Revealed on December twenty ninth, 2025 by Bob Ciura

Month-to-month dividend shares are securities that pay a dividend each month as an alternative of quarterly or yearly.

Month-to-month dividend shares have immediate attraction for a lot of revenue buyers. Shares that pay their dividends every month supply extra frequent payouts than conventional quarterly or semi-annual dividend payers.

Because of this, we created a full record of 83 month-to-month dividend shares.

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Month-to-month dividend payouts together with excessive yields are definitely enticing on the floor. Nonetheless, many month-to-month dividend shares have turned in poor efficiency, marked by low (and even damaging) whole returns.

Whereas previous efficiency isn’t a assure of future outcomes, it may be helpful to look again to see which month-to-month dividend shares carried out the perfect.

Due to this fact, this text will focus on the ten best-performing month-to-month dividend shares over the previous 10 years.

Desk Of Contents

The very best performing month-to-month dividend shares are ranked beneath, in accordance with their whole annualized returns.

You may immediately soar to a person part of the article by using the hyperlinks beneath:

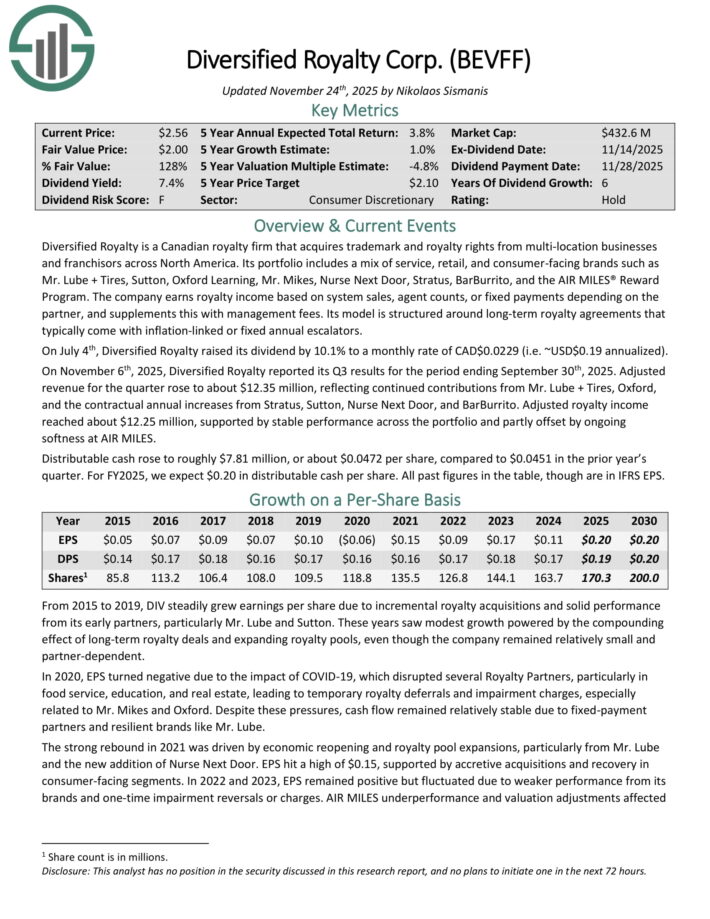

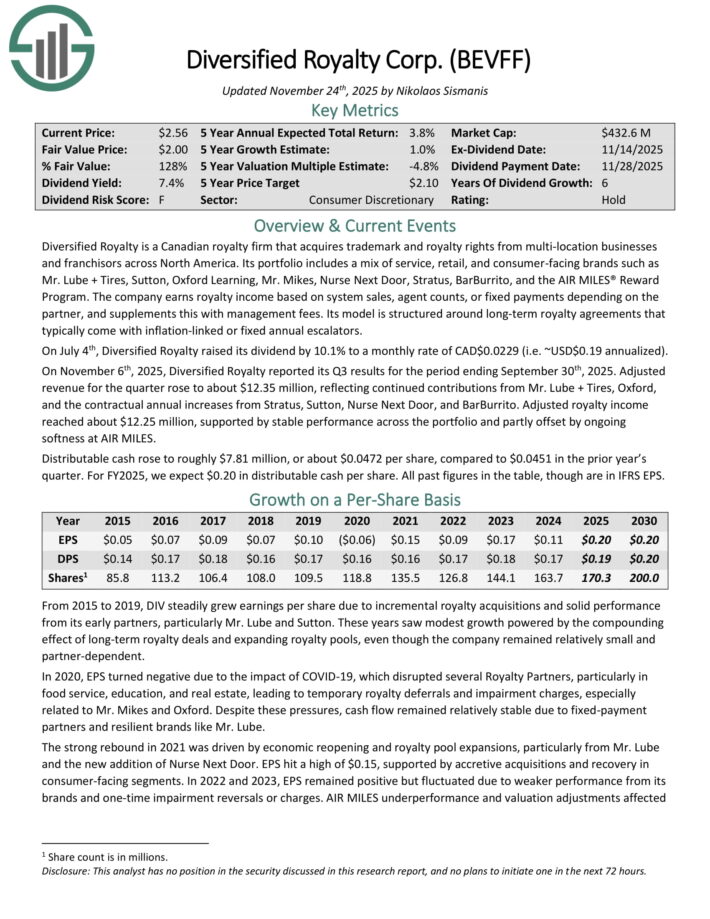

Greatest Performing Month-to-month Dividend Inventory #10: Diversified Royalty Corp. (BEVFF)

- Annualized 10-12 months Whole Returns: 13.9%

Diversified Royalty is a Canadian royalty agency that acquires trademark and royalty rights from multi-location companies and franchisors throughout North America.

Its portfolio contains a mixture of service, retail, and consumer-facing manufacturers reminiscent of Mr. Lube + Tires, Sutton, Oxford Studying, Mr. Mikes, Nurse Subsequent Door, Stratus, BarBurrito, and the AIR MILES Reward Program.

The corporate earns royalty revenue primarily based on system gross sales, agent counts, or fastened funds relying on the associate, and dietary supplements this with administration charges. Its mannequin is structured round long-term royalty agreements that usually include inflation-linked or fastened annual escalators.

On July 4th, Diversified Royalty raised its dividend by 10.1% to a month-to-month fee of CAD$0.0229.

