Printed on November 14th, 2025 by Bob Ciura

Dividend improvement is a robust signal of a company’s financial effectively being, administration’s confidence, and dedication to long-term value creation.

Dividend improvement shares have historically generated superior returns with a lot much less volatility relative to shares with flat dividends, shares that in the reduction of their dividend, and shares that don’t pay dividends

It’s significantly unusual to look out an investing concern that has historically offered – and I think about is susceptible to proceed offering – every superior returns and lower volatility.

And it stands to trigger that dividend improvement shares would supply every stronger returns and reduce volatility versus non-dividend improvement shares.

Rising dividends are a optimistic signal of underlying enterprise improvement on a per share basis and fixed cash transfer expertise functionality.

Dividend improvement is measured in years of consecutive will improve, and proportion or compound improve over loads of years.

All totally different points being equal, longer streaks and bigger proportion will improve are hottest.

Longer streaks are hottest because of they current a company can improve dividends over a wide range of monetary and aggressive environments. They current proof of a sturdy aggressive profit.

It’s no small feat to boost a dividend year-after-year for a few years at a time, by way of recessions, wars, and epidemics.

And since dividends are paid with exact cash, they may’t be faked. A company cannot pay dividends for any important dimension of time with out producing cash flows to assist the dividend.

Actually, not all dividend improvement shares make equally good investments…

Due to this we recommend shares with a minimum of 10+ consecutive years of dividend will improve, which we identify ‘blue chip’ shares.

You’ll be capable to get hold of our free blue chip shares guidelines with vital financial metrics, resembling dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Blue-chip shares are established, financially sturdy, and always worthwhile publicly traded corporations.

By investing in blue-chip shares with prolonged histories of accelerating dividends yearly, regardless of the state of the worldwide monetary system, merchants can unleash the flexibility of dividend improvement.

This article is going to give attention to 10 blue-chip shares with the easiest anticipated future dividend improvement throughout the Sure Analysis Evaluation Database.

The ten blue chip shares beneath are sorted by estimated dividend improvement price, from lowest to highest.

Desk of Contents

The desk of contents beneath permits for easy navigation.

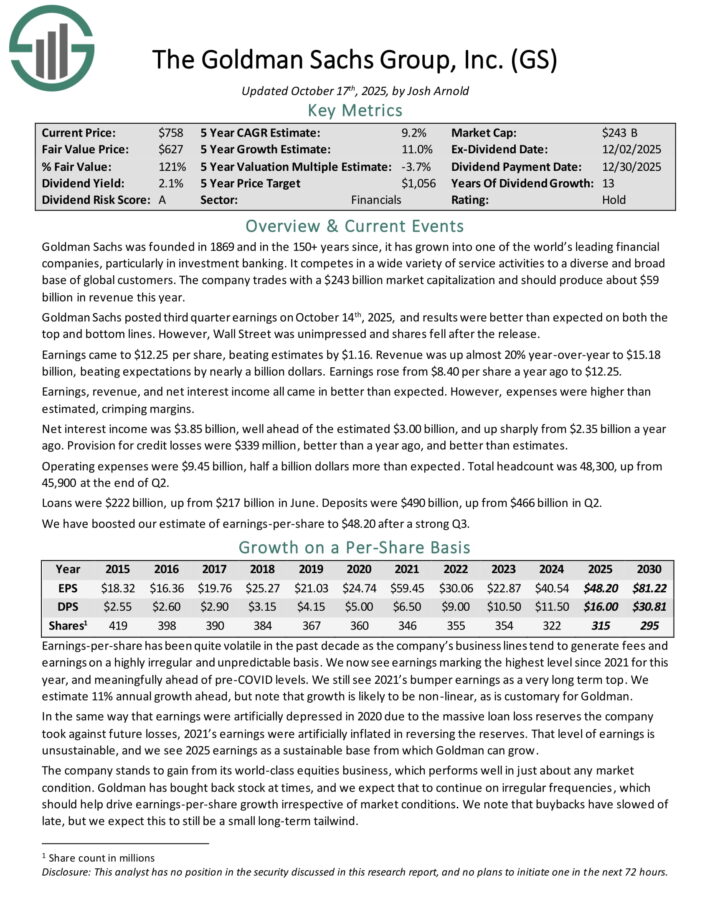

Dividend Progress Stock: Goldman Sachs Group (GS)

Goldman Sachs was primarily based in 1869 and throughout the 150+ years since, it has grown into one in all many world’s fundamental financial corporations, considerably in funding banking.

It competes in all types of service actions to a varied and broad base of worldwide prospects. The company ought to provide about $55 billion in earnings this yr.

Goldman Sachs posted third quarter earnings on October 14th, 2025, and outcomes have been larger than anticipated on every the best and bottom traces. Earnings bought right here to $12.25 per share, beating estimates by $1.16.

Earnings was up just about 20% year-over-year to $15.18 billion, beating expectations by virtually a billion {{dollars}}. Earnings rose from $8.40 per share a yr up to now to $12.25.

Web curiosity earnings was $3.85 billion, successfully ahead of the estimated $3.00 billion, and up sharply from $2.35 billion a yr up to now. Provision for credit score rating losses have been $339 million, larger than a yr up to now, and better than estimates.

