Revealed on March twenty sixth, 2025 by Bob Ciura

The aim of rational merchants is to maximize full return beneath a given set of constraints.

The three components of anticipated return are:

- Earnings-per-share growth

- Dividend funds

- Enlargement/contraction of the valuation a variety of

At Constructive Dividend, we contemplate high-quality dividend growth corporations signify the simplest shares to buy-and-hold for the long run.

Due to this we advocate shares which have established monitor info of paying dividends, and elevating their dividends over time.

Blue-chip shares are established, financially strong, and continuously worthwhile publicly traded corporations.

Their vitality makes them attention-grabbing investments for comparatively safe, reliable dividends and capital appreciation versus a lot much less established shares.

This evaluation report has the subsequent belongings that may assist you put cash into blue chip shares:

This document incorporates important metrics, along with: dividend yields, payout ratios, dividend growth prices, 52-week highs and lows, betas, and additional.

There are in the meanwhile higher than 500 securities in our blue chip shares document.

Even larger, merchants can maximize their portfolio return by shopping for prime quality dividend shares after they’re undervalued.

This textual content discusses the ten most interesting dividend shares inside the Constructive Analysis Evaluation Database in the meanwhile shopping for and promoting inside 10% of their 52-week lows.

The document excludes REITs, MLPs, and BDCs. The shares are organized by annual anticipated returns, in ascending order.

Desk of Contents

The desk of contents beneath permits for easy navigation.

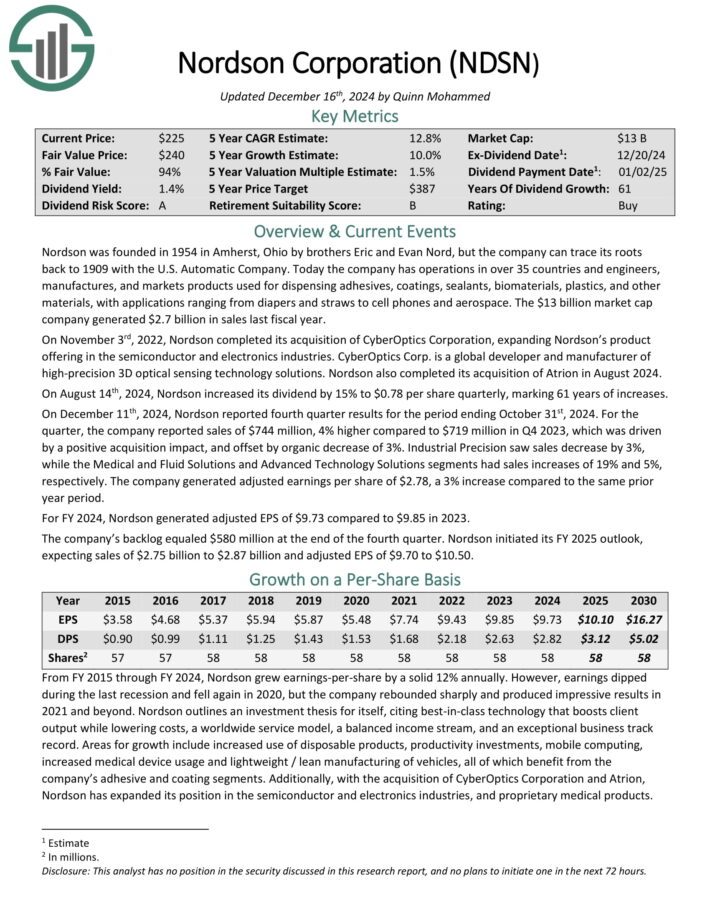

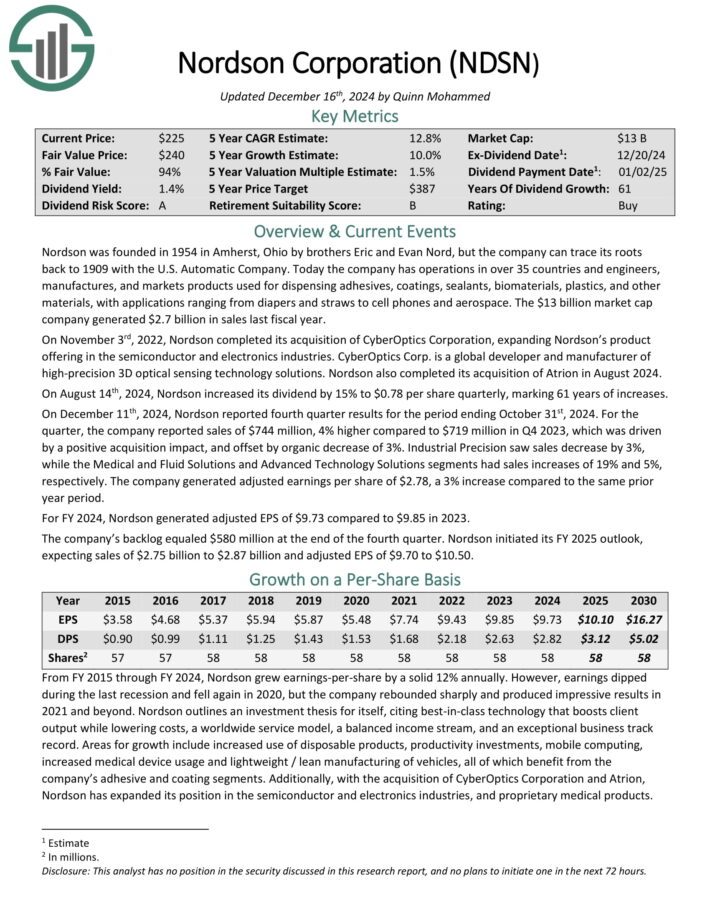

Crushed Down Dividend Stock #10: Nordson Corp. (NDSN)

- Anticipated Complete Return: 14.5%

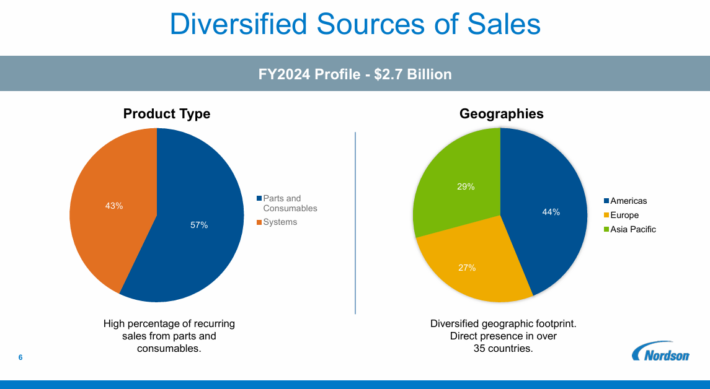

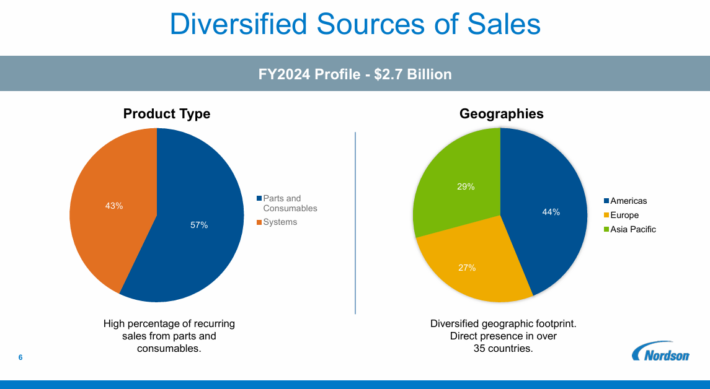

Nordson was primarily based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, nonetheless the agency can trace its roots once more to 1909 with the U.S. Automated Agency.