On November sixth, 2025, Diversified Royalty reported its Q3 outcomes for the interval ending September thirtieth, 2025. Adjusted income for the quarter rose to about $12.35 million, reflecting continued contributions from Mr. Lube + Tires, Oxford, and the contractual annual will increase from Stratus, Sutton, Nurse Subsequent Door, and BarBurrito.

Adjusted royalty revenue reached about $12.25 million, supported by secure efficiency throughout the portfolio and partly offset by ongoing softness at AIR MILES.

Distributable money rose to roughly $7.81 million, or about $0.0472 per share, in comparison with $0.0451 within the prior 12 months’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEVFF (preview of web page 1 of three proven beneath):

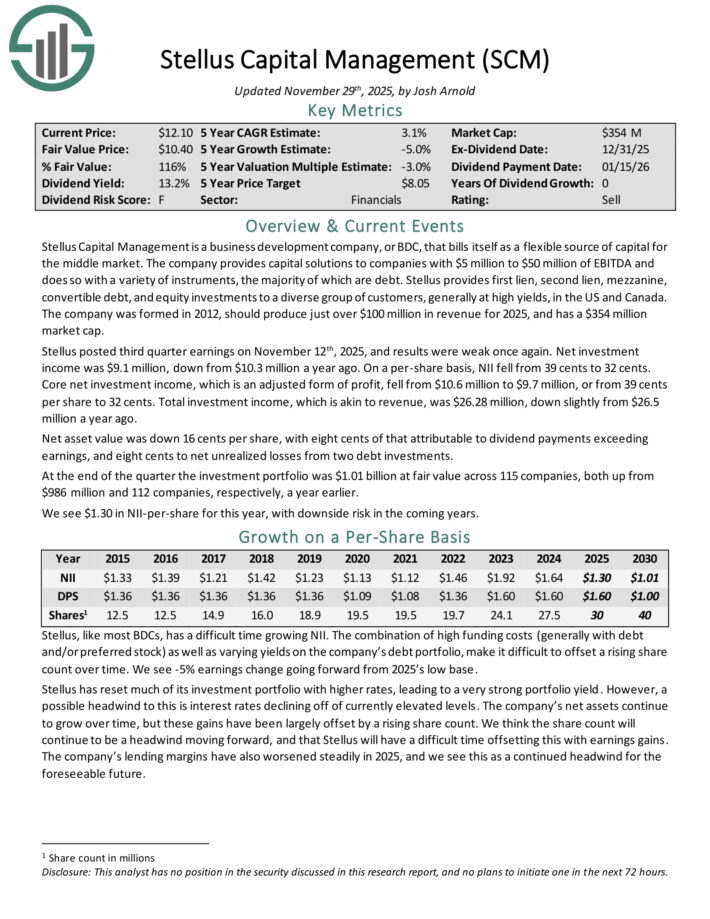

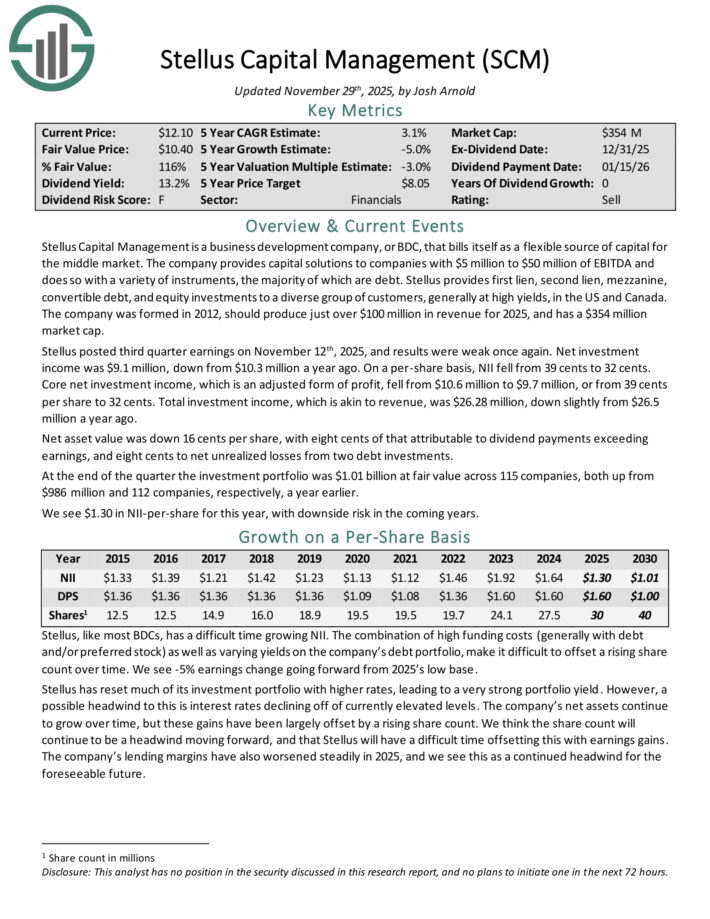

Greatest Performing Month-to-month Dividend Inventory #9: Stellus Capital (SCM)

- Annualized 10-12 months Whole Returns: 14.2%

Stellus Capital Administration offers capital options to corporations with $5 million to $50 million of EBITDA and does so with quite a lot of devices, the vast majority of that are debt.

Stellus offers first lien, second lien, mezzanine, convertible debt, and fairness investments to a various group of shoppers, usually at excessive yields, within the US and Canada.

Stellus posted third quarter earnings on November twelfth, 2025, and outcomes had been weak as soon as once more. Web funding revenue was $9.1 million, down from $10.3 million a 12 months in the past. On a per-share foundation, NII fell from 39 cents to 32 cents.

Core internet funding revenue, which is an adjusted type of revenue, fell from $10.6 million to $9.7 million, or from 39 cents per share to 32 cents. Whole funding revenue, which is akin to income, was $26.28 million, down barely from $26.5 million a 12 months in the past.

Web asset worth was down 16 cents per share, with eight cents of that attributable to dividend funds exceeding earnings, and eight cents to internet unrealized losses from two debt investments.

