Printed on June 18th, 2025 by Bob Ciura

The purpose of rational traders is to maximize whole return.

Whole return is the entire return of an funding over a given time interval. It contains all capital good points and any dividends or curiosity paid.

The three facets of whole return for shares are:

- Dividends

- Change in earnings-per-share

- Change within the price-to-earnings a number of

The free excessive dividend shares record spreadsheet under has our full record of particular person securities (shares, REITs, MLPs, and many others.) with with 5%+ dividend yields.

We calculate anticipated whole returns utilizing the three facets of whole return for greater than 600 securities in The Certain Evaluation Analysis Database.

Whereas we at the moment fee most of the shares we cowl as buys, because of anticipated annual returns above 10%, many are rated as holds because of mediocre returns.

Moreover, there are additionally loads of shares we at the moment fee as sells.

Usually, low (or adverse) projected whole return is because of overvaluation. Put merely, most of the shares we fee as sells are overvalued, because of their excessive present valuations.

Shopping for overvalued shares can lead to low, or adverse, future returns, even with a excessive dividend yield.

With that in thoughts, this text will cowl 10 excessive dividend shares we at the moment fee as sells in line with their low projected whole returns.

The record is sorted by annual anticipated returns over the subsequent 5 years, from lowest to highest.

Desk of Contents

You’ll be able to immediately soar to any particular part of the article by utilizing the hyperlinks under:

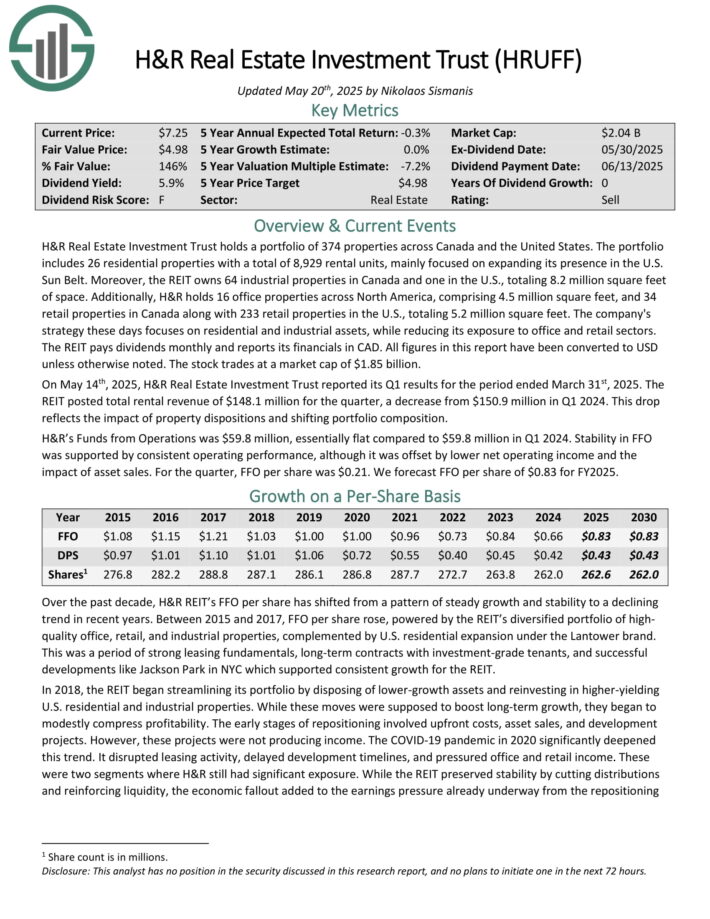

Excessive Dividend Inventory To Promote #10: H&R Actual Property Funding Belief (HRUFF)

- Annual Anticipated Return: -2.1%

H&R Actual Property Funding Belief holds a portfolio of 374 properties throughout Canada and the US. The portfolio contains 26 residential properties with a complete of 8,929 rental models, primarily centered on increasing its presence within the U.S. Solar Belt.

Furthermore, the REIT owns 64 industrial properties in Canada and one within the U.S., totaling 8.2 million sq. ft of house. Moreover, H&R holds 16 workplace properties throughout North America, comprising 4.5 million sq. ft, and 34 retail properties in Canada together with 233 retail properties within the U.S., totaling 5.2 million sq. ft.