At the moment the company has operations in over 35 nations and engineers, manufactures, and markets merchandise used for allotting adhesives, coatings, sealants, biomaterials, plastics, and completely different provides, with functions ranging from diapers and straws to cell telephones and aerospace.

Provide: Investor Presentation

On December eleventh, 2024, Nordson reported fourth quarter outcomes for the interval ending October thirty first, 2024. For the quarter, the company reported product sales of $744 million, 4% elevated compared with $719 million in This fall 2023, which was pushed by a optimistic acquisition affect, and offset by pure decrease of three%.

Industrial Precision observed product sales decrease by 3%, whereas the Medical and Fluid Choices and Superior Experience Choices segments had product sales will improve of 19% and 5%, respectively.

The company generated adjusted earnings per share of $2.78, a 3% improve compared with the equivalent prior yr interval.

Click on on proper right here to acquire our most recent Constructive Analysis report on NDSN (preview of internet web page 1 of three confirmed beneath):

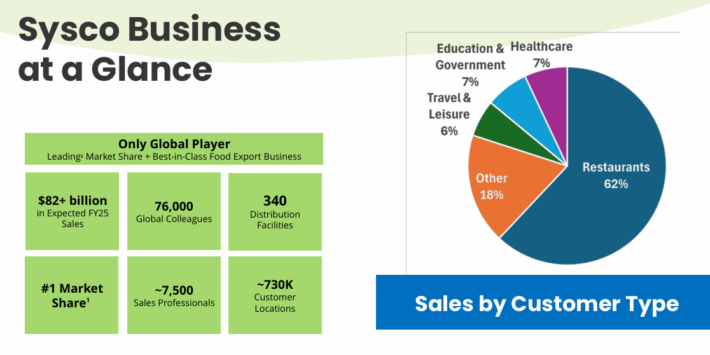

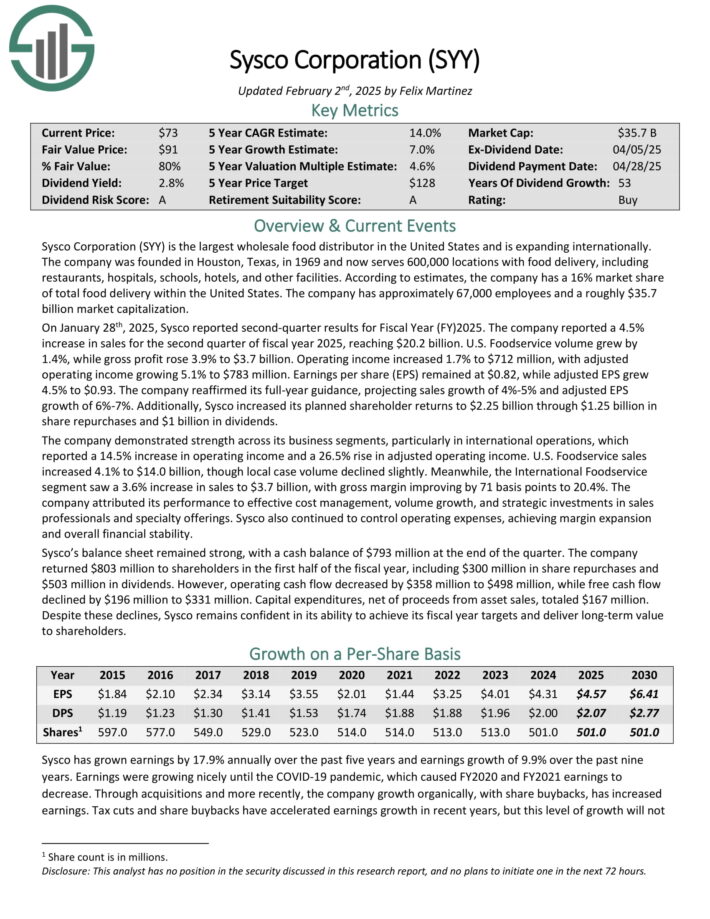

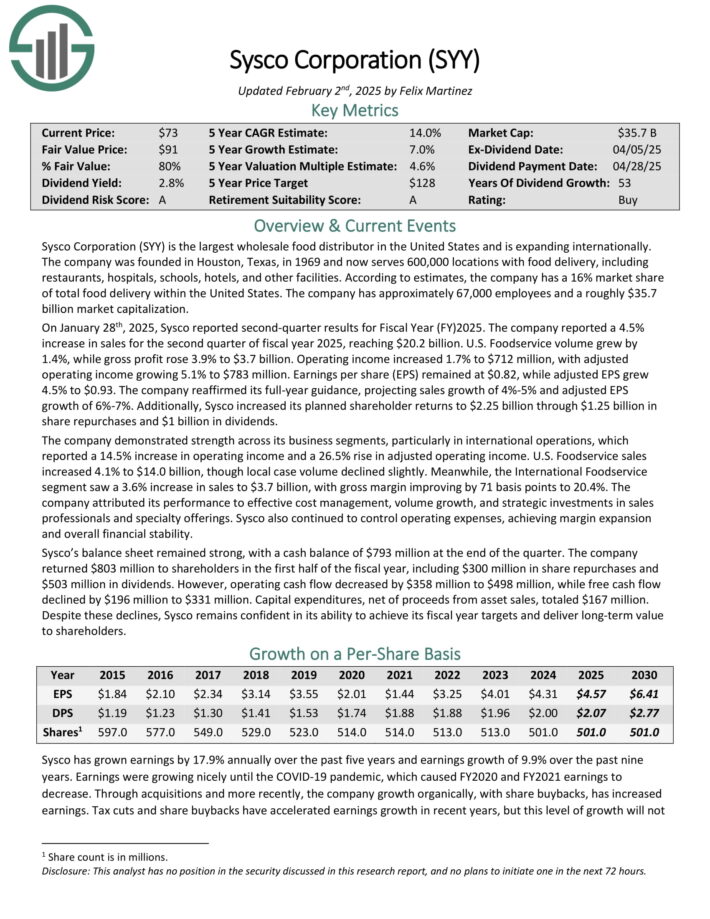

Crushed Down Dividend Stock #9: Sysco Corp. (SYY)

- Anticipated Complete Return: 14.7%

Sysco Firm is a very powerful wholesale meals distributor in america. The company serves 600,000 areas with meals provide, along with consuming locations, hospitals, schools, resorts, and completely different providers.

