Revealed on November 4th, 2025 by Bob Ciura

One of many large benefits of dividend progress investing is that it reduces threat and funding errors by focusing solely on shares that pay rising dividends.

Investing in high quality shares – and particularly dividend progress shares – provides threat discount based mostly on the character of the funding.

Shopping for a portfolio of high quality dividend shares results in diversification. Diversification reduces threat mathematically; when you have solely 5% of your portfolio in a inventory, you may’t lose greater than 5% in that inventory.

Dividend progress shares characterize confirmed companies. The longer an organization’s dividend streak, the extra it demonstrates its capacity to generate precise money and return it to shareholders.

This is the reason we advocate shares with a minimum of 10+ consecutive years of dividend will increase, which we name ‘blue chip’ shares.

You’ll be able to obtain our free blue chip shares checklist with vital monetary metrics, similar to dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Blue-chip shares are established, financially sturdy, and constantly worthwhile publicly traded firms.

By specializing in high quality companies that return money to shareholder by means of dividends, you may scale back errors and profit from compounding dividend revenue over time.

The next 10 blue chip shares have improve their dividends for a minimum of 10 years, have Dividend Danger Scores of ‘A’ or ‘B’ within the Certain Evaluation Analysis Database, and have present yields above 3%.

The ten blue chip shares are sorted by dividend yield, from lowest to highest.

Desk of Contents

The desk of contents beneath permits for straightforward navigation.

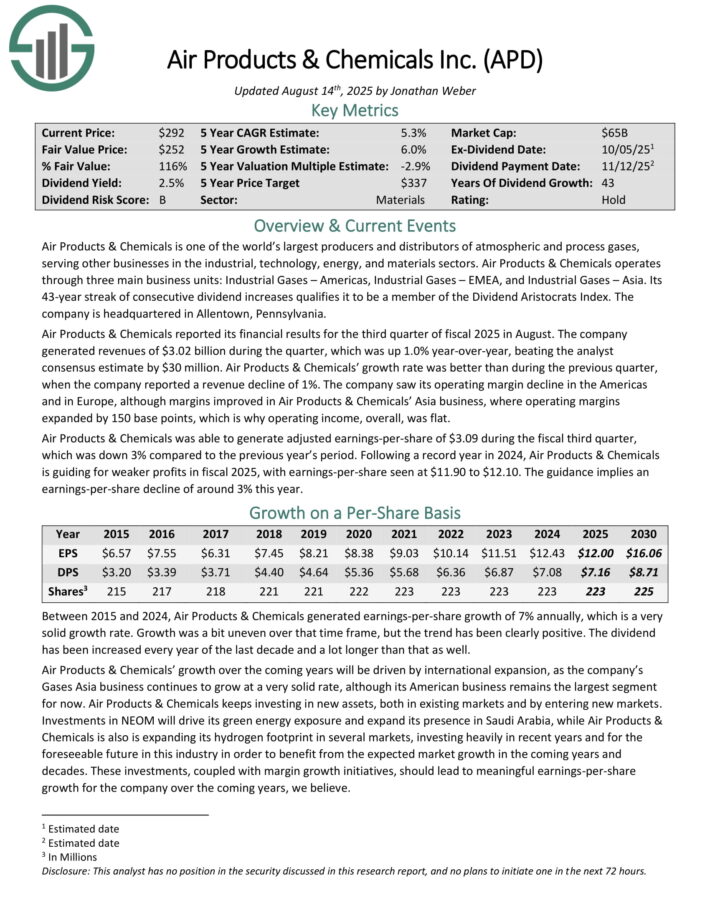

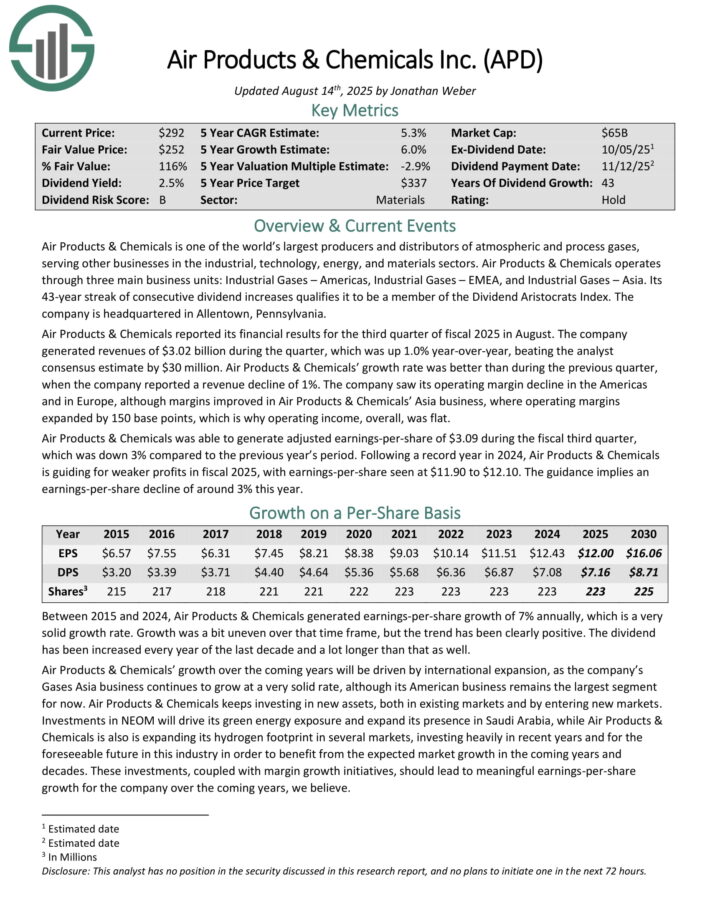

Dividend Inventory To Cut back Danger: Air Merchandise & Chemical substances (APD)

Air Merchandise & Chemical substances is likely one of the world’s largest producers and distributors of atmospheric and course of gases, serving different companies within the industrial, know-how, power, and supplies sectors.

Air Merchandise & Chemical substances operates by means of three essential enterprise models: Industrial Gases – Americas, Industrial Gases – EMEA, and Industrial Gases – Asia.

Its 43-year streak of consecutive dividend will increase qualifies it to be a member of the Dividend Aristocrats Index.

Air Merchandise & Chemical substances reported its monetary outcomes for the third quarter of fiscal 2025 in August. The corporate generated revenues of $3.02 billion through the quarter, which was up 1.0% year-over-year, beating the analyst consensus estimate by $30 million.

The corporate noticed its working margin decline within the Americas and in Europe, though margins improved in Air Merchandise & Chemical substances’ Asia enterprise, the place working margins expanded by 150 base factors, which is why working revenue, general, was flat.