The corporate’s technique lately focuses on residential and industrial property, whereas decreasing its publicity to workplace and retail sectors.

The REIT pays dividends month-to-month and studies its financials in CAD. All figures on this report have been transformed to USD until in any other case famous.

On Might 14th, 2025, H&R Actual Property Funding Belief reported its Q1 outcomes. The REIT posted whole rental income of $148.1 million for the quarter, a lower from $150.9 million in Q1 2024.

This drop displays the influence of property inclinations and shifting portfolio composition. H&R’s Funds from Operations was $59.8 million, primarily flat in comparison with $59.8 million in Q1 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRUFF (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Promote #9: Sabine Royalty Belief (SBR)

- Annual Anticipated Return: -0.5%

Sabine Royalty Belief is an oil and gasoline belief arrange in 1983 by Sabine Company. At initiation, the belief initially had an anticipated reserve lifetime of 9 to 10 years however it has surpassed expectations by a powerful margin.

The belief consists of royalty and mineral pursuits in producing properties and proved oil and gasoline properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It’s roughly 2/3 oil and 1/3 gasoline when it comes to revenues.

The belief’s property are static in that no additional properties may be added. The belief has no operations however is merely a pass-through automobile for royalties. SBR had royalty revenue of $82.6 million in 2024.

In early Might, SBR reported (5/9/25) monetary outcomes for the primary quarter of fiscal 2025. Manufacturing of oil grew 22% however manufacturing of gasoline dipped -1% over the prior yr’s quarter. As well as, the common realized costs of oil and gasoline decreased -26% and -7%, respectively. Because of this, distributable money circulation per unit declined -6%, from $1.27 to $1.19.

The outlook for this yr is adverse, as OPEC has begun to unwind its manufacturing cuts and intends to spice up its output by 2.0 million barrels per day till the top of 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on SBR (preview of web page 1 of three proven under):

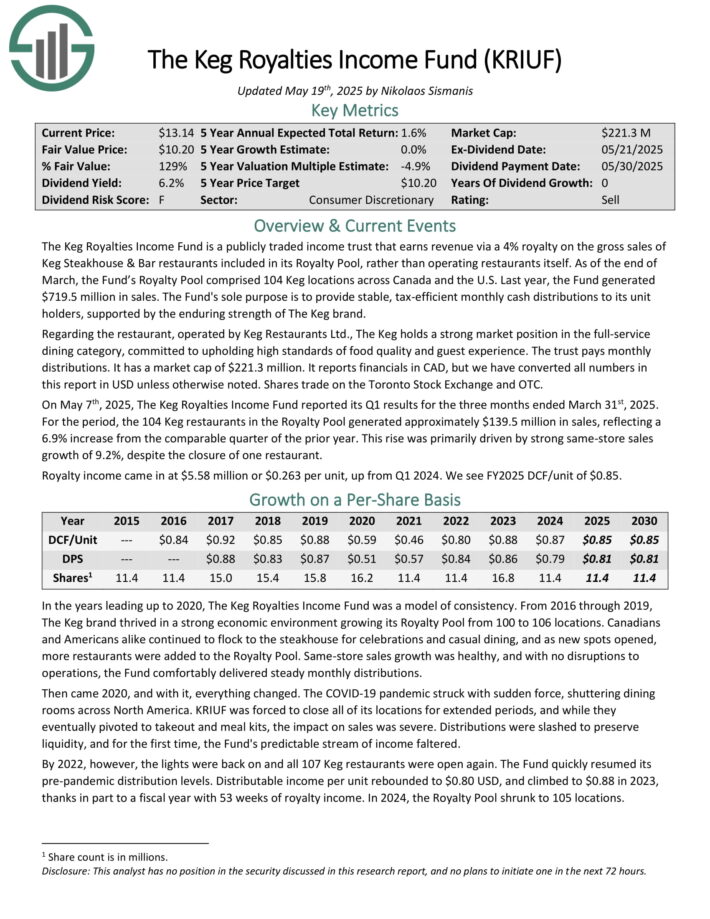

Excessive Dividend Inventory To Promote #8: The Keg Royalties Earnings Fund (KRIUF)

- Annual Anticipated Return: 1.2%

The Keg Royalties Earnings Fund is a publicly traded revenue belief that earns income through a 4% royalty on the product sales of Keg Steakhouse & Bar eating places included in its Royalty Pool, moderately than working eating places itself.