Provide: Investor Presentation

On January twenty eighth, 2025, Sysco reported second-quarter outcomes for Fiscal 12 months (FY)2025. The company reported a 4.5% improve in product sales for the second quarter of fiscal yr 2025, reaching $20.2 billion.

U.S. Foodservice amount grew by 1.4%, whereas gross income rose 3.9% to $3.7 billion. Working earnings elevated 1.7% to $712 million, with adjusted working earnings rising 5.1% to $783 million. Earnings per share (EPS) remained at $0.82, whereas adjusted EPS grew 4.5% to $0.93.

The company reaffirmed its full-year steering, projecting product sales growth of 4%-5% and adjusted EPS growth of 6%-7%.

Click on on proper right here to acquire our most recent Constructive Analysis report on SYY (preview of internet web page 1 of three confirmed beneath):

Crushed Down Dividend Stock #8: Archer Daniels Midland (ADM)

- Anticipated Complete Return: 14.9%

Archer-Daniels-Midland is a very powerful publicly traded farmland product agency in america. Archer-Daniels-Midland’s firms embody processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal 12 months (FY) 2024 on November 18th, 2024.

The company reported adjusted web earnings of $530 million and adjusted EPS of $1.09, every down from the prior yr as a consequence of a $461 million non-cash value related to its Wilmar equity funding.

Consolidated cash flows year-to-date reached $2.34 billion, reflecting strong operations no matter market challenges.

Click on on proper right here to acquire our most recent Constructive Analysis report on ADM (preview of internet web page 1 of three confirmed beneath):

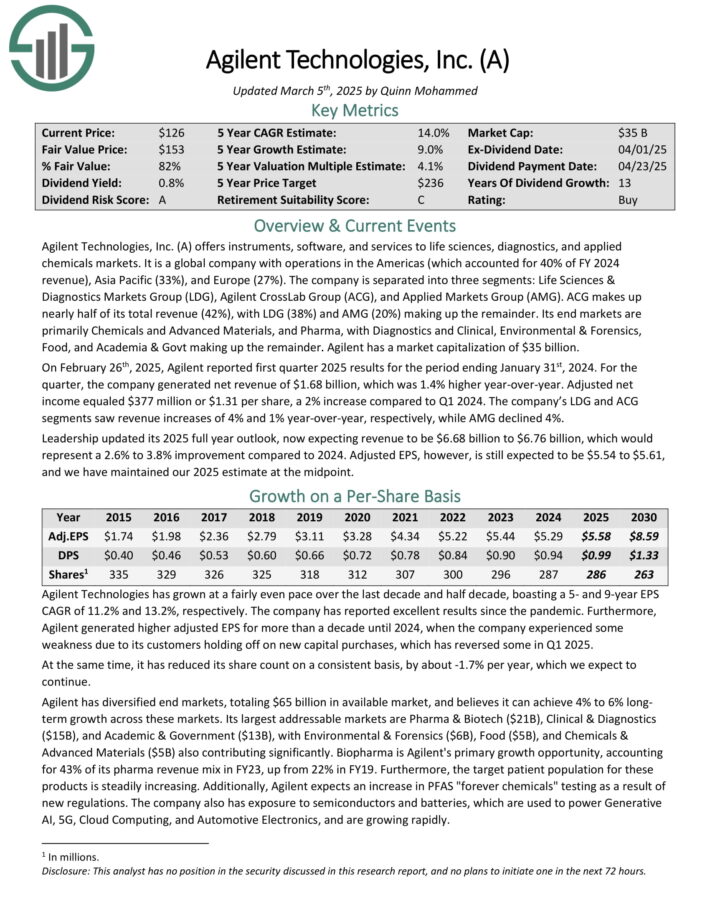

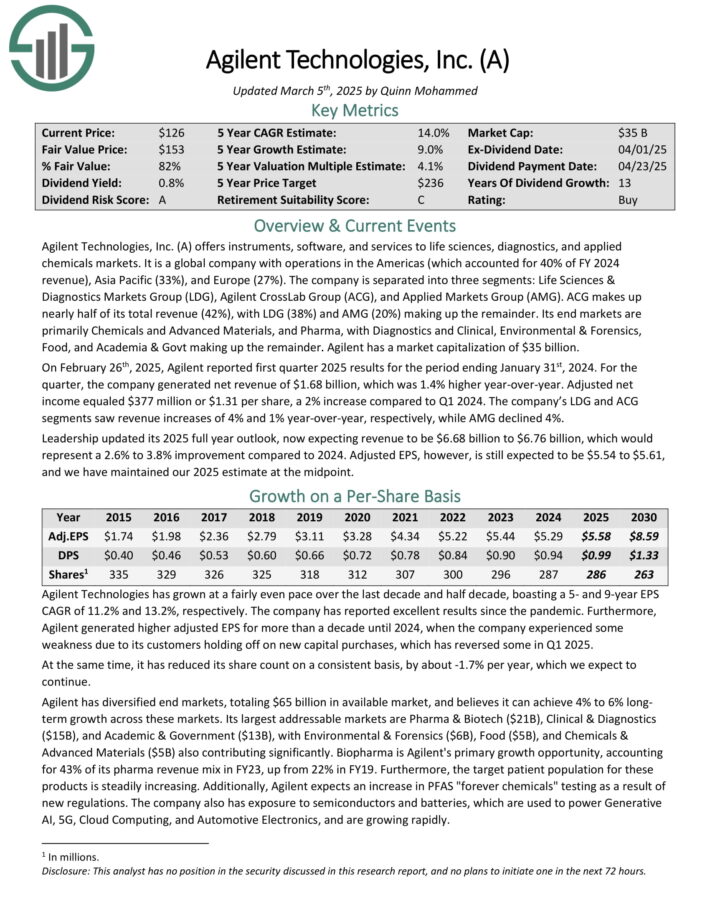

Crushed Down Dividend Stock #7: Agilent Utilized sciences (A)

- Anticipated Complete Return: 14.9%

Agilent Utilized sciences, Inc. (A) supplies gadgets, software program program, and suppliers to life sciences, diagnostics, and utilized chemical substances markets. It’s a world agency with operations inside the Americas (which accounted for 40% of FY 2024 revenue), Asia Pacific (33%), and Europe (27%).

The company is separated into three segments: Life Sciences & Diagnostics Markets Group (LDG), Agilent CrossLab Group (ACG), and Utilized Markets Group (AMG). ACG makes up virtually half of its full revenue (42%), with LDG (38%) and AMG (20%) making up the remaining.

Its end markets are primarily Chemical compounds and Superior Provides, and Pharma, with Diagnostics and Scientific, Environmental & Forensics, Meals, and Academia & Govt making up the remaining. Agilent has a market capitalization of $35 billion.

On February twenty sixth, 2025, Agilent reported first quarter 2025 outcomes for the interval ending January thirty first, 2024. For the quarter, the company generated web revenue of $1.68 billion, which was 1.4% elevated year-over-year.

