Revealed on September tenth, 2025 by Bob Ciura

Earnings traders are possible conversant in the Dividend Aristocrats, that are among the highest-quality shares to purchase and maintain for the long run.

We suggest long-term traders concentrate on high-quality dividend shares. To that finish, we view the Dividend Aristocrats as among the many finest dividend shares to buy-and-hold for the long term.

The Dividend Aristocrats have a protracted historical past of outperforming the market on the subject of risk-adjusted returns.

You’ll be able to obtain the total Dividend Aristocrats checklist, together with essential metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Disclaimer: Certain Dividend will not be affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official info.

Even higher, traders should buy high quality dividend shares when they’re additionally undervalued, which might result in excessive whole returns within the coming years.

In spite of everything, the aim of rational traders is to maximize whole return beneath a given set of constraints. Dividends can contribute a good portion of a inventory’s whole return.

Shares with low P/E ratios can provide engaging returns if their valuation multiples develop.

And when a low P/E inventory additionally has a excessive dividend yield, traders get ‘paid to attend’ for the valuation a number of to extend.

This text will focus on the ten least expensive Dividend Aristocrats now.

Desk of Contents

The desk of contents under permits for simple navigation. The shares are listed by 5-year annual return from valuation, in ascending order.

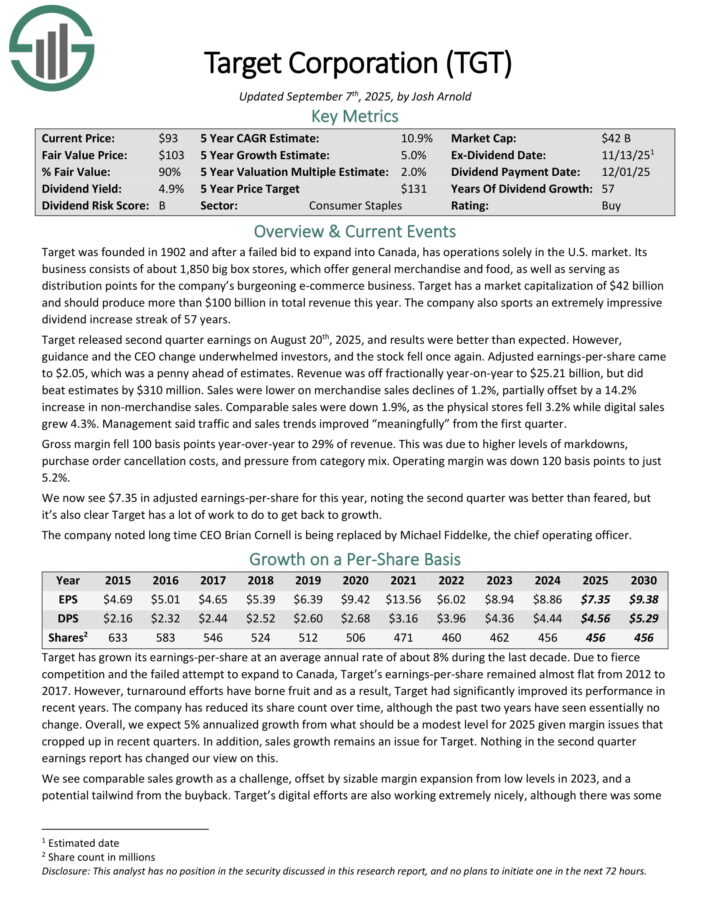

Least expensive Dividend Aristocrat #10: Goal Corp. (TGT)

- Annual Valuation Return: 2.5%

Goal was based in 1902 and now operates about 1,850 huge field shops, which provide basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal launched second quarter earnings on August twentieth, 2025, and outcomes had been higher than anticipated. Nonetheless, steerage and the CEO change underwhelmed traders, and the inventory fell as soon as once more.

Adjusted earnings-per-share got here to $2.05, which was a penny forward of estimates. Income was off fractionally year-on-year to $25.21 billion, however did beat estimates by $310 million. Gross sales had been decrease on merchandise gross sales declines of 1.2%, partially offset by a 14.2% improve in non-merchandise gross sales.

Comparable gross sales had been down 1.9%, because the bodily shops fell 3.2% whereas digital gross sales grew 4.3%. Administration mentioned visitors and gross sales developments improved “meaningfully” from the primary quarter.

The corporate is investing closely in its enterprise so as to navigate via the altering panorama within the retail sector. The payout is now 62% of earnings for this yr, which is elevated from historic ranges, however the dividend stays well-covered.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven under):