Air Merchandise & Chemical substances was capable of generate adjusted earnings-per-share of $3.09 through the fiscal third quarter, which was down 3% in comparison with the earlier 12 months’s interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on APD (preview of web page 1 of three proven beneath):

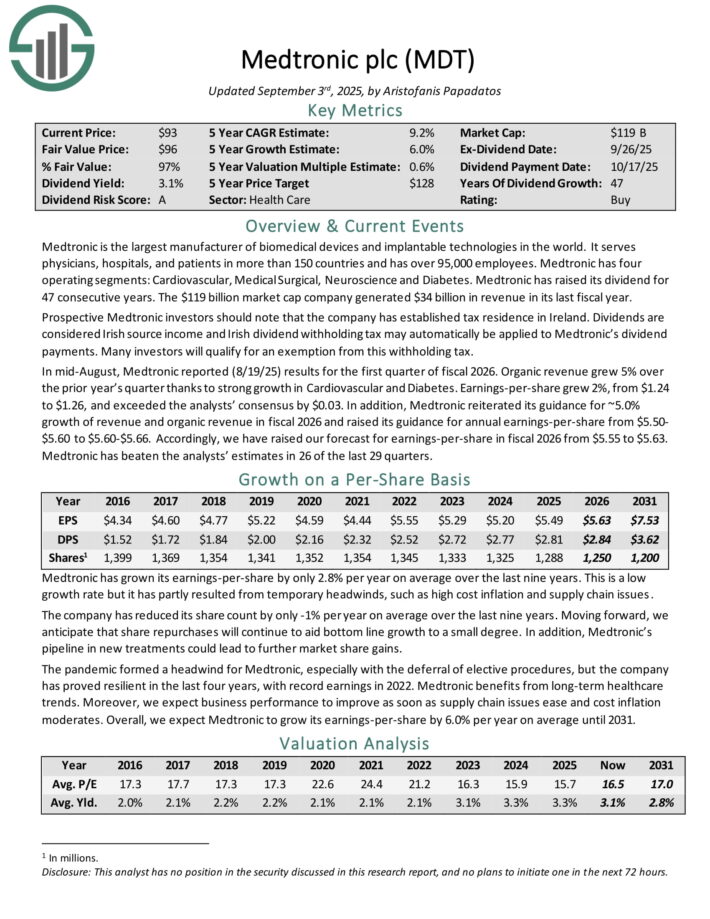

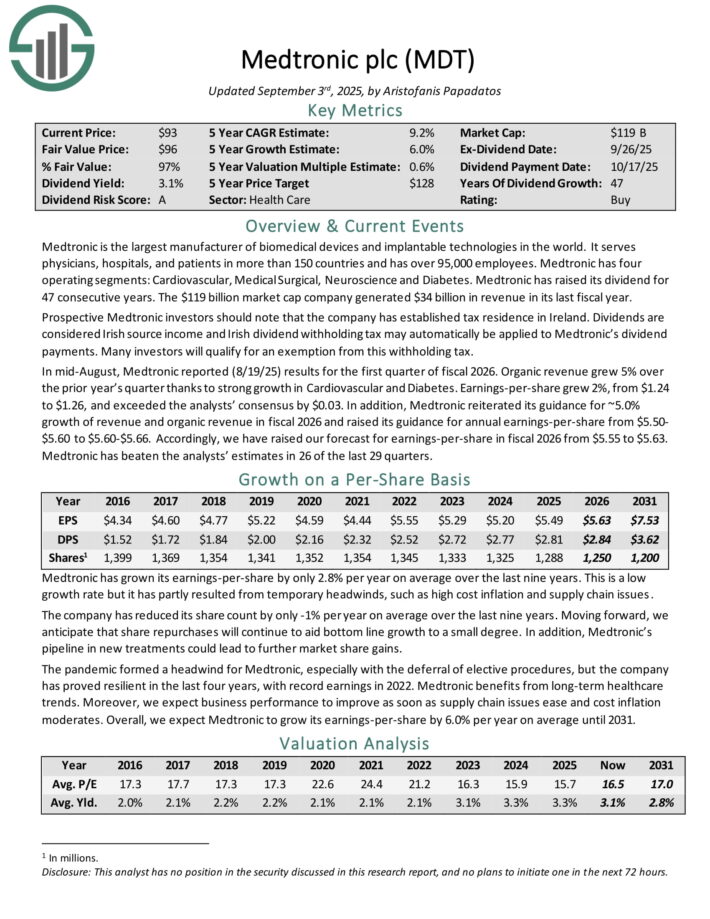

Dividend Inventory To Cut back Danger: Medtronic plc (MDT)

Medtronic is the biggest producer of biomedical gadgets and implantable applied sciences on the planet. It serves physicians, hospitals, and sufferers in additional than 150 nations and has over 95,000 workers.

Medtronic has 4 working segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 47 consecutive years. The corporate generated $34 billion in income in its final fiscal 12 months.

In mid-August, Medtronic reported (8/19/25) outcomes for the primary quarter of fiscal 2026. Natural income grew 5% over the prior 12 months’s quarter because of sturdy progress in Cardiovascular and Diabetes. Earnings-per-share grew 2%, from $1.24 to $1.26, and exceeded the analysts’ consensus by $0.03.

As well as, Medtronic reiterated its steerage for ~5.0% progress of income and natural income in fiscal 2026 and raised its steerage for annual earnings-per-share from $5.50-$5.60 to $5.60-$5.66.

Click on right here to obtain our most up-to-date Certain Evaluation report on MDT (preview of web page 1 of three proven beneath):