Adjusted web earnings equaled $377 million or $1.31 per share, a 2% improve compared with Q1 2024. The company’s LDG and ACG segments observed revenue will improve of 4% and 1% year-over-year, respectively, whereas AMG declined 4%.

Click on on proper right here to acquire our most recent Constructive Analysis report on Agilent (preview of internet web page 1 of three confirmed beneath):

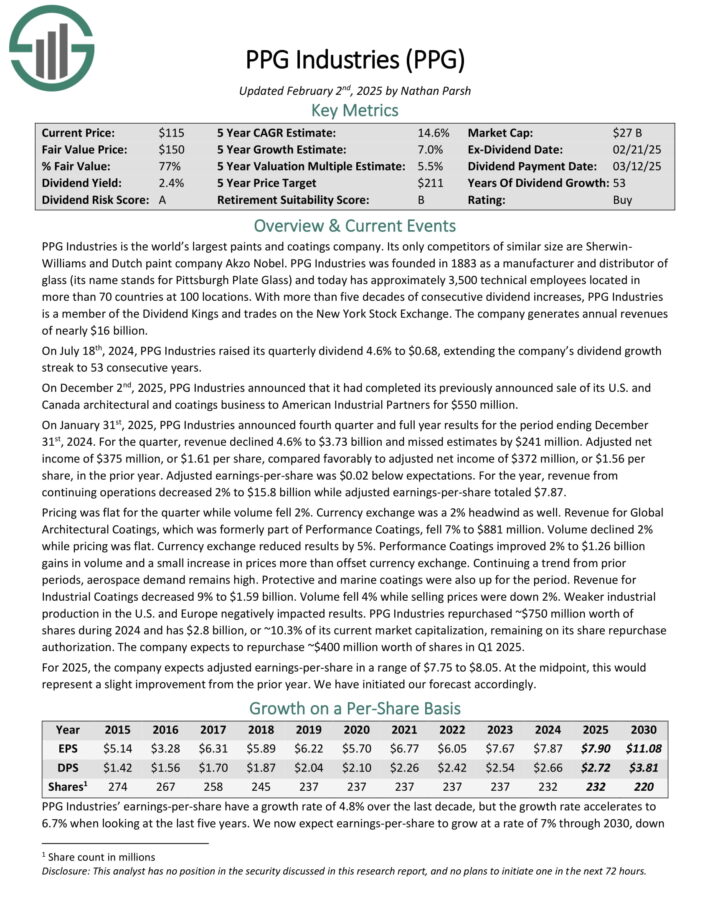

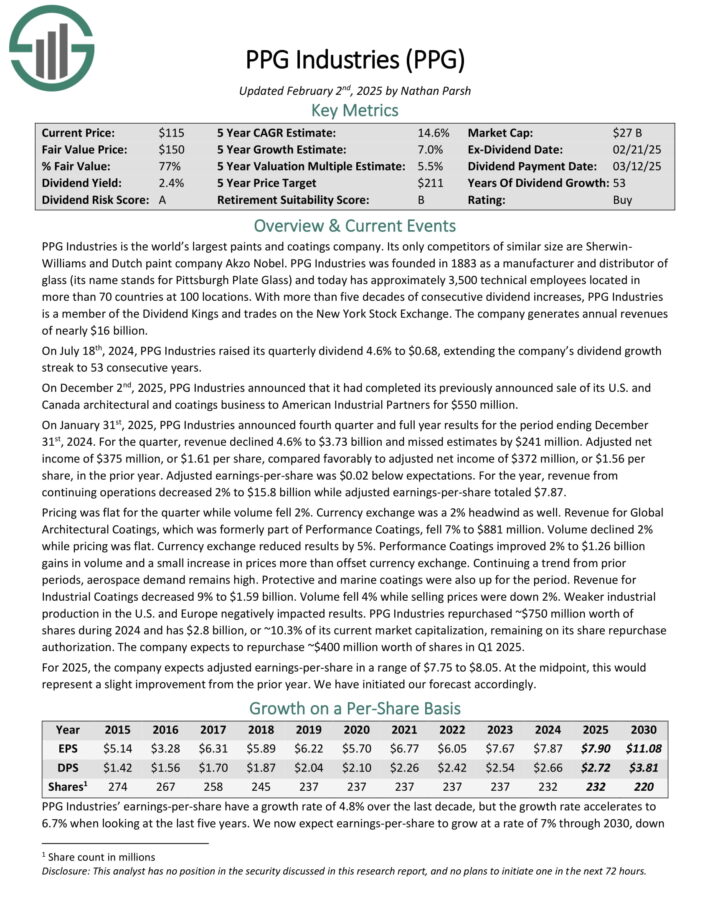

Crushed Down Dividend Stock #6: PPG Industries (PPG)

- Anticipated Complete Return: 15.2%

PPG Industries is the world’s largest paints and coatings agency. Its solely rivals of comparable dimension are Sherwin-Williams and Dutch paint agency Akzo Nobel.

PPG Industries was primarily based in 1883 as a producer and distributor of glass (its title stands for Pittsburgh Plate Glass) and proper now has roughly 3,500 technical employees located in extra than 70 nations at 100 areas.

On January thirty first, 2025, PPG Industries launched fourth quarter and full yr outcomes for the interval ending December thirty first, 2024. For the quarter, revenue declined 4.6% to $3.73 billion and missed estimates by $241 million.

Adjusted web earnings of $375 million, or $1.61 per share, in distinction favorably to adjusted web earnings of $372 million, or $1.56 per share, inside the prior yr. Adjusted earnings-per-share was $0.02 beneath expectations.

For the yr, revenue from persevering with operations decreased 2% to $15.8 billion whereas adjusted earnings-per-share totaled $7.87.

PPG Industries repurchased ~$750 million worth of shares all through 2024 and has $2.8 billion, or ~10.3% of its current market capitalization, remaining on its share repurchase authorization. The company expects to repurchase ~$400 million worth of shares in Q1 2025.

For 2025, the company expects adjusted earnings-per-share in a selection of $7.75 to $8.05.