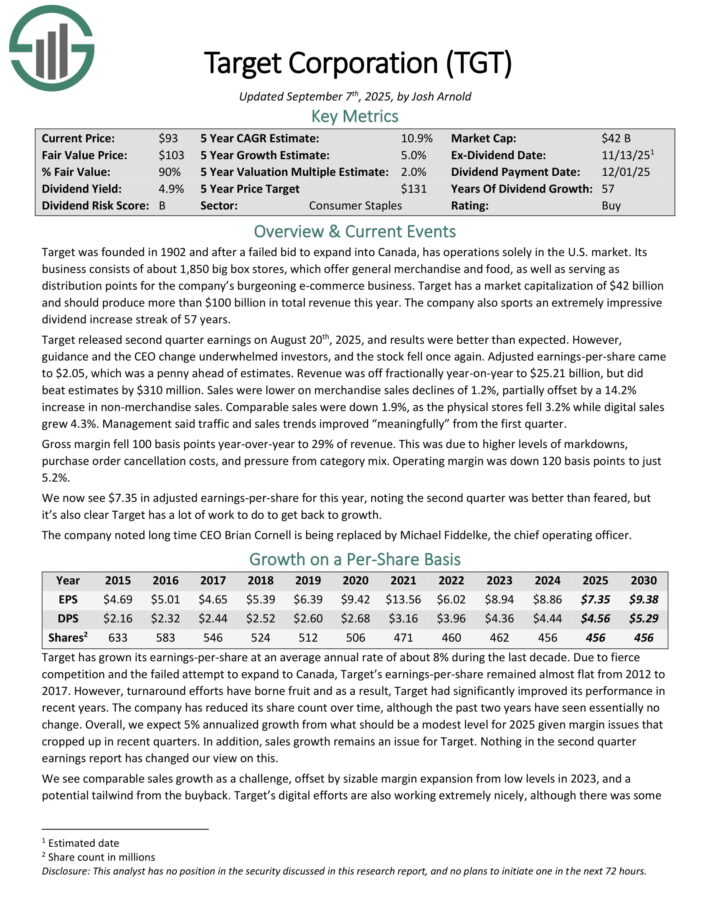

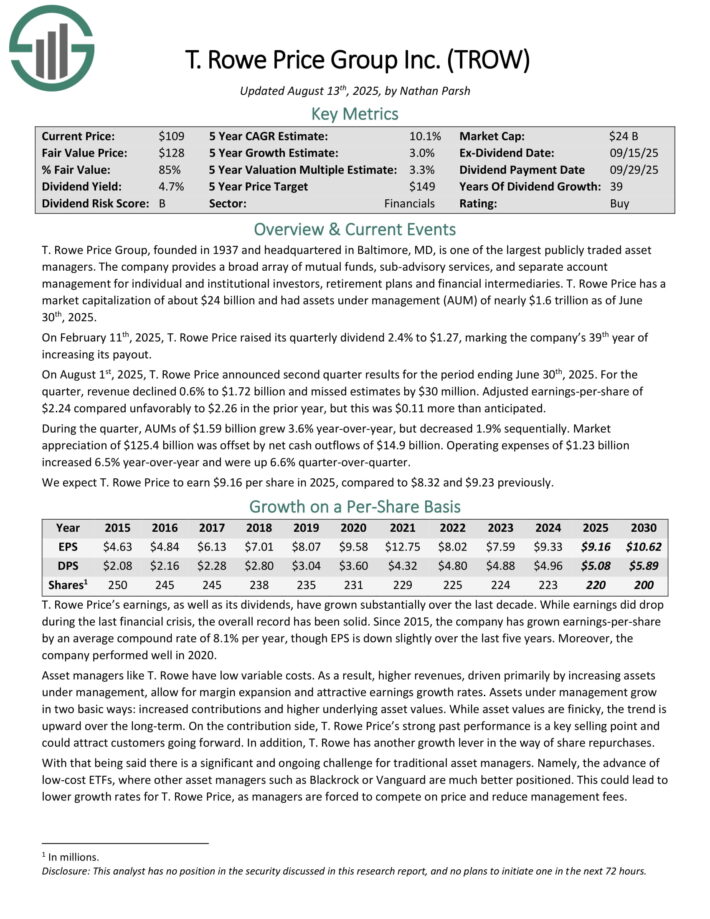

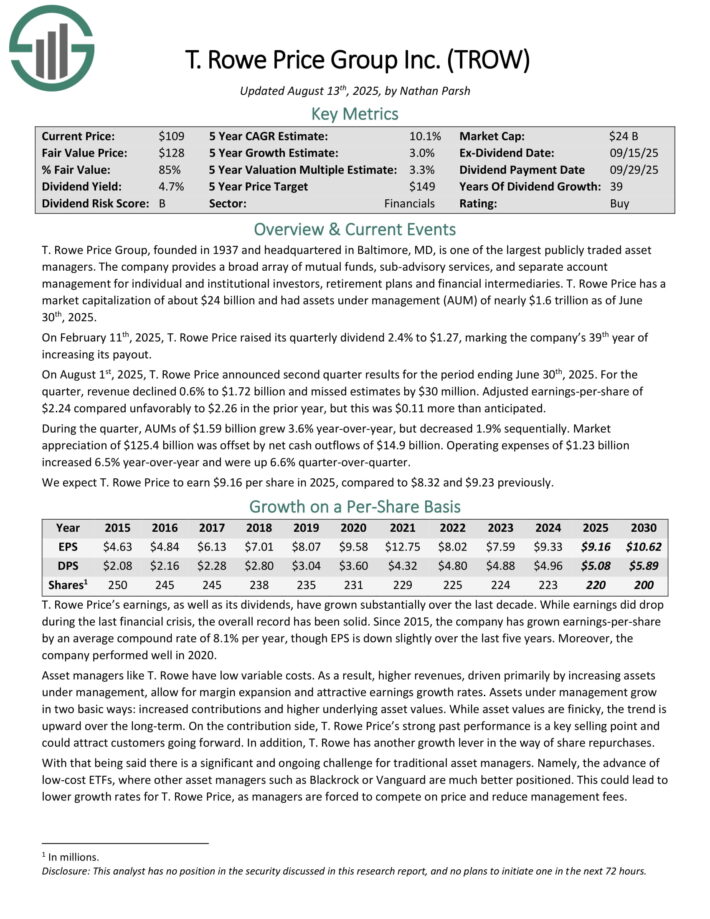

Least expensive Dividend Aristocrat #9: T. Rowe Worth Group (TROW)

- Annual Valuation Return: 3.7%

T. Rowe Worth Group is without doubt one of the largest publicly traded asset managers. The corporate gives a broad array of mutual funds, sub-advisory companies, and separate account administration for particular person and institutional traders, retirement plans and monetary intermediaries.

T. Rowe Worth had property beneath administration (AUM) of practically $1.6 trillion as of June thirtieth, 2025.

On February eleventh, 2025, T. Rowe Worth raised its quarterly dividend 2.4% to $1.27, marking the corporate’s thirty ninth yr of accelerating its payout.

On August 1st, 2025, T. Rowe Worth introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income declined 0.6% to $1.72 billion and missed estimates by $30 million.

Adjusted earnings-per-share of $2.24 in contrast unfavorably to $2.26 within the prior yr, however this was $0.11 greater than anticipated.

In the course of the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, however decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by web money outflows of $14.9 billion.

Working bills of $1.23 billion elevated 6.5% year-over-year and had been up 6.6% quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven under):

