Article revealed on Would possibly twentieth, 2025 by Bob Ciura

The healthcare sector is dwelling to quite a lot of the most well liked dividend shares in our funding universe.

The importance of healthcare inside the lives of many purchasers makes this sector one of many regular and recession-resistant within the full stock market, and permits well-managed healthcare companies to spice up their dividends yr in and yr out.

Clearly, this sector holds attraction for dividend progress merchants.

To that end, we’ve compiled an inventory of over 300 healthcare shares (along with important investing metrics like price-to-earnings ratios and dividend yields) which you’ll acquire underneath:

Nonetheless, the healthcare sector has seen elevated volatility in newest weeks.

On Would possibly twelfth, 2025, President Trump issued an authorities order that makes an try to equalize the worth people within the USA pay for pharmaceuticals relative to completely different developed nations.

Critically, the chief order moreover targets to open an avenue for Folks to buy medication straight from producers, bypassing price will improve imposed by intermediaries.

So, what does this suggest for pharmaceuticals and properly being insurers inside the U.S. over the next quite a lot of years? The temporary reply is that the long term stays not sure.

That’s because of there’s no guarantee this authorities order might have the supposed influence. Approved challenges to the 2025 authorities order are anticipated, and the place points will land is simply not attainable to know with any certainty.

Based mostly totally on the above analysis, and market prices given that announcement, this authorities order is simply not anticipated to significantly impact pharmaceutical companies.

For merchants, this spells different. The subsequent 10 healthcare dividend shares have turn into further engaging as a consequence of their newest price declines, and will proceed to spice up their dividends over the next quite a lot of years.

Phrase: UnitedHealth Group (UNH) was excluded from this analysis, as the company is reportedly beneath investigation by the Division of Justice for attainable Medicare fraud.

Desk of Contents

The desk of contents underneath permits for easy navigation. The shares are listed by 5-year anticipated returns, in ascending order.

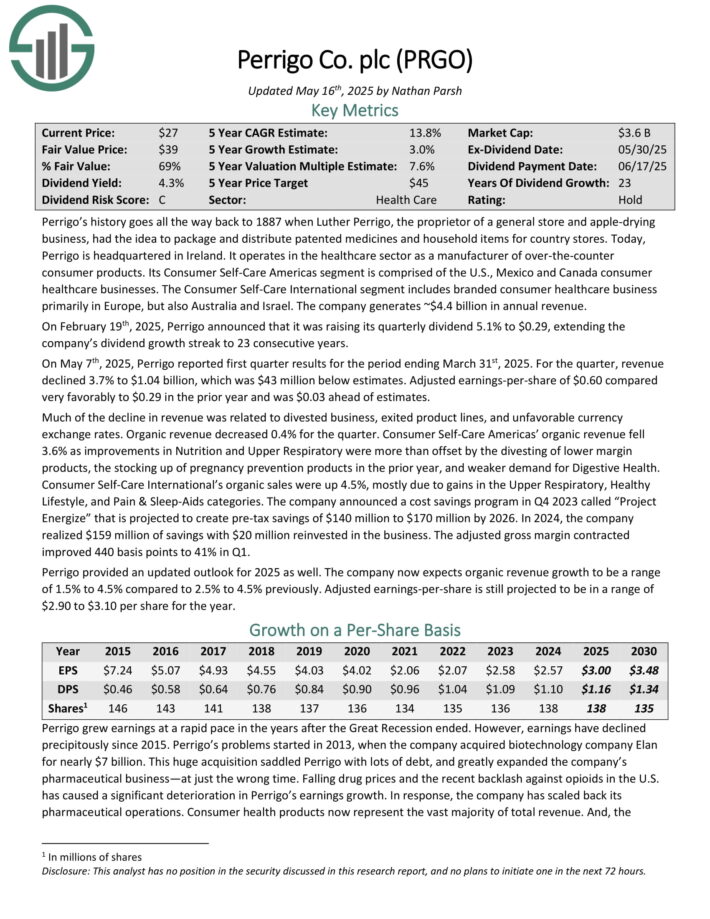

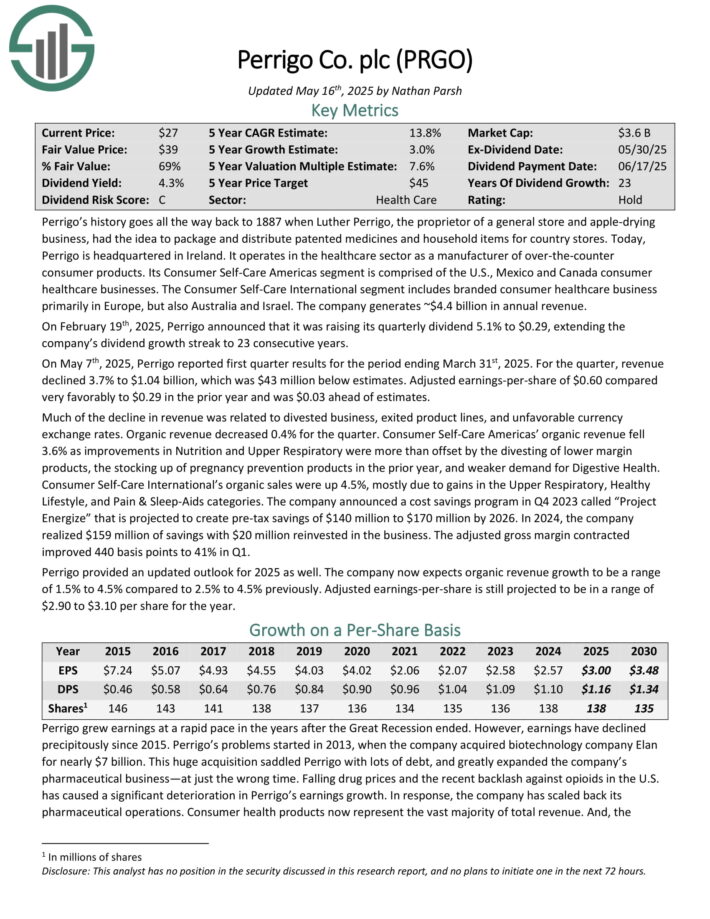

Healthcare Dividend Progress Stock #10: Perrigo Agency plc (PRGO)

- Annual Anticipated Returns: 13.6%

Perrigo operates inside the healthcare sector as a producer of over-the-counter consumer merchandise. Its Consumer Self-Care Americas part is comprised of the U.S., Mexico and Canada consumer healthcare corporations.

The Consumer Self-Care Worldwide part consists of branded consumer healthcare enterprise primarily in Europe, however moreover Australia and Israel. The company generates ~$4.4 billion in annual revenue.