Click on on proper right here to acquire our most recent Constructive Analysis report on PPG (preview of internet web page 1 of three confirmed beneath):

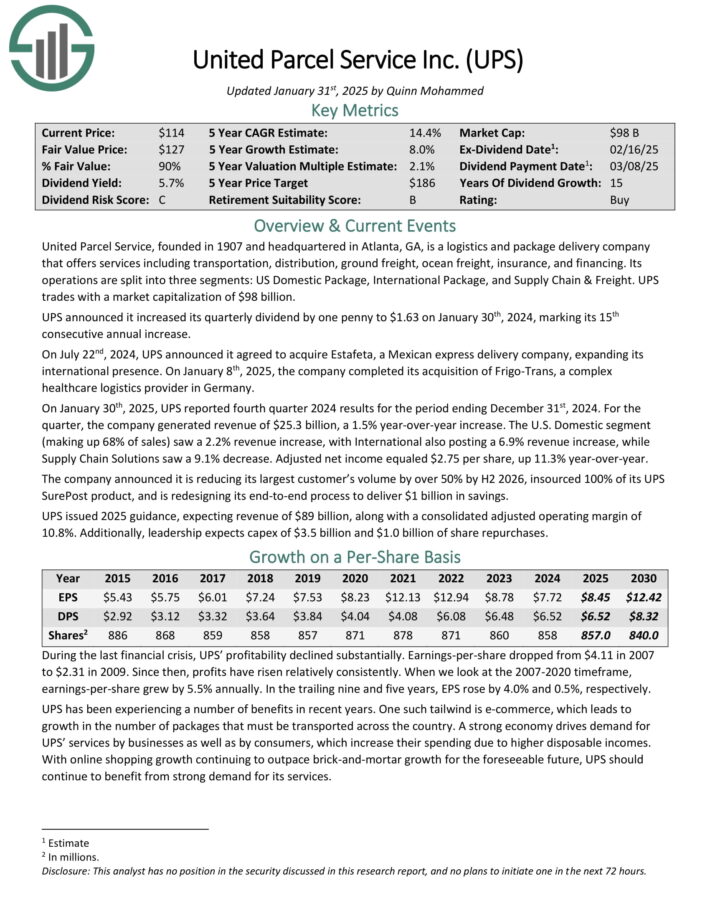

Crushed Down Dividend Stock #5: United Parcel Service (UPS)

- Anticipated Complete Return: 15.3%

United Parcel Service is a logistics and bundle provide agency that provides suppliers along with transportation, distribution, flooring freight, ocean freight, insurance coverage protection, and financing.

Its operations are minimize up into three segments: US Residence Bundle, Worldwide Bundle, and Present Chain & Freight.

On January thirtieth, 2025, UPS reported fourth quarter 2024 outcomes for the interval ending December thirty first, 2024. For the quarter, the company generated revenue of $25.3 billion, a 1.5% year-over-year improve.

Provide: Investor Presentation

The U.S. Residence part (making up 68% of product sales) observed a 2.2% revenue improve, with Worldwide moreover posting a 6.9% revenue improve, whereas Present Chain Choices observed a 9.1% decrease. Adjusted web earnings equaled $2.75 per share, up 11.3% year-over-year.

The company launched it’s reducing its largest purchaser’s amount by over 50% by H2 2026, insourced 100% of its UPS SurePost product, and is redesigning its end-to-end course of to ship $1 billion in monetary financial savings.

Click on on proper right here to acquire our most recent Constructive Analysis report on UPS (preview of internet web page 1 of three confirmed beneath):

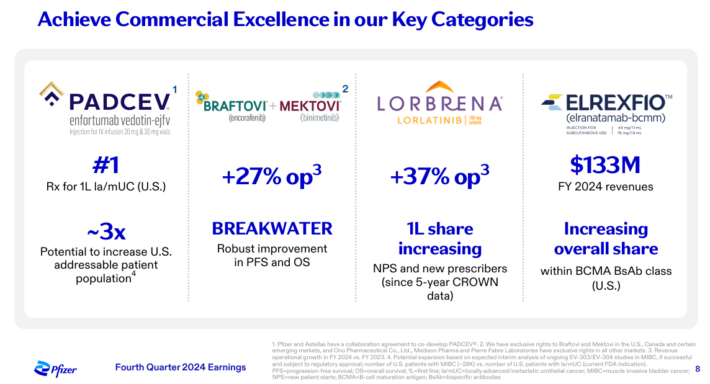

Crushed Down Dividend Stock #4: Pfizer Inc. (PFE)

- Anticipated Complete Return: 15.9%

Pfizer Inc. is a world pharmaceutical agency specializing in prescription drugs and vaccines. Pfizer usual the GSK Shopper Healthcare Joint Enterprise in 2019 with GlaxoSmithKline plc, which contains its over-the-counter enterprise.

Pfizer owns 32% of the JV, nonetheless is exiting the company, now usually known as Haleon. Pfizer spun off its Upjohn part and merged it with Mylan forming Viatris for its off patent, branded and generic medicines in 2020.

Pfizer’s prime merchandise are Eliquis, Ibrance, Prevnar family, Vyndaqel family, Abrysvo, Xeljanz, and Comirnaty.

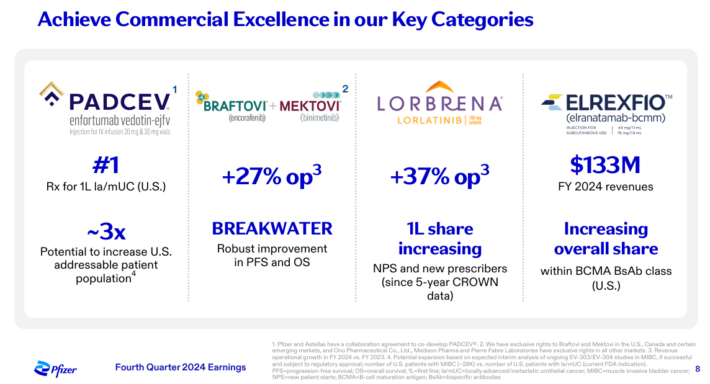

Provide: Investor Presentation

Pfizer’s current product line is predicted to supply prime line and bottom-line growth as a consequence of important R&D and acquisitions.

Pfizer reported steady This fall 2024 outcomes on February 4th, 2025. Agency-wide revenue grew 21% operationally and adjusted diluted earnings per share climbed to $0.63 versus $0.10 on a year-over-year basis as a consequence of stabilizing COVID-19 related product sales, rising revenue from the current portfolio, and reduce payments.

World Biopharmaceuticals product sales gained 22% to $17,413M from $14,186M led by helpful properties in Primary Care (+27%), Specialty Care (+12%), and Oncology (+27%). Pfizer Centerone observed 11% lower product sales to $325M, whereas Ignite revenue was $26M.

Of the best selling drugs, product sales elevated for Eliquis (+14%), Prevnar (-4%), Plaxlovid (flat), Cominraty (-37%), Vyndaqel/ Vyndamax (+61%), Ibrance (-2%), and Xtandi (+24).

