Printed on October 14th, 2025 by Bob Ciura

Dividend shares are naturally fascinating for earnings merchants, nonetheless not all dividend shares are buys.

Earnings merchants often have to avoid dividend cuts each time potential. Not solely does a dividend reduce finish in an absence of earnings, nonetheless a company’s share value often declines after asserting a dividend low cost or suspension.

With this in ideas, we compiled a listing of extreme dividend shares with dividend yields above 5%. You might acquire your free copy of the extreme dividend shares file by clicking on the hyperlink beneath:

Earnings merchants ought to aim to avoid dividend cuts or elimination as so much as potential.

The ten shares on this text all have Dividend Risk Scores of ‘D’ or ‘F’ (our lowest grades) throughout the Constructive Analysis Evaluation Database, with payout ratios above 100%.

A payout ratio above 100% signifies the company isn’t producing ample underlying earnings to take care of the dividend payout. This leaves a extreme chance of a dividend reduce or elimination in the end in the end.

Due to this, these 10 harmful extreme dividend shares have promote scores from Constructive Dividend.

The file is sorted by current yield, from lowest to highest.

Desk of Contents

You might instantly soar to any explicit a part of the article by means of using the hyperlinks beneath:

Harmful Extreme Dividend Stock #10: Cross Timbers Royalty Perception (CRT)

Cross Timbers Royalty Perception is an oil and gas perception (about 50/50), organize in 1991 by XTO Vitality.

Its unitholders have a 90% net income curiosity in producing properties in Texas, Oklahoma, and New Mexico; and a 75% net income curiosity in working curiosity properties in Texas and Oklahoma.

In mid-Might, CRT reported (5/14/25) outcomes for the first quarter of fiscal 2025. Oil and gas volumes grew 4% and 19%, respectively, over the prior yr’s quarter.

The everyday realized prices of oil and gas dipped -6% and -10%, respectively, nonetheless distributable cash flow into (DCF) per unit grew 12% attributable to elevated volumes.

Click on on proper right here to acquire our latest Constructive Analysis report on Cross Timbers Royalty Perception (CRT) (preview of net web page 1 of three confirmed beneath):

Harmful Extreme Dividend Stock #9: Timbercreek Financial Corp. (TBCRF)