Working payments have been $9.45 billion, half a billion {{dollars}} better than anticipated. Entire headcount was 48,300, up from 45,900 on the end of Q2. Loans have been $222 billion, up from $217 billion in June. Deposits have been $490 billion, up from $466 billion in Q2.

Click on on proper right here to acquire our latest Sure Analysis report on GS (preview of internet web page 1 of three confirmed beneath):

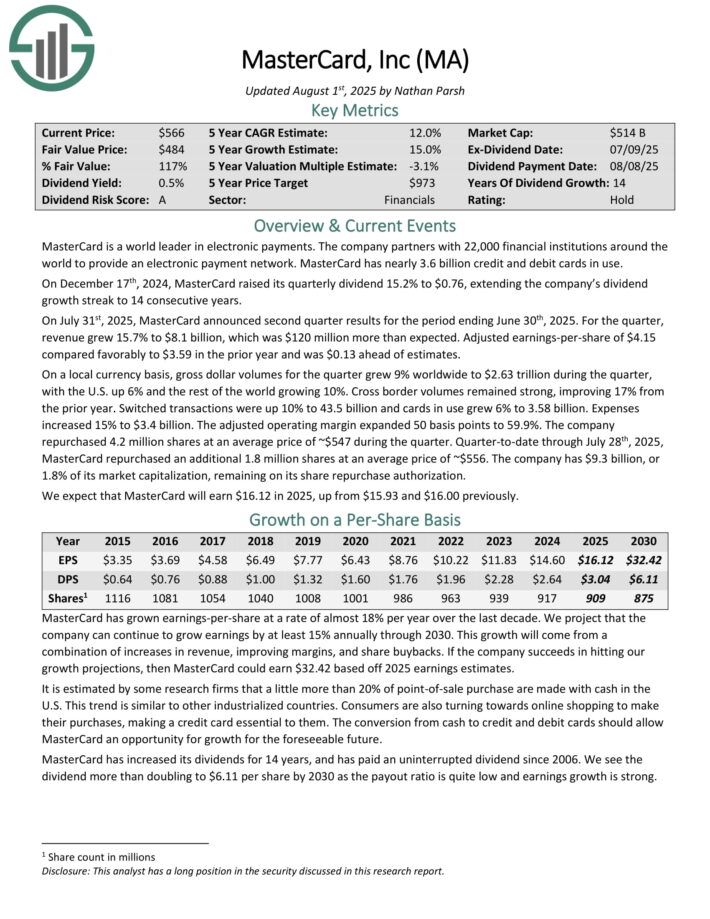

Dividend Progress Stock: Mastercard Inc. (MA)

MasterCard is a world chief in digital funds. The company companions with 25,000 financial institutions world extensive to supply an digital price group. MasterCard has better than 3.1 billion credit score rating and debit enjoying playing cards in use.

On July thirty first, 2025, MasterCard launched second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, earnings grew 15.7% to $8.1 billion, which was $120 million better than anticipated. Adjusted earnings-per-share of $4.15 in distinction favorably to $3.59 throughout the prior yr and was $0.13 ahead of estimates.

On a neighborhood overseas cash basis, gross dollar volumes for the quarter grew 9% worldwide to $2.63 trillion via the quarter, with the U.S. up 6% and the rest of the world rising 10%. Cross border volumes remained sturdy, bettering 17% from the prior yr.

Switched transactions have been up 10% to 43.5 billion and enjoying playing cards in use grew 6% to a few.58 billion. Payments elevated 15% to $3.4 billion. The adjusted working margin expanded 50 basis elements to 59.9%.

The company repurchased 4.2 million shares at a median worth of ~$547 via the quarter. Quarter-to-date by way of July twenty eighth, 2025, MasterCard repurchased an additional 1.8 million shares at a median worth of ~$556.

Click on on proper right here to acquire our latest Sure Analysis report on Mastercard (preview of internet web page 1 of three confirmed beneath):