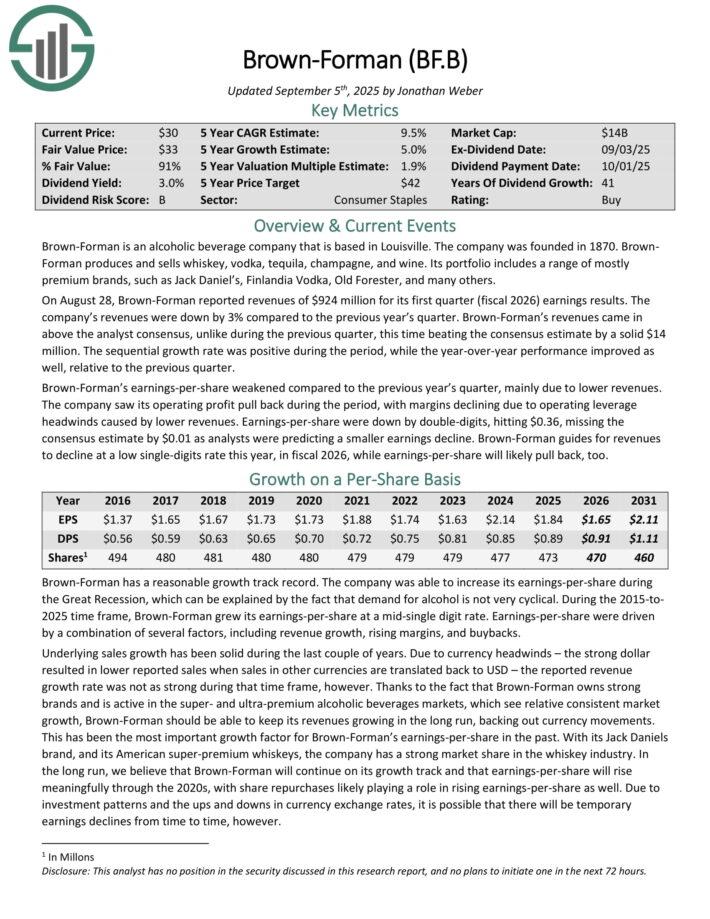

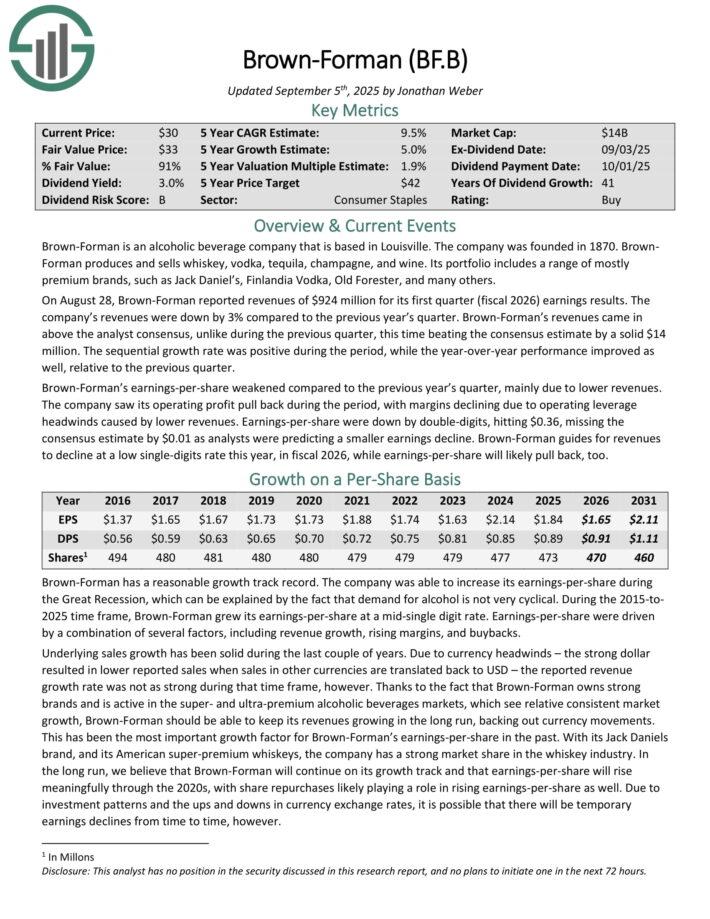

Least expensive Dividend Aristocrat #8: Brown-Forman Corp. (BF.B)

- Annual Valuation Return: 3.9%

Brown-Forman is an alcoholic beverage firm that’s based mostly in Louisville. The corporate was based in 1870. It produces and sells whiskey, vodka, tequila, champagne, and wine.

Its portfolio features a vary of largely premium manufacturers, comparable to Jack Daniel’s, Finlandia Vodka, Previous Forester, and plenty of others.

On August 28, Brown-Forman reported revenues of $924 million for its first quarter (fiscal 2026) earnings outcomes. The corporate’s revenues had been down by 3% in comparison with the earlier yr’s quarter.

Revenues got here in above the analyst consensus, in contrast to through the earlier quarter, this time beating the consensus estimate by a stable $14 million. The sequential development fee was optimistic through the interval, whereas the year-over-year efficiency improved as properly, relative to the earlier quarter.

Brown-Forman’s earnings-per-share weakened in comparison with the earlier yr’s quarter, primarily because of decrease revenues. The corporate noticed its working revenue pull again through the interval, with margins declining because of working leverage headwinds attributable to decrease revenues.

Earnings-per-share had been down by double-digits, hitting $0.36, lacking the consensus estimate by $0.01 as analysts had been predicting a smaller earnings decline.

Brown-Forman guides for revenues to say no at a low single-digits fee this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on BF.B (preview of web page 1 of three proven under):