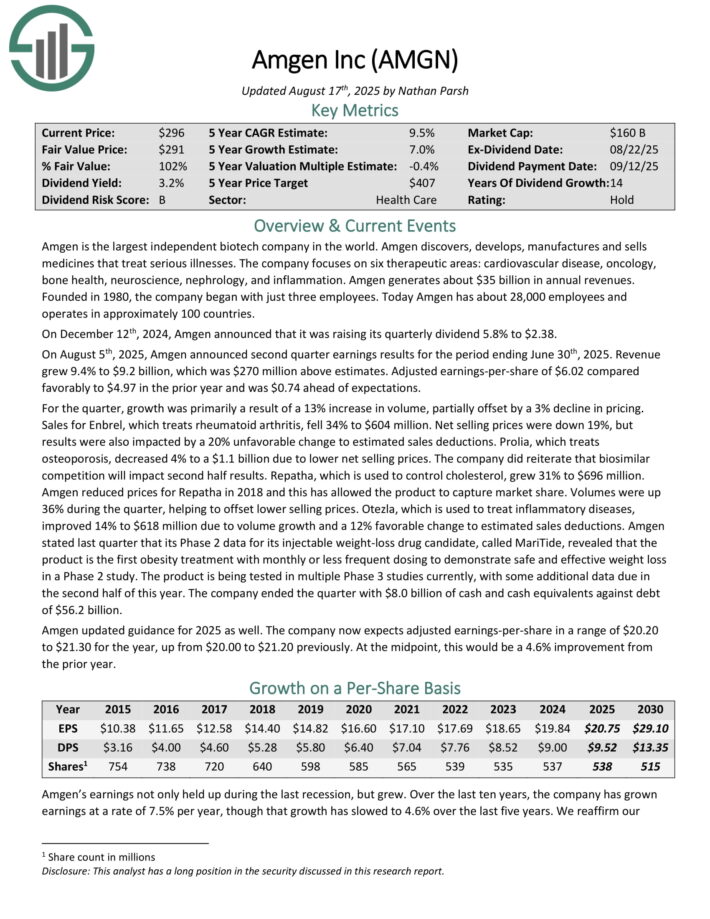

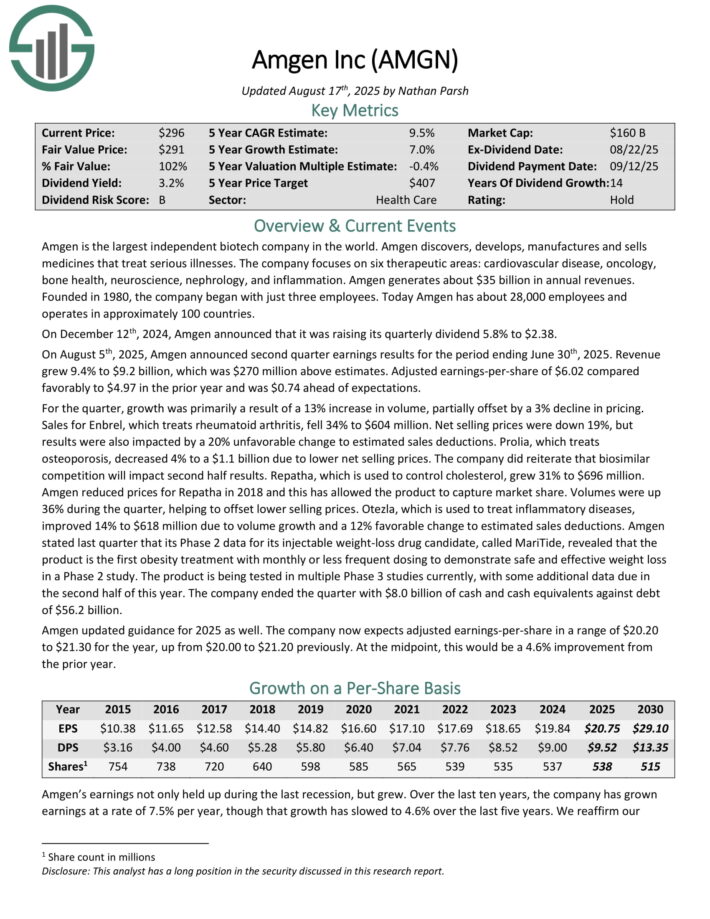

Dividend Inventory To Cut back Danger: AMGEN Inc. (AMGN)

Amgen is the biggest unbiased biotech firm on the planet. Amgen discovers, develops, manufactures and sells medicines that deal with critical sicknesses. The corporate focuses on six therapeutic areas: heart problems, oncology, bone well being, neuroscience, nephrology, and irritation. Amgen generates about $35 billion in annual revenues.

On August fifth, 2025, Amgen introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. Income grew 9.4% to $9.2 billion, which was $270 million above estimates. Adjusted earnings-per-share of $6.02 in contrast favorably to $4.97 within the prior 12 months and was $0.74 forward of expectations.

For the quarter, progress was primarily a results of a 13% improve in quantity, partially offset by a 3% decline in pricing. Gross sales for Enbrel, which treats rheumatoid arthritis, fell 34% to $604 million. Web promoting costs had been down 19%, however outcomes had been additionally impacted by a 20% unfavorable change to estimated gross sales deductions.

Prolia, which treats osteoporosis, decreased 4% to a $1.1 billion attributable to decrease web promoting costs. The corporate did reiterate that biosimilar competitors will impression second half outcomes. Repatha, which is used to manage ldl cholesterol, grew 31% to $696 million.

Amgen acknowledged final quarter that its Part 2 knowledge for its injectable weight-loss drug candidate, referred to as MariTide, revealed that the product is the primary weight problems remedy with month-to-month or much less frequent dosing to exhibit protected and efficient weight reduction in a Part 2 research.

The product is being examined in a number of Part 3 research presently, with some further knowledge due within the second half of this 12 months. The corporate ended the quarter with $8.0 billion of money and money equivalents in opposition to debt of $56.2 billion.

Amgen up to date steerage for 2025 as nicely. The corporate now expects adjusted earnings-per-share in a spread of $20.20 to $21.30 for the 12 months, up from $20.00 to $21.20 beforehand. On the midpoint, this is able to be a 4.6% enchancment from the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on AMGN (preview of web page 1 of three proven beneath):

