most of commonplace deviation to get a greater understanding of a safety’s volatility, and due to this fact its danger.

Importantly, low or excessive commonplace deviation measures the scale of the actions a safety might make from its common efficiency.

This text will focus on the ten lowest commonplace deviation shares within the Positive Evaluation Analysis Database that even have excessive dividend yields above 5%.

The shares are listed by annualized commonplace deviation over the previous 5 years, in ascending order.

Desk Of Contents

The desk of contents under gives for straightforward navigation of the article:

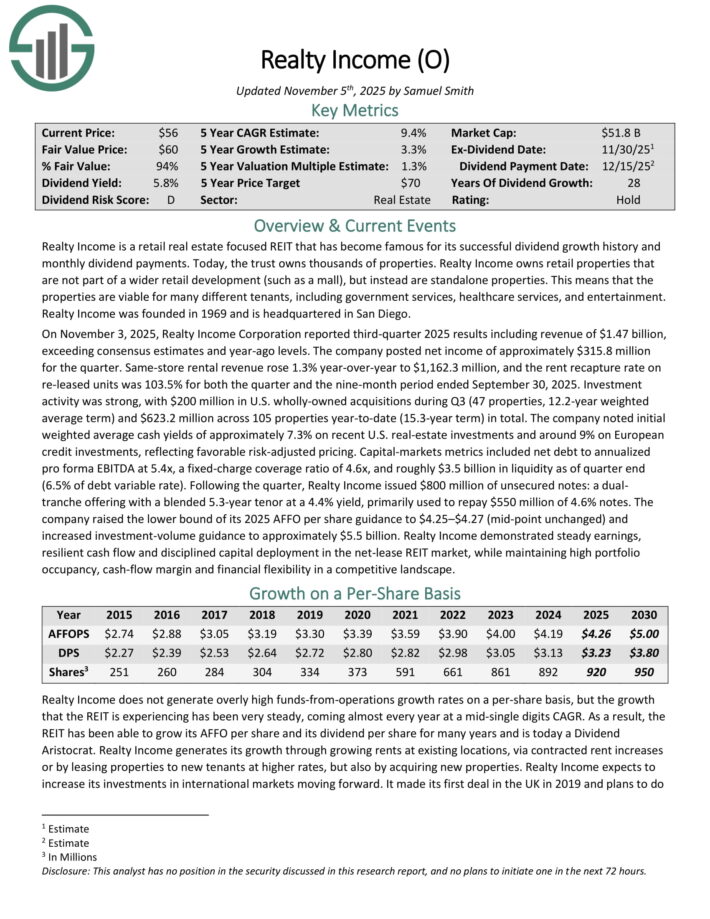

Low Volatility Excessive Dividend Inventory #10: Sonoco Merchandise Co. (SON)

- Annualized 5-12 months Customary Deviation: 19.5%

Sonoco Merchandise gives packaging, industrial merchandise and provide chain companies to its prospects. The markets that use the corporate’s merchandise embody these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend development streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior 12 months, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Shopper Packaging revenues surged 110% to $1.23 billion, principally on account of contributions from Eviosys.

Quantity development was sturdy and favorable forex alternate charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million as a result of impression of international forex alternate charges and decrease quantity following two plant divestitures in China final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven under):