On Would possibly seventh, 2025, Perrigo reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, revenue declined 3.7% to $1.04 billion, which was $43 million underneath estimates. Adjusted earnings-per-share of $0.60 in distinction very favorably to $0.29 inside the prior yr and was $0.03 ahead of estimates.

Lots of the decline in revenue was related to divested enterprise, exited product traces, and unfavorable international cash change expenses. Pure revenue decreased 0.4% for the quarter.

Consumer Self-Care Americas’ pure revenue fell 3.6% as enhancements in Vitamin and Greater Respiratory had been larger than offset by the divesting of lower margin merchandise, the stocking up of being pregnant prevention merchandise inside the prior yr, and weaker demand for Digestive Effectively being.

Click on on proper right here to acquire our latest Constructive Analysis report on PRGO (preview of internet web page 1 of three confirmed underneath):

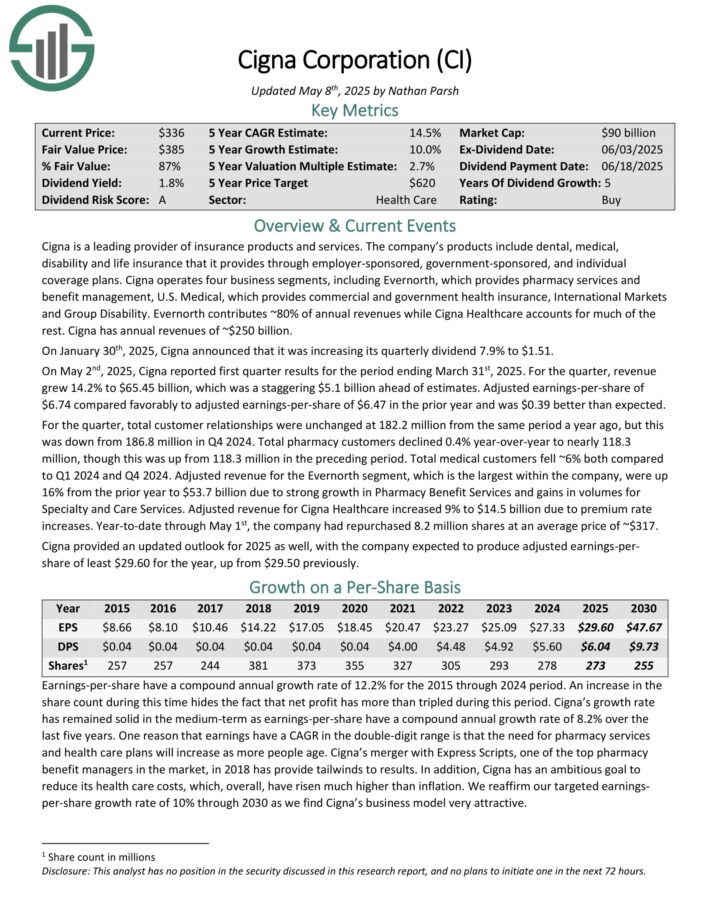

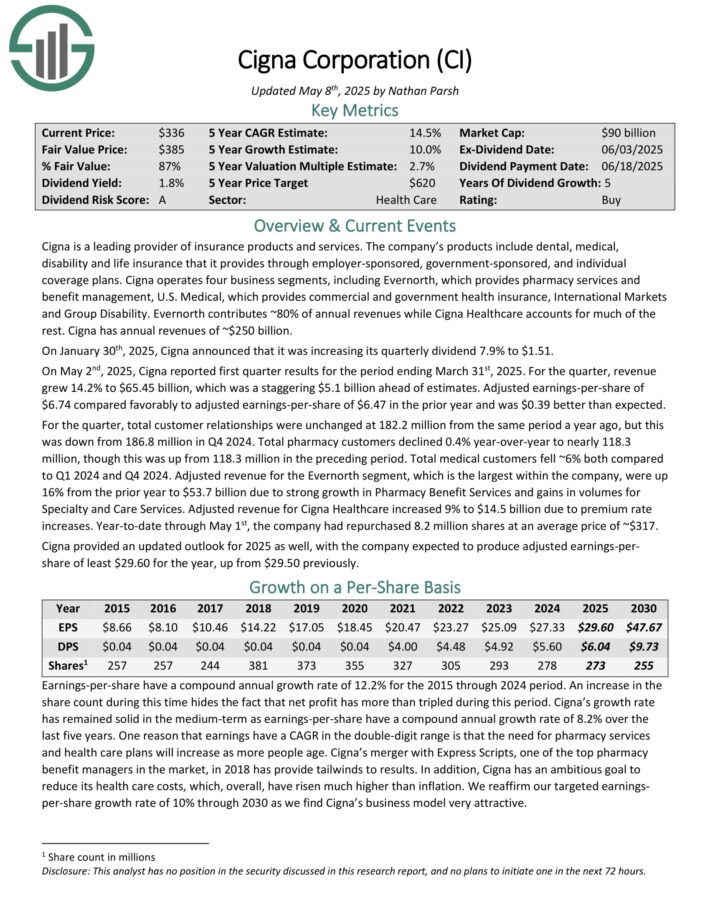

Healthcare Dividend Progress Stock #9: Cigna Group (CI)

- Annual Anticipated Returns: 15.1%

Cigna is a primary provider of insurance coverage protection providers and merchandise. The company’s merchandise embody dental, medical, incapacity and life insurance coverage protection that it provides by employer-sponsored, government-sponsored, and specific individual safety plans.

Cigna operates 4 enterprise segments, along with Evernorth, which provides pharmacy corporations and revenue administration, U.S. Medical, which provides enterprise and authorities medical insurance coverage, Worldwide Markets and Group Incapacity.

Evernorth contributes ~80% of annual revenues whereas Cigna Healthcare accounts for lots of the remaining. Cigna has annual revenues of ~$250 billion.

On Would possibly 2nd, 2025, Cigna reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, revenue grew 14.2% to $65.45 billion, which was a staggering $5.1 billion ahead of estimates.

Adjusted earnings-per-share of $6.74 in distinction favorably to adjusted earnings-per-share of $6.47 inside the prior yr and was $0.39 greater than anticipated.

For the quarter, full purchaser relationships had been unchanged at 182.2 million from the equivalent interval a yr prior to now, nonetheless this was down from 186.8 million in This autumn 2024.