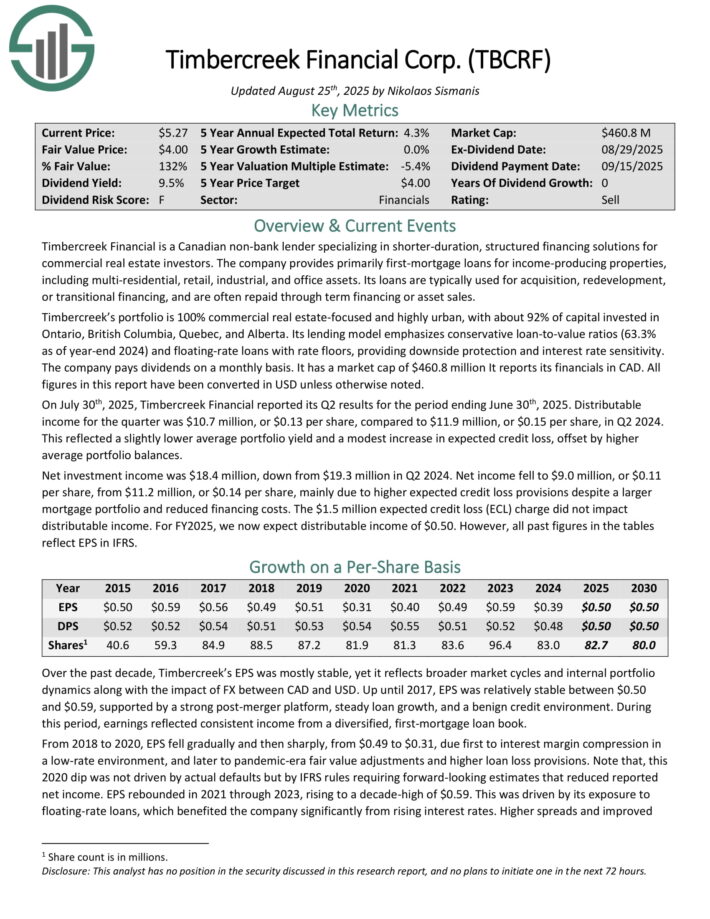

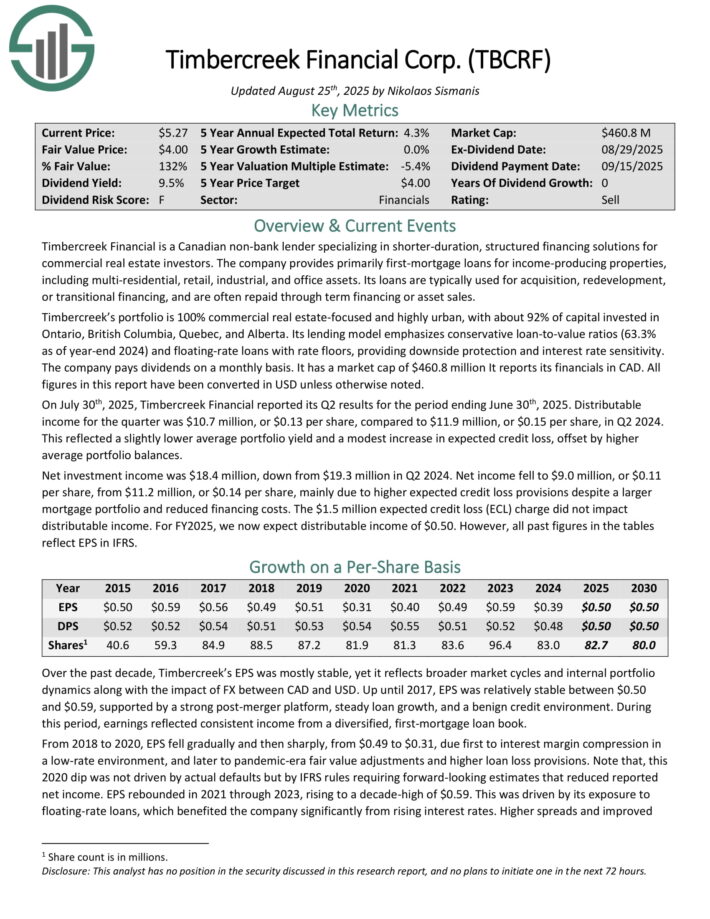

Timbercreek Financial is a Canadian non-bank lender specializing in shorter-duration, structured financing choices for industrial precise property merchants.

The company affords primarily first-mortgage loans for income-producing properties, along with multi-residential, retail, industrial, and office property. Its loans are often used for acquisition, redevelopment, or transitional financing, and are typically repaid by the use of time interval financing or asset product sales.

Timbercreek’s portfolio is 100% industrial precise estate-focused and very metropolis, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta.

On July thirtieth, 2025, Timbercreek Financial reported its Q2 outcomes. Distributable earnings for the quarter was $10.7 million, or $0.13 per share, as compared with $11.9 million, or $0.15 per share, in Q2 2024.

This mirrored a barely lower frequent portfolio yield and a modest improve in anticipated credit score rating loss, offset by elevated frequent portfolio balances.

Net funding earnings was $18.4 million, down from $19.3 million in Q2 2024. Net earnings fell to $9.0 million, or $0.11 per share, from $11.2 million, or $0.14 per share, primarily on account of elevated anticipated credit score rating loss provisions no matter a much bigger mortgage portfolio and diminished financing costs.

Click on on proper right here to acquire our latest Constructive Analysis report on TBCRF (preview of net web page 1 of three confirmed beneath):

Harmful Extreme Dividend Stock #8: PermRock Royalty Perception (PRT)