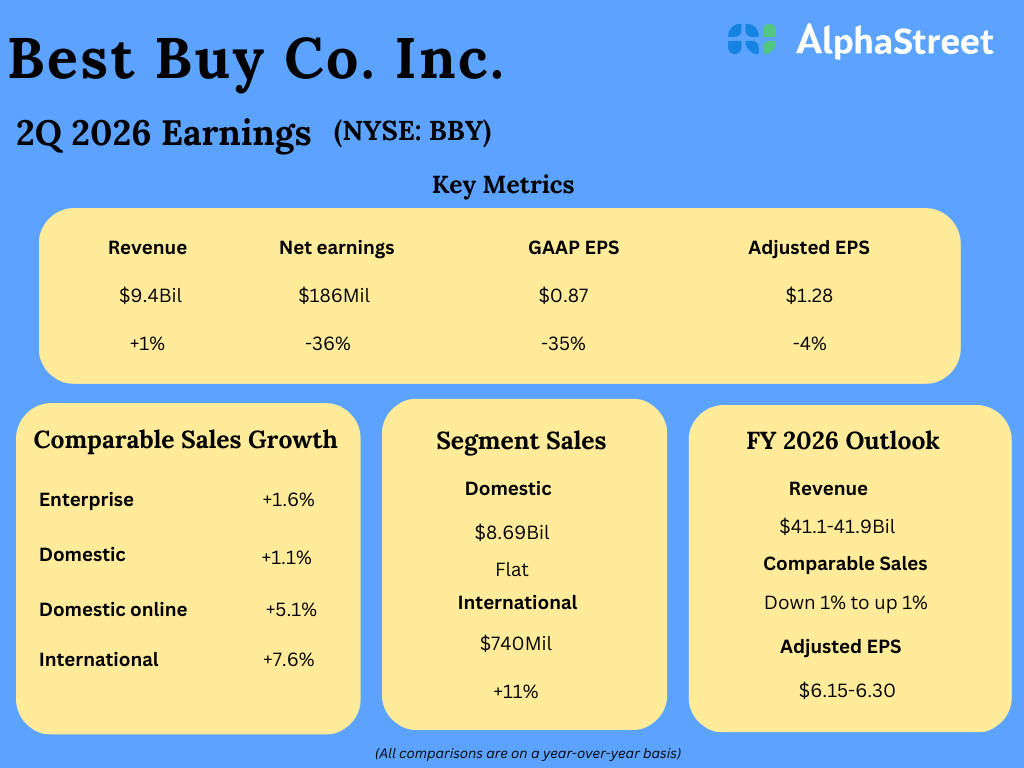

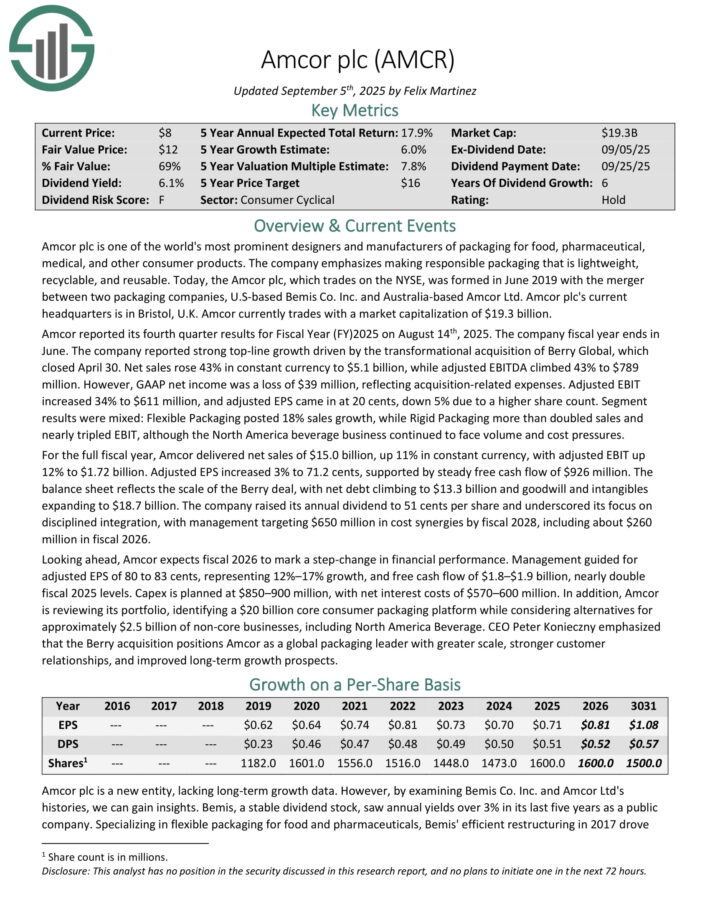

Low Volatility Excessive Dividend Inventory #9: Amcor plc (AMCR)

- Annualized 5-12 months Customary Deviation: 19.3%

Amcor plc is among the world’s most distinguished designers and producers of packaging for meals, pharmaceutical, medical, and different shopper merchandise. The corporate emphasizes making accountable packaging that’s light-weight, recyclable, and reusable.

Amcor reported its fourth quarter outcomes for Fiscal 12 months 2025 on August 14th, 2025. The corporate fiscal 12 months ends in June. The corporate reported sturdy top-line development pushed by the transformational acquisition of Berry World, which closed April 30.

Web gross sales rose 43% in fixed forex to $5.1 billion, whereas adjusted EBITDA climbed 43% to $789 million. Nevertheless, GAAP web earnings was a lack of $39 million, reflecting acquisition-related bills. Adjusted EBIT elevated 34% to $611 million, and adjusted EPS got here in at 20 cents, down 5% on account of the next share rely.

Phase outcomes had been combined: Versatile Packaging posted 18% gross sales development, whereas Inflexible Packaging greater than doubled gross sales and practically tripled EBIT, though the North America beverage enterprise continued to face quantity and price pressures.

For the total fiscal 12 months, Amcor delivered web gross sales of $15.0 billion, up 11% in fixed forex, with adjusted EBIT up 12% to $1.72 billion. Adjusted EPS elevated 3% to 71.2 cents, supported by regular free money circulate of $926 million.

The steadiness sheet displays the dimensions of the Berry deal, with web debt climbing to $13.3 billion and goodwill and intangibles increasing to $18.7 billion.

The corporate raised its annual dividend to 51 cents per share and underscored its concentrate on disciplined integration, with administration focusing on $650 million in value synergies by fiscal 2028, together with about $260 million in fiscal 2026.