As of the top of March, the Fund’s Royalty Pool comprised 104 Keg places throughout Canada and the U.S. Final yr, the Fund generated $719.5 million in gross sales.

The Keg holds a powerful market place within the full-service eating class, dedicated to upholding excessive requirements of meals high quality and visitor expertise.

It studies financials in CAD, however we have now transformed all numbers on this report in USD until in any other case famous. Shares commerce on the Toronto Inventory Change and OTC.

On Might seventh, 2025, The Keg Royalties Earnings Fund reported its Q1 outcomes for the three months ended March thirty first, 2025. For the interval, the 104 Keg eating places within the Royalty Pool generated roughly $139.5 million in gross sales, reflecting a 6.9% improve from the comparable quarter of the prior yr.

This rise was primarily pushed by sturdy same-store gross sales development of 9.2%, regardless of the closure of 1 restaurant.

Click on right here to obtain our most up-to-date Certain Evaluation report on KRIUF (preview of web page 1 of three proven under):

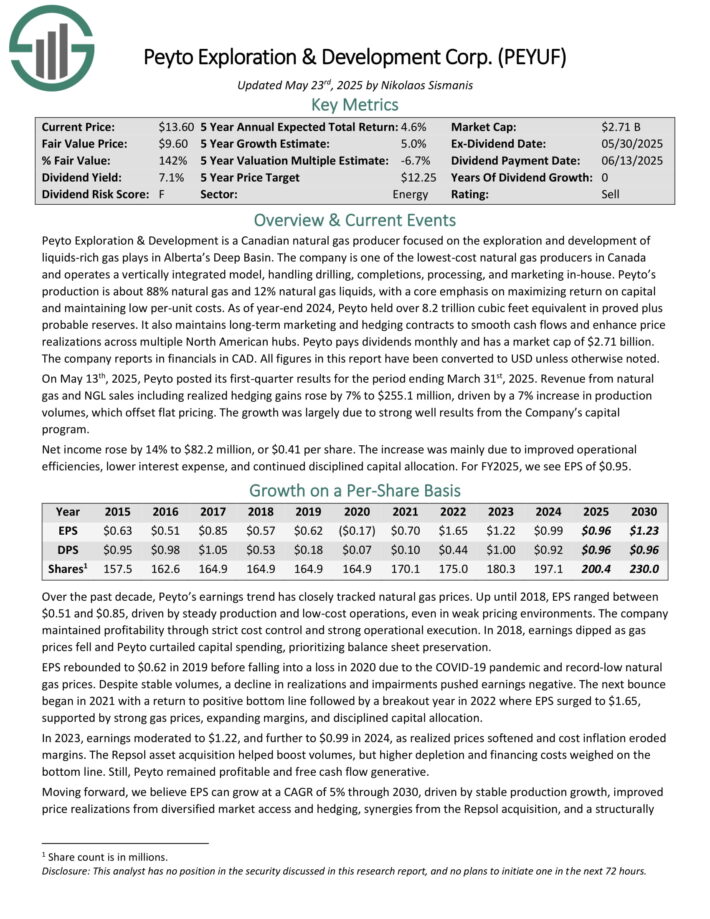

Excessive Dividend Inventory To Promote #7: Peyto Exploration & Growth (PEYUF)

- Annual Anticipated Return: 2.4%

Peyto Exploration & Growth is a Canadian pure gasoline producer centered on the exploration and improvement of liquids-rich gasoline performs in Alberta’s Deep Basin.

The corporate is likely one of the lowest-cost pure gasoline producers in Canada and operates a vertically built-in mannequin, dealing with drilling, completions, processing, and advertising in-house.

Peyto’s manufacturing is about 88% pure gasoline and 12% pure gasoline liquids, with a core emphasis on maximizing return on capital and sustaining low per-unit prices.

As of year-end 2024, Peyto held over 8.2 trillion cubic ft equal in proved plus possible reserves. It additionally maintains long-term advertising and hedging contracts to easy money flows and improve value realizations throughout a number of North American hubs.

The corporate studies in financials in CAD. All figures on this report have been transformed to USD until in any other case famous.