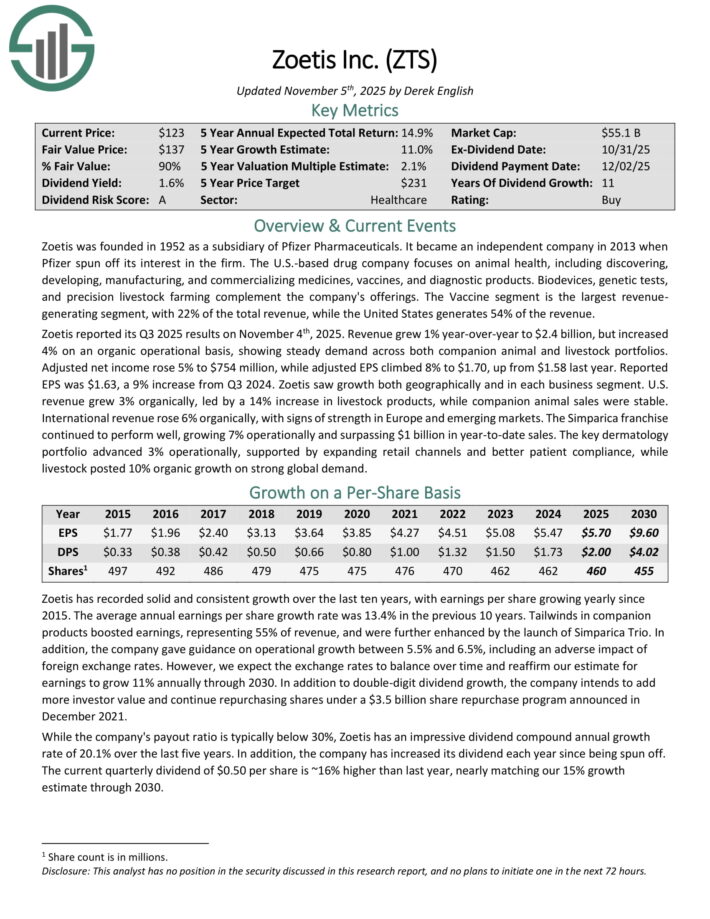

Dividend Progress Stock: Zoetis Inc. (ZTS)

Zoetis was primarily based in 1952 as a subsidiary of Pfizer Pharmaceuticals. It turned an unbiased agency in 2013 when Pfizer spun off its curiosity throughout the company.

The U.S.-based drug agency focuses on animal effectively being, along with discovering, creating, manufacturing, and commercializing medicines, vaccines, and diagnostic merchandise.

Biodevices, genetic checks, and precision livestock farming complement the company’s decisions. The Vaccine part is crucial earnings producing part, with 22% of the entire earnings, whereas america generates 54% of the earnings.

Zoetis reported its Q3 2025 outcomes on November 4th, 2025. Earnings grew 1% year-over-year to $2.4 billion, nonetheless elevated 4% on an pure operational basis, displaying common demand all through every companion animal and livestock portfolios.

Adjusted web earnings rose 5% to $754 million, whereas adjusted EPS climbed 8% to $1.70, up from $1.58 last yr. Reported EPS was $1.63, a 9% improve from Q3 2024. Zoetis seen improvement every geographically and in each enterprise part.

U.S. earnings grew 3% organically, led by a 14% improve in livestock merchandise, whereas companion animal product sales have been regular.

Worldwide earnings rose 6% organically, with indicators of energy in Europe and rising markets. The Simparica franchise continued to hold out successfully, rising 7% operationally and surpassing $1 billion in year-to-date product sales.

Click on on proper right here to acquire our latest Sure Analysis report on ZTS (preview of internet web page 1 of three confirmed beneath):

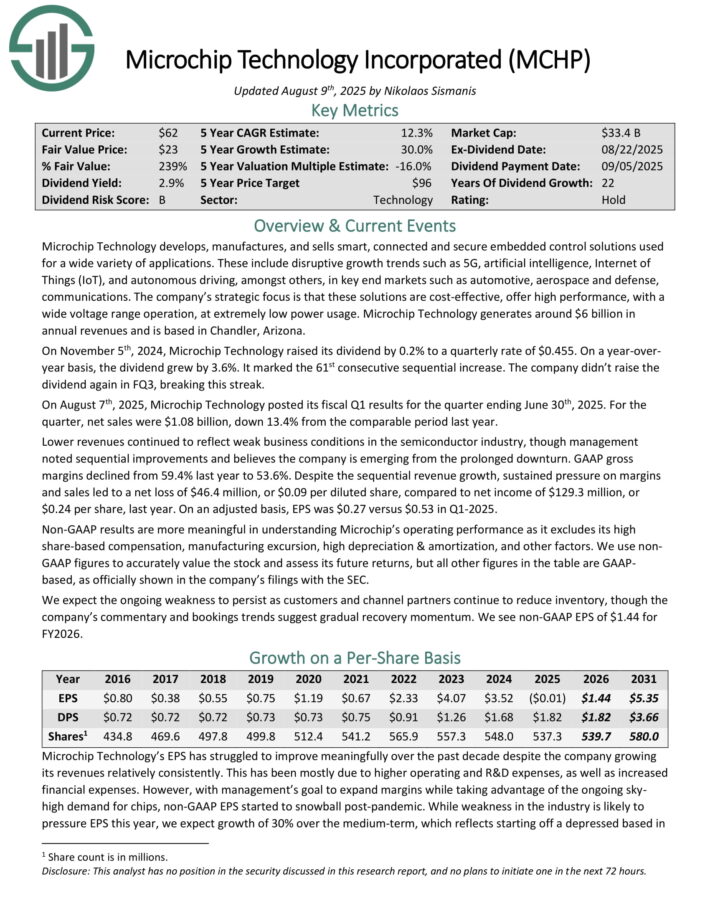

Dividend Progress Stock: Microchip Experience (MCHP)

Microchip Experience develops, manufactures, and sells good, linked and secure embedded administration choices used for all types of features.

These embody disruptive improvement traits resembling 5G, artificial intelligence, Net of Points (IoT), and autonomous driving, amongst others, in key end markets resembling automotive, aerospace and safety, communications.

Microchip Experience generates spherical $6 billion in annual revenues and is based in Chandler, Arizona.