Click on right here to obtain our most up-to-date Positive Evaluation report on AMCR (preview of web page 1 of three proven under):

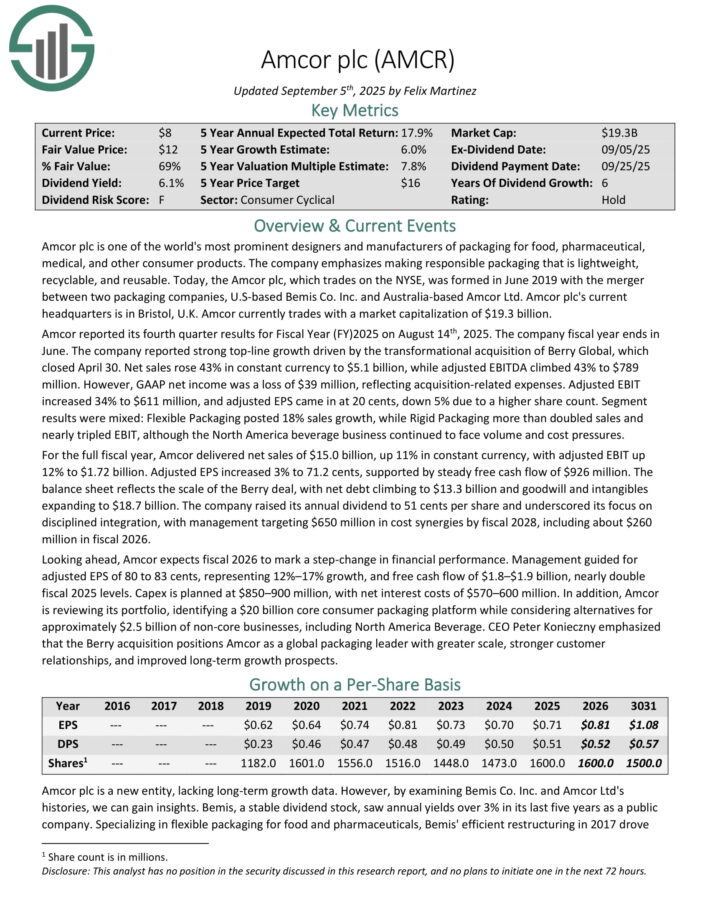

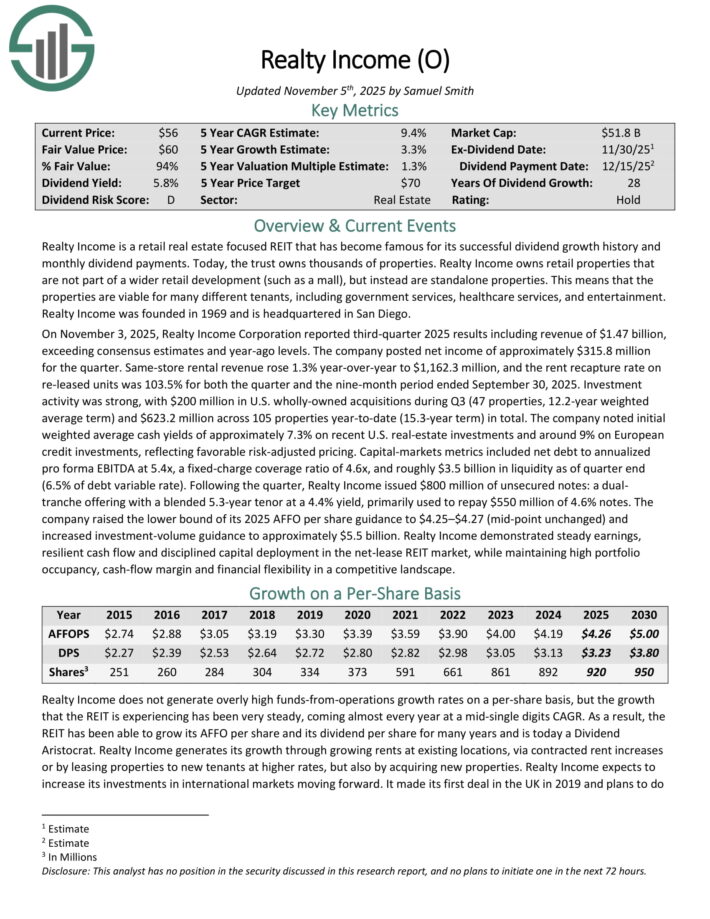

Low Volatility Excessive Dividend Inventory #8: Realty Revenue (O)

- Annualized 5-12 months Customary Deviation: 19.3%

Realty Revenue is a retail actual property targeted REIT that has turn into well-known for its profitable dividend development historical past and month-to-month dividend funds. At present, the belief owns 1000’s of properties.

Realty Revenue owns retail properties that aren’t a part of a wider retail growth (equivalent to a mall), however as a substitute are standalone properties. Which means that the properties are viable for a lot of totally different tenants, together with authorities companies, healthcare companies, and leisure.

On November 3, 2025, Realty Revenue Company reported third-quarter 2025 outcomes together with income of $1.47 billion, exceeding consensus estimates and year-ago ranges.

The corporate posted web earnings of roughly $315.8 million for the quarter. Identical-store rental income rose 1.3% year-over-year to $1,162.3 million, and the hire recapture fee on re-leased items was 103.5% for each the quarter and the nine-month interval ended September 30, 2025.

Funding exercise was sturdy, with $200 million in U.S. wholly-owned acquisitions throughout Q3 (47 properties, 12.2-year weighted common time period) and $623.2 million throughout 105 properties year-to-date (15.3-year time period) in whole.