Click on on proper right here to acquire our latest Constructive Analysis report on CI (preview of internet web page 1 of three confirmed underneath):

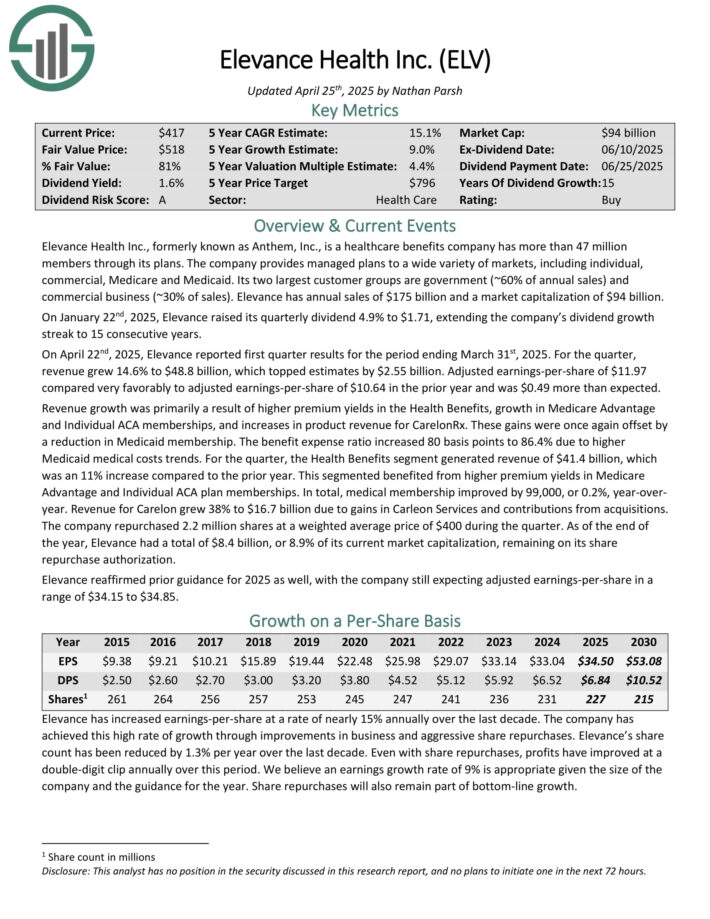

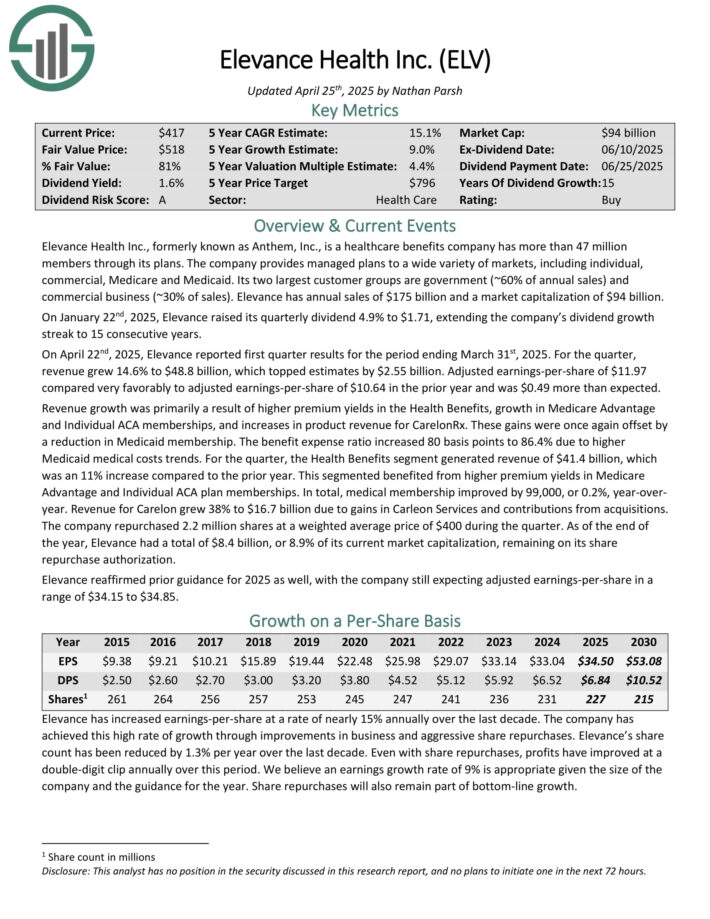

Healthcare Dividend Progress Stock #8: Elevance Effectively being Inc. (ELV)

- Annual Anticipated Returns: 15.5%

Elevance Effectively being Inc., beforehand usually known as Anthem, Inc., is a healthcare benefits agency has larger than 47 million members by its plans.

The company provides managed plans to all types of markets, along with specific individual, enterprise, Medicare and Medicaid. Its two largest purchaser groups are authorities (~60% of annual product sales) and enterprise enterprise (~30% of product sales). Elevance has annual product sales of $175 billion.

On January twenty second, 2025, Elevance raised its quarterly dividend 4.9% to $1.71, extending the company’s dividend progress streak to fifteen consecutive years.

On April twenty second, 2025, Elevance reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, revenue grew 14.6% to $48.8 billion, which topped estimates by $2.55 billion. Adjusted earnings-per-share of $11.97 in distinction very favorably to adjusted earnings-per-share of $10.64 inside the prior yr and was $0.49 larger than anticipated.

Earnings progress was primarily a outcomes of larger premium yields inside the Effectively being Benefits, progress in Medicare Profit and Explicit individual ACA memberships, and can improve in product revenue for CarelonRx. These optimistic elements had been as quickly as as soon as extra offset by a reduction in Medicaid membership.

Click on on proper right here to acquire our latest Constructive Analysis report on ELV (preview of internet web page 1 of three confirmed underneath):