On August seventh, 2025, Microchip Experience posted its fiscal Q1 outcomes for the quarter ending June thirtieth, 2025. For the quarter, web product sales have been $1.08 billion, down 13.4% from the comparable interval last yr.

Lower revenues continued to duplicate weak enterprise circumstances throughout the semiconductor commerce, though administration well-known sequential enhancements and believes the company is rising from the prolonged downturn.

GAAP gross margins declined from 59.4% last yr to 53.6%. Whatever the sequential earnings improvement, sustained stress on margins and product sales led to a web lack of $46.4 million, or $0.09 per diluted share, as compared with web earnings of $129.3 million, or $0.24 per share, last yr.

On an adjusted basis, EPS was $0.27 versus $0.53 in Q1-2025.

Click on on proper right here to acquire our latest Sure Analysis report on MCHP (preview of internet web page 1 of three confirmed beneath):

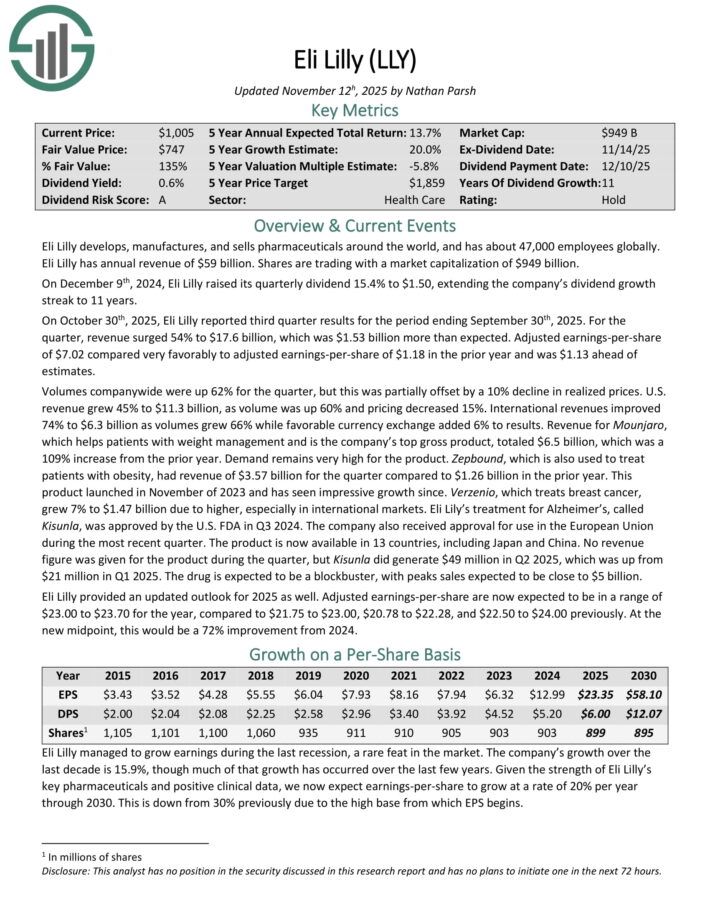

Dividend Progress Stock: Eli Lilly (LLY)

Eli Lilly develops, manufactures, and sells pharmaceuticals world extensive, and has about 47,000 employees globally. Eli Lilly has annual earnings of $59 billion.

On October thirtieth, 2025, Eli Lilly reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, earnings surged 54% to $17.6 billion, which was $1.53 billion better than anticipated.

Adjusted earnings-per-share of $7.02 in distinction very favorably to adjusted earnings-per-share of $1.18 throughout the prior yr and was $1.13 ahead of estimates.

Volumes companywide have been up 62% for the quarter, nonetheless this was partially offset by a ten% decline in realized prices. U.S. earnings grew 45% to $11.3 billion, as amount was up 60% and pricing decreased 15%.

Worldwide revenues improved 74% to $6.3 billion as volumes grew 66% whereas favorable overseas cash alternate added 6% to outcomes. Earnings for Mounjaro, which helps victims with weight administration and is the company’s prime gross product, totaled $6.5 billion, which was a 109% improve from the prior yr.

Zepbound, which can be utilized to take care of victims with weight issues, had earnings of $3.57 billion for the quarter as compared with $1.26 billion throughout the prior yr. This product launched in November of 2023 and has seen spectacular improvement since.

Verzenio, which treats breast most cancers, grew 7% to $1.47 billion as a consequence of elevated, significantly in worldwide markets.

Eli Lilly provided an updated outlook for 2025 as successfully. Adjusted earnings-per-share are literally anticipated to be in a variety of $23.00 to $23.70 for the yr.