The corporate raised the decrease sure of its 2025 AFFO per share steering to $4.25–$4.27 (mid-point unchanged) and elevated investment-volume steering to roughly $5.5 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on O (preview of web page 1 of three proven under):

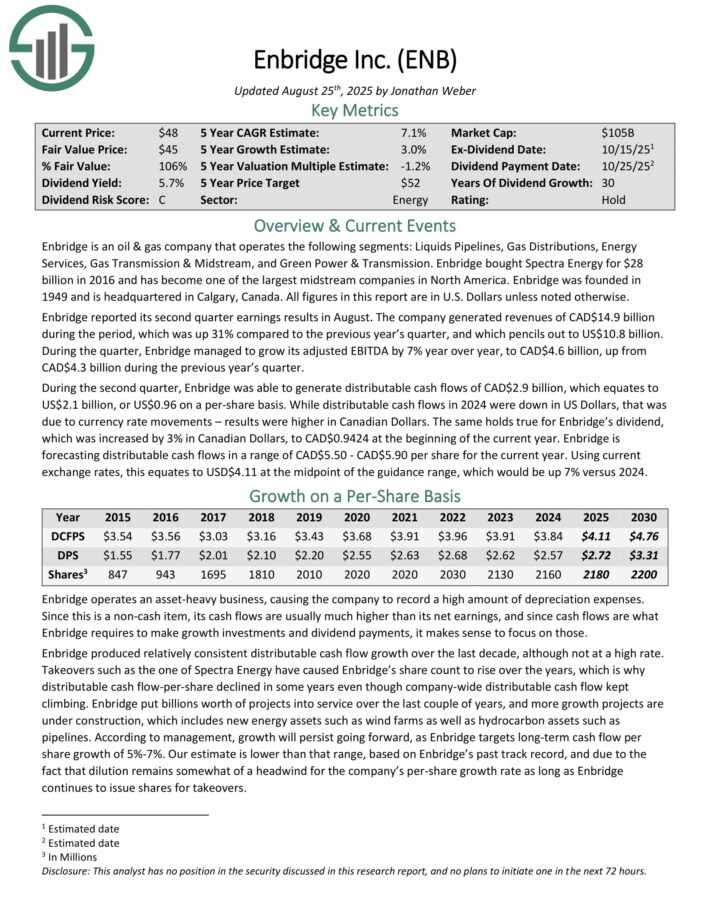

Low Volatility Excessive Dividend Inventory #7: Enbridge Inc. (ENB)

- Annualized 5-12 months Customary Deviation: 19.1%

Enbridge is an oil & gasoline firm that operates the next segments: Liquids Pipelines, Fuel Distributions, Vitality Providers, Fuel Transmission & Midstream, and Inexperienced Energy & Transmission.

Enbridge purchased Spectra Vitality for $28 billion in 2016 and has turn into one of many largest midstream firms in North America. Enbridge was based in 1949 and is headquartered in Calgary, Canada.

Throughout the second quarter, Enbridge was capable of generate distributable money flows of CAD$2.9 billion, which equates to US$2.1 billion, or US$0.96 on a per-share foundation.

Whereas distributable money flows in 2024 had been down in US {Dollars}, that was on account of forex fee actions – outcomes had been increased in Canadian {Dollars}.

The identical holds true for Enbridge’s dividend, which was elevated by 3% in Canadian {Dollars}, to CAD$0.9424 at first of the present 12 months.

Enbridge is forecasting distributable money flows in a spread of CAD$5.50 – CAD$5.90 per share for the present 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on ENB (preview of web page 1 of three proven under):

Low Volatility Excessive Dividend Inventory #6: Verizon Communications (VZ)

- Annualized 5-12 months Customary Deviation: 18.9%

Verizon Communications is among the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a few quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On September fifth, 2025, Verizon introduced that it was rising its quarterly dividend 1.8% to $0.69 for the November third, 2025 fee, extending the corporate’s dividend development streak to 21 consecutive years.

On October twenty ninth, 2025, Verizon reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income grew 1.5% to $33.8 billion, however this was $470 million under estimates. Adjusted earnings-per-share of $1.21 in contrast favorably to $1.19 within the prior 12 months and was $0.02 higher than anticipated.

For the quarter, Verizon Shopper had postpaid cellphone web losses of seven,000, which compares to web additions of 18,000 in the identical interval of final 12 months. Nevertheless, wi-fi retail core pay as you go web additions grew 47,000, marking the fifth consecutive quarter of optimistic subscriber development.

Shopper wi-fi retail postpaid cellphone churn fee stays low at 0.91%. The Shopper section grew 2.9% to $26.1 billion whereas shopper wi-fi service income elevated 2.4% to $17.4 billion. Shopper wi-fi postpaid common income per account grew 2.0% to $147.91.

Broadband totaled 306K web new prospects through the interval, which marks 13 consecutive quarters of no less than 300K web provides. The full fastened wi-fi buyer base is nearly 5.4 million. Verizon goals to have 8 to 9 million fastened wi-fi subscribers by 2028.

Wi-fi retail postpaid web additions had been 110K for the interval. Free money circulate was $15.8 billion for the primary three quarters of the 12 months, up from $14.5 billion for a similar interval in 2024.

Verizon reaffirmed prior steering for 2025 as properly, with the corporate nonetheless anticipating wi-fi service income to develop 2% to 2.8% for the 12 months. Verizon can also be anticipated to supply adjusted EPS development in a spread of 1% to three%.