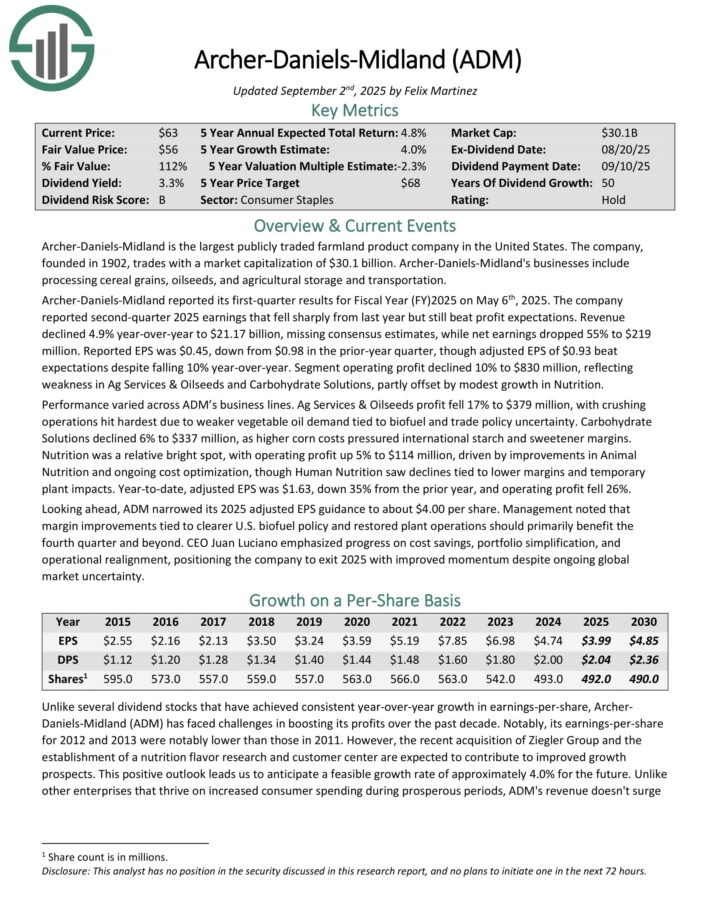

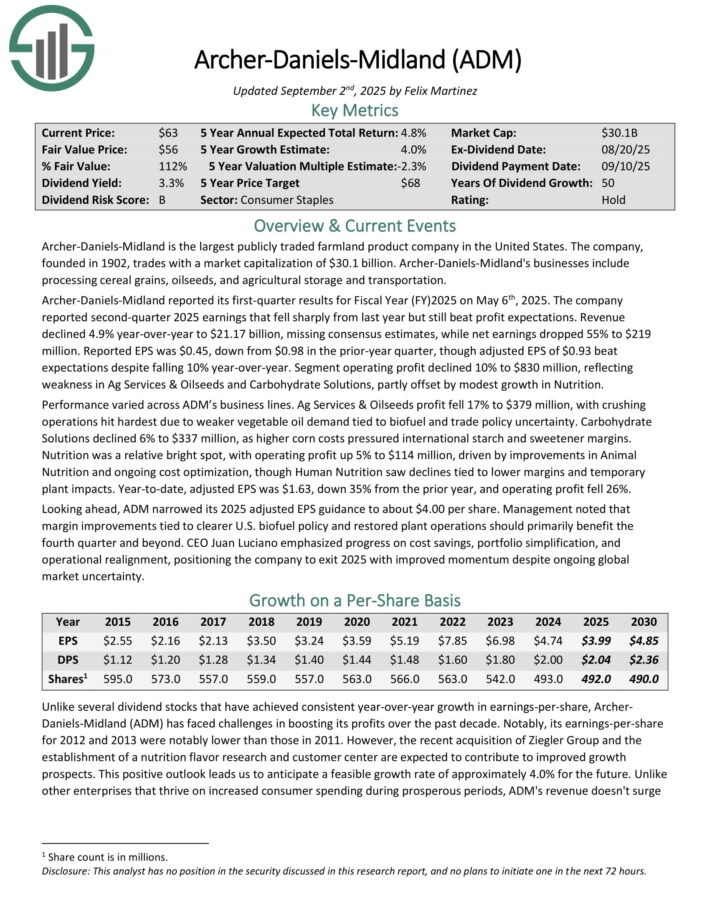

Dividend Inventory To Cut back Danger: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the biggest publicly traded farmland product firm in america. Its companies embody processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its first-quarter outcomes for Fiscal 12 months (FY)2025 on Might sixth, 2025. The corporate reported second-quarter 2025 earnings that fell sharply from final 12 months however nonetheless beat revenue expectations. Income declined 4.9% year-over-year to $21.17 billion, lacking consensus estimates, whereas web earnings dropped 55% to $219 million.

Reported EPS was $0.45, down from $0.98 within the prior-year quarter, although adjusted EPS of $0.93 beat expectations regardless of falling 10% year-over-year. Section working revenue declined 10% to $830 million, reflecting weak point in Ag Providers & Oilseeds and Carbohydrate Options, partly offset by modest progress in Vitamin.

Efficiency different throughout ADM’s enterprise traces. Ag Providers & Oilseeds revenue fell 17% to $379 million, with crushing operations hit hardest attributable to weaker vegetable oil demand tied to biofuel and commerce coverage uncertainty. Carbohydrate Options declined 6% to $337 million, as increased corn prices pressured worldwide starch and sweetener margins.

Vitamin was a relative vivid spot, with working revenue up 5% to $114 million, pushed by enhancements in Animal

Vitamin and ongoing value optimization, although Human Vitamin noticed declines tied to decrease margins and short-term

plant impacts. 12 months-to-date, adjusted EPS was $1.63, down 35% from the prior 12 months, and working revenue fell 26%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADM (preview of web page 1 of three proven beneath):