Click on on proper right here to acquire our latest Sure Analysis report on LLY (preview of internet web page 1 of three confirmed beneath):

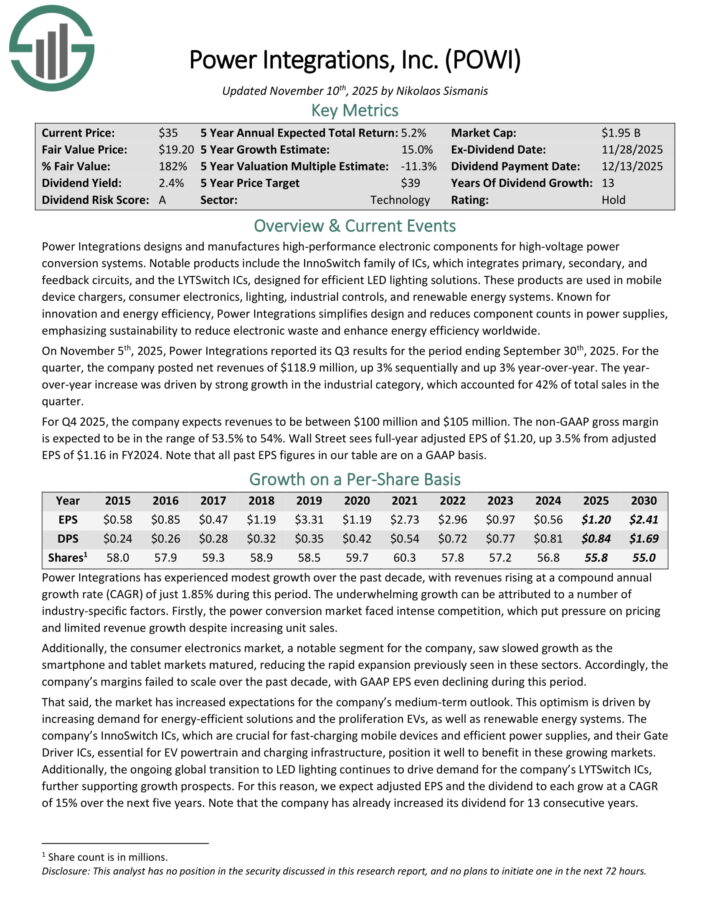

Dividend Progress Stock: Vitality Integrations Inc. (POWI)

Vitality Integrations designs and manufactures high-performance digital components for high-voltage vitality conversion strategies.

Notable merchandise embody the InnoSwitch family of ICs, which integrates main, secondary, and options circuits, and the LYTSwitch ICs, designed for setting pleasant LED lighting choices. These merchandise are utilized in cell gadget chargers, shopper electronics, lighting, industrial controls, and renewable energy strategies.

Recognized for innovation and energy effectivity, Vitality Integrations simplifies design and reduces half counts in vitality supplies, emphasizing sustainability to reduce digital waste and enhance energy effectivity worldwide.

On November fifth, 2025, Vitality Integrations reported its Q3 outcomes. For the quarter, the company posted web revenues of $118.9 million, up 3% sequentially and up 3% year-over-year. The year-over-year improve was pushed by sturdy improvement throughout the industrial class, which accounted for 42% of entire product sales throughout the quarter.

For This fall 2025, the company expects revenues to be between $100 million and $105 million. The non-GAAP gross margin is anticipated to be throughout the fluctuate of 53.5% to 54%.

Wall Avenue sees full-year adjusted EPS of $1.20, up 3.5% from adjusted EPS of $1.16 in FY2024. Remember that each one earlier EPS figures in our desk are on a GAAP basis.

Click on on proper right here to acquire our latest Sure Analysis report on POWI (preview of internet web page 1 of three confirmed beneath):