On Might thirteenth, 2025, Peyto posted its first-quarter outcomes for the interval ending March thirty first, 2025. Income from pure gasoline and NGL gross sales together with realized hedging good points rose by 7% to $255.1 million, pushed by a 7% improve in manufacturing volumes, which offset flat pricing. The expansion was largely because of sturdy effectively outcomes from the Firm’s capital program.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEYUF (preview of web page 1 of three proven under):

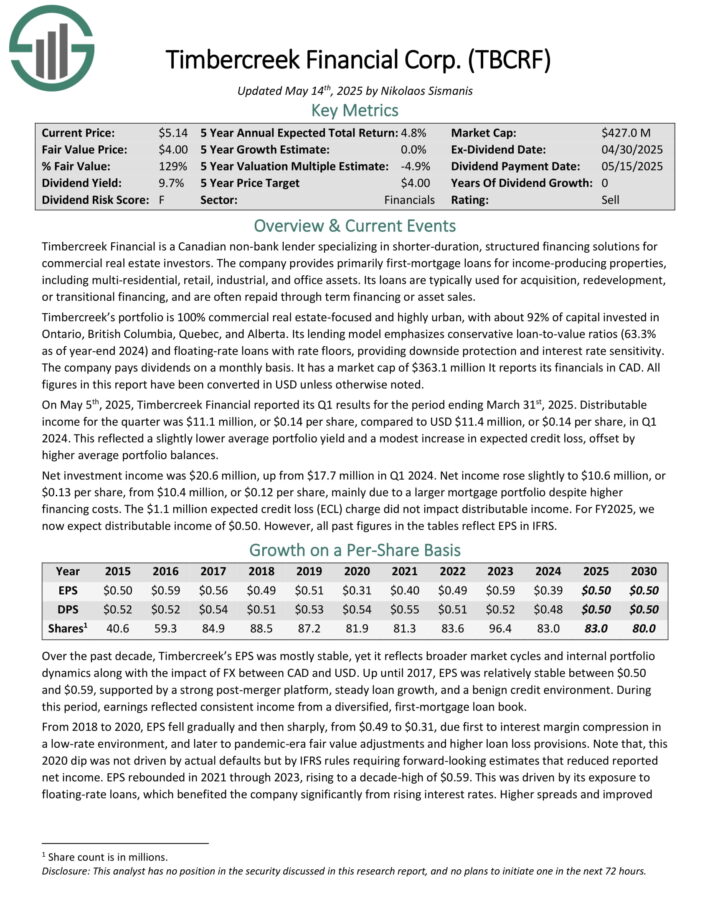

Excessive Dividend Inventory To Promote #6: Timbercreek Monetary Corp. (TBCRF)

- Annual Anticipated Return: 3.1%

Timbercreek Monetary is a Canadian non-bank lender specializing in shorter-duration, structured financing options for business actual property traders.

The corporate offers primarily first-mortgage loans for income-producing properties, together with multi-residential, retail, industrial, and workplace property.

Its loans are usually used for acquisition, redevelopment, or transitional financing, and are sometimes repaid via time period financing or asset gross sales.

Timbercreek’s portfolio is 100% business actual estate-focused and extremely city, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta. Its lending mannequin emphasizes conservative loan-to-value ratios (63.3% as of year-end 2024) and floating-rate loans with fee flooring, offering draw back safety and rate of interest sensitivity.

All figures on this report have been transformed in USD until in any other case famous.

On Might fifth, 2025, Timbercreek Monetary reported its Q1 outcomes for the interval ending March thirty first, 2025. Distributable revenue for the quarter was $11.1 million, or $0.14 per share, in comparison with USD $11.4 million, or $0.14 per share, in Q1 2024.

This mirrored a barely decrease common portfolio yield and a modest improve in anticipated credit score loss, offset by increased common portfolio balances.