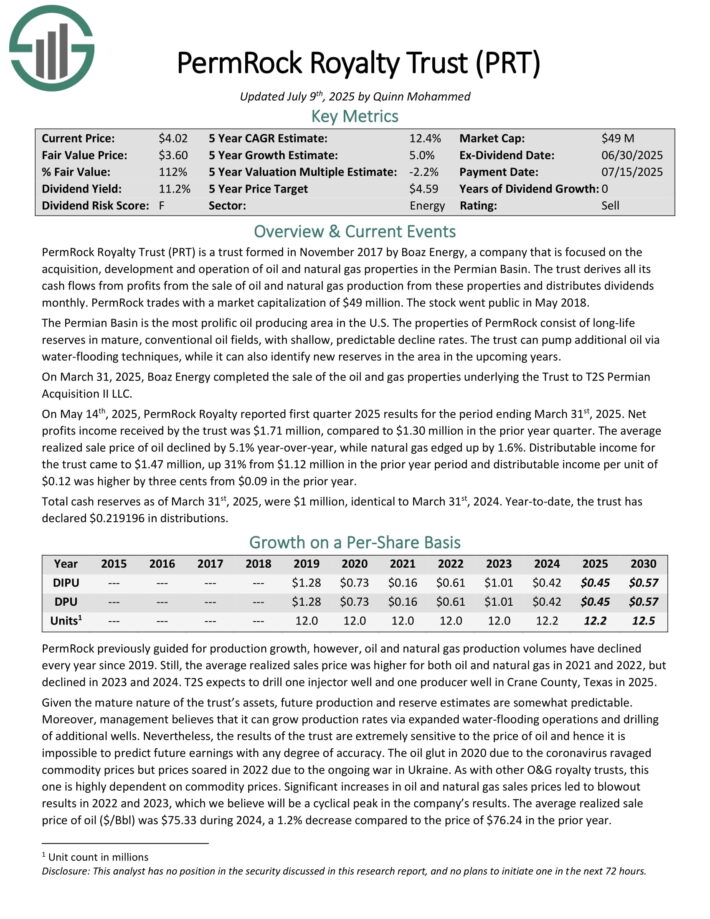

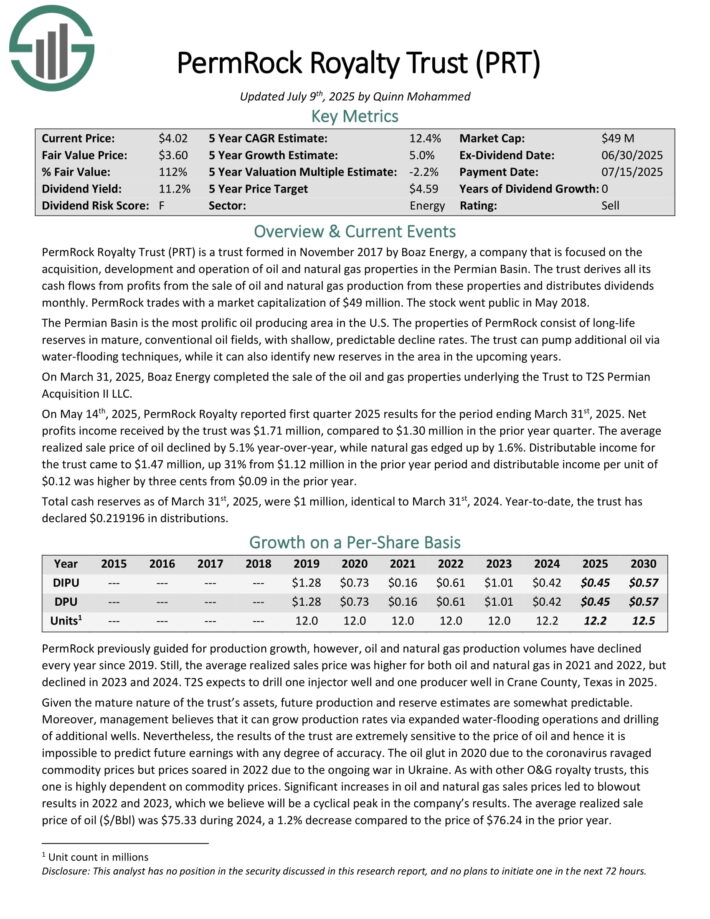

PermRock Royalty Perception is a perception original in late 2017 by Boaz Vitality, a company that’s focused on the acquisition, progress and operation of oil and pure gas properties throughout the Permian Basin. The Perception benefits from the distinctive traits of the Permian Basin, which is basically probably the most prolific oil-producing house throughout the U.S.