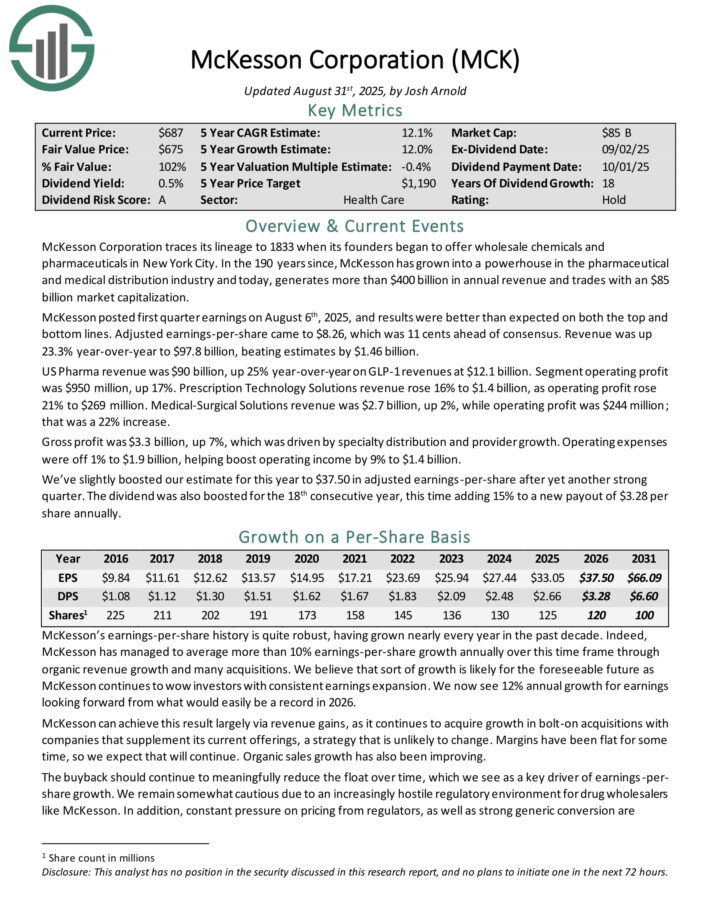

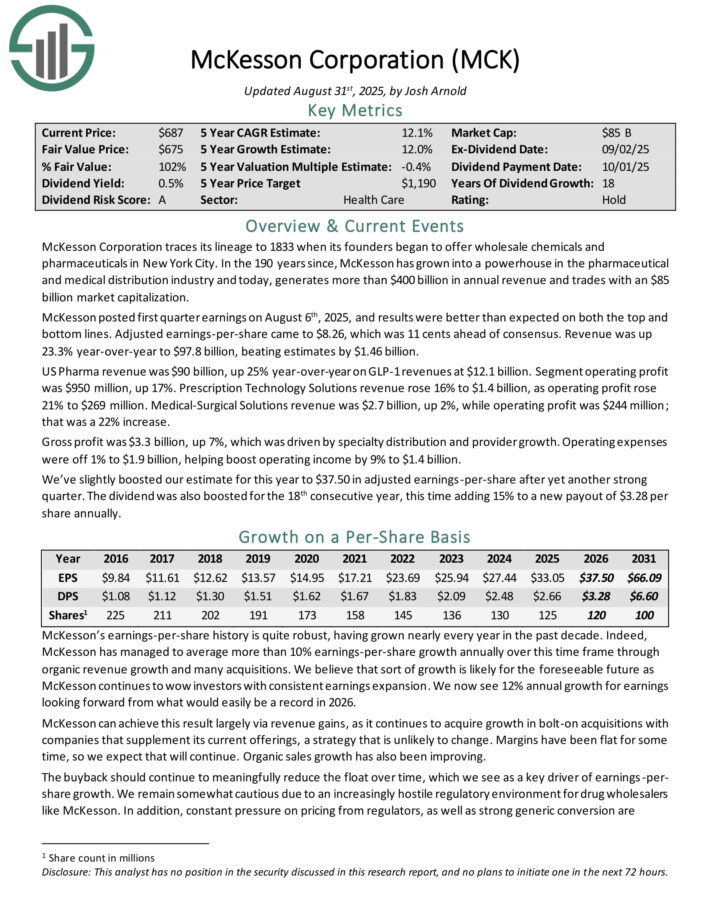

Dividend Progress Stock: McKesson Firm (MCK)

McKesson Firm traces its lineage to 1833 when its founders began to produce wholesale chemical compounds and pharmaceuticals in New York Metropolis.

Inside the 190 years since, McKesson has grown proper right into a powerhouse throughout the pharmaceutical and medical distribution commerce and at current, generates better than $300 billion in annual earnings.

McKesson posted first quarter earnings on August sixth, 2025, and outcomes have been larger than anticipated on every the best and bottom traces.

Adjusted earnings-per-share bought right here to $8.26, which was 11 cents ahead of consensus. Earnings was up 23.3% year-over-year to $97.8 billion, beating estimates by $1.46 billion.

US Pharma earnings was $90 billion, up 25% year-over-year on GLP-1 revenues at $12.1 billion. Part working income was $950 million, up 17%.

Prescription Experience Choices earnings rose 16% to $1.4 billion, as working income rose 21% to $269 million. Medical-Surgical Choices earnings was $2.7 billion, up 2%, whereas working income was $244 million; that was a 22% improve.

Gross income was $3.3 billion, up 7%, which was pushed by specialty distribution and provider improvement. Working payments have been off 1% to $1.9 billion, serving to reinforce working earnings by 9% to $1.4 billion.

Click on on proper right here to acquire our latest Sure Analysis report on MCK (preview of internet web page 1 of three confirmed beneath):