Click on right here to obtain our most up-to-date Positive Evaluation report on VZ (preview of web page 1 of three proven under):

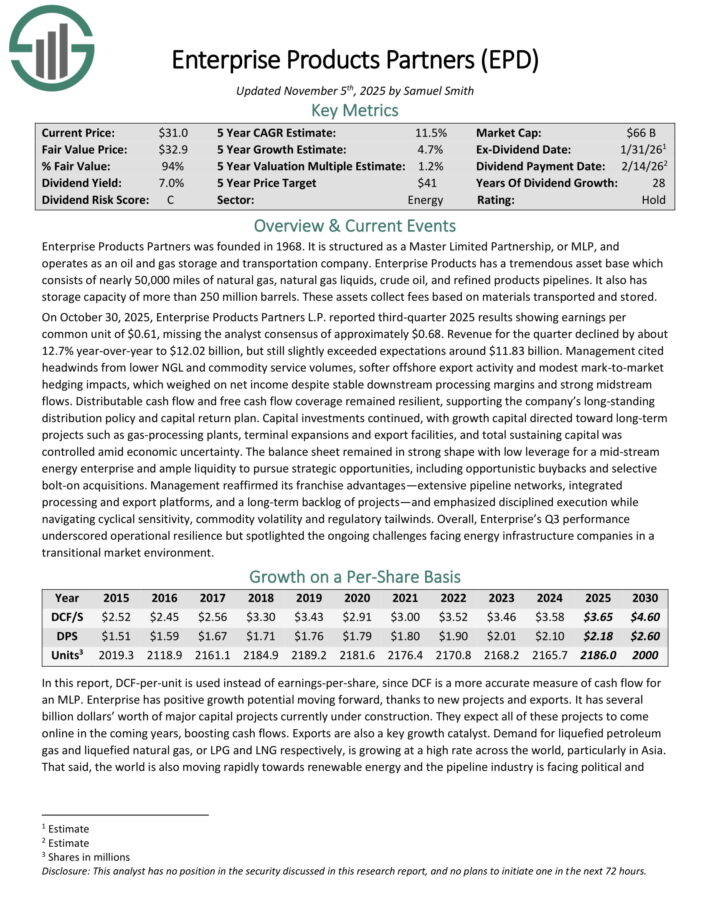

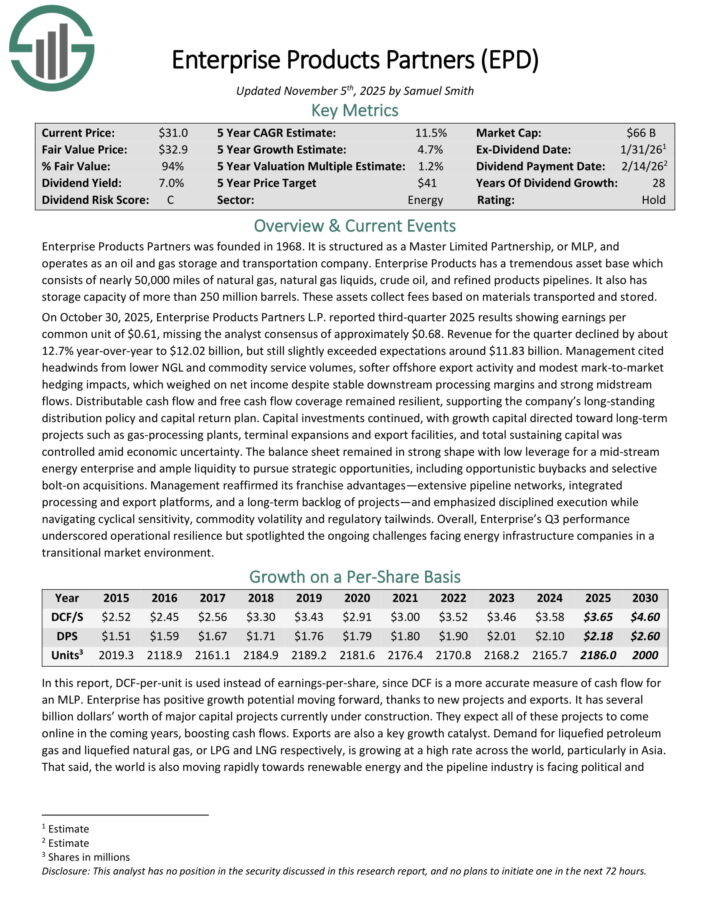

Low Volatility Excessive Dividend Inventory #5: Enterprise Merchandise Companions LP (EPD)

- Annualized 5-12 months Customary Deviation: 18.8%

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has an incredible asset base which consists of practically 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines. It additionally has storage capability of greater than 250 million barrels. These property accumulate charges based mostly on supplies transported and saved.

On October 30, 2025, Enterprise Merchandise Companions L.P. reported third-quarter 2025 outcomes displaying earnings per frequent unit of $0.61, lacking the analyst consensus of roughly $0.68. Income for the quarter declined by about 12.7% year-over-year to $12.02 billion, however nonetheless barely exceeded expectations round $11.83 billion.