On Might 14th, 2025, PermRock Royalty reported first quarter 2025 outcomes for the interval ending March thirty first, 2025. Net earnings earnings acquired by the idea was $1.71 million, as compared with $1.30 million throughout the prior yr quarter. The everyday realized sale value of oil declined by 5.1% year-over-year, whereas pure gas edged up by 1.6%.

Distributable earnings for the idea bought right here to $1.47 million, up 31% from $1.12 million throughout the prior yr interval and distributable earnings per unit of $0.12 was elevated by three cents from $0.09 throughout the prior yr.

Click on on proper right here to acquire our latest Constructive Analysis report on PermRock Royalty Perception (PRT) (preview of net web page 1 of three confirmed beneath):

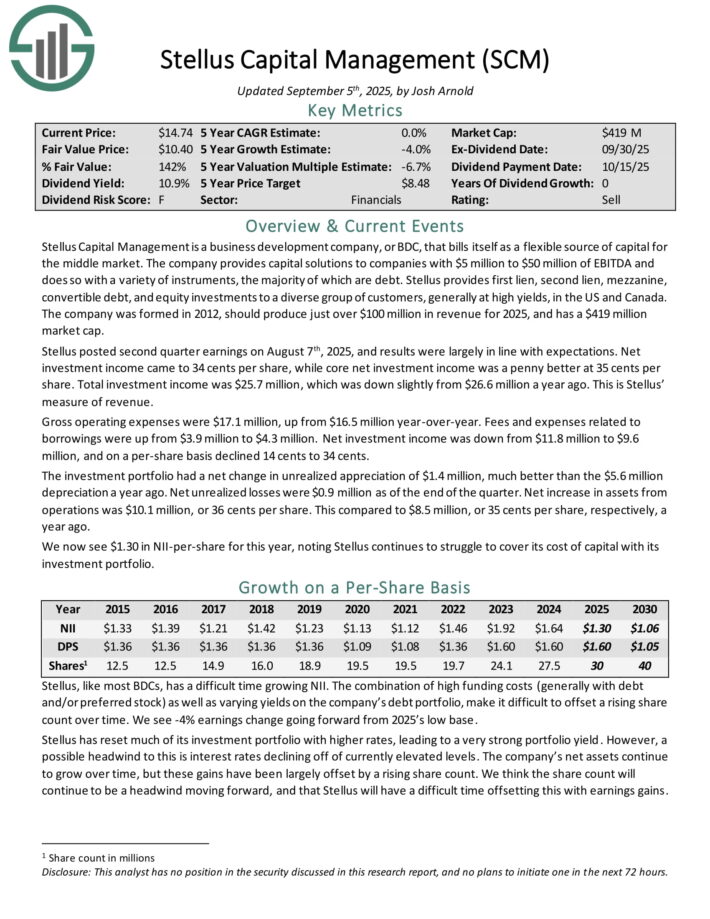

Harmful Extreme Dividend Stock #7: Stellus Capital (SCM)

Stellus Capital Administration affords capital choices to corporations with $5 million to $50 million of EBITDA and does so with various units, the overwhelming majority of which can be debt.

Stellus affords first lien, second lien, mezzanine, convertible debt, and equity investments to a numerous group of customers, often at extreme yields, throughout the US and Canada.

Stellus posted second quarter earnings on August seventh, 2025, and outcomes have been largely consistent with expectations. Net funding earnings bought right here to 34 cents per share, whereas core net funding earnings was a penny larger at 35 cents per share.

Full funding earnings was $25.7 million, which was down barely from $26.6 million a yr prior to now. That’s Stellus’ measure of earnings.

Gross working payments have been $17.1 million, up from $16.5 million year-over-year. Prices and payments related to borrowings have been up from $3.9 million to $4.3 million. Net funding earnings was down from $11.8 million to $9.6 million, and on a per-share basis declined 14 cents to 34 cents.

The funding portfolio had an internet change in unrealized appreciation of $1.4 million, so much higher than the $5.6 million depreciation a yr prior to now.