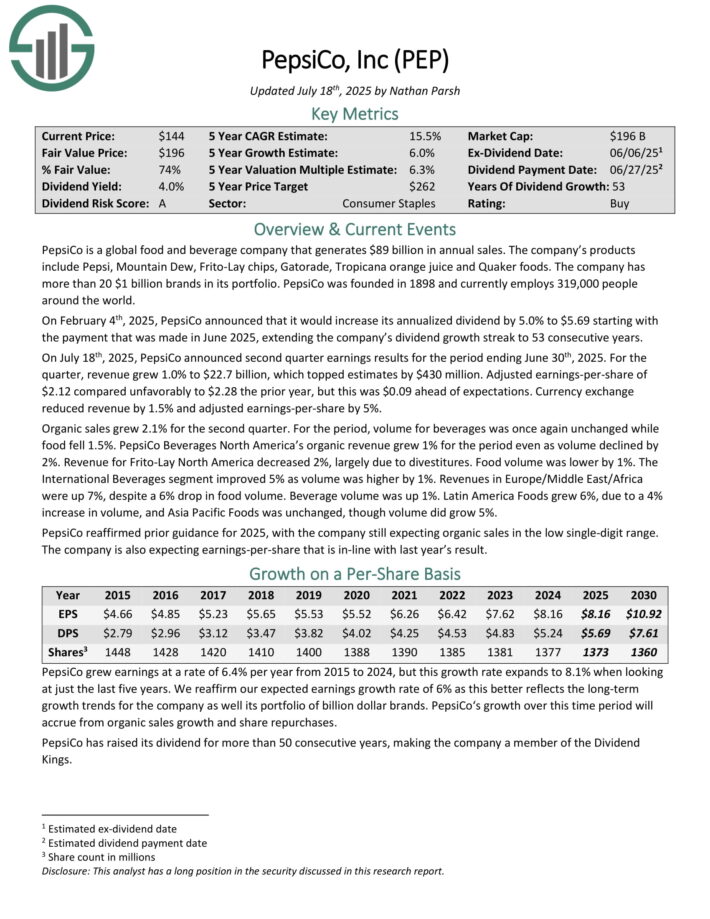

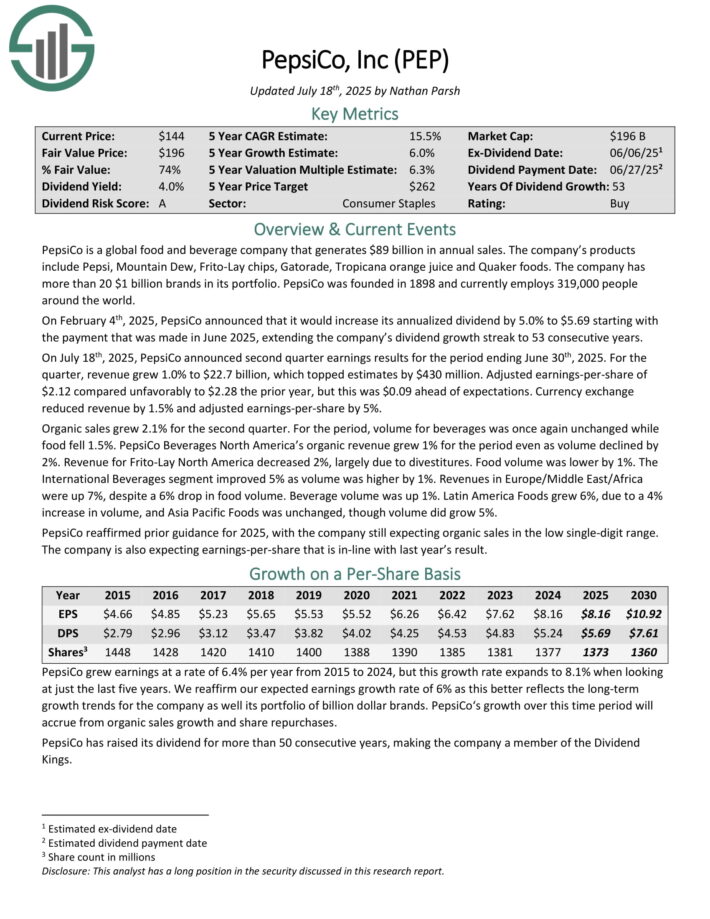

Dividend Inventory To Cut back Danger: PepsiCo Inc. (PEP)

PepsiCo is a worldwide meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

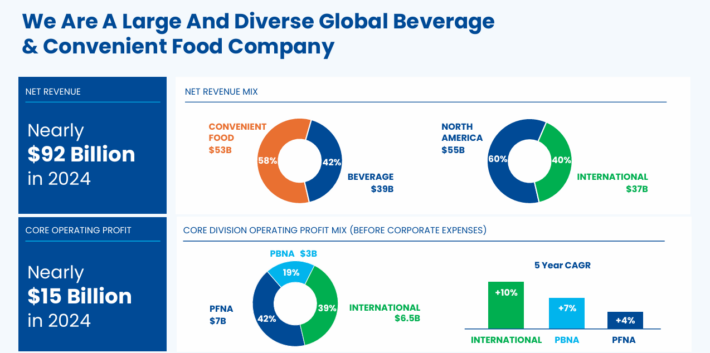

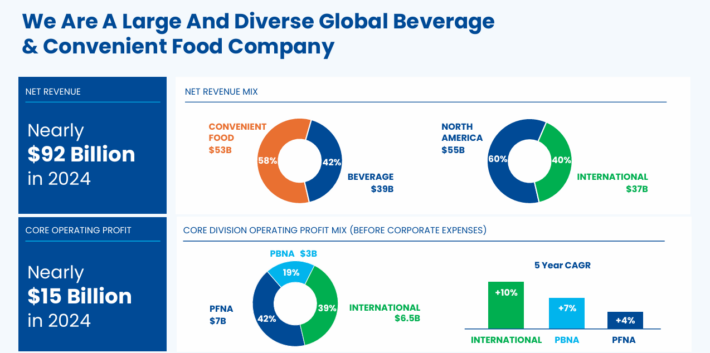

Its enterprise is cut up roughly 60-40 when it comes to meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior 12 months, however this was $0.09 forward of expectations. Foreign money change decreased income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven beneath):