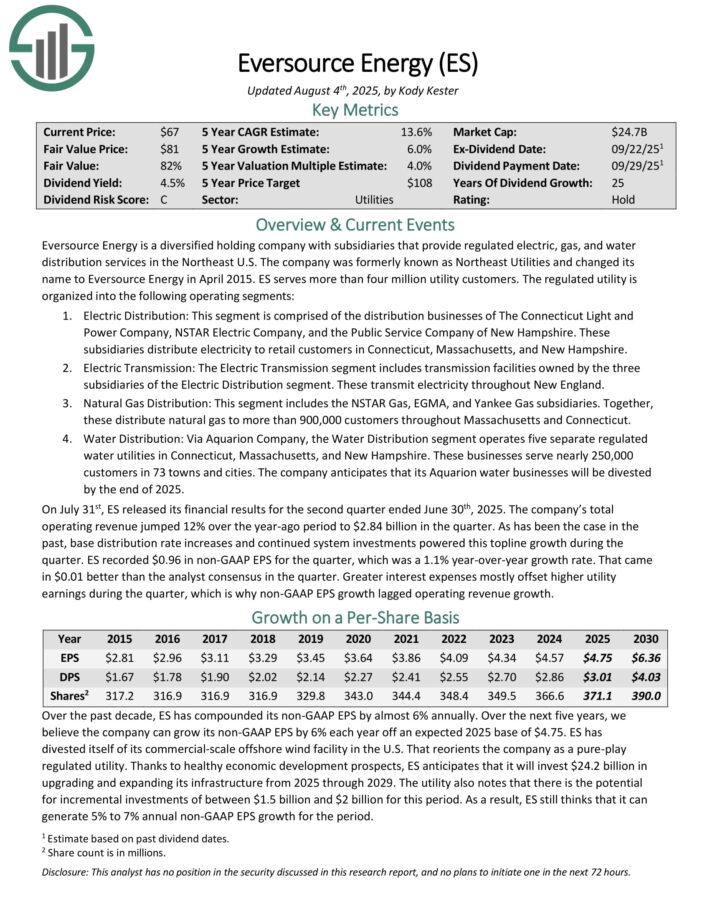

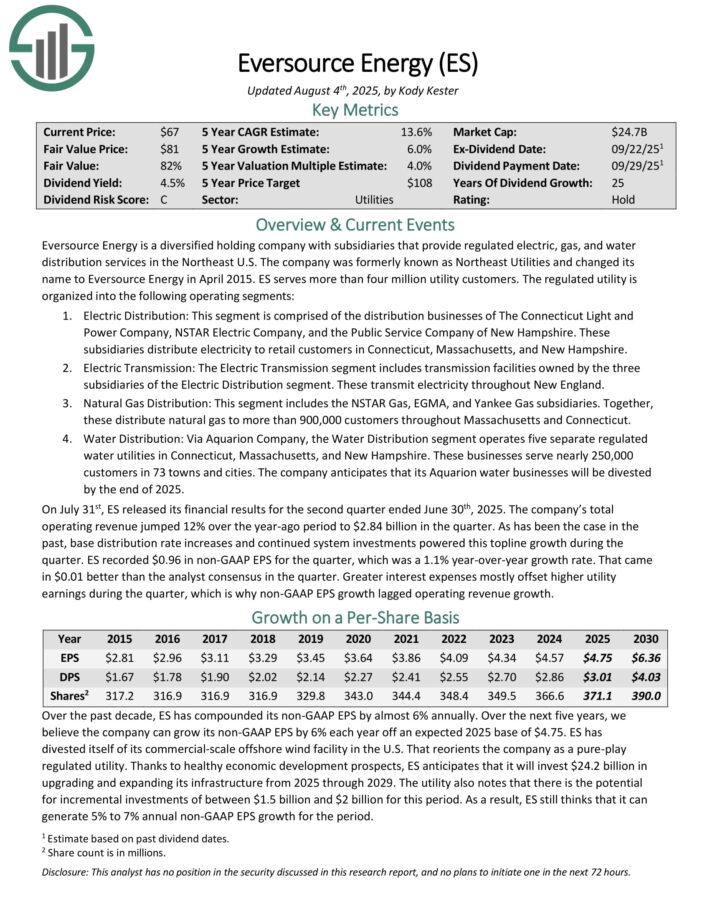

Least expensive Dividend Aristocrat #7: Eversource Power (ES)

- Annual Valuation Return: 5.0%

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million prospects. Eversource has delivered regular development to shareholders for a few years.

On July thirty first, ES launched its monetary outcomes for the second quarter ended June thirtieth, 2025. The corporate’s whole working income jumped 12% over the year-ago interval to $2.84 billion within the quarter.

As has been the case prior to now, base distribution fee will increase and continued system investments powered this top-line development through the quarter.

ES recorded $0.96 in non-GAAP EPS for the quarter, which was a 1.1% year-over-year development fee. That got here in $0.01 higher than the analyst consensus within the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven under):

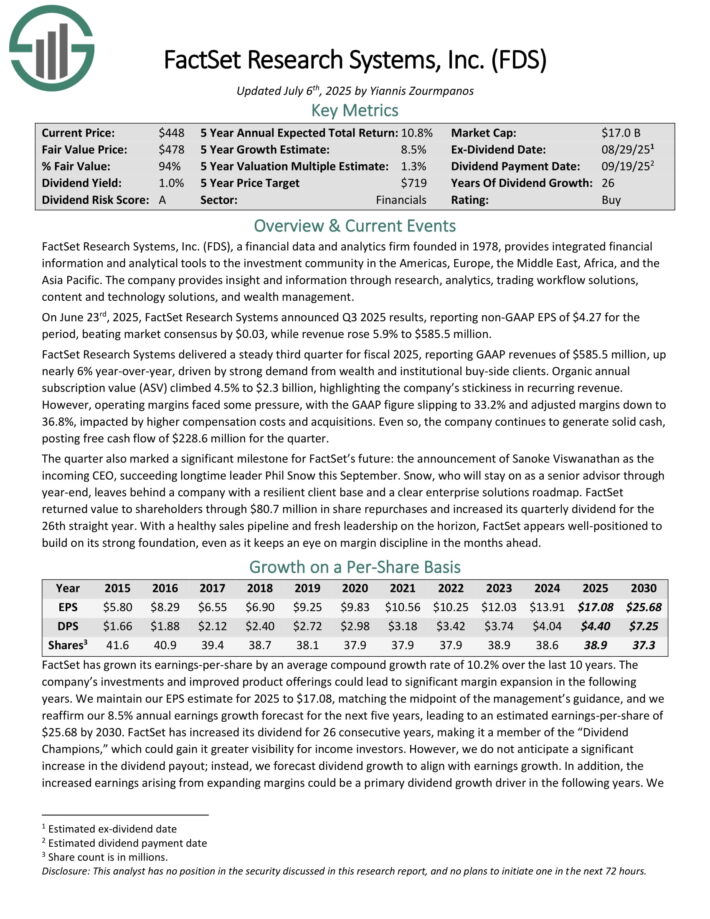

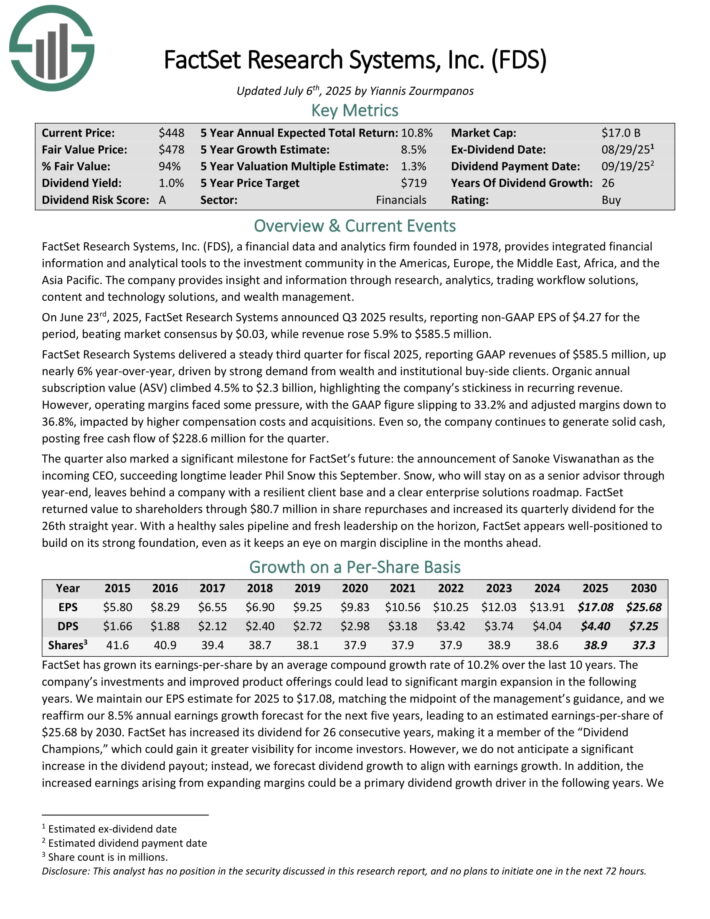

Least expensive Dividend Aristocrat #6: Factset Analysis Programs (FDS)

- Annual Valuation Return: 5.1%

FactSet Analysis Programs, a monetary information and analytics agency based in 1978, gives built-in monetary info and analytical instruments to the funding group within the Americas, Europe, the Center East, Africa, and Asia-Pacific.

The corporate gives perception and knowledge via analysis, analytics, buying and selling workflow options, content material and expertise options, and wealth administration.

On June twenty third, 2025, FactSet Analysis Programs introduced Q3 2025 outcomes, reporting non-GAAP EPS of $4.27 for the interval, beating market consensus by $0.03, whereas income rose 5.9% to $585.5 million.