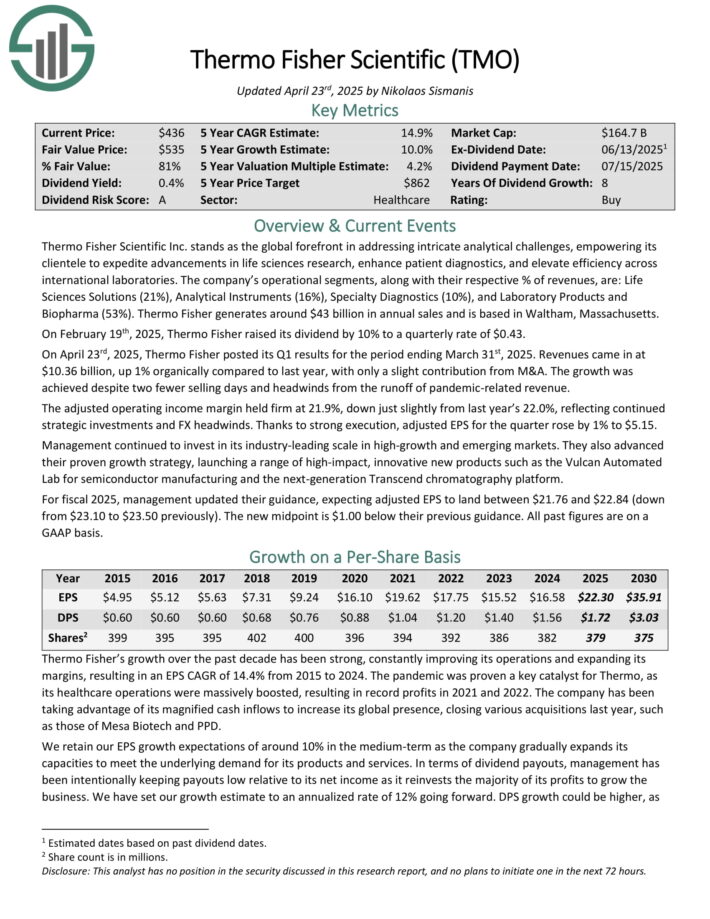

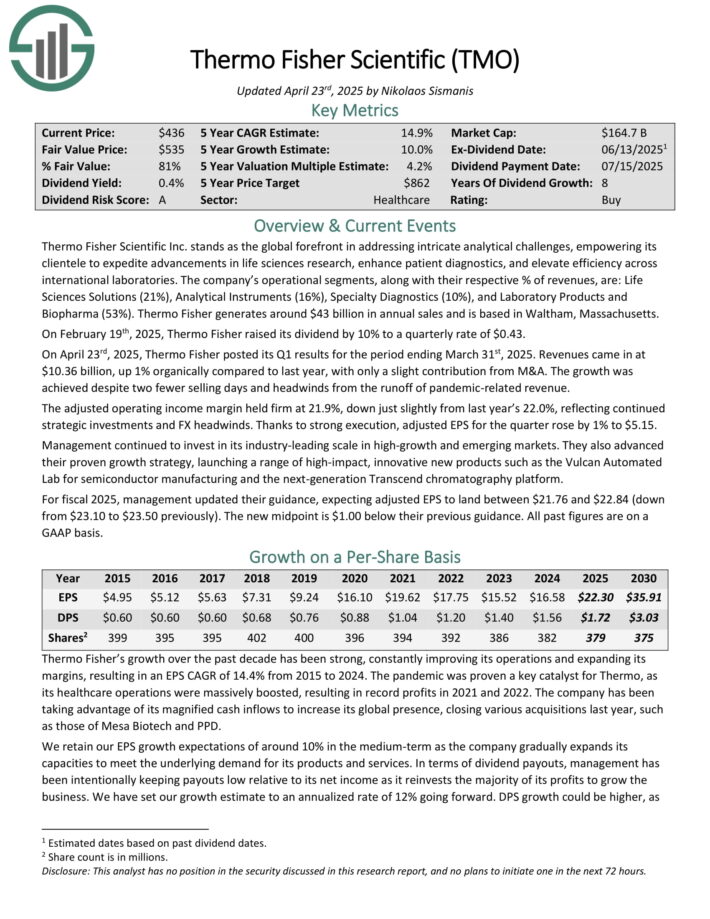

Healthcare Dividend Progress Stock #7: Thermo Fisher Scientific (TMO)

- Annual Anticipated Returns: 16.1%

Thermo Fisher Scientific Inc. stands because the worldwide forefront in addressing intricate analytical challenges, empowering its clientele to expedite developments in life sciences evaluation, enhance affected individual diagnostics, and elevate effectivity all through worldwide laboratories.

The company’s operational segments are Life Sciences Choices (21%), Analytical Gadgets (16%), Specialty Diagnostics (10%), and Laboratory Merchandise and Biopharma (53%).

Thermo Fisher generates spherical $43 billion in annual product sales and is based in Waltham, Massachusetts. On February nineteenth, 2025, Thermo Fisher raised its dividend by 10% to a quarterly price of $0.43.

On April twenty third, 2025, Thermo Fisher posted its Q1 outcomes for the interval ending March thirty first, 2025. Revenues obtained right here in at $10.36 billion, up 1% organically compared with last yr, with solely a slight contribution from M&A. Progress was achieved no matter two fewer selling days and headwinds from the runoff of pandemic-related revenue.

The adjusted working income margin held company at 21.9%, down merely barely from last yr’s 22.0%, reflecting continued strategic investments and FX headwinds. Due to sturdy execution, adjusted EPS for the quarter rose by 1% to $5.15.

Click on on proper right here to acquire our latest Constructive Analysis report on TMO (preview of internet web page 1 of three confirmed underneath):

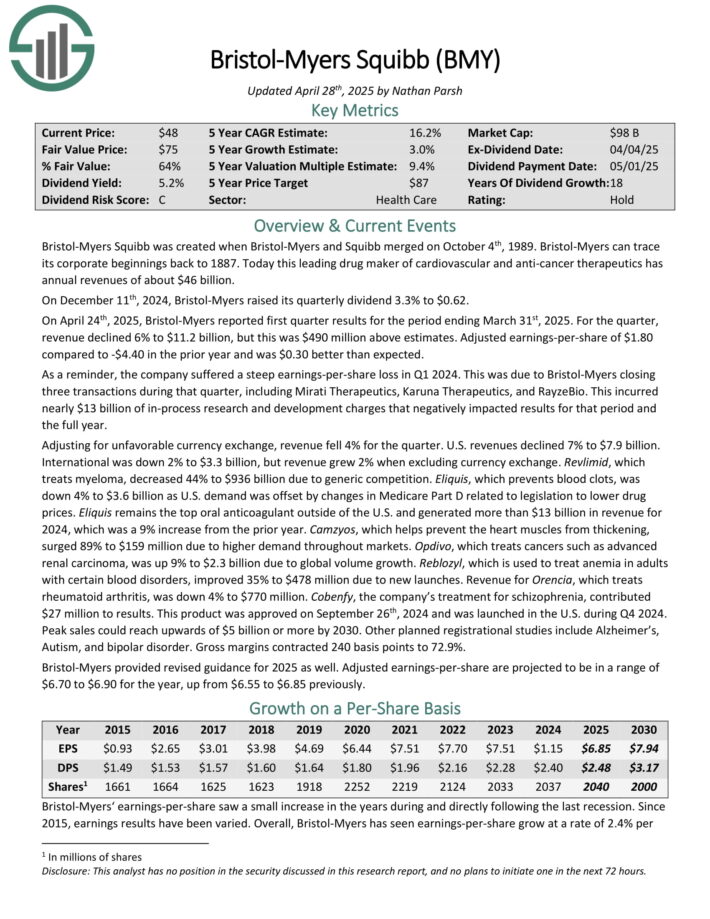

Healthcare Dividend Progress Stock #6: Bristol-Myers Squibb (BMY)