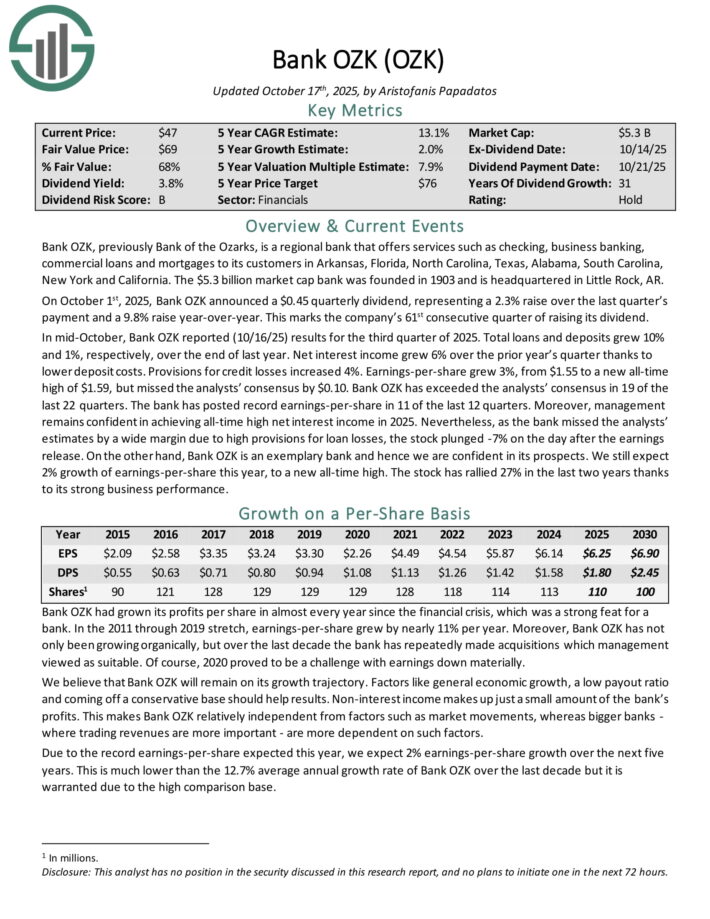

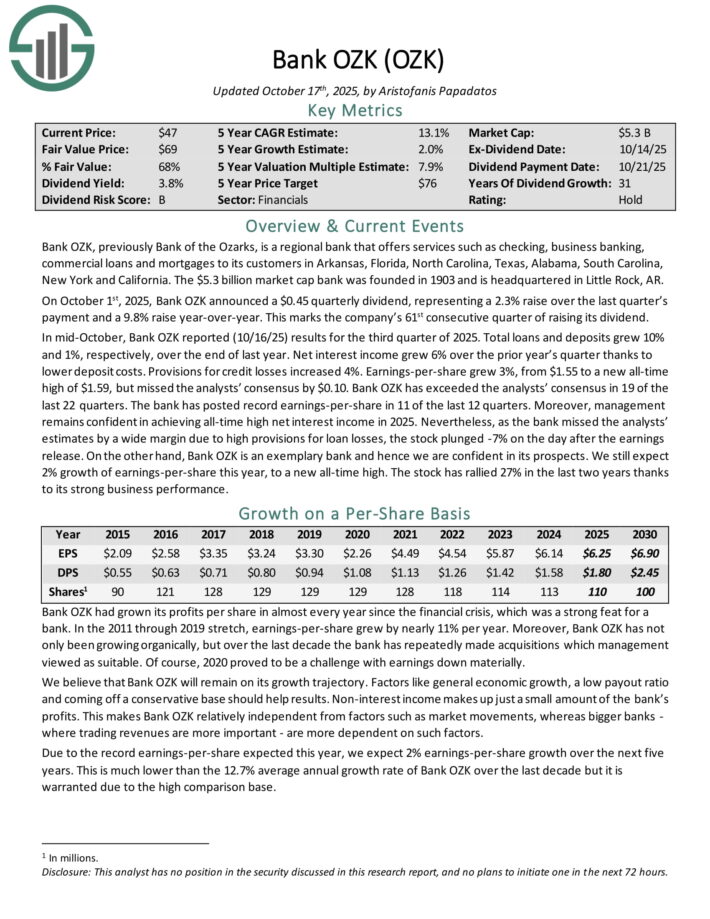

Dividend Inventory To Cut back Danger: Financial institution OZK (OZK)

Financial institution OZK, beforehand Financial institution of the Ozarks, is a regional financial institution that gives companies similar to checking, enterprise banking, industrial loans and mortgages to its clients in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California.

On October 1st, 2025, Financial institution OZK introduced a $0.45 quarterly dividend, representing a 2.3% elevate over the past quarter’s fee and a 9.8% elevate year-over-year. This marks the corporate’s 61st consecutive quarter of elevating its dividend.

In mid-October, Financial institution OZK reported (10/16/25) outcomes for the third quarter of 2025. Whole loans and deposits grew 10% and 1%, respectively, over the top of final 12 months. Web curiosity revenue grew 6% over the prior 12 months’s quarter because of decrease deposit prices. Provisions for credit score losses elevated 4%.

Earnings-per-share grew 3%, from $1.55 to a brand new all-time excessive of $1.59, however missed the analysts’ consensus by $0.10. Financial institution OZK has exceeded the analysts’ consensus in 19 of the final 22 quarters. The financial institution has posted file earnings-per-share in 11 of the final 12 quarters.

Furthermore, administration stays assured in attaining all-time excessive web curiosity revenue in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on OZK (preview of web page 1 of three proven beneath):

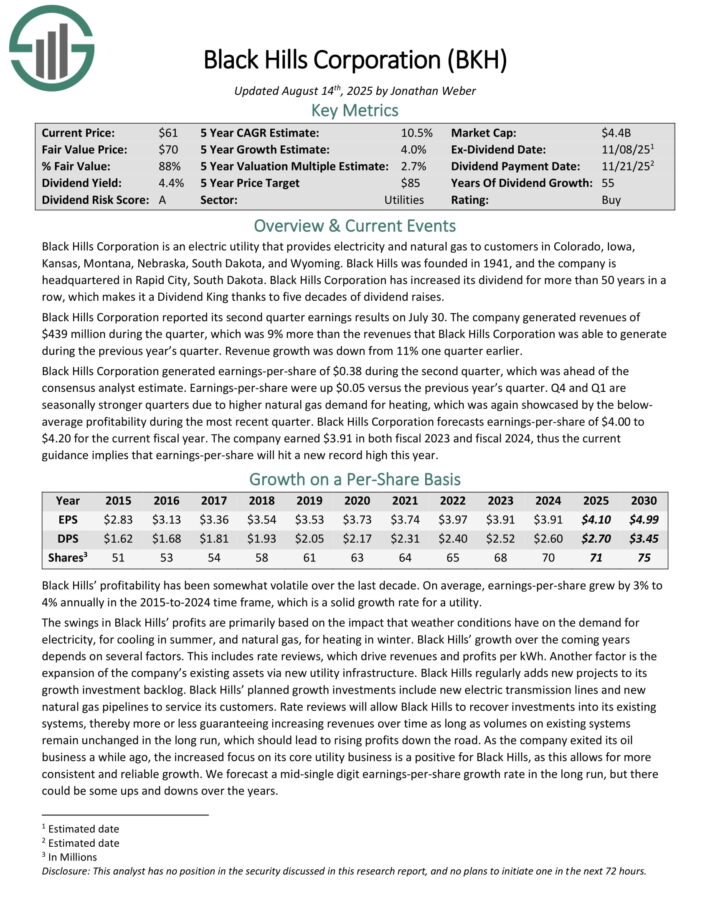

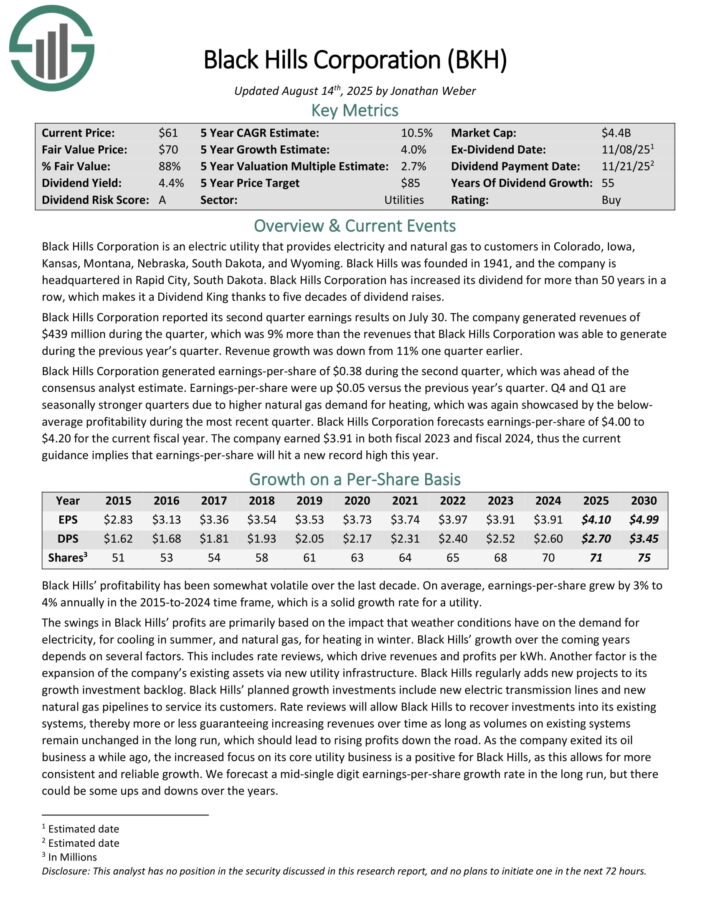

Dividend Inventory To Cut back Danger: Black Hills Company (BKH)