Click on on proper right here to acquire our most recent Constructive Analysis report on PFE (preview of internet web page 1 of three confirmed beneath):

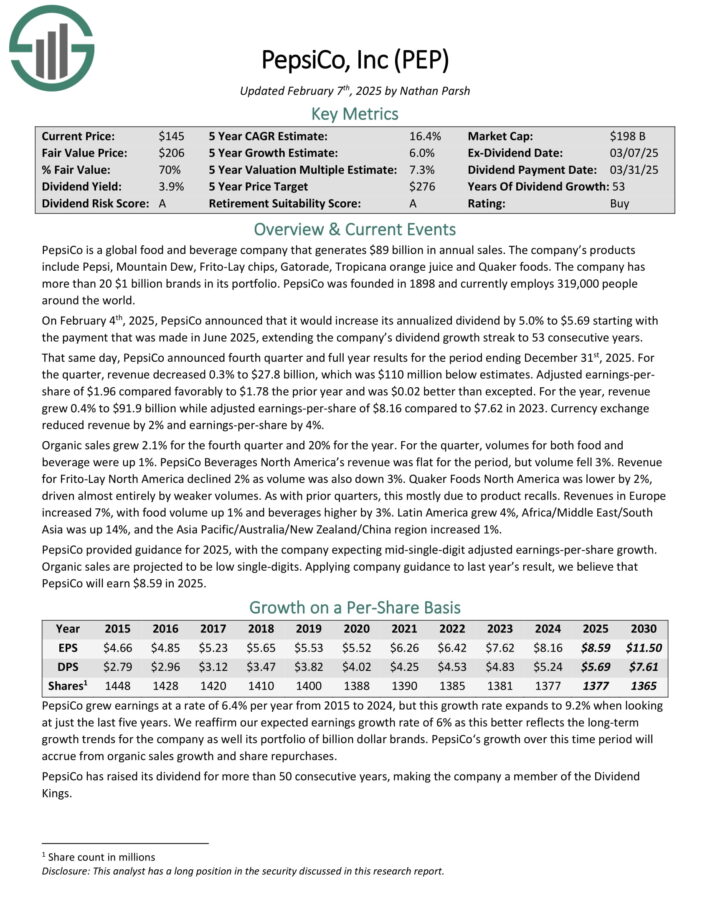

Crushed Down Dividend Stock #3: PepsiCo Inc. (PEP)

- Anticipated Complete Return: 16.3%

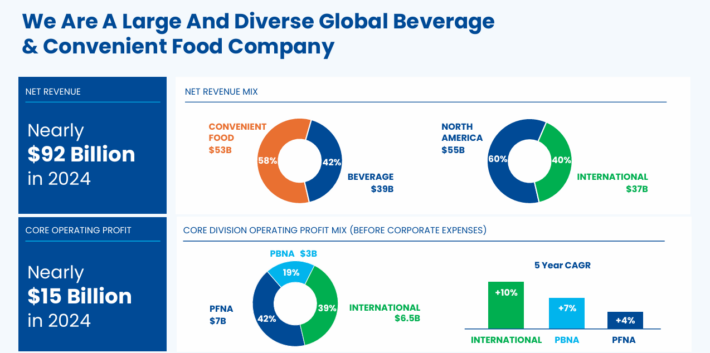

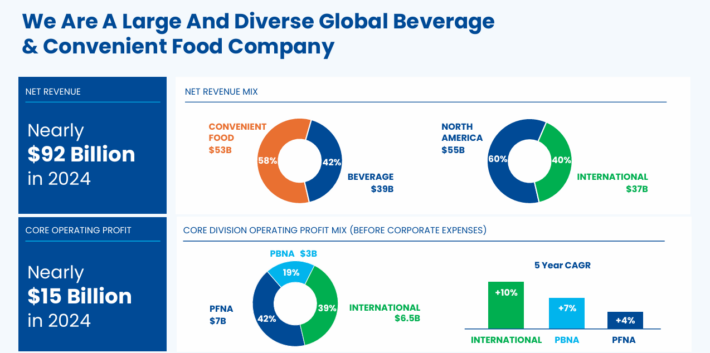

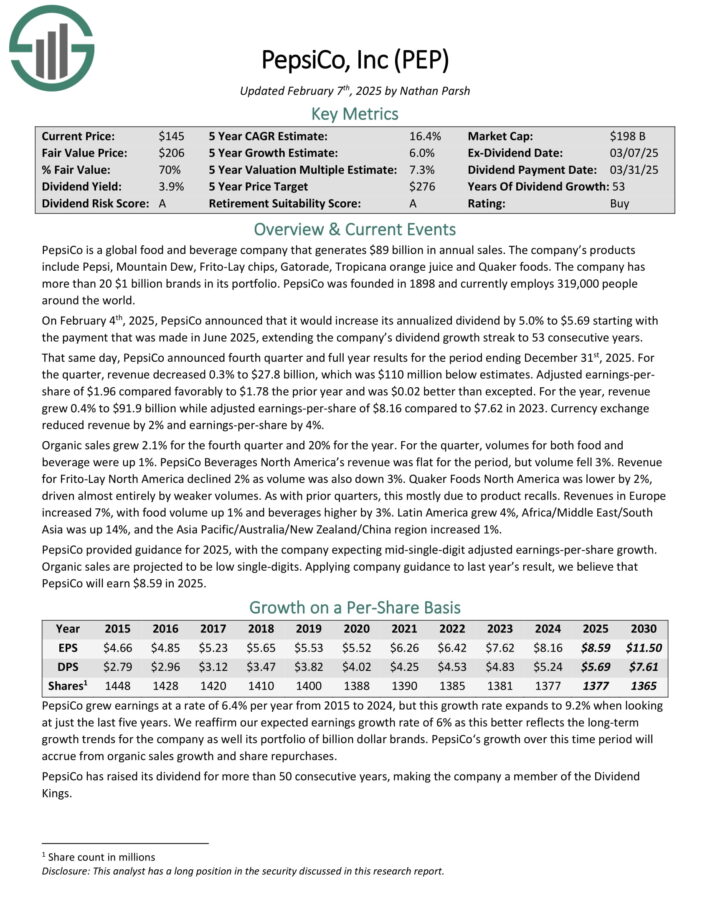

PepsiCo is a world meals and beverage agency. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is minimize up roughly 60-40 by means of meals and beverage revenue. Moreover it’s balanced geographically between the U.S. and the rest of the world.

Provide: Investor Presentation

On February 4th, 2025, PepsiCo launched that it’ll improve its annualized dividend by 5.0% to $5.69 starting with the price that was made in June 2025, extending the company’s dividend growth streak to 53 consecutive years.

That exact same day, PepsiCo launched fourth quarter and full yr outcomes for the interval ending December thirty first, 2025. For the quarter, revenue decreased 0.3% to $27.8 billion, which was $110 million beneath estimates.

Adjusted earnings-per-share of $1.96 in distinction favorably to $1.78 the prior yr and was $0.02 larger than excepted.

For the yr, revenue grew 0.4% to $91.9 billion whereas adjusted earnings-per-share of $8.16 compared with $7.62 in 2023. Foreign exchange commerce decreased revenue by 2% and earnings-per-share by 4%.