It delivered a gentle third quarter for fiscal 2025, reporting GAAP revenues of $585.5 million, up practically 6% year-over-year, pushed by sturdy demand from wealth and institutional buy-side shoppers.

Natural annual subscription worth (ASV) climbed 4.5% to $2.3 billion, highlighting the corporate’s stickiness in recurring income.

Nonetheless, working margins confronted some strain, with the GAAP determine slipping to 33.2% and adjusted margins right down to 36.8%, impacted by larger compensation prices and acquisitions.

Even so, the corporate continues to generate stable money, posting free money movement of $228.6 million for the quarter.

FactSet returned worth to shareholders via $80.7 million in share repurchases and elevated its quarterly dividend for the twenty sixth straight yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on FDS (preview of web page 1 of three proven under):

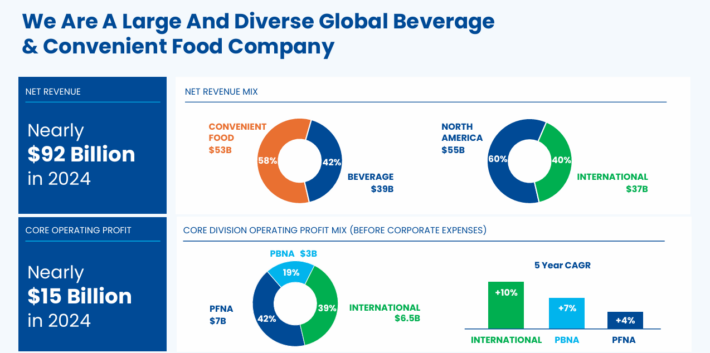

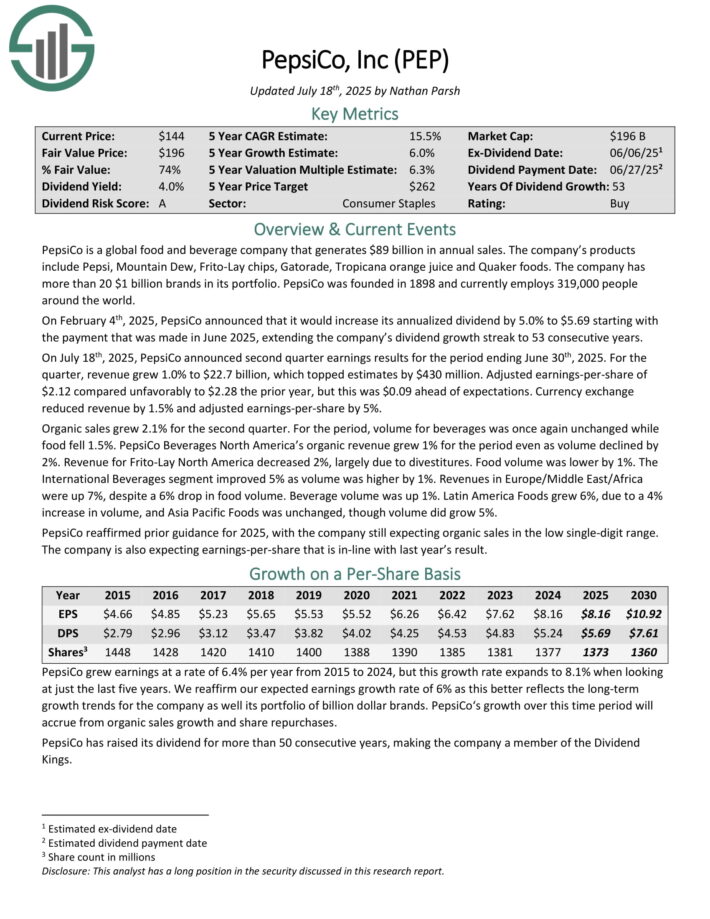

Least expensive Dividend Aristocrat #5: PepsiCo Inc. (PEP)

- Annual Valuation Return: 6.5%

PepsiCo is a world meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

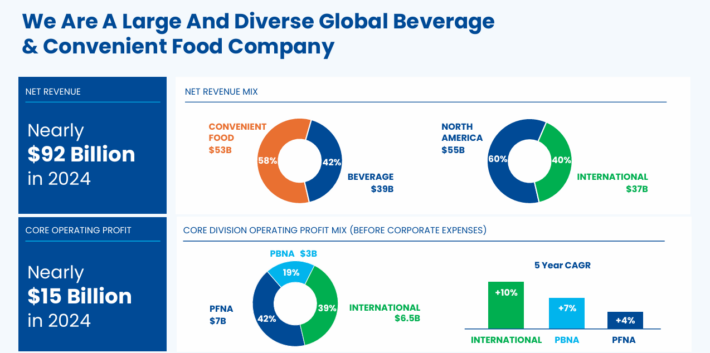

Its enterprise is cut up roughly 60-40 by way of meals and beverage income. Additionally it is balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior yr, however this was $0.09 forward of expectations. Foreign money change diminished income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven under):