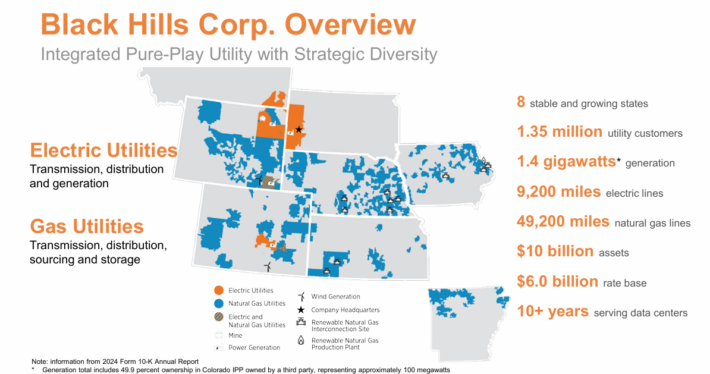

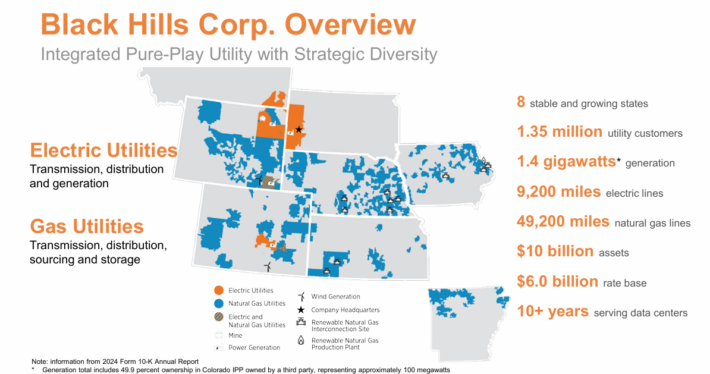

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility clients in eight states. Its pure gasoline property embody 49,200 miles of pure gasoline traces. Individually, it has ~9,200 miles of electrical traces and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Black Hills Company reported its second quarter earnings outcomes on July 30. The corporate generated revenues of $439 million through the quarter, up 9% year-over-year.

Black Hills Company generated earnings-per-share of $0.38 through the second quarter, which was forward of the consensus analyst estimate.

Earnings-per-share had been up $0.05 versus the earlier 12 months’s quarter. This fall and Q1 are seasonally stronger quarters attributable to increased pure gasoline demand for heating.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

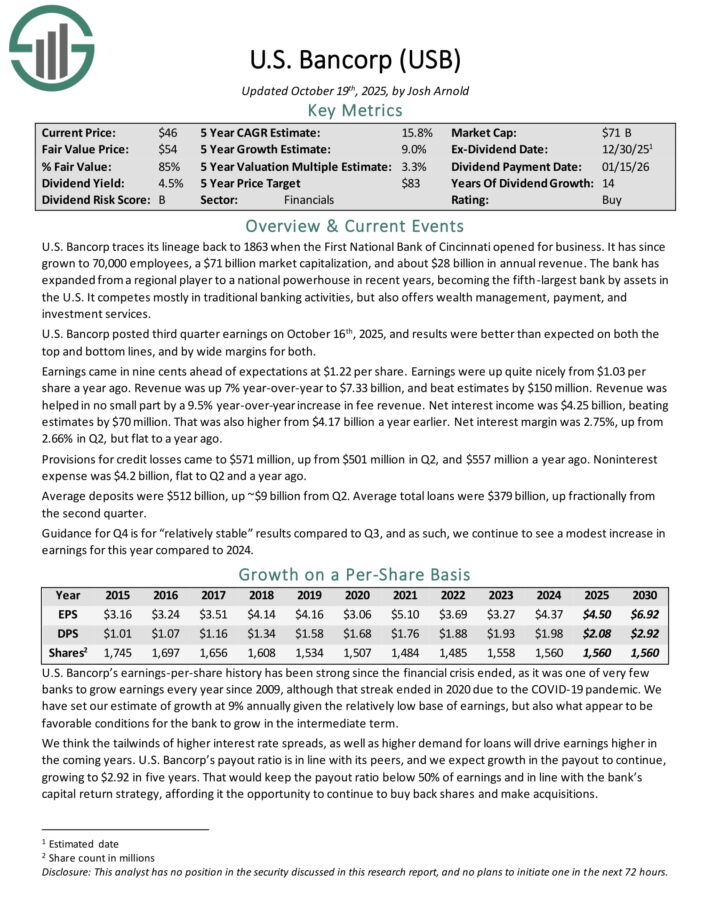

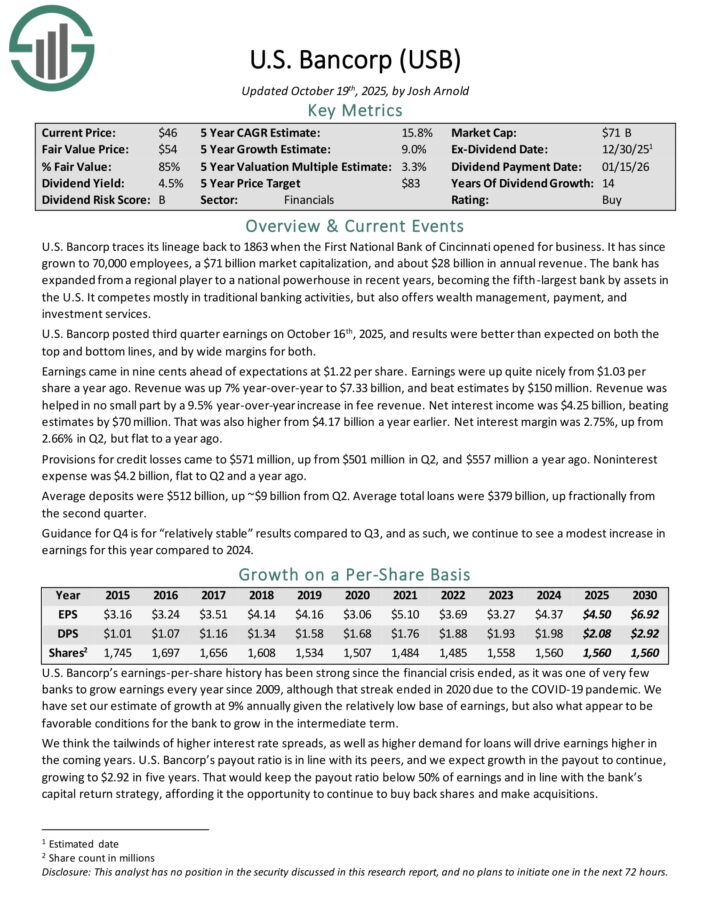

Dividend Inventory To Cut back Danger: U.S. Bancorp (USB)

U.S. Bancorp traces its lineage again to 1863 when the First Nationwide Financial institution of Cincinnati opened for enterprise. It has since grown to 70,000 workers, and about $28 billion in annual income.