On the finish of the quarter the funding portfolio was $1.01 billion at honest worth throughout 115 corporations, each up from $986 million and 112 corporations, respectively, a 12 months earlier.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCM (preview of web page 1 of three proven beneath):

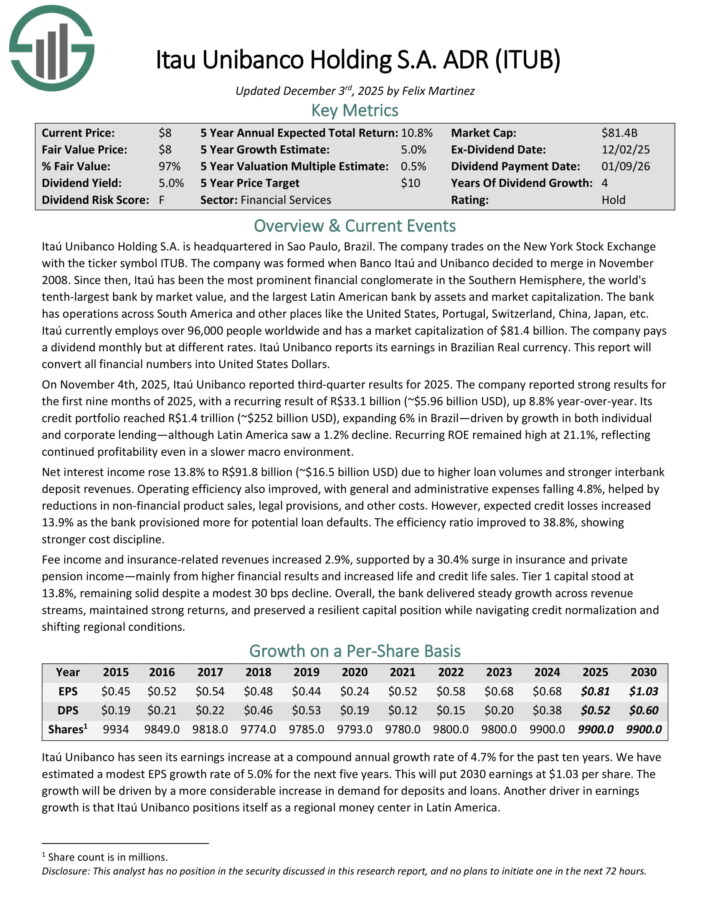

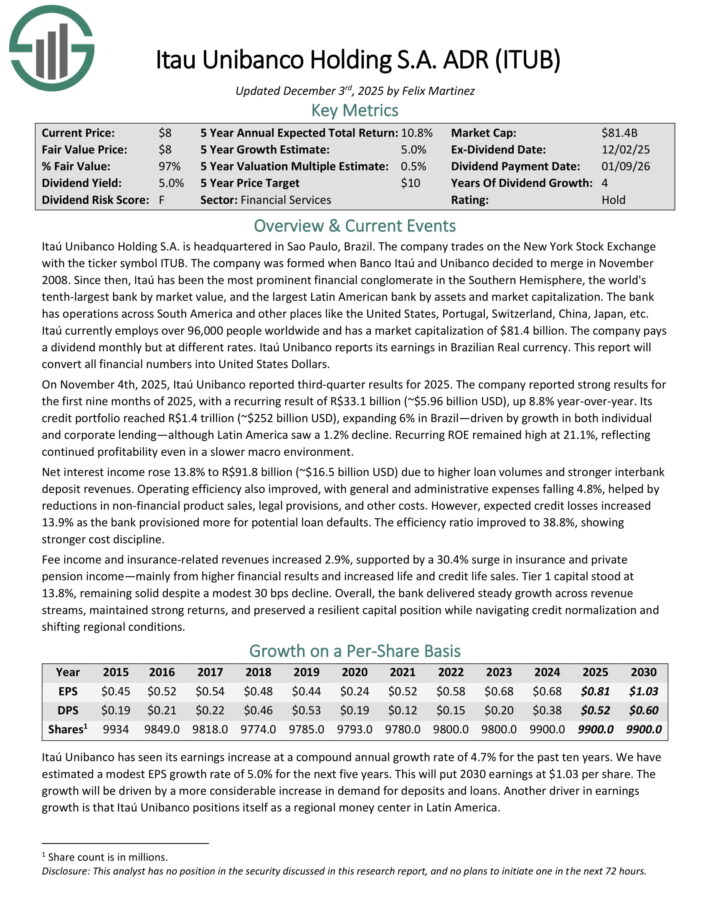

Greatest Performing Month-to-month Dividend Inventory #8: Itau Unibanco (ITUB)

- Annualized 10-12 months Whole Returns: 14.9%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. It’s the world’s tenth-largest financial institution by market worth, and the most important Latin American financial institution by belongings and market capitalization.

The financial institution has operations throughout South America and different locations like the USA, Portugal, Switzerland, China, Japan, and many others.

Itaú presently employs over 96,000 folks worldwide and has a market capitalization of $81.4 billion.

On November 4th, 2025, Itaú Unibanco reported third-quarter outcomes for 2025. The corporate reported sturdy outcomes for the primary 9 months of 2025, with a recurring results of R$33.1 billion (~$5.96 billion USD), up 8.8% year-over-year.

Its credit score portfolio reached R$1.4 trillion (~$252 billion USD), increasing 6% in Brazil—pushed by development in each particular person and company lending—though Latin America noticed a 1.2% decline.

Recurring ROE remained excessive at 21.1%, reflecting continued profitability even in a slower macro setting.

Web curiosity revenue rose 13.8% to R$91.8 billion (~$16.5 billion USD) on account of increased mortgage volumes and stronger interbank deposit revenues.