Click on on proper right here to acquire our latest Constructive Analysis report on SCM (preview of net web page 1 of three confirmed beneath):

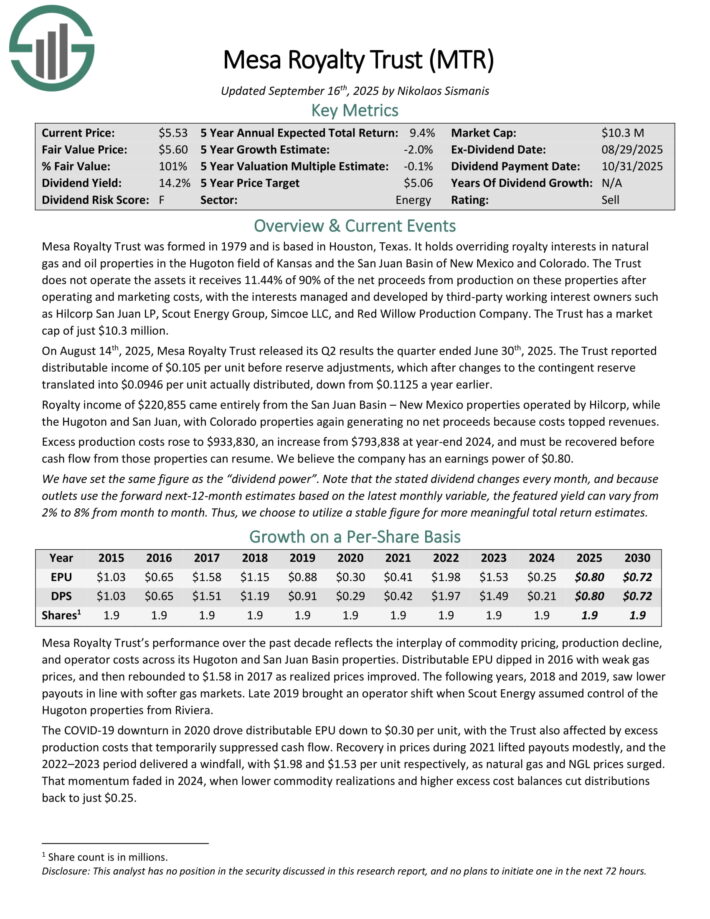

Harmful Extreme Dividend Stock #6: Mesa Royalty Perception (MTR)

Mesa Royalty Perception was original in 1979 and depends in Houston, Texas. It holds overriding royalty pursuits in pure gas and oil properties throughout the Hugoton self-discipline of Kansas and the San Juan Basin of New Mexico and Colorado.

The Perception doesn’t operate the property it receives 11.44% of 90% of the net proceeds from manufacturing on these properties after working and promoting costs, with the pursuits managed and developed by third-party working curiosity householders resembling Hilcorp San Juan LP, Scout Vitality Group, Simcoe LLC, and Pink Willow Manufacturing Agency.

On August 14th, 2025, Mesa Royalty Perception launched its Q2 outcomes the quarter ended June thirtieth, 2025. The Perception reported distributable earnings of $0.105 per unit sooner than reserve adjustments, which after modifications to the contingent reserve translated into $0.0946 per unit really distributed, down from $0.1125 a yr earlier.

Royalty earnings of $220,855 bought right here completely from the San Juan Basin – New Mexico properties operated by Hilcorp, whereas the Hugoton and San Juan, with Colorado properties as soon as extra producing no net proceeds on account of costs topped revenues.

Further manufacturing costs rose to $933,830, an increase from $793,838 at year-end 2024, and needs to be recovered sooner than cash flow into from these properties can resume. We think about the company has an earnings power of $0.80.

Click on on proper right here to acquire our latest Constructive Analysis report on MTR (preview of net web page 1 of three confirmed beneath):