Click on right here to obtain our most up-to-date Certain Evaluation report on TBCRF (preview of web page 1 of three proven under):

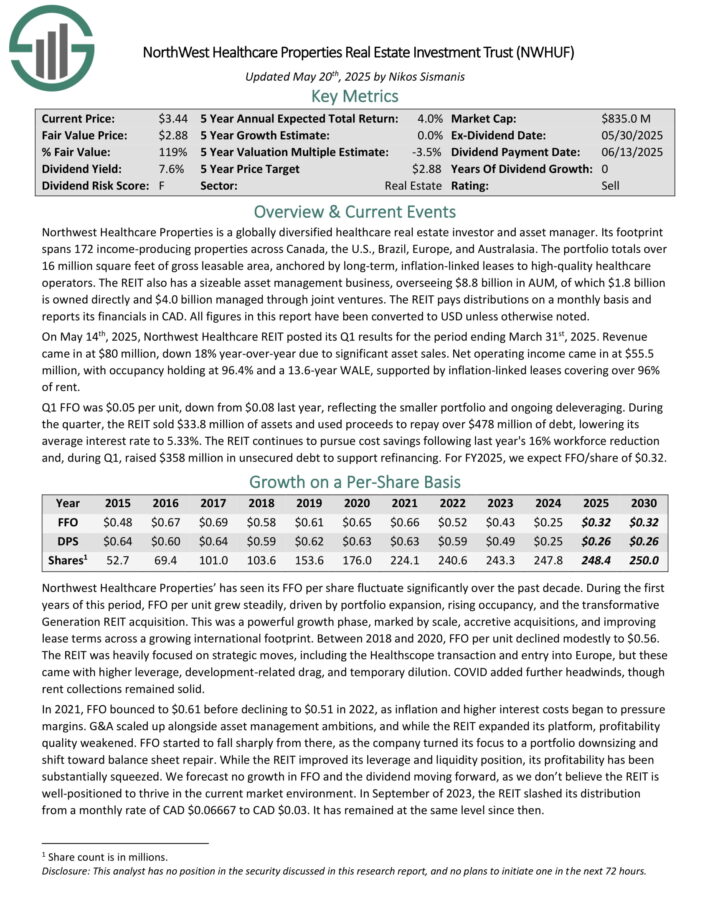

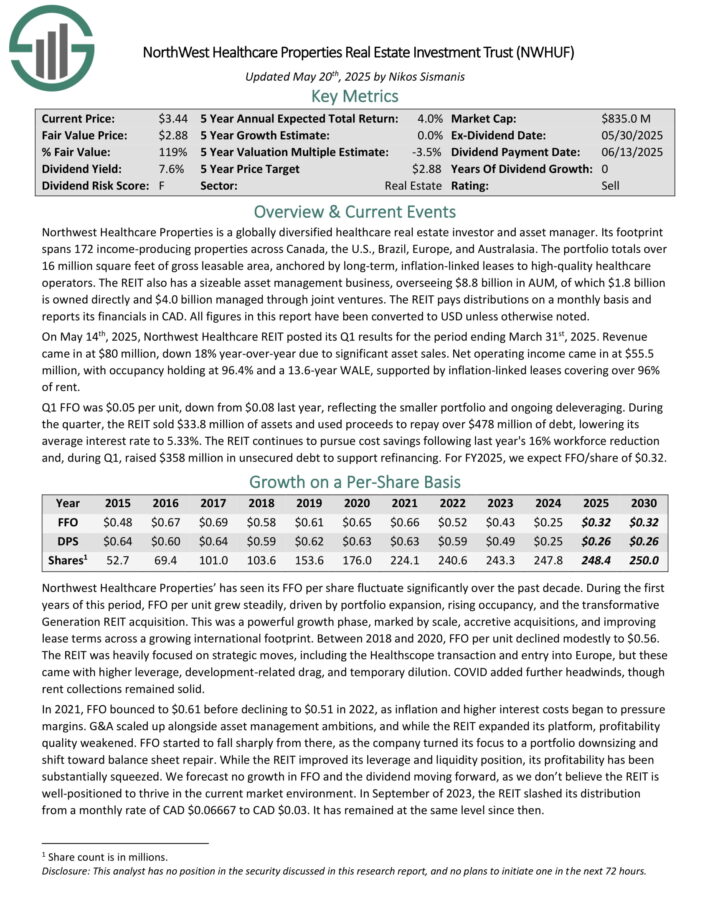

Excessive Dividend Inventory To Promote #5: NorthWest Healthcare Properties (NWHUF)

- Annual Anticipated Return: 3.7%

Northwest Healthcare Properties is a globally diversified healthcare actual property investor and asset supervisor. Its footprint spans 172 income-producing properties throughout Canada, the U.S., Brazil, Europe, and Australasia.

The portfolio totals over 16 million sq. ft of gross leasable space, anchored by long-term, inflation-linked leases to high-quality healthcare operators.