Click on on proper right here to acquire our most recent Constructive Analysis report on PEP (preview of internet web page 1 of three confirmed beneath):

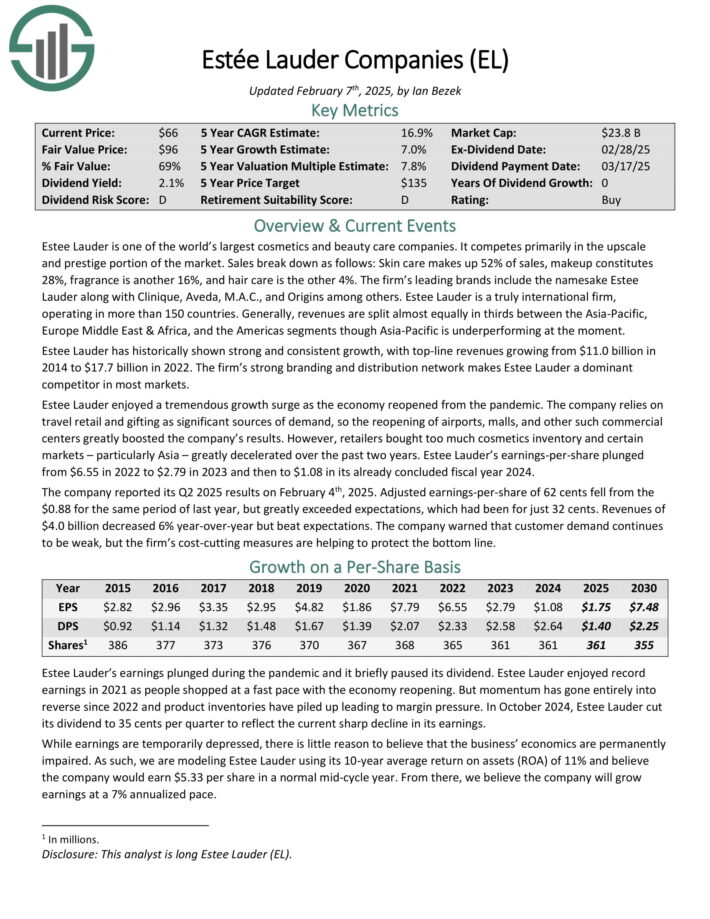

Crushed Down Dividend Stock #2: Estee Lauder Cos. (EL)

- Anticipated Complete Return: 16.9%

Estee Lauder is no doubt one of many world’s largest cosmetics and sweetness care corporations. It competes primarily inside the upscale and standing portion of the market. Product sales break down as follows: Skincare makes up 52% of product sales, make-up constitutes 28%, fragrance is one different 16%, and hair care is the other 4%.

Primary producers embody the namesake Estee Lauder along with Clinique, Aveda, M.A.C., and Origins amongst others. Estee Lauder is a extremely worldwide company, working in extra than 150 nations.

Often, revenues are minimize up just about equally in thirds between the Asia-Pacific, Europe Heart East & Africa, and the Americas segments though Asia-Pacific is underperforming for the time being.

Estee Lauder has historically confirmed strong and fixed growth, with top-line revenues rising from $11.0 billion in 2014 to $17.7 billion in 2022. The company’s strong branding and distribution group makes Estee Lauder a dominant competitor in most markets.

The company reported its Q2 2025 outcomes on February 4th, 2025. Adjusted earnings-per-share of 62 cents fell from the $0.88 for the same interval of ultimate yr, nonetheless enormously exceeded expectations of merely 32 cents. Revenues of $4.0 billion decreased 6% year-over-year nonetheless beat expectations.

Click on on proper right here to acquire our most recent Constructive Analysis report on EL (preview of internet web page 1 of three confirmed beneath):