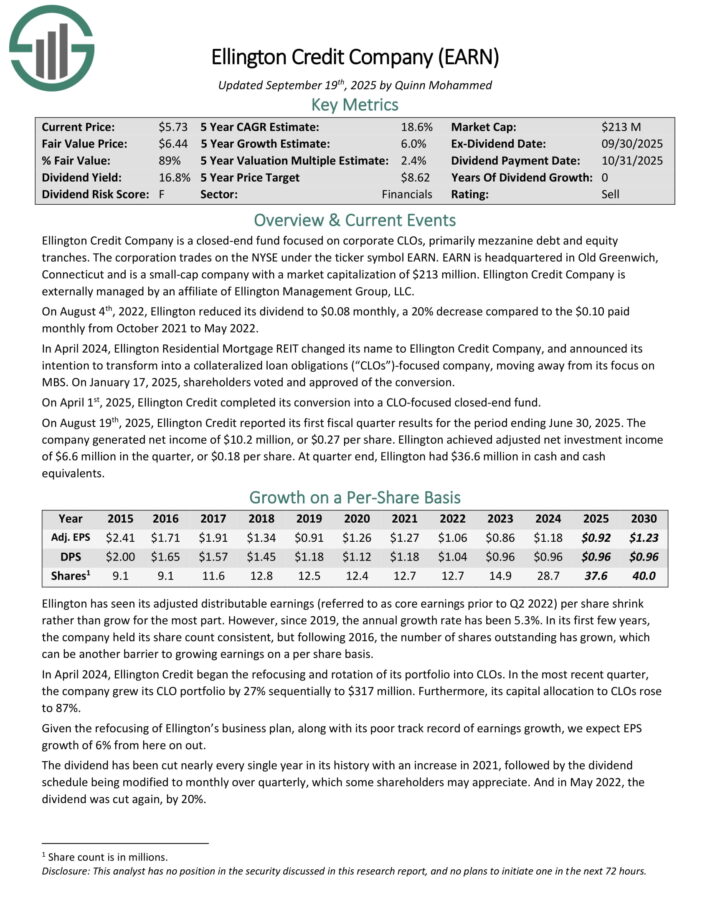

Harmful Extreme Dividend Stock #5: Ellington Credit score rating Co. (EARN)

Ellington Credit score rating Co. acquires, invests in, and manages residential mortgage and precise property related property. Ellington focuses completely on residential mortgage-backed securities, significantly these backed by a U.S. Authorities firm or U.S. authorities–sponsored enterprise.

Firm MBS are created and backed by authorities corporations or enterprises, whereas non-agency MBS are not assured by the federal authorities.

On August nineteenth, 2025, Ellington Credit score rating reported its first fiscal quarter outcomes for the interval ending June 30, 2025. The company generated net earnings of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net funding earnings of $6.6 million throughout the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click on on proper right here to acquire our latest Constructive Analysis report on EARN (preview of net web page 1 of three confirmed beneath):

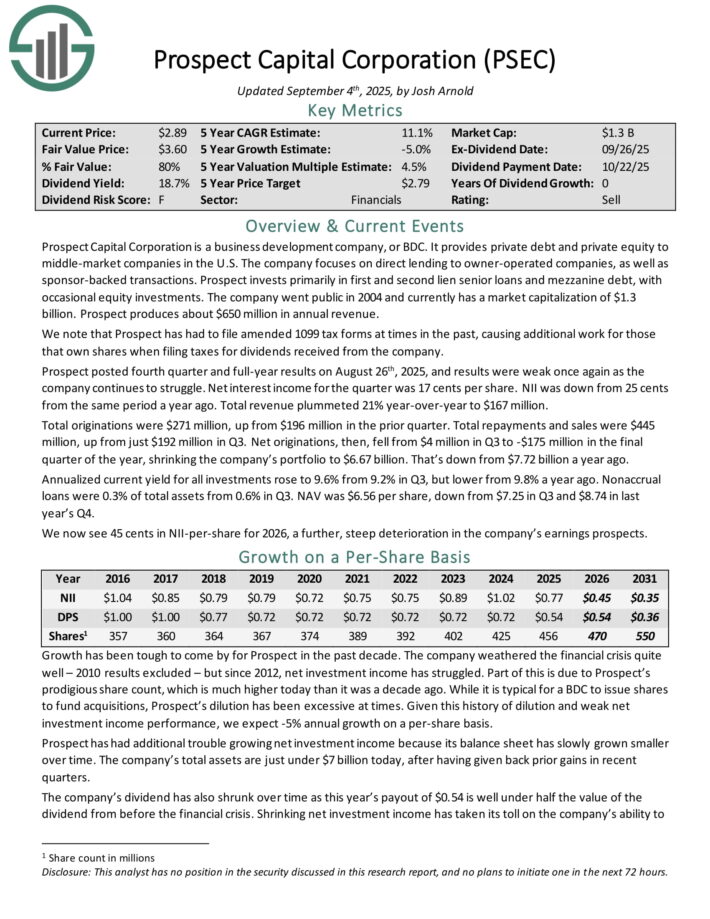

Harmful Extreme Dividend Stock #4: Prospect Capital (PSEC)

Prospect Capital Firm is a Enterprise Enchancment Agency, or BDC, that offers personal debt and private equity to middle–market corporations throughout the U.S.