Administration cited headwinds from decrease NGL and commodity service volumes, softer offshore export exercise and modest mark-to-market hedging impacts, which weighed on web earnings regardless of secure downstream processing margins and robust midstream flows.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPD (preview of web page 1 of three proven under):

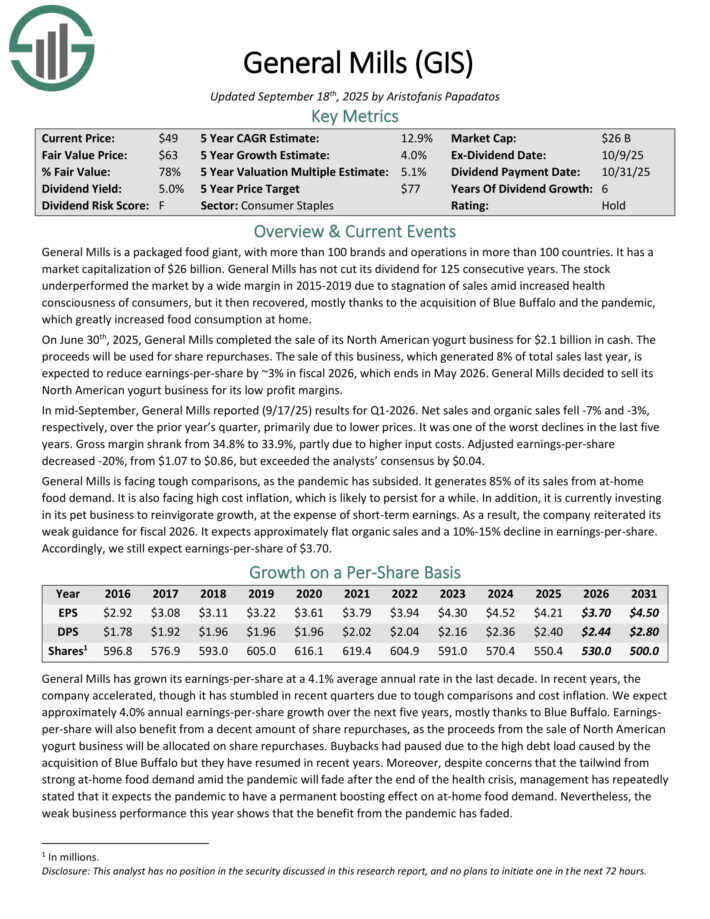

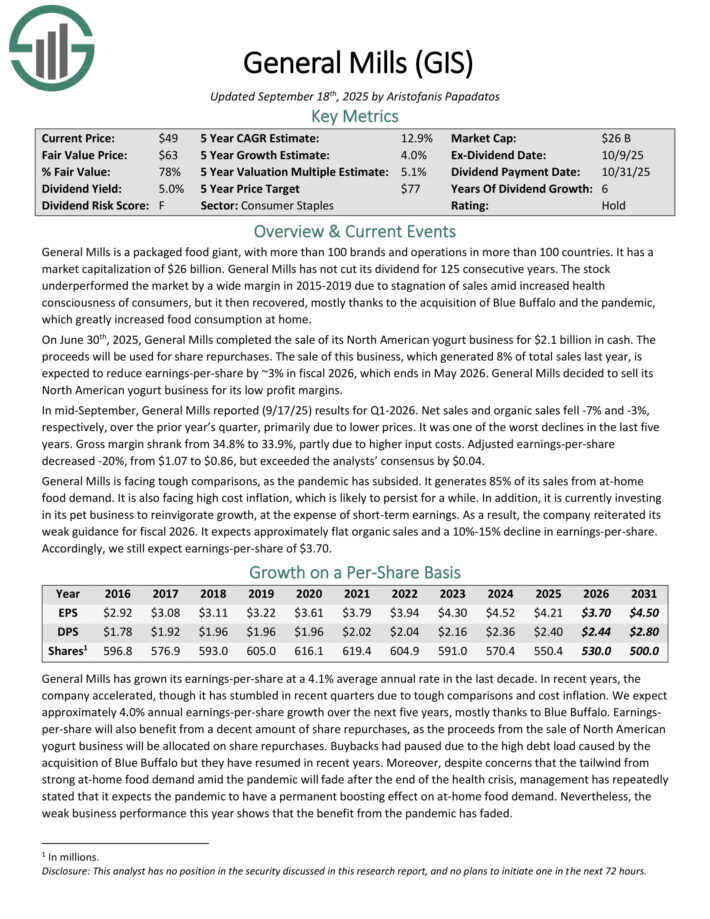

Low Volatility Excessive Dividend Inventory #4: Normal Mills (GIS)

- Annualized 5-12 months Customary Deviation: 18.5%

Normal Mills is a packaged meals big, with greater than 100 manufacturers and operations in additional than 100 nations. It has a market capitalization of $26 billion. Normal Mills has not reduce its dividend for 125 consecutive years.

On June thirtieth, 2025, Normal Mills accomplished the sale of its North American yogurt enterprise for $2.1 billion in money. The proceeds can be used for share repurchases.

The sale of this enterprise, which generated 8% of whole gross sales final 12 months, is predicted to scale back earnings-per-share by ~3% in fiscal 2026, which ends in Could 2026. Normal Mills determined to promote its North American yogurt enterprise for its low revenue margins.

In mid-September, Normal Mills reported (9/17/25) outcomes for Q1-2026. Web gross sales and natural gross sales fell -7% and -3%, respectively, over the prior 12 months’s quarter, primarily on account of decrease costs.

It was one of many worst declines within the final 5 years. Gross margin shrank from 34.8% to 33.9%, partly on account of increased enter prices.