- Annual Anticipated Returns: 16.5%

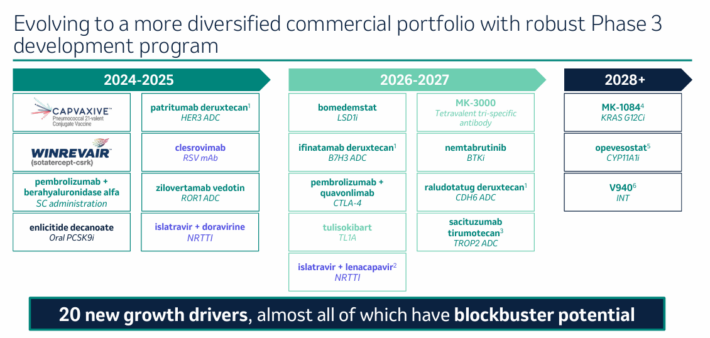

Bristol-Myers Squibb was created when Bristol-Myers and Squibb merged on October 4th, 1989. This important drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On December eleventh, 2024, Bristol-Myers raised its quarterly dividend 3.3% to $0.62.

On April twenty fourth, 2025, Bristol-Myers reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, revenue declined 6% to $11.2 billion, nonetheless this was $490 million above estimates.

Adjusted earnings-per-share of $1.80 compared with -$4.40 inside the prior yr and was $0.30 greater than anticipated. The company suffered a steep earnings-per-share loss in Q1 2024.

Adjusting for unfavorable international cash change, revenue fell 4% for the quarter. U.S. revenues declined 7% to $7.9 billion. Worldwide was down 2% to $3.3 billion, nonetheless revenue grew 2% when excluding international cash change.

Revlimid, which treats myeloma, decreased 44% to $936 billion as a consequence of generic rivals.

Bristol-Myers provided revised steering for 2025 as properly. Adjusted earnings-per-share are projected to be in a selection of $6.70 to $6.90 for the yr, up from $6.55 to $6.85 beforehand.

Click on on proper right here to acquire our latest Constructive Analysis report on BMY (preview of internet web page 1 of three confirmed underneath):

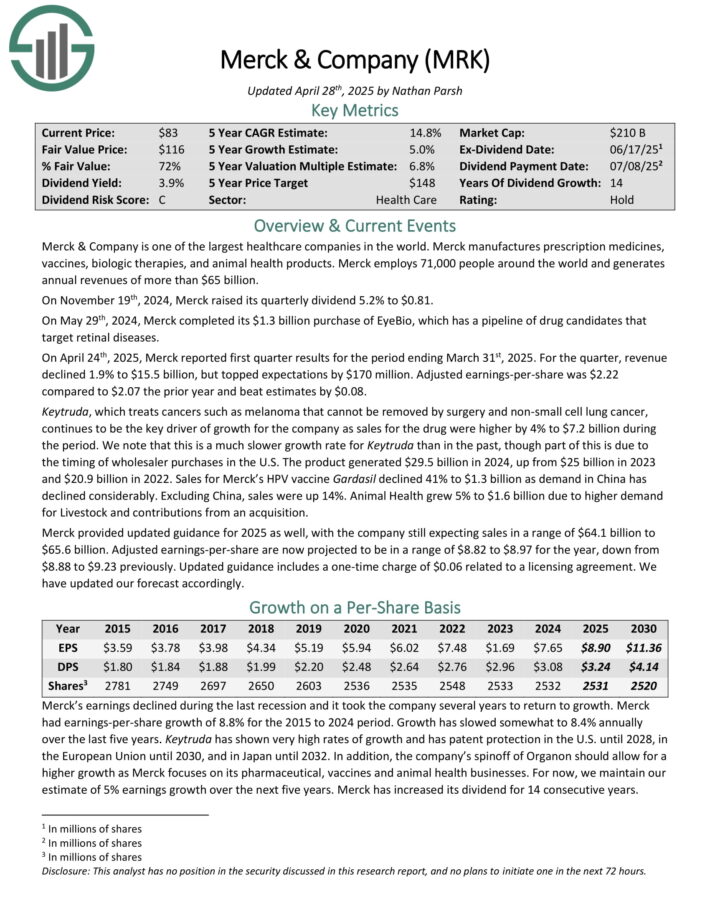

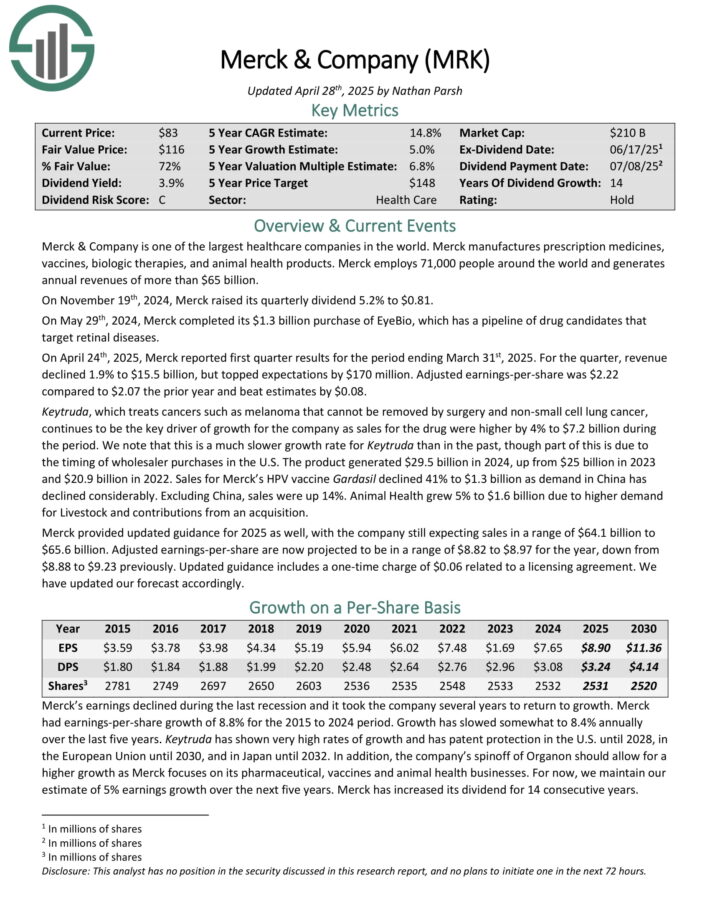

Healthcare Dividend Progress Stock #5: Merck & Co. (MRK)

- Annual Anticipated Returns: 16.6%

Merck & Agency is no doubt one of many largest healthcare companies on the planet. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal properly being merchandise.