The company focuses on direct lending to proprietor–operated corporations, along with sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted fourth quarter and full-year outcomes on August twenty sixth, 2025, and outcomes have been weak as quickly as as soon as extra as the company continues to wrestle. Net curiosity earnings for the quarter was 17 cents per share. NII was down from 25 cents from the equivalent interval a yr prior to now. Full earnings plummeted 21% year-over-year to $167 million.

Full originations have been $271 million, up from $196 million throughout the prior quarter. Full repayments and product sales have been $445 million, up from merely $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million throughout the remaining quarter of the yr, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a yr prior to now.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, nonetheless lower from 9.8% a yr prior to now.

Click on on proper right here to acquire our latest Constructive Analysis report on PSEC (preview of net web page 1 of three confirmed beneath):

Overly Harmful Extreme Dividend Stock #3: Orchid Island Capital (ORC)

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), along with pass-through and structured firm RMBSs.

These financial units generate cash flow into based mostly totally on residential loans resembling mortgages, subprime, and home-equity loans.

On July 24, 2025, Orchid Island Capital, Inc. reported its financial outcomes for the second quarter of 2025. The company recorded an internet lack of $33.6 million, or $0.29 per frequent share, pushed by net curiosity earnings of $23.2 million, full payments of $5.0 million, and net realized and unrealized losses of $51.7 million on RMBS and derivatives.

Dividends declared and paid have been $0.36 per frequent share, with e-book value per share at $7.21 by June 30, 2025, reflecting a whole return of (4.66)%.

Liquidity remained sturdy at $492.5 million, comprising cash and unpledged securities, representing 54% of stockholders’ equity, with borrowing functionality exceeding $6.7 billion all through 24 lenders.

Click on on proper right here to acquire our latest Constructive Analysis report on Orchid Island Capital, Inc. (ORC) (preview of net web page 1 of three confirmed beneath):

Harmful Extreme Dividend Stock #2: Horizon Experience Finance (HRZN)

Horizon Experience Finance Corp. is a BDC that offers enterprise capital to small and medium–sized corporations throughout the experience, life sciences, and healthcare–IT sectors.

The company has generated participating hazard–adjusted returns by the use of straight originated senior secured loans and additional capital appreciation by the use of warrants.

On August seventh, 2025, Horizon launched its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, full funding earnings fell 4.5% year-over-year to $24.5 million, primarily on account of lower curiosity earnings on investments from the debt funding portfolio.

Further significantly, the company’s dollar-weighted annualized yield on frequent debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Net funding earnings per share (IIS) fell to $0.28, down from $0.36 as compared with Q2-2024. Net asset value (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its month-to-month distributions, Horizon’s undistributed spillover earnings as of the highest of the quarter was $0.94 per share, indicating a considerable cash cushion. Administration assured merchants of the dividend’s stability by declaring three forward month-to-month dividends at a worth of $0.11.

Click on on proper right here to acquire our latest Constructive Analysis report on HRZN (preview of net web page 1 of three confirmed beneath):