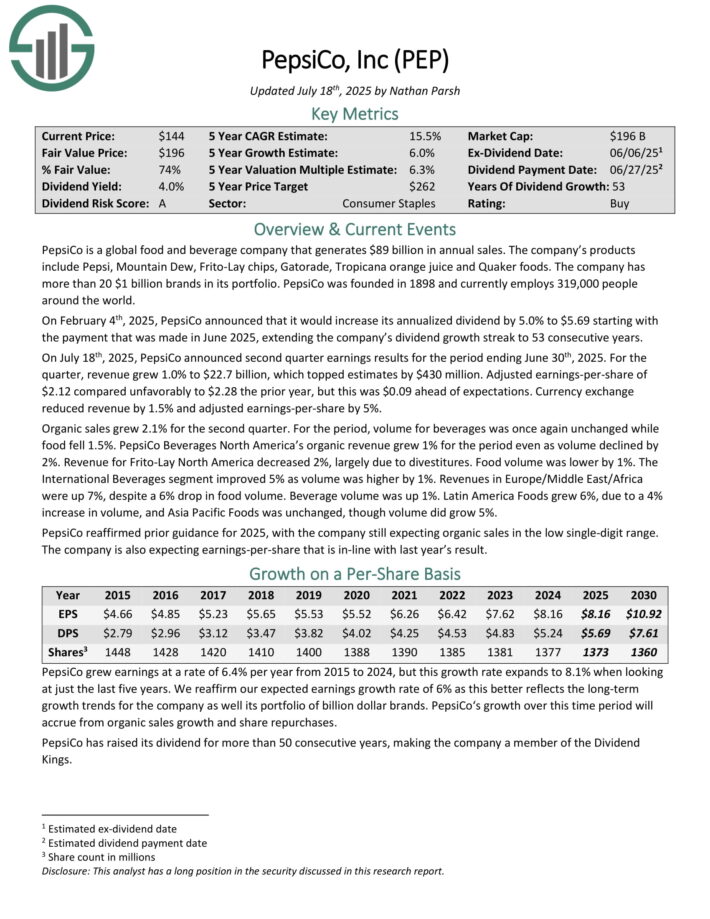

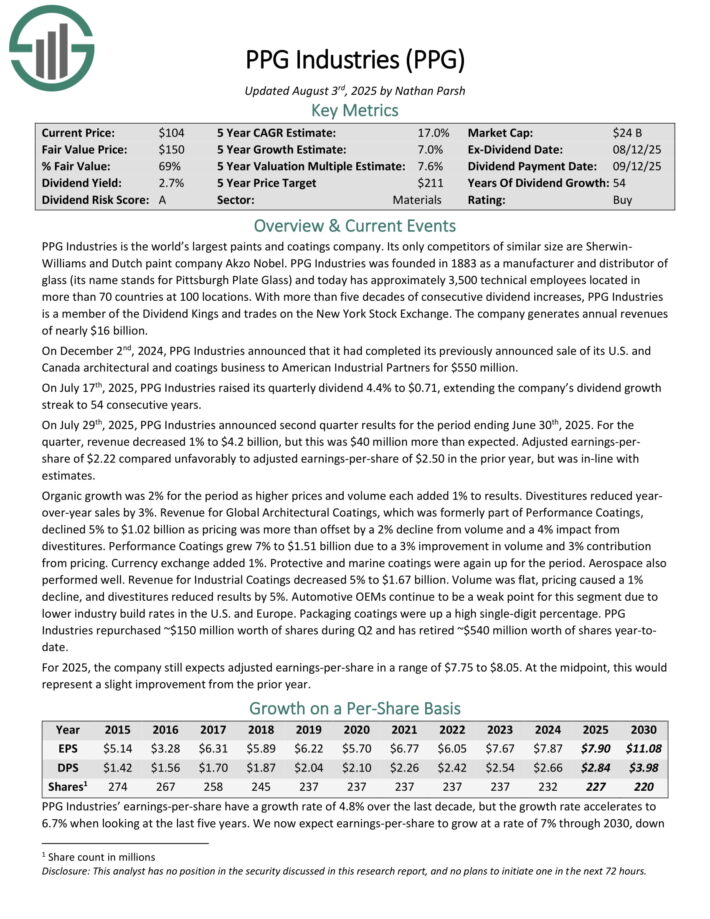

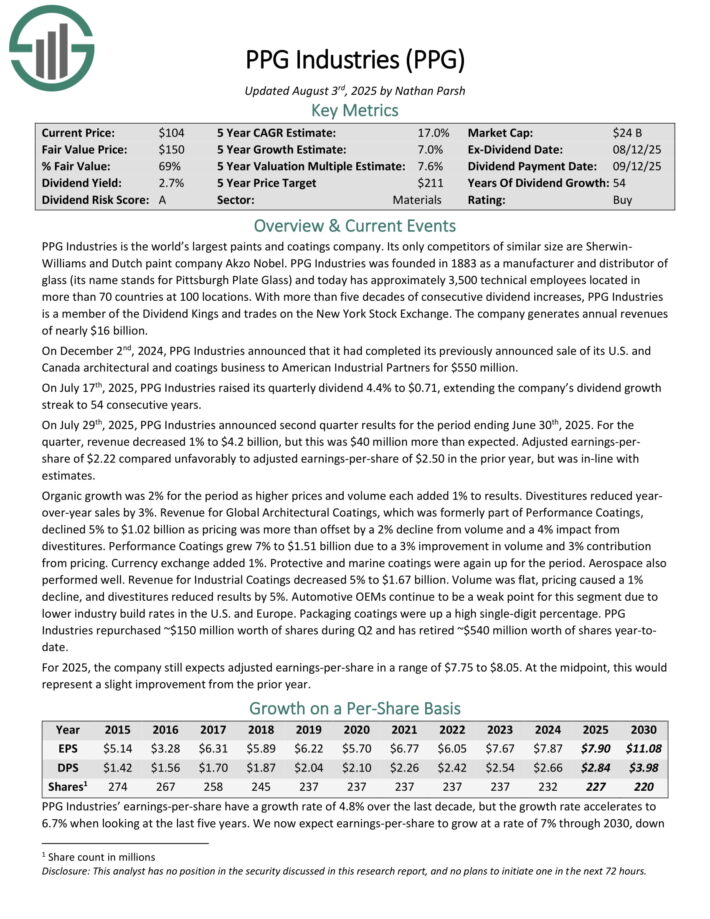

Least expensive Dividend Aristocrat #4: PPG Industries (PPG)

- Annual Valuation Return: 6.5%

PPG Industries is the world’s largest paints and coatings firm. Its solely rivals of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its identify stands for Pittsburgh Plate Glass) and in the present day has roughly 3,500 technical workers situated in additional than 70 nations at 100 places.

On July seventeenth, 2025, PPG Industries raised its quarterly dividend 4.4% to $0.71, extending the corporate’s dividend development streak to 54 consecutive years.

On July twenty ninth, 2025, PPG Industries introduced second-quarter outcomes. For the quarter, income decreased 1% to $4.2 billion, however this was $40 million greater than anticipated. Adjusted earnings-per-share of $2.22 in contrast unfavorably to adjusted earnings-per-share of $2.50 within the prior yr, however was in-line with estimates.

Natural development was 2% for the interval as larger costs and quantity every added 1% to outcomes. Divestitures diminished year-over-year gross sales by 3%. Income for World Architectural Coatings declined 5% to $1.02 billion as pricing was greater than offset by a 2% decline from quantity and a 4% impression from divestitures.

Efficiency Coatings grew 7% to $1.51 billion because of a 3% enchancment in quantity and three% contribution from pricing. Foreign money change added 1%. Protecting and marine coatings had been once more up for the interval.

PPG Industries repurchased ~$150 million price of shares throughout Q2 and has retired ~$540 million price of shares year-to-date.