The REIT additionally has a sizeable asset administration enterprise, overseeing $8.8 billion in AUM, of which $1.8 billion is owned immediately and $4.0 billion managed via joint ventures. The REIT pays distributions on a month-to-month foundation and studies its financials in CAD. All figures on this report have been transformed to USD until in any other case famous.

On Might 14th, 2025, Northwest Healthcare REIT posted its Q1 outcomes for the interval ending March thirty first, 2025. Income got here in at $80 million, down 18% year-over-year because of vital asset gross sales.

Web working revenue got here in at $55.5 million, with occupancy holding at 96.4% and a 13.6-year WALE, supported by inflation-linked leases overlaying over 96% of hire.

Q1 FFO was $0.05 per unit, down from $0.08 final yr, reflecting the smaller portfolio and ongoing deleveraging. Throughout the quarter, the REIT offered $33.8 million of property and used proceeds to repay over $478 million of debt, decreasing its common rate of interest to five.33%.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWHUF (preview of web page 1 of three proven under):

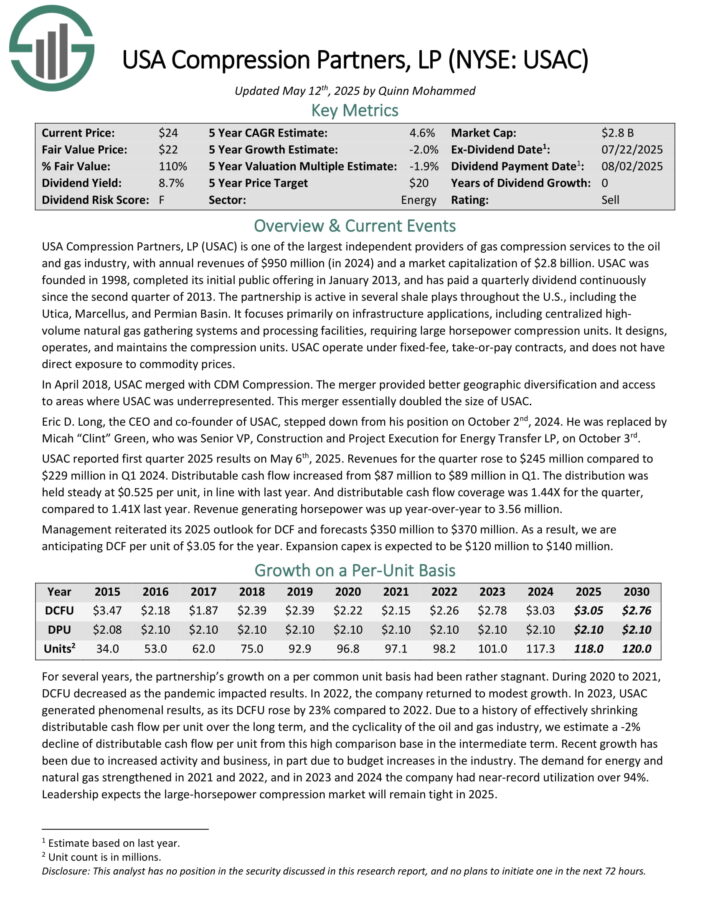

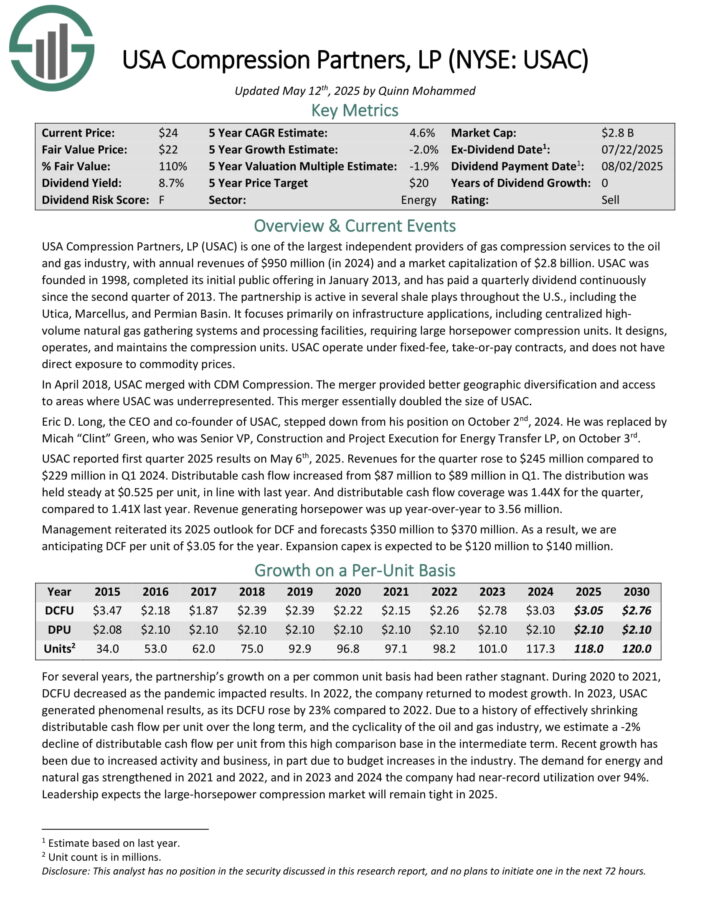

Excessive Dividend Inventory To Promote #4: USA Compression Companions LP (USAC)

- Annual Anticipated Return: 4.0%

USA Compression Companions, LP is likely one of the largest impartial suppliers of gasoline compression companies to the oil and gasoline trade, with annual revenues of $950 million in 2024.

The partnership is energetic in a number of shale performs all through the U.S., together with the Utica, Marcellus, and Permian Basin. It focuses totally on infrastructure functions, together with centralized high-volume pure gasoline gathering techniques and processing services, requiring giant horsepower compression models.

It designs, operates, and maintains the compression models. USAC function beneath fixed-fee, take-or-pay contracts, and doesn’t have direct publicity to commodity costs.

USAC reported first quarter 2025 outcomes on Might sixth, 2025. Revenues for the quarter rose to $245 million in comparison with $229 million in Q1 2024. Distributable money circulation elevated from $87 million to $89 million in Q1. The distribution was held regular at $0.525 per unit, in keeping with final yr.