Working effectivity additionally improved, with normal and administrative bills falling 4.8%, helped by reductions in non-financial product gross sales, authorized provisions, and different prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on ITUB (preview of web page 1 of three proven beneath):

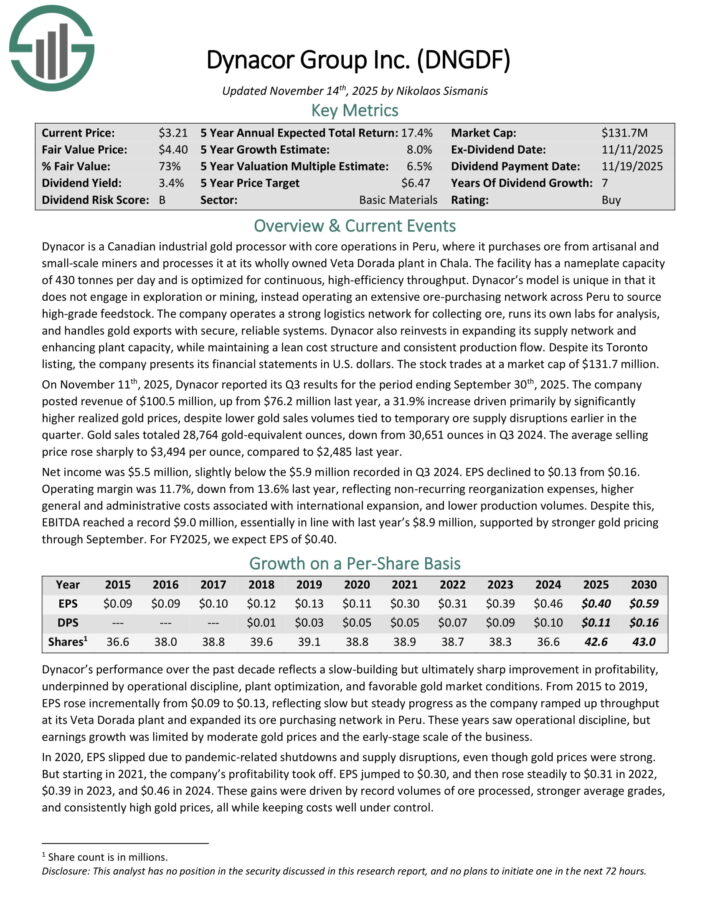

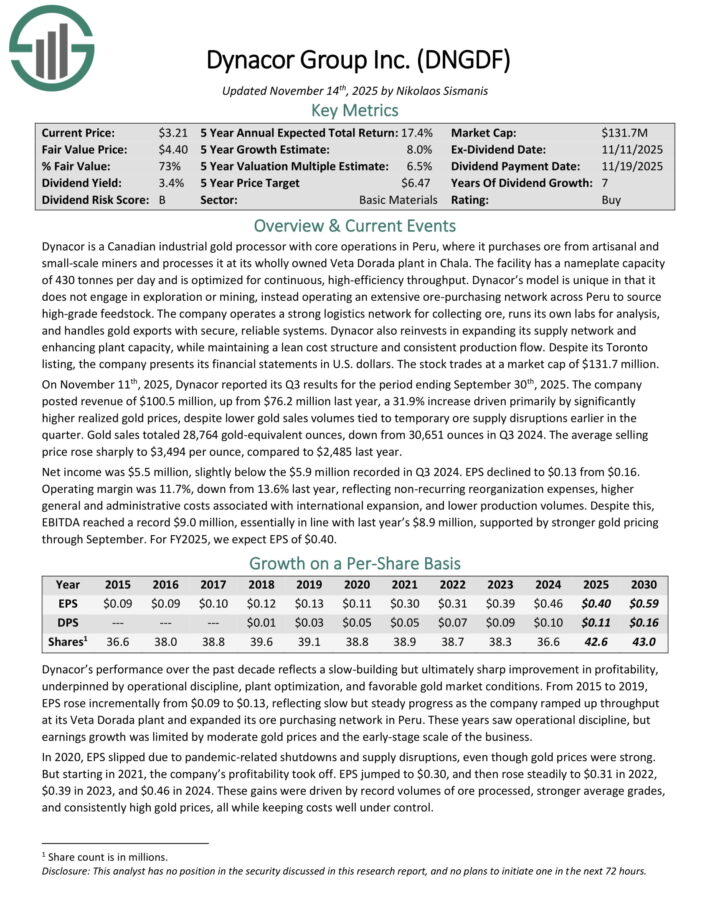

Greatest Performing Month-to-month Dividend Inventory #7: Dynacor Group (DNGDF)

- Annualized 10-12 months Whole Returns: 15.3%

Dynacor is a Canadian industrial gold processor with core operations in Peru, the place it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The ability has a nameplate capability of 430 tonnes per day and is optimized for steady, high-efficiency throughput.

Dynacor’s mannequin is exclusive in that it doesn’t interact in exploration or mining, as an alternative working an in depth ore buying community throughout Peru to supply high-grade feedstock.

The corporate operates a powerful logistics community for gathering ore, runs its personal labs for evaluation, and handles gold exports with safe, dependable techniques.

Dynacor additionally reinvests in increasing its provide community and enhancing plant capability, whereas sustaining a lean value construction and constant manufacturing circulation.

On November eleventh, 2025, Dynacor reported its Q3 outcomes. The corporate posted income of $100.5 million, up from $76.2 million final 12 months, a 31.9% improve pushed primarily by considerably increased realized gold costs, regardless of decrease gold gross sales volumes tied to momentary ore provide disruptions earlier within the quarter.

Gold gross sales totaled 28,764 gold-equivalent ounces, down from 30,651 ounces in Q3 2024. The common promoting worth rose sharply to $3,494 per ounce, in comparison with $2,485 final 12 months.

Web revenue was $5.5 million, barely beneath the $5.9 million recorded in Q3 2024. EPS declined to $0.13 from $0.16. Working margin was 11.7%, down from 13.6% final 12 months, reflecting non-recurring reorganization bills, increased normal and administrative prices related to worldwide growth, and decrease manufacturing volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on DNGDF (preview of web page 1 of three proven beneath):