Merck employs 68,000 people world large and generates annual revenues of larger than $63 billion.

Provide: Investor Presentation

On April twenty fourth, 2025, Merck reported first quarter outcomes. For the quarter, revenue declined 1.9% to $15.5 billion, nonetheless topped expectations by $170 million. Adjusted earnings-per-share was $2.22 compared with $2.07 the prior yr and beat estimates by $0.08.

Keytruda, which treats cancers paying homage to melanoma that may not be eradicated by surgical process and non-small cell lung most cancers, continues to be the vital factor driver of progress for the company as product sales for the drug had been larger by 4% to $7.2 billion by way of the interval. The product generated $29.5 billion in 2024, up from $25 billion in 2023 and $20.9 billion in 2022.

Click on on proper right here to acquire our latest Constructive Analysis report on MRK (preview of internet web page 1 of three confirmed underneath):

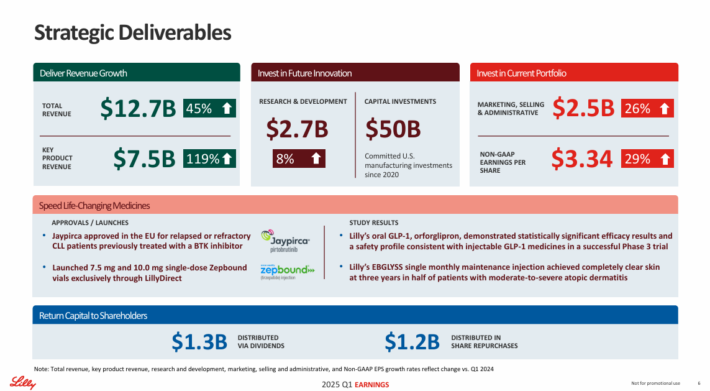

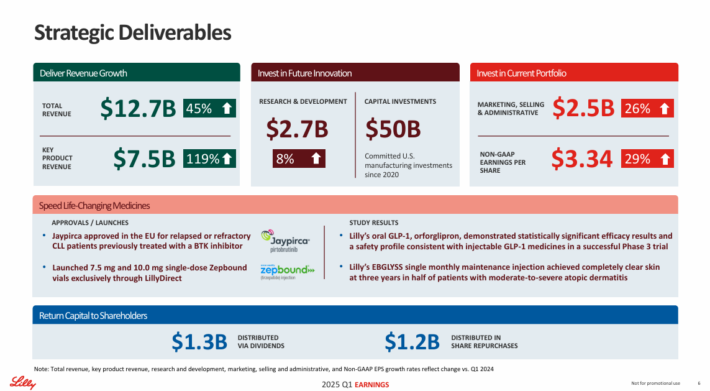

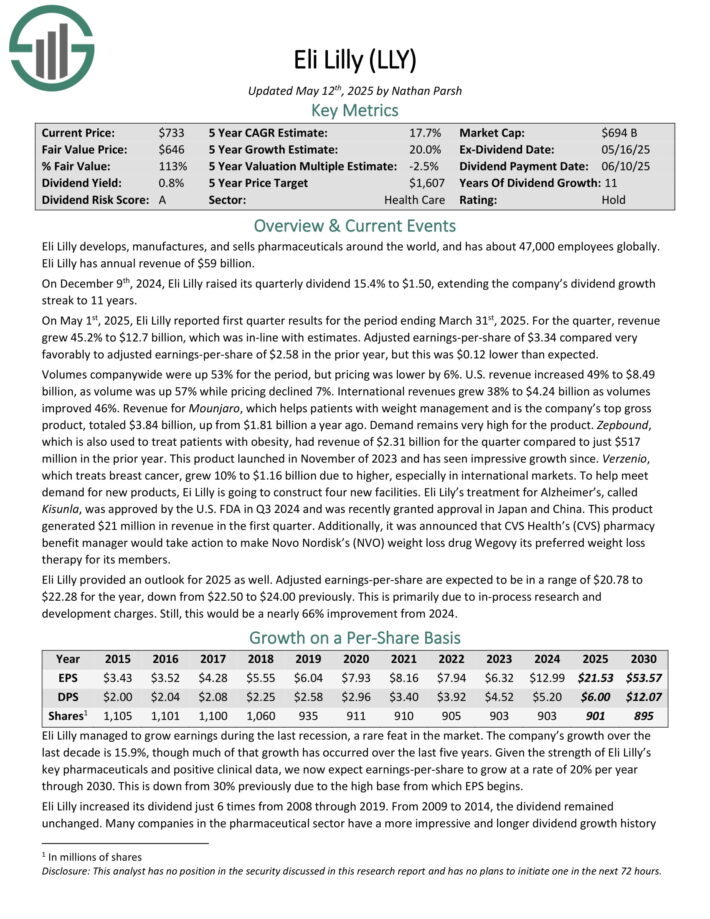

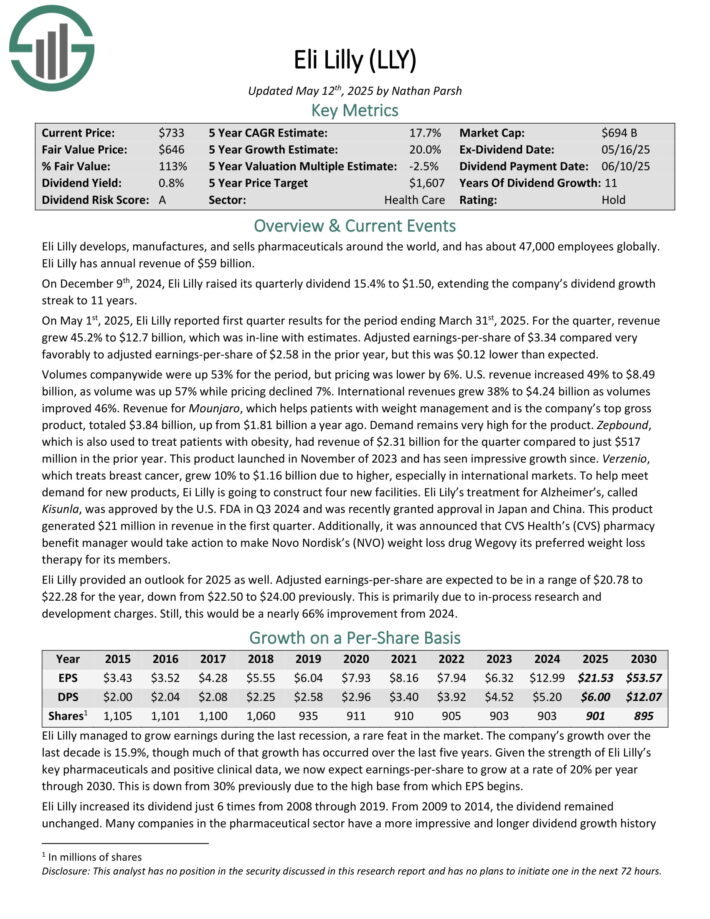

Healthcare Dividend Progress Stock #4: Eli Lilly & Co. (LLY)