Distributable money circulation protection was 1.44X for the quarter, in comparison with 1.41X final yr. Income producing horsepower was up year-over-year to three.56 million. Administration reiterated its 2025 outlook for DCF and forecasts $350 million to $370 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on USAC (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Promote #3: Pizza Pizza Royalty Corp. (PZRIF)

- Annual Anticipated Return: 4.0%

Pizza Pizza Royalty Corp. is a Canadian entity which collects and distributes a dividend stream primarily based on royalties earned from the Pizza Pizza and Pizza 73 restaurant chains.

The corporate’s base reporting forex is Canadian {Dollars}, however this report will use U.S. Greenback figures besides when in any other case famous.

Pizza Pizza Royalty Corp. receives revenue from 797 mixed whole restaurant places throughout Canada beneath its two manufacturers. Greater than 150 of those are non-traditional places sited in public locations resembling universities and hospitals.

Pizza Pizza has outsized publicity to the province of Alberta because of its possession of Pizza 73 which is centered in that province.

Pizza Pizza reported its Q1 2025 outcomes on Might seventh, 2025. Identical retailer gross sales grew 1.2% in Q1 versus the prior yr. Whereas nothing extraordinary, this was a sequential enchancment as Pizza Pizza had reported adverse identical retailer gross sales all through 2024.

Whereas revenues ticked up, so did bills, resulting in flattish outcomes. EPS of 17 cents fell by 1% from the identical interval of the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on PZRIF (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Promote #2: Northland Energy (NPIFF)

- Annual Anticipated Return: 4.1%

Northland Energy develops, builds, owns, and operates energy era property, together with offshore and onshore wind, photo voltaic, pure gasoline, and battery power storage techniques.

It additionally provides power via a regulated utility in Colombia. Northland manages 3.2 GW of gross working capability and has 2.4 GW in energetic building throughout three tasks: Hai Lengthy (Taiwan), Baltic Energy (Poland), and Oneida (Canada), with a broader improvement pipeline totaling about 10 GW.

Northland studies in CAD. All figures have been transformed to USD until in any other case famous. On Might thirteenth, 2025, Northland Energy reported its Q1 outcomes for the interval ending March thirty first, 2025. Income declined 14% year-over-year to about $467 million, primarily because of exceptionally low wind situations in Europe and a powerful wind quarter the yr prior, partially offset by increased contributions from North American onshore wind and pure gasoline property.