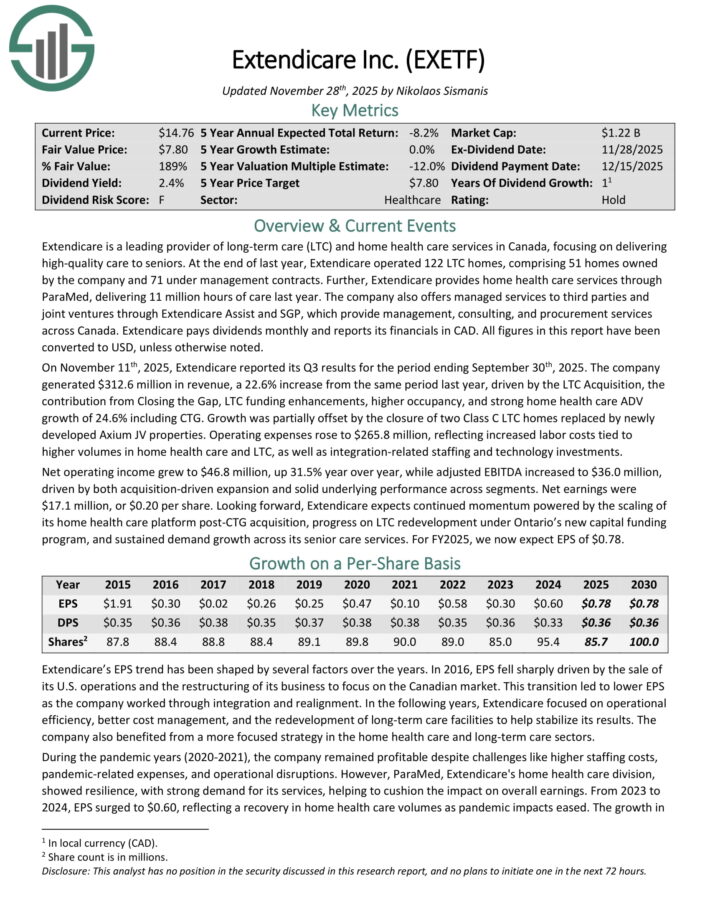

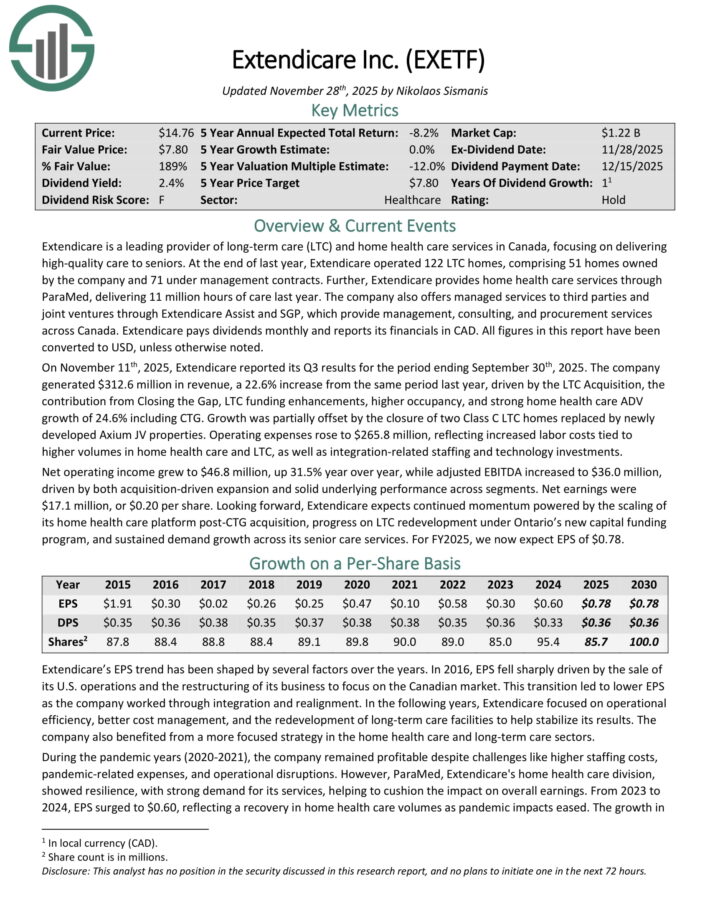

Greatest Performing Month-to-month Dividend Inventory #6: Extendicare, Inc. (EXETF)

- Annualized 10-12 months Whole Returns: 15.4%

Extendicare is a number one supplier of long-term care (LTC) and residential well being care companies in Canada, specializing in delivering high-quality care to seniors.

On the finish of final 12 months, Extendicare operated 122 LTC properties, comprising 51 properties owned by the corporate and 71 below administration contracts.

Additional, Extendicare offers residence well being care companies by ParaMed, delivering 11 million hours of care final 12 months. The corporate additionally affords managed companies to 3rd events and joint ventures by Extendicare Help and SGP, which offer administration, consulting, and procurement companies throughout Canada.

On November eleventh, 2025, Extendicare reported its Q3 outcomes for the interval ending September thirtieth, 2025. The corporate generated $312.6 million in income, a 22.6% improve from the identical interval final 12 months, pushed by the LTC Acquisition, the contribution from Closing the Hole, LTC funding enhancements, increased occupancy, and powerful residence well being care ADV development of 24.6% together with CTG.

Development was partially offset by the closure of two Class C LTC properties changed by newly developed Axium JV properties.

Working bills rose to $265.8 million, reflecting elevated labor prices tied to increased volumes in residence well being care and LTC, in addition to integration-related staffing and know-how investments.

Web working revenue grew to $46.8 million, up 31.5% 12 months over 12 months, whereas adjusted EBITDA elevated to $36.0 million, pushed by each acquisition-driven growth and stable underlying efficiency throughout segments. Web earnings had been $17.1 million, or $0.20 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on EXETF (preview of web page 1 of three proven beneath):