- Annual Anticipated Returns: 16.9%

Eli Lilly develops, manufactures, and sells pharmaceuticals world large, and has about 47,000 workers globally. Eli Lilly has annual revenue of $59 billion.

On Would possibly 1st, 2025, Eli Lilly reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, revenue grew 45.2% to $12.7 billion, which was in-line with estimates.

Adjusted earnings-per-share of $3.34 in distinction very favorably to adjusted earnings-per-share of $2.58 inside the prior yr, nonetheless this was $0.12 lower than anticipated.

Provide: Investor Presentation

Volumes company-wide had been up 53% for the interval, nonetheless pricing was lower by 6%. U.S. revenue elevated 49% to $8.49 billion, as amount was up 57% whereas pricing declined 7%. Worldwide revenues grew 38% to $4.24 billion as volumes improved 46%.

Earnings for Mounjaro, which helps victims with weight administration and is the company’s excessive gross product, totaled $3.84 billion, up from $1.81 billion a yr prior to now. Demand stays very extreme for the product.

Zepbound, which can be utilized to take care of victims with weight issues, had revenue of $2.31 billion for the quarter compared with merely $517 million inside the prior yr. This product launched in November of 2023 and has seen spectacular progress since.

Verzenio, which treats breast most cancers, grew 10% to $1.16 billion.

Click on on proper right here to acquire our latest Constructive Analysis report on LLY (preview of internet web page 1 of three confirmed underneath):

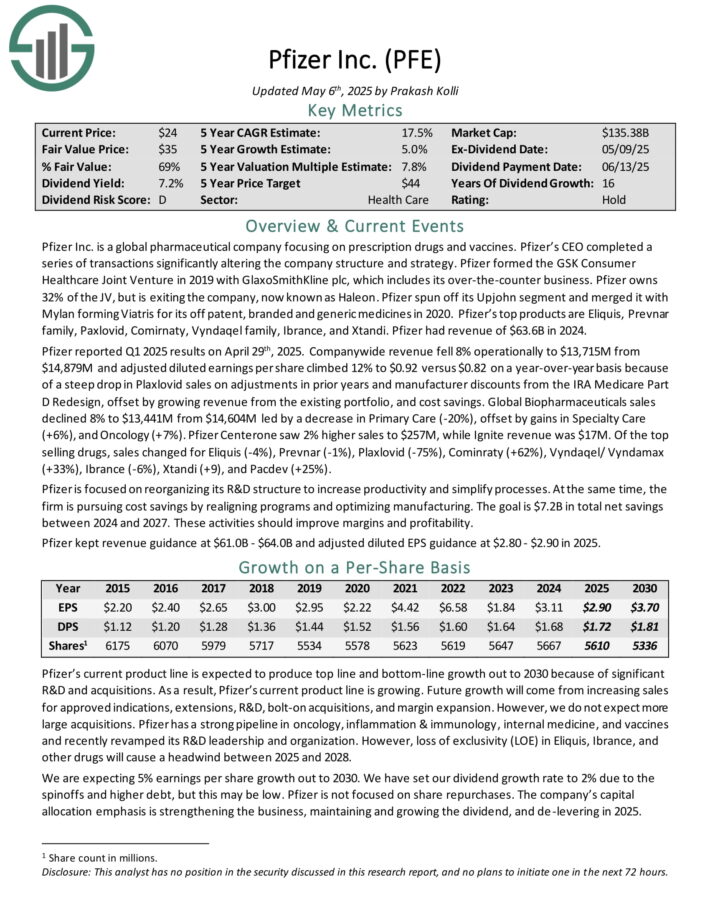

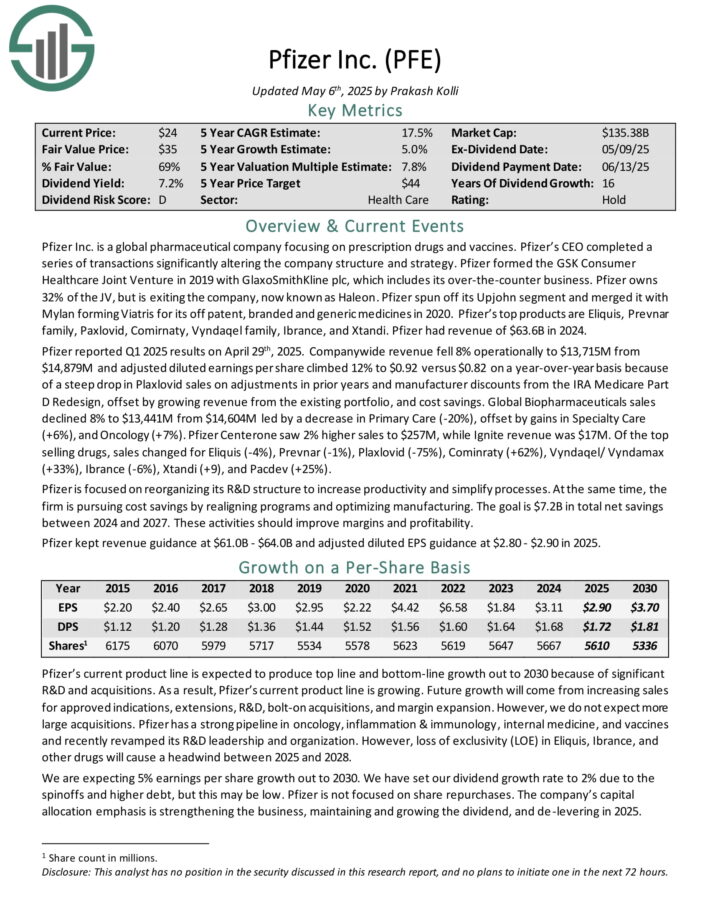

Healthcare Dividend Progress Stock #3: Pfizer Inc. (PFE)

- Annual Anticipated Returns: 18.2%

Pfizer Inc. is a worldwide pharmaceutical agency specializing in pharmaceuticals and vaccines. Pfizer’s excessive merchandise are Eliquis, Prevnar family, Paxlovid, Comirnaty, Vyndaqel family, Ibrance, and Xtandi. Pfizer had revenue of $63.6B in 2024.