Adjusted earnings-per-share decreased -20%, from $1.07 to $0.86, however exceeded the analysts’ consensus by $0.04. Normal Mills is dealing with powerful comparisons, because the pandemic has subsided.

It generates 85% of its gross sales from at-home meals demand. It’s also dealing with excessive value inflation, which is more likely to persist for some time.

As well as, it’s at present investing in its pet enterprise to reinvigorate development, on the expense of short-term earnings. In consequence, the corporate reiterated its weak steering for fiscal 2026.

It expects roughly flat natural gross sales and a ten%-15% decline in earnings-per-share.

Click on right here to obtain our most up-to-date Positive Evaluation report on GIS (preview of web page 1 of three proven under):

Low Volatility Excessive Dividend Inventory #3: TELUS Corp. (TU)

- Annualized 5-12 months Customary Deviation: 18.4%

TELUS Company is among the ‘massive three’ Canadian telecommunications firms together with BCE, Inc. (BCE) and Rogers Communications (RCI).

TELUS is concentrated in Western Canada and gives a full vary of communication services by means of two enterprise segments: Wireline and Wi-fi.

In early November, TELUS reported (11/7/25) monetary outcomes for the third quarter of fiscal 2025. The corporate posted respectable buyer development.

It posted whole cell buyer development of 82,000, development of fastened prospects by 206,000 and a wholesome churn fee of 0.91% at its postpaid cell enterprise.

Nevertheless, income remained primarily flat over the prior 12 months’s quarter. Earnings-per-share declined -15%, from $0.20 to $0.17, principally on account of thinner working margins.

Administration now expects development of income in the direction of the low finish of its steering for two%-4% and reiterated its steering for 3%-5% development of adjusted EBITDA in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on TU (preview of web page 1 of three proven under):