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven under):

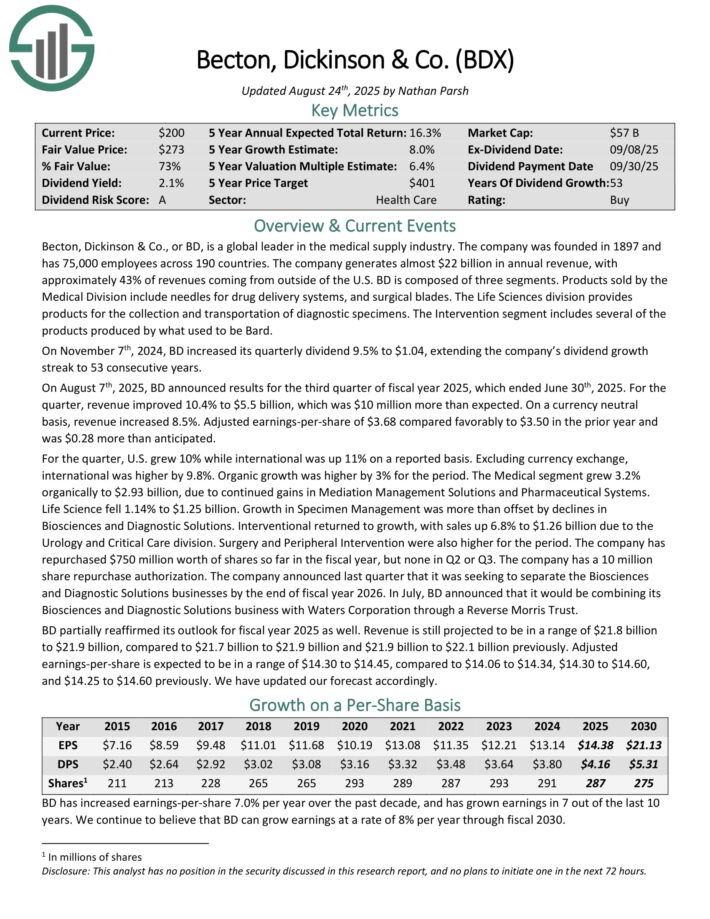

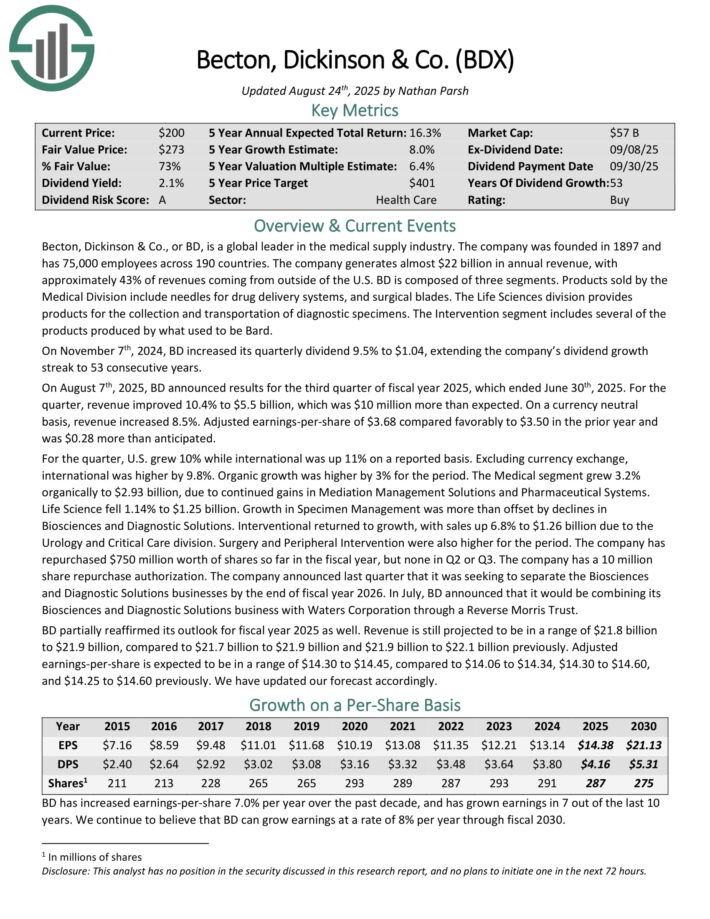

Least expensive Dividend Aristocrat #3: Becton Dickinson & Co. (BDX)

- Annual Valuation Return: 7.5%

Becton, Dickinson & Co. is a world chief within the medical provide business. The corporate was based in 1897 and has 75,000 workers throughout 190 nations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from outdoors of the U.S.

Becton, Dickinson & Co., or BD, is a world chief within the medical provide business. The corporate generates nearly $22 billion in annual income, with roughly 43% of revenues coming from outdoors of the U.S.

On August seventh, 2025, BD introduced outcomes for the third quarter of fiscal yr 2025, which ended June thirtieth, 2025. For the quarter, income improved 10.4% to $5.5 billion, which was $10 million greater than anticipated.

On a forex impartial foundation, income elevated 8.5%. Adjusted earnings-per-share of $3.68 in contrast favorably to $3.50 within the prior yr and was $0.28 greater than anticipated.

For the quarter, U.S. grew 10% whereas worldwide was up 11% on a reported foundation. Excluding forex change, worldwide was larger by 9.8%. Natural development was larger by 3% for the interval.

BD partially reaffirmed its outlook for fiscal yr 2025 as properly. Income remains to be projected to be in a variety of $21.8 billion to $21.9 billion, in comparison with $21.7 billion to $21.9 billion beforehand. Adjusted earnings-per-share is predicted to be in a variety of $14.30 to $14.45.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDX (preview of web page 1 of three proven under):