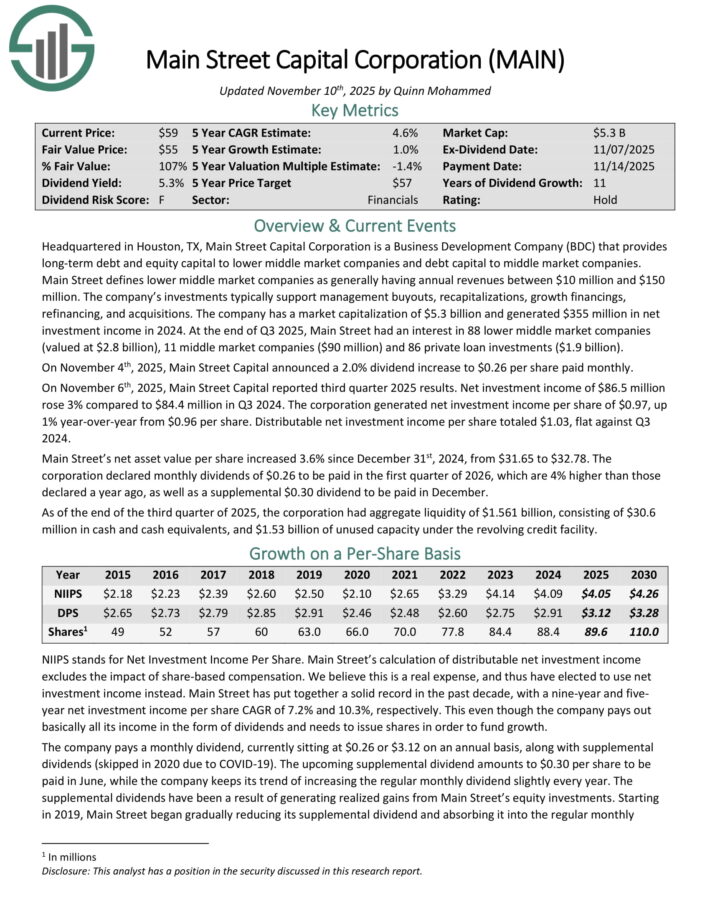

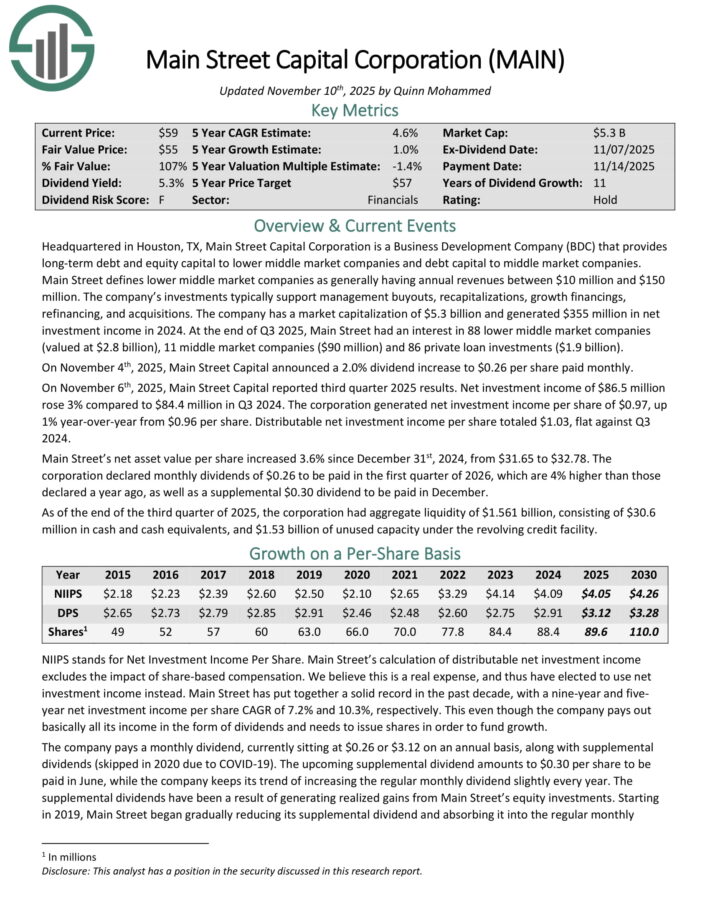

Greatest Performing Month-to-month Dividend Inventory #5: Primary Avenue Capital (MAIN)

- Annualized 10-12 months Whole Returns: 15.7%

Primary Avenue Capital Company is a Enterprise Growth Firm (BDC) that gives long-term debt and fairness capital to decrease center market corporations and debt capital to center market corporations.

Primary Avenue defines decrease center market corporations as usually having annual revenues between $10 million and $150 million.

The corporate’s investments usually assist administration buyouts, recapitalizations, development financings, refinancing, and acquisitions. The corporate has a market capitalization of $5.3 billion and generated $355 million in internet funding revenue in 2024.

On the finish of Q3 2025, Primary Avenue had an curiosity in 88 decrease center market corporations (valued at $2.8 billion), 11 center market corporations ($90 million) and 86 non-public mortgage investments ($1.9 billion).

The company had mixture liquidity of $1.561 billion, consisting of $30.6 million in money and money equivalents, and $1.53 billion of unused capability below the revolving credit score facility.

On November 4th, 2025, Primary Avenue Capital introduced a 2.0% dividend improve to $0.26 per share paid month-to-month.

On November sixth, 2025, Primary Avenue Capital reported third quarter 2025 outcomes. Web funding revenue of $86.5 million rose 3% in comparison with $84.4 million in Q3 2024.

The company generated internet funding revenue per share of $0.97, up 1% year-over-year from $0.96 per share. Distributable internet funding revenue per share totaled $1.03, flat in opposition to Q3 2024.

Primary Avenue’s internet asset worth per share elevated 3.6% since December thirty first, 2024, from $31.65 to $32.78.

The company declared month-to-month dividends of $0.26 to be paid within the first quarter of 2026, that are 4% increased than these declared a 12 months in the past, in addition to a supplemental $0.30 dividend to be paid in December.

Click on right here to obtain our most up-to-date Certain Evaluation report on MAIN (preview of web page 1 of three proven beneath):

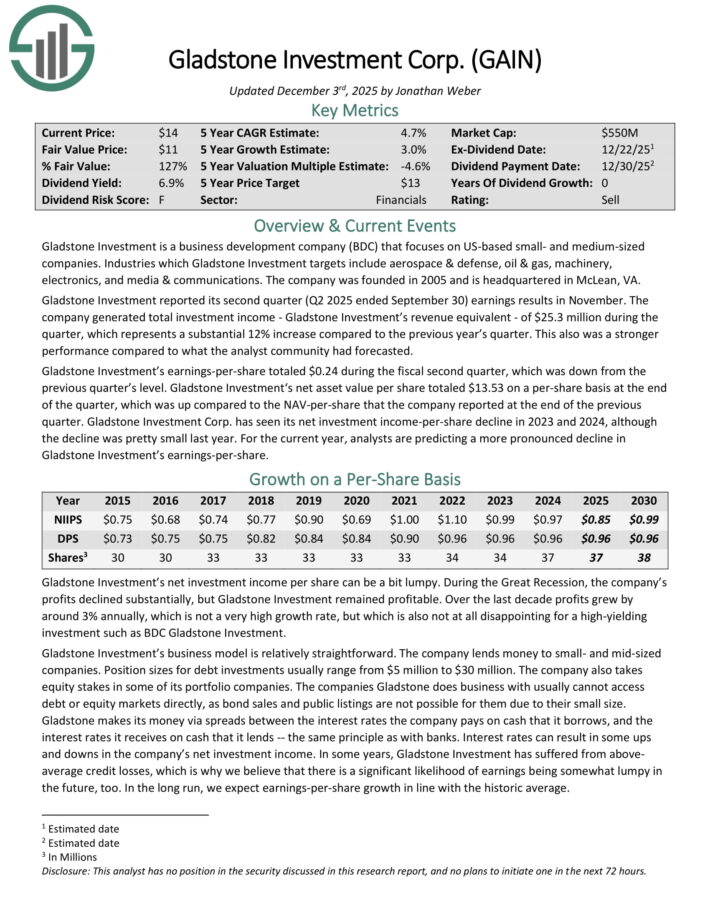

Greatest Performing Month-to-month Dividend Inventory #4: Gladstone Funding (GAIN)