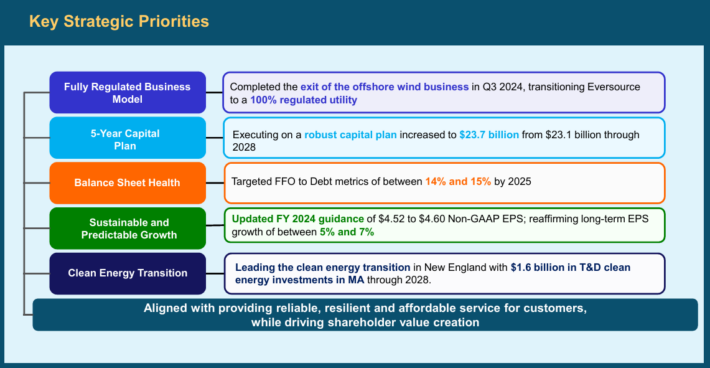

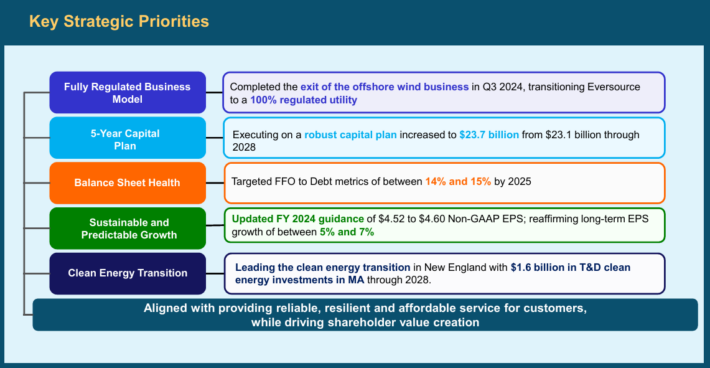

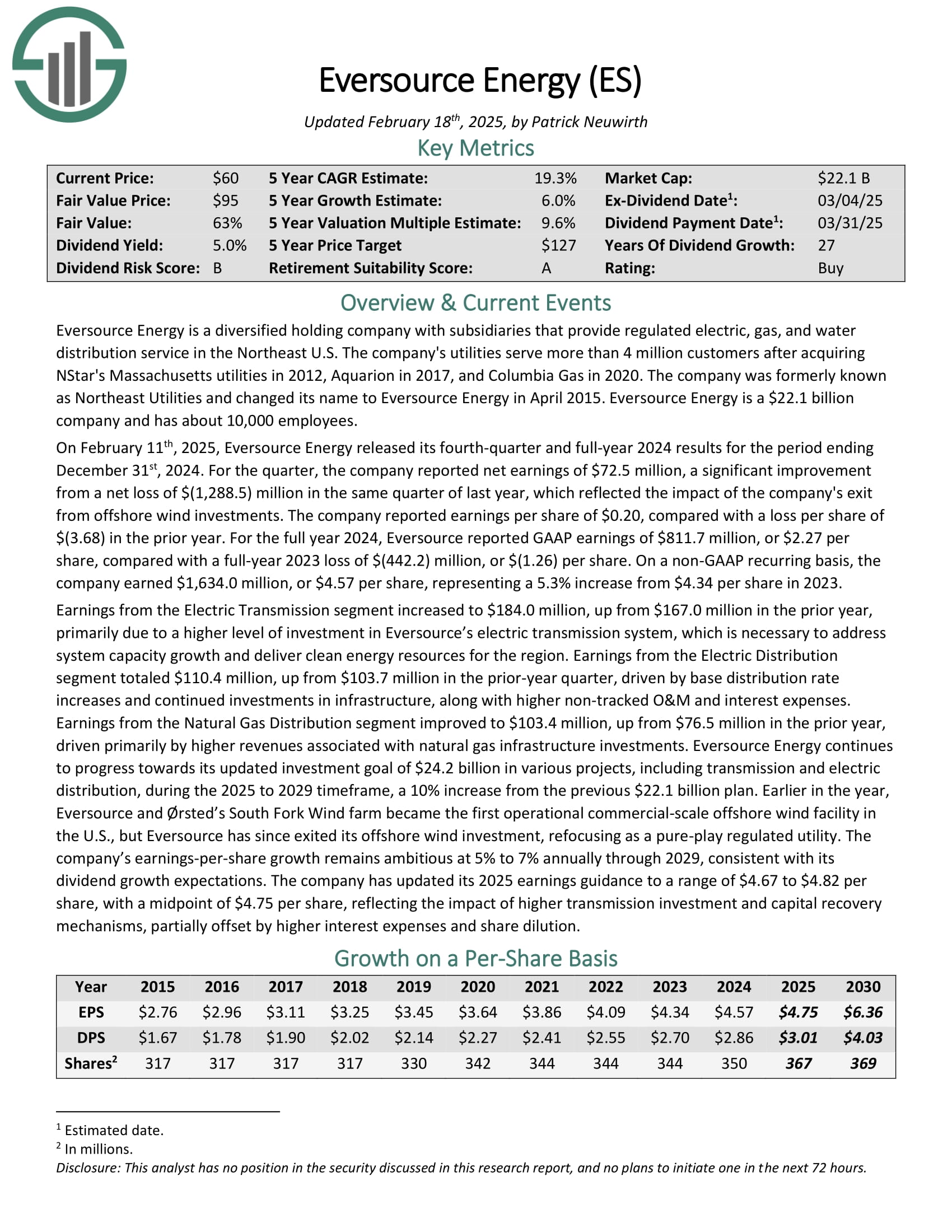

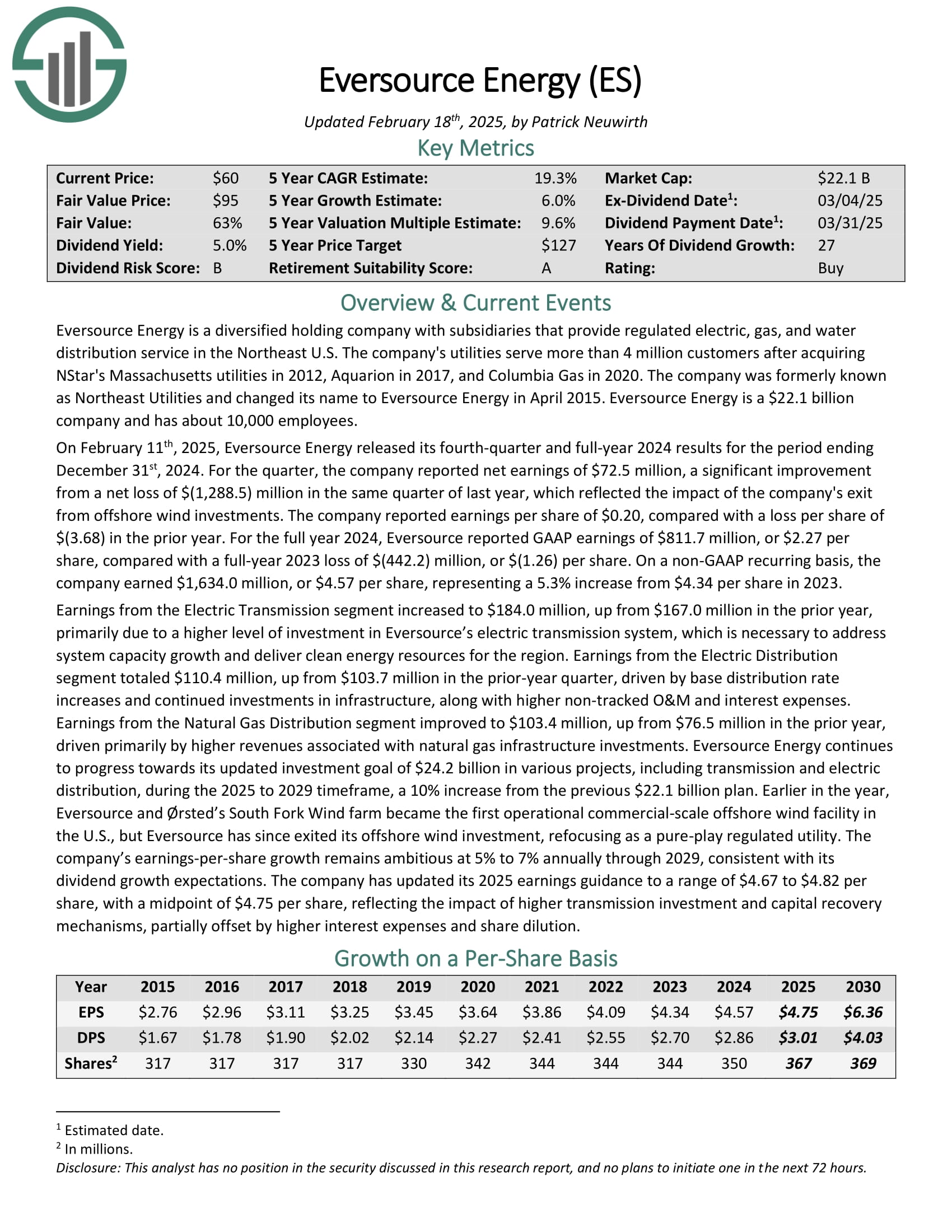

Crushed Down Dividend Stock #1: Eversource Energy (ES)

- Anticipated Complete Return: 19.7%

Eversource Energy is a diversified holding agency with subsidiaries that current regulated electrical, gasoline, and water distribution service inside the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Energy are the three new Dividend Aristocrats for 2025.

The company’s utilities serve higher than 4 million purchasers after shopping for NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has delivered common growth to shareholders for a couple of years.

Provide: Investor Presentation

On February eleventh, 2025, Eversource Energy launched its fourth-quarter and full-year 2024 outcomes. For the quarter, the company reported web earnings of $72.5 million, a significant enchancment from a web lack of $(1,288.5) million within the equivalent quarter of ultimate yr, which mirrored the affect of the company’s exit from offshore wind investments.

The company reported earnings per share of $0.20, in distinction with a loss per share of $(3.68) inside the prior yr. For the whole yr 2024, Eversource reported GAAP earnings of $811.7 million, or $2.27 per share, in distinction with a full-year 2023 lack of $(442.2) million, or $(1.26) per share.

On a non-GAAP recurring basis, the company earned $1,634.0 million, or $4.57 per share, representing a 5.3% improve from 2023.

Click on on proper right here to acquire our most recent Constructive Analysis report on ES (preview of internet web page 1 of three confirmed beneath):

Totally different Blue Chip Stock Sources

The belongings beneath will give you a higher understanding of dividend growth investing:

Thanks for learning this textual content. Please ship any options, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@sort":"Individual","title":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/11/Blue-Chip-Shares-e1667696058583.png","width":0,"peak":0},"writer":{"@sort":"Group","title":"","url":"https://indexinvestingnews.com","emblem":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link