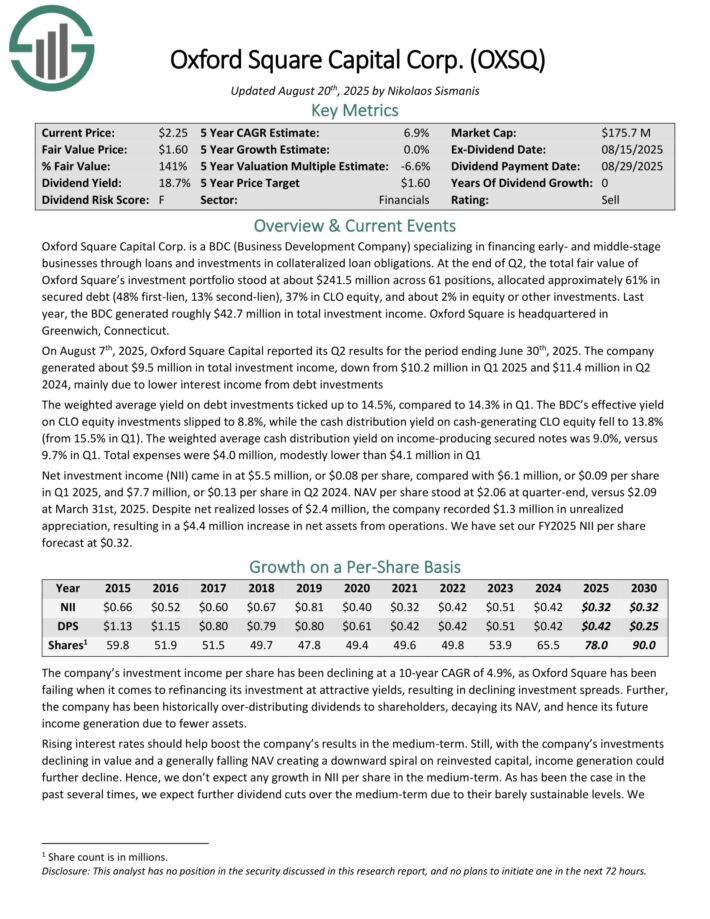

Harmful Extreme Dividend Stock #1: Oxford Sq. Capital (OXSQ)

Oxford Sq. Capital Corp. is a BDC (Enterprise Enchancment Agency) specializing in financing early- and middle-stage corporations by the use of loans and investments in collateralized mortgage obligations.

On the end of ultimate quarter, the entire truthful value of Oxford Sq.’s funding portfolio stood at about $243.2 million all through 61 positions, allotted roughly 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO equity, and about 1% in equity or totally different investments. Closing yr, the BDC generated roughly $42.7 million in full funding earnings.

On August seventh, 2025, Oxford Sq. Capital reported its Q2 outcomes for the interval ending June thirtieth, 2025. The company generated about $9.5 million in full funding earnings, down from $10.2 million in Q1 2025 and $11.4 million in Q2 2024, primarily on account of lower curiosity earnings from debt investments.

The weighted frequent yield on debt investments ticked as a lot as 14.5%, as compared with 14.3% in Q1. The BDC’s environment friendly yield on CLO equity investments slipped to eight.8%, whereas the cash distribution yield on cash-generating CLO equity fell to 13.8% (from 15.5% in Q1).

The weighted frequent cash distribution yield on income-producing secured notes was 9.0%, versus 9.7% in Q1. Full payments have been $4.0 million, modestly lower than $4.1 million in Q1.

Net funding earnings (NII) bought right here in at $5.5 million, or $0.08 per share, in distinction with $6.1 million, or $0.09 per share in Q1 2025, and $7.7 million, or $0.13 per share in Q2 2024.

Click on on proper right here to acquire our latest Constructive Analysis report on OXSQ (preview of net web page 1 of three confirmed beneath):

Remaining Concepts

Extreme dividend shares are naturally fascinating on the ground, on account of their extreme dividend yields.

Nevertheless earnings merchants need to guarantee they don’t fall proper right into a dividend ‘lure’, which suggests shopping for a stock solely on account of its extreme yield, solely to see the company reduce or take away the dividend payout.

The ten harmful dividend shares on this file have unsustainable dividends, as indicated by their terribly extreme dividend payout ratios.

Due to this, earnings merchants looking out for top of the range dividend shares for long-term earnings, ought to advertise the ten harmful dividend shares on this text.

Additional Finding out

In the event you’re fascinated with discovering high-quality dividend progress shares and/or totally different high-yield securities and earnings securities, the subsequent Constructive Dividend belongings will most likely be useful:

Extreme-Yield Specific particular person Security Evaluation

Completely different Constructive Dividend Property

Thanks for finding out this textual content. Please ship any strategies, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@sort":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Excessive-Dividend-Picture.jpg","width":0,"peak":0},"writer":{"@sort":"Group","title":"","url":"https://indexinvestingnews.com","brand":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link