- Annualized 10-12 months Whole Returns: 16.9%

Gladstone Funding is a enterprise improvement firm (BDC) that focuses on US-based small- and medium-sized corporations.

Industries which Gladstone Funding targets embody aerospace & protection, oil & gasoline, equipment, electronics, and media & communications. The corporate was based in 2005 and is headquartered in McLean, VA.

Gladstone Funding reported its second quarter (Q2 2025 ended September 30) earnings leads to November. The corporate generated whole funding revenue of $25.3 million in the course of the quarter, which represented a 12% improve year-over-year.

Gladstone Funding’s earnings-per-share totaled $0.24 in the course of the fiscal second quarter, which was down from the earlier quarter’s degree.

Gladstone Funding‘s internet asset worth per share totaled $13.53 on a per-share foundation on the finish of the quarter, which was up in comparison with the NAV-per-share that the corporate reported on the finish of the earlier quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on GAIN (preview of web page 1 of three proven beneath):

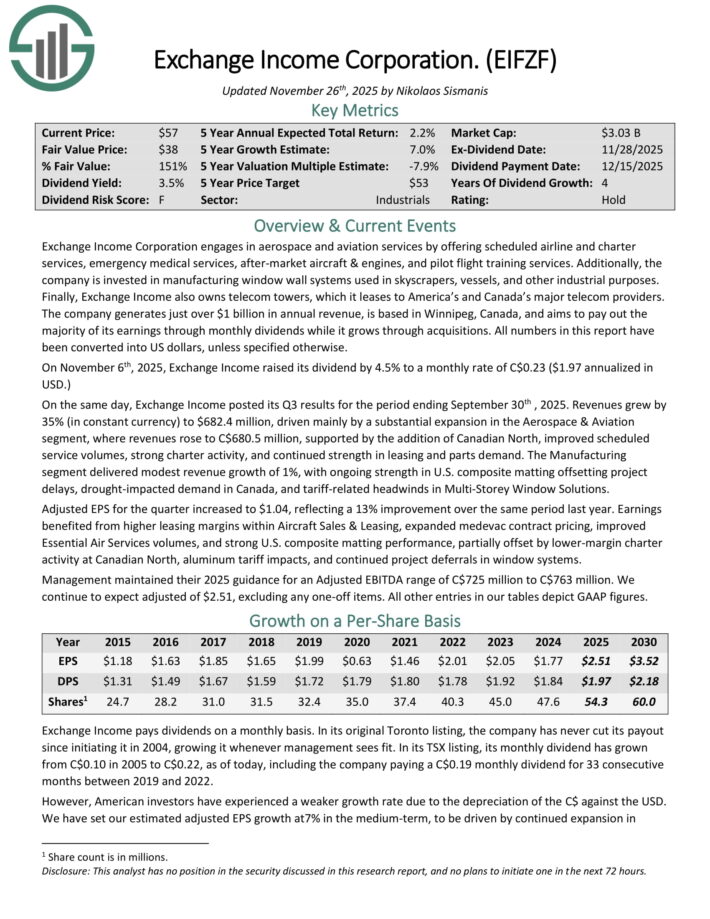

Greatest Performing Month-to-month Dividend Inventory #3: Trade Earnings Corp. (EIFZF)

- Annualized 10-12 months Whole Returns: 18.5%

Trade Earnings Company engages in aerospace and aviation companies by providing scheduled airline and constitution companies, emergency medical companies, after-market plane & engines, and pilot flight coaching companies.

Moreover, the corporate is invested in manufacturing window wall techniques utilized in skyscrapers, vessels, and different industrial functions.

Lastly, Trade Earnings additionally owns telecom towers, which it leases to America’s and Canada’s main telecom suppliers. The corporate generates simply over $1 billion in annual income.

On November sixth, 2025, Trade Earnings raised its dividend by 4.5% to a month-to-month fee of C$0.23 ($1.97 annualized in USD.) On the identical day, Trade Earnings posted its Q3 outcomes for the interval ending September thirtieth , 2025.

Income grew by 35% (in fixed foreign money) to $682.4 million, pushed primarily by a considerable growth within the Aerospace & Aviation section, the place revenues rose to C$680.5 million, supported by the addition of Canadian North, improved scheduled service volumes, sturdy constitution exercise, and continued energy in leasing and components demand.

Adjusted EPS for the quarter elevated to $1.04, reflecting a 13% enchancment over the identical interval final 12 months.

Earnings benefited from increased leasing margins inside Plane Gross sales & Leasing, expanded medevac contract pricing, improved Important Air Providers volumes, and powerful U.S. composite matting efficiency.