Adjusted EBITDA fell 20% to roughly $260 million, reflecting weaker offshore wind manufacturing regardless of continued operational self-discipline. Web revenue fell to $80 million from $107 million a yr earlier, pushed by the identical headwinds in offshore era and spinoff truthful worth modifications.

Click on right here to obtain our most up-to-date Certain Evaluation report on NPIFF (preview of web page 1 of three proven under):

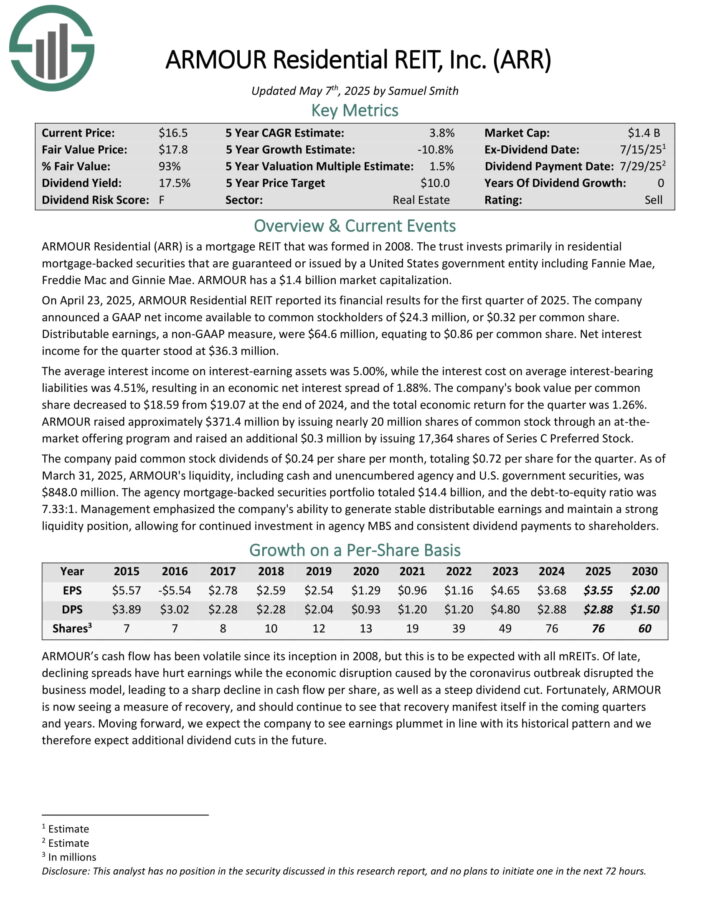

Excessive Dividend Inventory To Promote #1: ARMOUR Residential REIT (ARR)

- Annual Anticipated Return: 4.3%

ARMOUR Residential invests in residential mortgage-backed securities that embody U.S. Authorities-sponsored entities (GSE) resembling Fannie Mae and Freddie Mac.

It additionally contains Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate house loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different varieties of investments.

On April 23, 2025, ARMOUR Residential REIT reported its monetary outcomes for the primary quarter of 2025. The corporate introduced a GAAP internet revenue accessible to widespread stockholders of $24.3 million, or $0.32 per widespread share.

Distributable earnings, a non-GAAP measure, had been $64.6 million, equating to $0.86 per widespread share. Web curiosity revenue for the quarter stood at $36.3 million.

The typical curiosity revenue on interest-earning property was 5.00%, whereas the curiosity value on common interest-bearing liabilities was 4.51%, leading to an financial internet curiosity unfold of 1.88%. The corporate’s e-book worth per widespread share decreased to $18.59 from $19.07 on the finish of 2024, and the overall financial return for the quarter was 1.26%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven under):

Remaining Ideas & Further Studying

Excessive dividend shares are naturally interesting on the floor, because of their excessive dividend yields.

However revenue traders want to ensure they don’t fall right into a dividend ‘entice’, that means buying an overvalued inventory solely because of its excessive yield.

There are different necessary elements when shopping for shares, particularly the overall return potential. Shares with adverse or low future returns ought to be offered, even after they provide a excessive dividend yield.

If you’re considering discovering different high-yield securities and revenue securities, the next Certain Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].