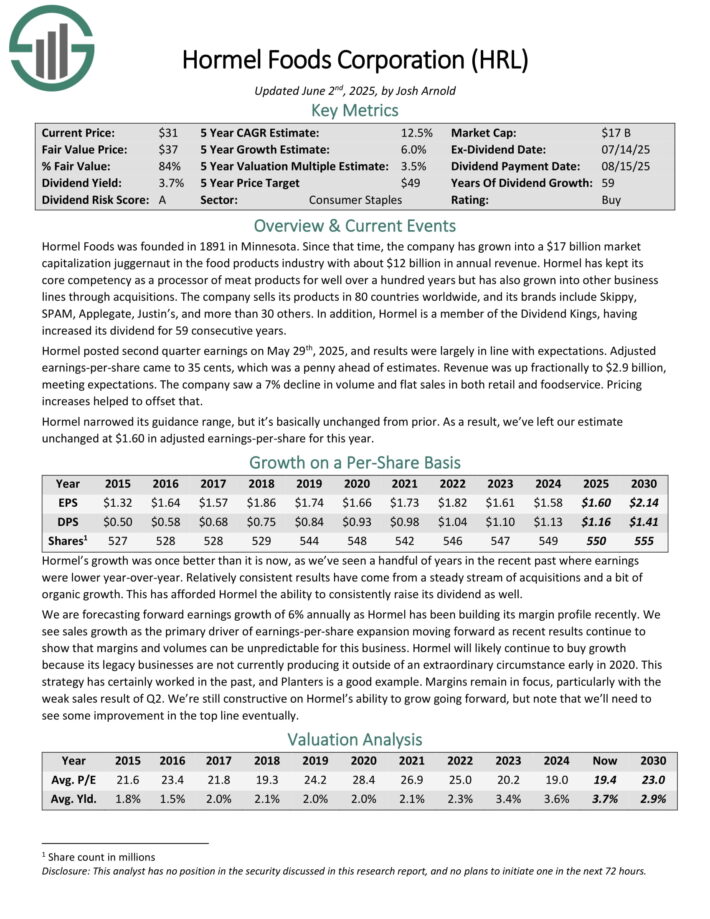

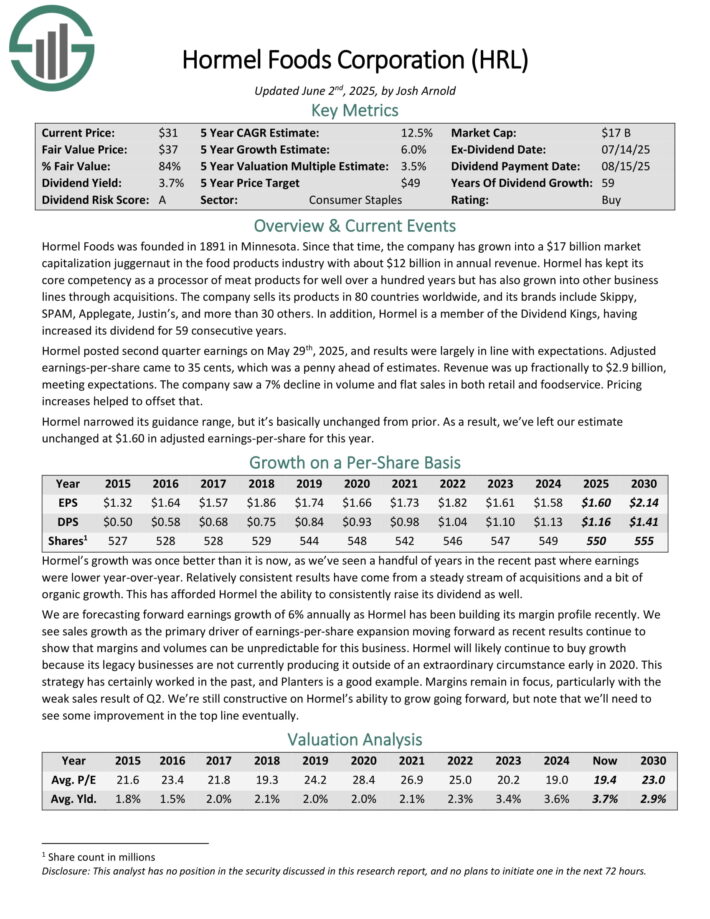

Least expensive Dividend Aristocrat #2: Hormel Meals (HRL)

- Annual Valuation Return: 7.7%

Hormel Meals was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with practically $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for properly over 100 years, however has additionally grown into different enterprise traces via acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Only a few of its prime manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

The corporate has elevated its dividend for 59 consecutive years.

Supply: Investor Presentation

Hormel posted second quarter earnings on Might twenty ninth, 2025, and outcomes had been largely in step with expectations. Adjusted earnings-per-share got here to 35 cents, which was a penny forward of estimates.

Income was up fractionally to $2.9 billion, assembly expectations. The corporate noticed a 7% decline in quantity and flat gross sales in each retail and foodservice. Pricing will increase helped to offset that.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven under):

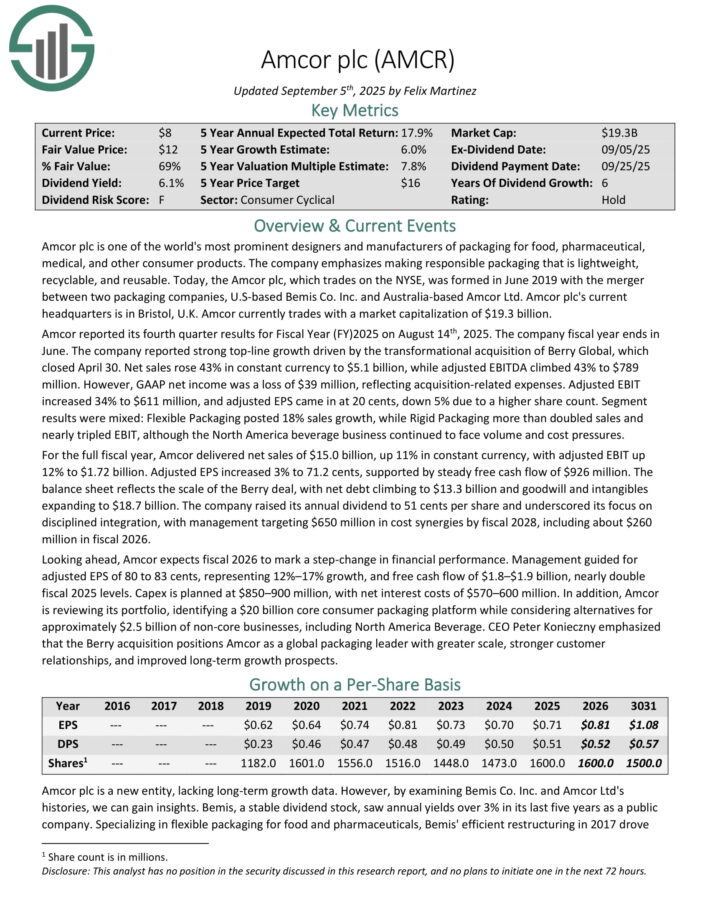

Least expensive Dividend Aristocrat #1: Amcor plc (AMCR)

- Annual Valuation Return: 7.8%

Amcor plc is without doubt one of the world’s most outstanding designers and producers of packaging for meals, pharmaceutical, medical, and different shopper merchandise. The corporate emphasizes making accountable packaging that’s light-weight, recyclable, and reusable.

Amcor reported its fourth quarter outcomes for Fiscal Yr 2025 on August 14th, 2025. The corporate fiscal yr ends in June. The corporate reported sturdy top-line development pushed by the transformational acquisition of Berry World, which closed April 30.

Web gross sales rose 43% in fixed forex to $5.1 billion, whereas adjusted EBITDA climbed 43% to $789 million. Nonetheless, GAAP web earnings was a lack of $39 million, reflecting acquisition-related bills. Adjusted EBIT elevated 34% to $611 million, and adjusted EPS got here in at 20 cents, down 5% because of a better share rely.

Section outcomes had been blended: Versatile Packaging posted 18% gross sales development, whereas Inflexible Packaging greater than doubled gross sales and practically tripled EBIT, though the North America beverage enterprise continued to face quantity and price pressures.

For the total fiscal yr, Amcor delivered web gross sales of $15.0 billion, up 11% in fixed forex, with adjusted EBIT up 12% to $1.72 billion. Adjusted EPS elevated 3% to 71.2 cents, supported by regular free money movement of $926 million.

The stability sheet displays the dimensions of the Berry deal, with web debt climbing to $13.3 billion and goodwill and intangibles increasing to $18.7 billion.

The corporate raised its annual dividend to 51 cents per share and underscored its concentrate on disciplined integration, with administration focusing on $650 million in value synergies by fiscal 2028, together with about $260 million in fiscal 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on AMCR (preview of web page 1 of three proven under):

Extra Studying

The next Certain Dividend databases comprise probably the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].