Click on right here to obtain our most up-to-date Certain Evaluation report on EIFZF (preview of web page 1 of three proven beneath):

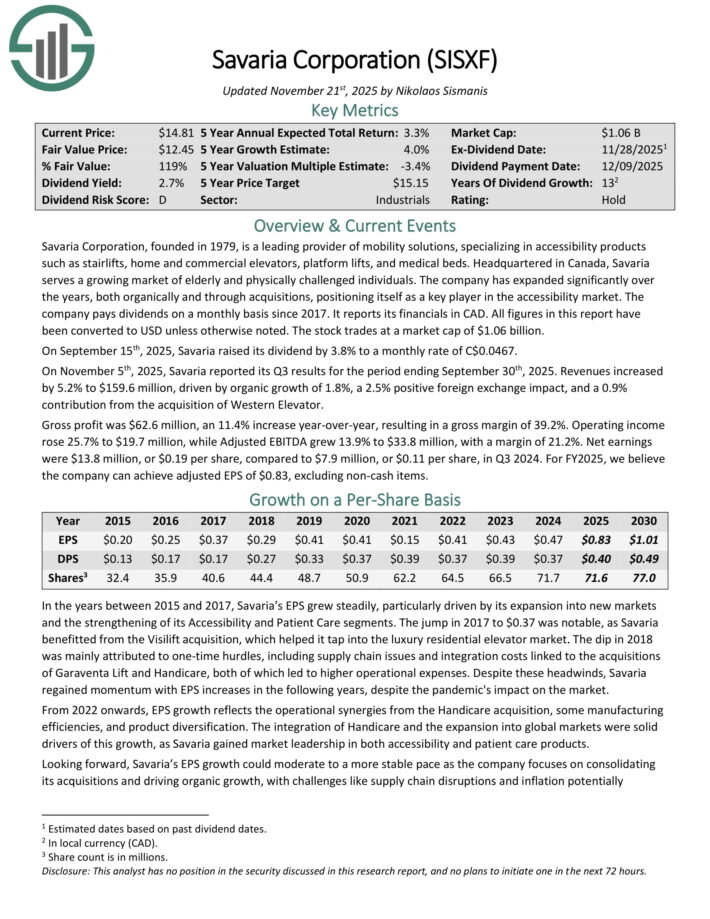

Greatest Performing Month-to-month Dividend Inventory #2: Savaria Corp. (SISXF)

- Annualized 10-12 months Whole Returns: 19.5%

Savaria Company is a number one supplier of mobility options, specializing in accessibility merchandise reminiscent of stairlifts, residence and industrial elevators, platform lifts, and medical beds.

Headquartered in Canada, Savaria serves a rising market of aged and bodily challenged people. The corporate has expanded considerably through the years, each organically and thru acquisitions, positioning itself as a key participant within the accessibility market.

On September fifteenth, 2025, Savaria raised its dividend by 3.8% to a month-to-month fee of C$0.0467. On November fifth, 2025, Savaria reported its Q3 outcomes for the interval ending September thirtieth, 2025.

Revenues elevated by 5.2% to $159.6 million, pushed by natural development of 1.8%, a 2.5% optimistic international trade influence, and a 0.9% contribution from the acquisition of Western Elevator.

Gross revenue was $62.6 million, an 11.4% improve year-over-year, leading to a gross margin of 39.2%. Working revenue rose 25.7% to $19.7 million, whereas Adjusted EBITDA grew 13.9% to $33.8 million, with a margin of 21.2%. Web earnings had been $13.8 million, or $0.19 per share, in comparison with $7.9 million, or $0.11 per share, in Q3 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on SISXF (preview of web page 1 of three proven beneath):

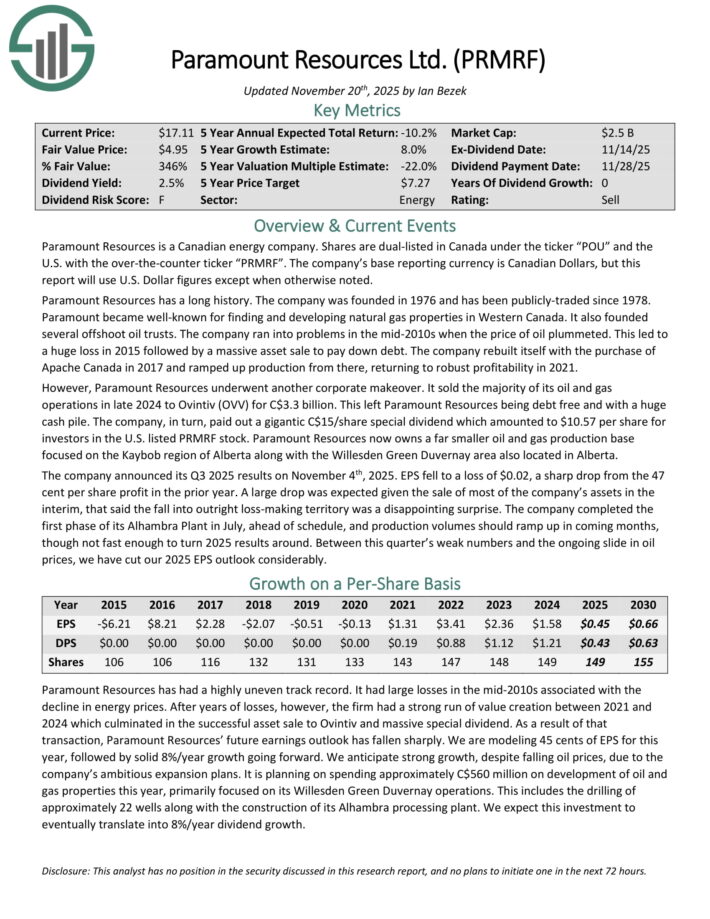

Greatest Performing Month-to-month Dividend Inventory #1: Paramount Assets (PRMRF)

- Annualized 10-12 months Whole Returns: 24.4%

Paramount Assets is a Canadian vitality firm. Paramount Assets has a protracted historical past. The corporate was based in 1976 and has been publicly-traded since 1978.

Paramount Assets now owns a much smaller oil and gasoline manufacturing base centered on the Kaybob area of Alberta together with the Willesden Inexperienced Duvernay space additionally situated in Alberta.

The corporate introduced its Q3 2025 outcomes on November 4th, 2025. EPS fell to a lack of $0.02, a pointy drop from the 47 cent per share revenue within the prior 12 months.

A big drop was anticipated given the sale of many of the firm’s belongings within the interim, that stated the autumn into outright loss-making territory was a disappointing shock.

The corporate accomplished the primary section of its Alhambra Plant in July, forward of schedule, and manufacturing volumes ought to ramp up in coming months.

It’s planning on spending roughly C$560 million on improvement of oil and gasoline properties this 12 months, primarily centered on its Willesden Inexperienced Duvernay operations.

This contains the drilling of roughly 22 wells together with the development of its Alhambra processing plant.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRMRF (preview of web page 1 of three proven beneath):

Additional Studying

In case you are keen on discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources will likely be helpful:

Month-to-month Dividend Inventory Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].