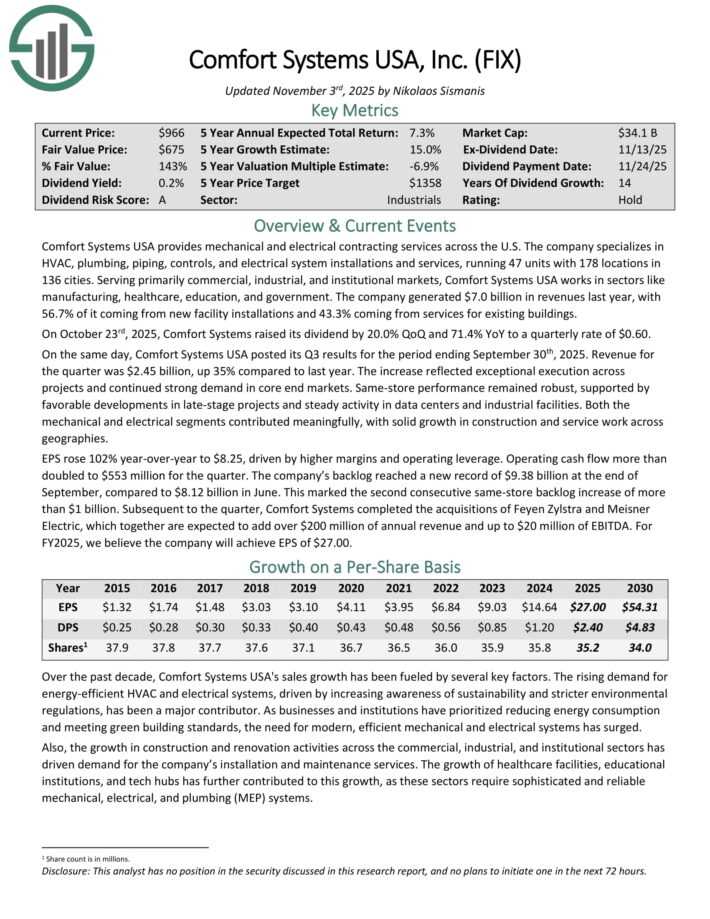

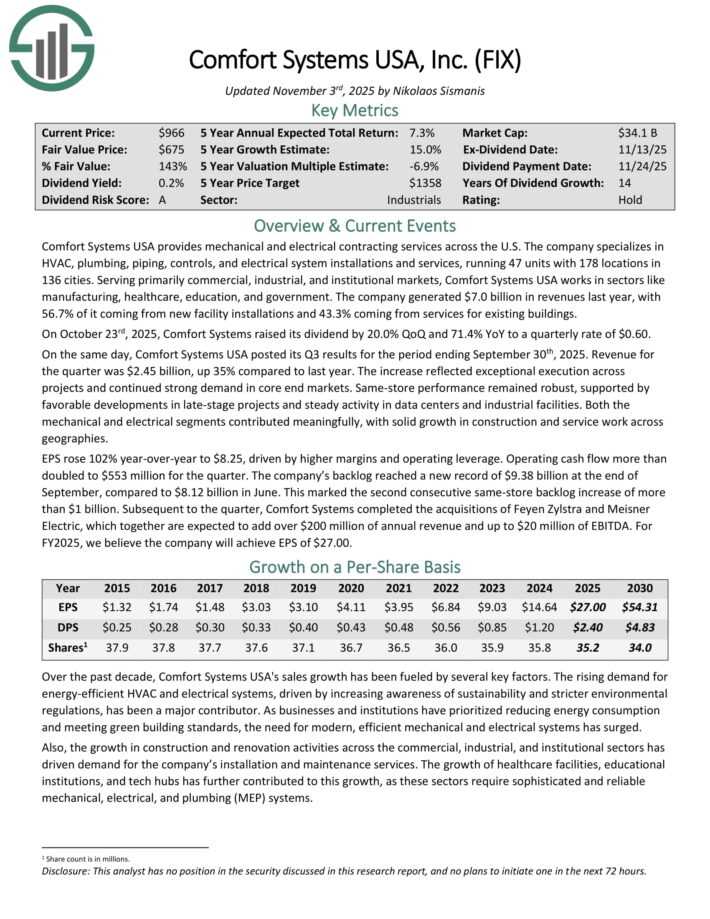

Dividend Progress Stock: Comfort Applications USA (FIX)

Comfort Applications USA offers mechanical and electrical contracting corporations all through the U.S. The company focuses on HVAC, plumbing, piping, controls, and electrical system installations and firms, working 47 gadgets with 178 areas in 136 cities.

Serving primarily enterprise, industrial, and institutional markets, Comfort Applications USA works in sectors like manufacturing, healthcare, education, and authorities. The company generated $7.0 billion in revenues last yr, with 56.7% of it coming from new facility installations and 43.3% coming from corporations for current buildings.

On October twenty third, 2025, Comfort Applications raised its dividend by 20.0% QoQ and 71.4% YoY to a quarterly price of $0.60. On the an identical day, Comfort Applications USA posted its Q3 outcomes for the interval ending September thirtieth, 2025. Earnings for the quarter was $2.45 billion, up 35% as compared with last yr.

The rise mirrored distinctive execution all through duties and continued sturdy demand in core end markets. Comparable-store effectivity remained sturdy, supported by favorable developments in late-stage duties and common train in data amenities and industrial companies.

Every the mechanical and electrical segments contributed meaningfully, with secure improvement in constructing and restore work all through geographies.

EPS rose 102% year-over-year to $8.25, pushed by elevated margins and dealing leverage. Working cash transfer better than doubled to $553 million for the quarter. The company’s backlog reached a model new doc of $9.38 billion on the end of September, as compared with $8.12 billion in June.

This marked the second consecutive same-store backlog improve of better than $1 billion. Subsequent to the quarter, Comfort Applications achieved the acquisitions of Feyen Zylstra and Meisner Electrical, which collectively are anticipated in order so as to add over $200 million of annual earnings and as a lot as $20 million of EBITDA.

Click on on proper right here to acquire our latest Sure Analysis report on FIX (preview of internet web page 1 of three confirmed beneath):

Dividend Progress Stock: Lemaitre Vascular (LMAT)

LeMaitre Vascular develops, markets, corporations, and backs medical items and implants to take care of peripheral vascular sickness.

Their decisions embody restore transfer allografts, angioscopes, embolectomy and thrombectomy catheters, occlusion and perfusion catheters, artery graft biologic grafts, carotid shunts, radiopaque tape, valvulotomes, vascular grafts, cardiac patches, and closure strategies.