Pfizer reported Q1 2025 outcomes on April twenty ninth, 2025. Agency-wide revenue fell 8% operationally and adjusted diluted earnings per share climbed 12% to $0.92 versus $0.82 on a year-over-year basis.

The revenue decline was as a result of a steep drop in Plaxlovid product sales on adjustments in prior years and producer reductions from the IRA Medicare Half D Redesign, offset by rising revenue from the current portfolio, and value monetary financial savings.

Worldwide Biopharmaceuticals product sales declined 8% led by a decrease in Foremost Care (-20%), offset by optimistic elements in Specialty Care (+6%), and Oncology (+7%).

Click on on proper right here to acquire our latest Constructive Analysis report on PFE (preview of internet web page 1 of three confirmed underneath):

Healthcare Dividend Progress Stock #2: Novo Nordisk (NVO)

- Annual Anticipated Returns: 18.7%

Novo Nordisk A/S ADR is an enormous worldwide pharmaceutical agency headquartered in Denmark. The company focuses on two core enterprise segments: Diabetes & Weight issues Care and Unusual Diseases.

The Diabetes & Weight issues Care part manufactures insulin, related provide packages, oral anti-diabetic merchandise, and merchandise to take care of weight issues. The Unusual Diseases part manufactures merchandise for hemophilia and completely different continuous diseases. Novo Nordisk derives ~92% of revenue from diabetes and weight issues.

Novo Nordisk reported great Q1 2025 outcomes on Would possibly seventh, 2025. Agency-wide product sales had been up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year basis.

Diabetes & Weight issues product sales elevated 21% pushed by will improve in Ozempic and Rybelsus (GLP-1), Wegovy (weight issues), long-acting insulin, and fast-acting insulin, offset by lower product sales for premix insulin, Saxenda (weight issues), Victoza (GLP-1), and flat human insulin.

The Unusual Sickness part product sales rose 5% attributable to rising unusual blood and endocrine issues medication. The company is rising its blockbuster GLP-1 and weight issues medication to completely different indications and dosing sizes.

The company lowered its outlook to 13 – 21% product sales progress and 16%- 24% working income progress in 2025.

Click on on proper right here to acquire our latest Constructive Analysis report on NVO (preview of internet web page 1 of three confirmed underneath):

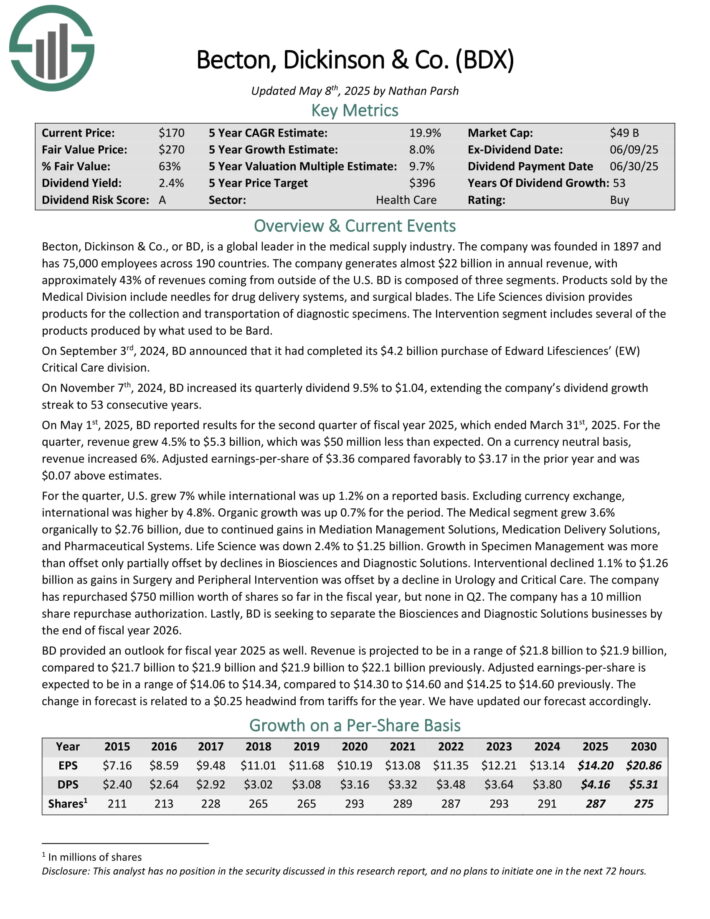

Healthcare Dividend Progress Stock #1: Becton Dickinson & Co. (BDX)

- Annual Anticipated Returns: 18.9%

Becton, Dickinson & Co., or BD, is a worldwide chief inside the medical present commerce. The company generates practically $22 billion in annual revenue, with roughly 43% of revenues coming from outside of the U.S.

BD consists of three segments. Merchandise provided by the Medical Division embody needles for drug provide packages, and surgical blades. The Life Sciences division provides merchandise for the gathering and transportation of diagnostic specimens. The Intervention part consists of quite a lot of of the merchandise produced by what was Bard.

On Would possibly 1st, 2025, BD reported outcomes for the second quarter of fiscal yr 2025, which ended March thirty first, 2025. For the quarter, revenue grew 4.5% to $5.3 billion, which was $50 million decrease than anticipated.

On a international cash neutral basis, revenue elevated 6%. Adjusted earnings-per-share of $3.36 in distinction favorably to $3.17 inside the prior yr and was $0.07 above estimates.

For the quarter, U.S. grew 7% whereas worldwide was up 1.2% on a reported basis. Excluding international cash change, worldwide was larger by 4.8%. Pure progress was up 0.7% for the interval.

Click on on proper right here to acquire our latest Constructive Analysis report on BDX (preview of internet web page 1 of three confirmed underneath):

Additional Learning

In case you might be severe about discovering completely different high-yield securities, the subsequent Constructive Dividend sources may be useful:

Extreme-Yield Explicit individual Security Evaluation

Totally different Constructive Dividend Property

Thanks for learning this textual content. Please ship any recommendations, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@kind":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@kind":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/11/Healthcare-Shares-e1667947822452.png","width":0,"top":0},"writer":{"@kind":"Group","title":"","url":"https://indexinvestingnews.com","brand":{"@kind":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link