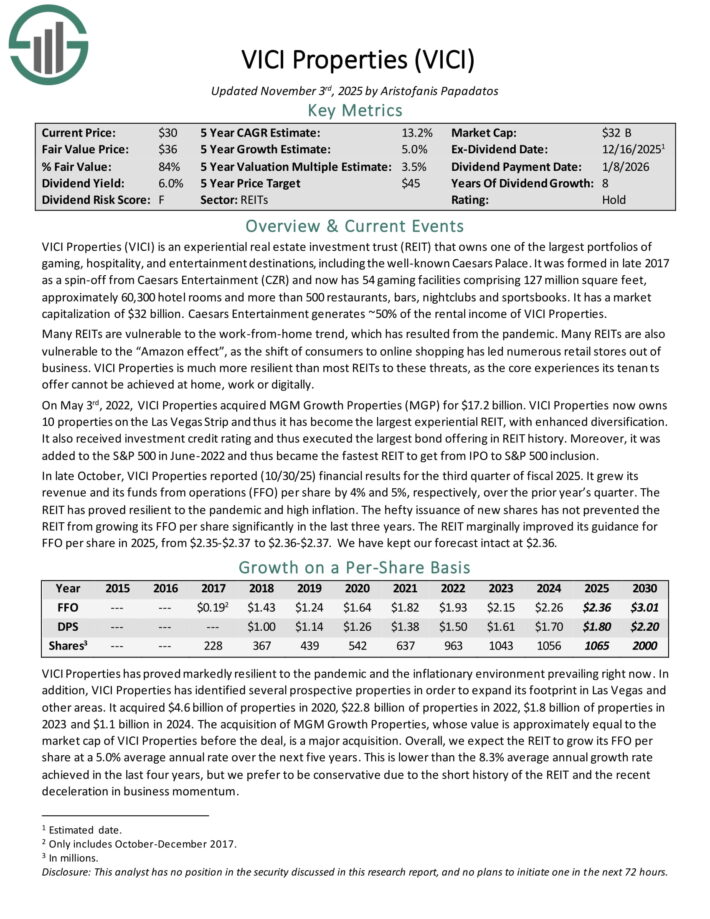

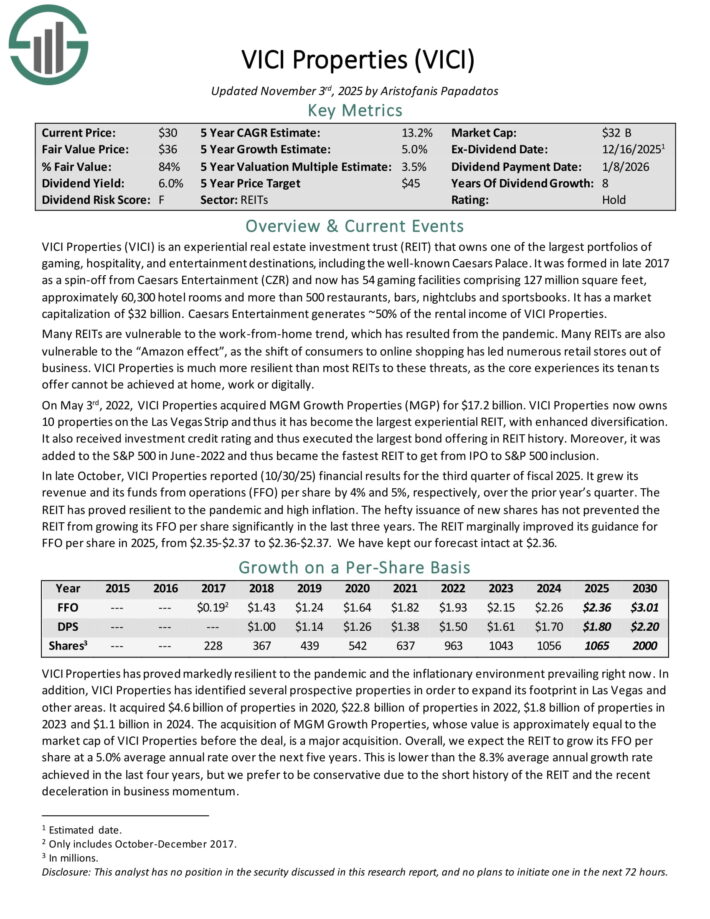

Low Volatility Excessive Dividend Inventory #2: VICI Properties (VICI)

- Annualized 5-12 months Customary Deviation: 18.1%

VICI Properties is an experiential actual property funding belief (REIT) that owns one of many largest portfolios of gaming, hospitality, and leisure locations, together with the well-known Caesars Palace.

It now has 54 gaming services comprising 127 million sq. ft, roughly 60,300 resort rooms and greater than 500 eating places, bars, nightclubs and sportsbooks.

Caesars Leisure generates ~50% of the rental earnings of VICI Properties.

In late October, VICI Properties reported (10/30/25) monetary outcomes for the third quarter of fiscal 2025. It grew its income and its funds from operations (FFO) per share by 4% and 5%, respectively, over the prior 12 months’s quarter.

The REIT has proved resilient to the pandemic and excessive inflation. The hefty issuance of recent shares has not prevented the REIT from rising its FFO per share considerably within the final three years.

The REIT marginally improved its steering for FFO per share in 2025, from $2.35-$2.37 to $2.36-$2.37.

Click on right here to obtain our most up-to-date Positive Evaluation report on VICI (preview of web page 1 of three proven under):

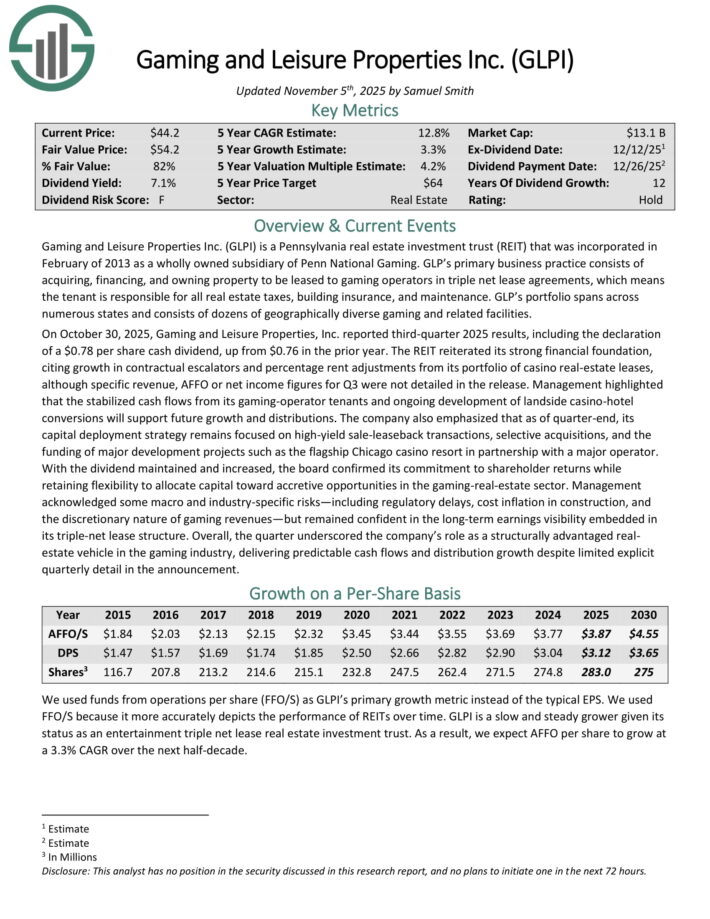

Low Volatility Excessive Dividend Inventory #1: Gaming & Leisure Properties (GLPI)

- Annualized 5-12 months Customary Deviation: 16.6%

Gaming and Leisure Properties is a Pennsylvania actual property funding belief (REIT) that was included in February of 2013 as a completely owned subsidiary of Penn Nationwide Gaming.

GLP’s main enterprise apply consists of buying, financing, and proudly owning property to be leased to gaming operators in triple web lease agreements, which suggests the tenant is chargeable for all actual property taxes, constructing insurance coverage, and upkeep.

GLP’s portfolio spans throughout quite a few states and consists of dozens of geographically numerous gaming and associated services.

On October 30, 2025, Gaming and Leisure Properties, Inc. reported third-quarter 2025 outcomes, together with the declaration of a $0.78 per share money dividend, up from $0.76 within the prior 12 months.

The REIT reiterated its sturdy monetary basis, citing development in contractual escalators and share hire changes from its portfolio of on line casino real-estate leases, though particular income, AFFO or web earnings figures for Q3 weren’t detailed within the launch.

Click on right here to obtain our most up-to-date Positive Evaluation report on GLPI (preview of web page 1 of three proven under):

Extra Studying

If you’re involved in discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].