On August fifth, 2025, LeMaitre launched outcomes for the second quarter of 2025, reporting Q2 non-GAAP EPS of $0.60 that beat analysts’ estimates by $0.03.

LeMaitre Vascular delivered sturdy Q2 2025 outcomes, with product sales climbing 15% year-over-year to $64.2 million, solely pushed by pure improvement.

Optimistic elements have been led by catheters, which have been up 27%, and grafts, which have been elevated by 19%, with worth will improve contributing 8% and unit volumes together with 7% to improvement. Regional effectivity was broad-based, with EMEA product sales up 23%, Americas up 12%, and APAC up 12%.

Gross margin expanded 110 basis elements to 70.0% on improved pricing and manufacturing efficiencies, whereas working earnings rose 12% to $16.1 million, representing a 25% margin. Cash elevated by $16.9 million sequentially to $319.5 million.

The company raised full-year steering to $251 million in product sales (+14%) and $2.30 EPS (+19%) on the midpoint.

Click on on proper right here to acquire our latest Sure Analysis report on LMAT (preview of internet web page 1 of three confirmed beneath):

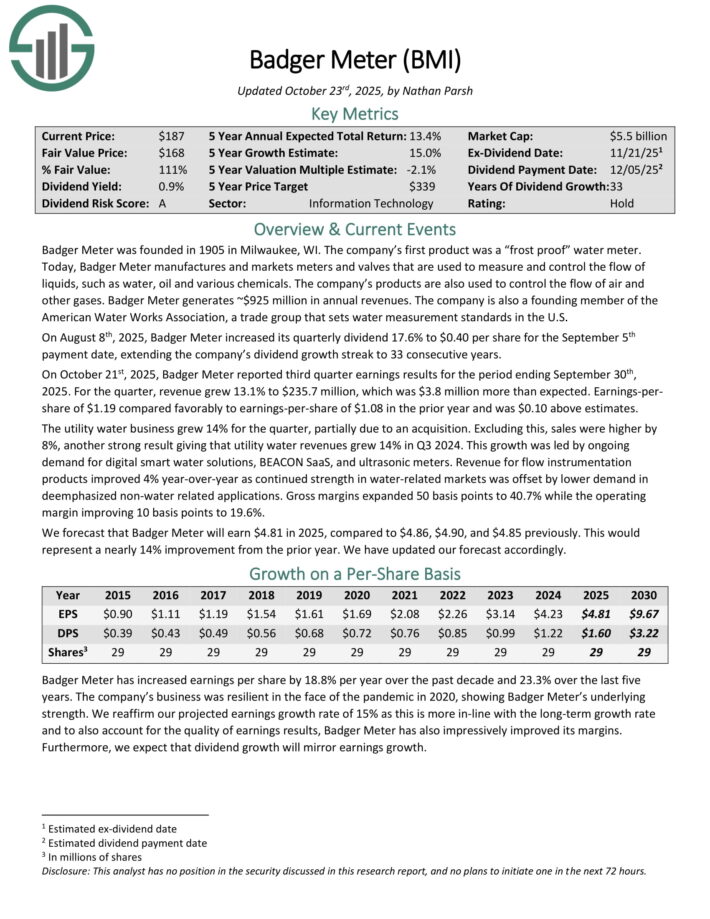

Dividend Progress Stock: Badger Meter (BMI)

Badger Meter manufactures and markets meters and valves which may be used to measure and administration the transfer of liquids, resembling water, oil and different chemical compounds.

The company’s merchandise are moreover used to manage the transfer of air and totally different gases. Badger Meter generates ~$925 million in annual revenues.

On August eighth, 2025, Badger Meter elevated its quarterly dividend 17.6% to $0.40 per share for the September fifth price date, extending the company’s dividend improvement streak to 33 consecutive years.

On October twenty first, 2025, Badger Meter reported third quarter earnings outcomes. For the quarter, earnings grew 13.1% to $235.7 million, which was $3.8 million better than anticipated.

Earnings-per-share of $1.19 in distinction favorably to earnings-per-share of $1.08 throughout the prior yr and was $0.10 above estimates.

The utility water enterprise grew 14% for the quarter, partially as a consequence of an acquisition. Excluding this, product sales have been elevated by 8%, one different sturdy consequence giving that utility water revenues grew 14% in Q3 2024. This improvement was led by ongoing demand for digital good water choices, BEACON SaaS, and ultrasonic meters.

Earnings for transfer instrumentation merchandise improved 4% year-over-year as continued energy in water-related markets was offset by lower demand in de-emphasized non-water related features.

Click on on proper right here to acquire our latest Sure Analysis report on BMI (preview of internet web page 1 of three confirmed beneath):

Additional Learning

In case you’re desirous about discovering totally different top quality dividend improvement shares, the following Sure Dividend belongings is also useful:

Totally different Sure Dividend Sources

Thanks for finding out this textual content. Please ship any options, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@sort":"Individual","identify":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/11/Blue-Chip-Shares-e1667696058583.png","width":0,"peak":0},"writer":{"@sort":"Group","identify":"","url":"https://indexinvestingnews.com","brand":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link