The financial institution has expanded from a regional participant to a nationwide powerhouse in recent times, changing into the fifth-largest financial institution by property within the U.S. It competes principally in conventional banking actions, but additionally provides wealth administration, fee, and funding companies.

U.S. Bancorp posted third quarter earnings on October sixteenth, 2025, and outcomes had been higher than anticipated on each the highest and backside traces, and by vast margins for each.

Earnings got here in 9 cents forward of expectations at $1.22 per share. Earnings had been up fairly properly from $1.03 per share a 12 months in the past. Income was up 7% year-over-year to $7.33 billion, and beat estimates by $150 million. Income was helped in no small half by a 9.5% year-over-year improve in charge income.

Web curiosity revenue was $4.25 billion, beating estimates by $70 million. That was additionally increased from $4.17 billion a 12 months earlier. Web curiosity margin was 2.75%, up from 2.66% in Q2, however flat to a 12 months in the past.

Provisions for credit score losses got here to $571 million, up from $501 million in Q2, and $557 million a 12 months in the past. Noninterest expense was $4.2 billion, flat to Q2 and a 12 months in the past.

Common deposits had been $512 billion, up ~$9 billion from Q2. Common whole loans had been $379 billion, up fractionally from the second quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on USB (preview of web page 1 of three proven beneath):

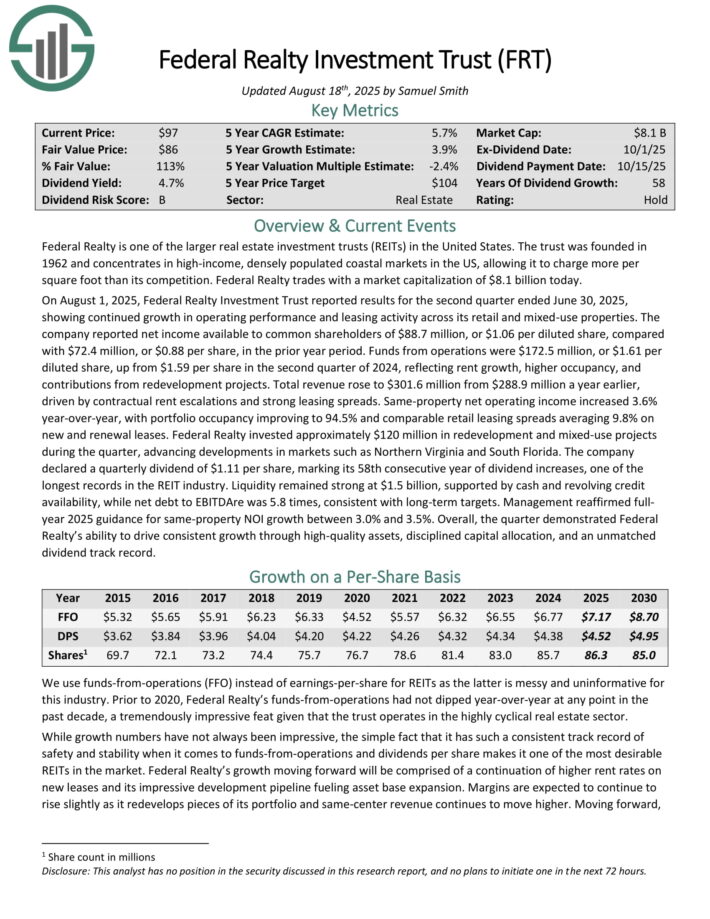

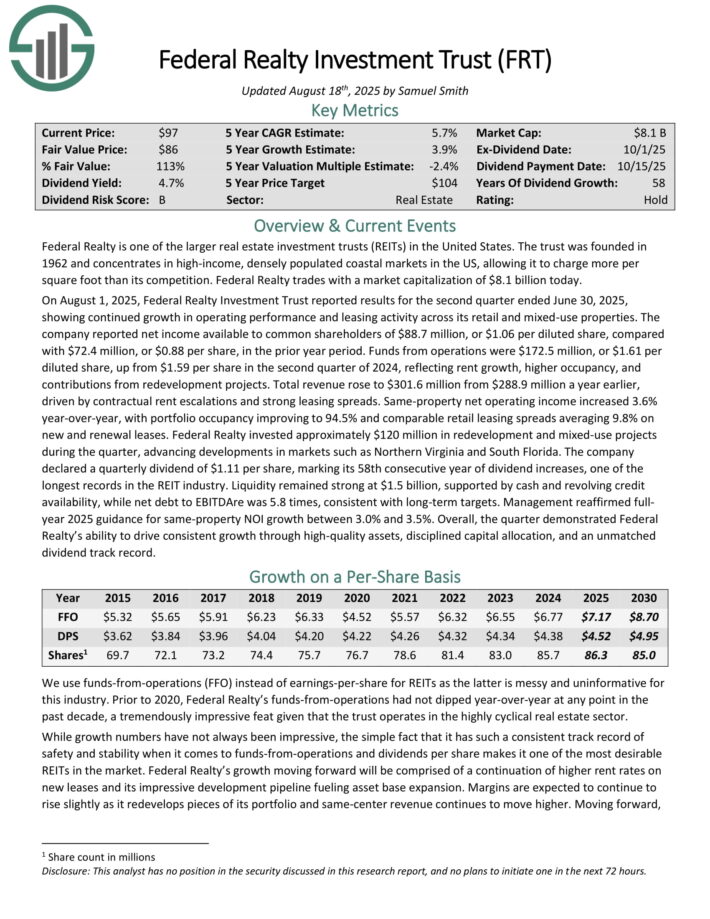

Dividend Inventory To Cut back Danger: Federal Realty Funding Belief (FRT)

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and hire out actual property properties.

It makes use of a good portion of its rental revenue, in addition to exterior financing, to accumulate new properties.

On August 1, 2025, Federal Realty Funding Belief reported outcomes for the second quarter. The corporate reported web revenue accessible to frequent shareholders of $88.7 million, or $1.06 per diluted share, in contrast with $72.4 million, or $0.88 per share, within the prior 12 months interval.

Funds from operations had been $172.5 million, or $1.61 per diluted share, up from $1.59 per share within the second quarter of 2024, reflecting hire progress, increased occupancy, and contributions from redevelopment tasks.

Whole income rose to $301.6 million from $288.9 million a 12 months earlier, pushed by contractual hire escalations and powerful leasing spreads.

Similar-property web working revenue elevated 3.6% year-over-year, with portfolio occupancy bettering to 94.5% and comparable retail leasing spreads averaging 9.8% on new and renewal leases.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

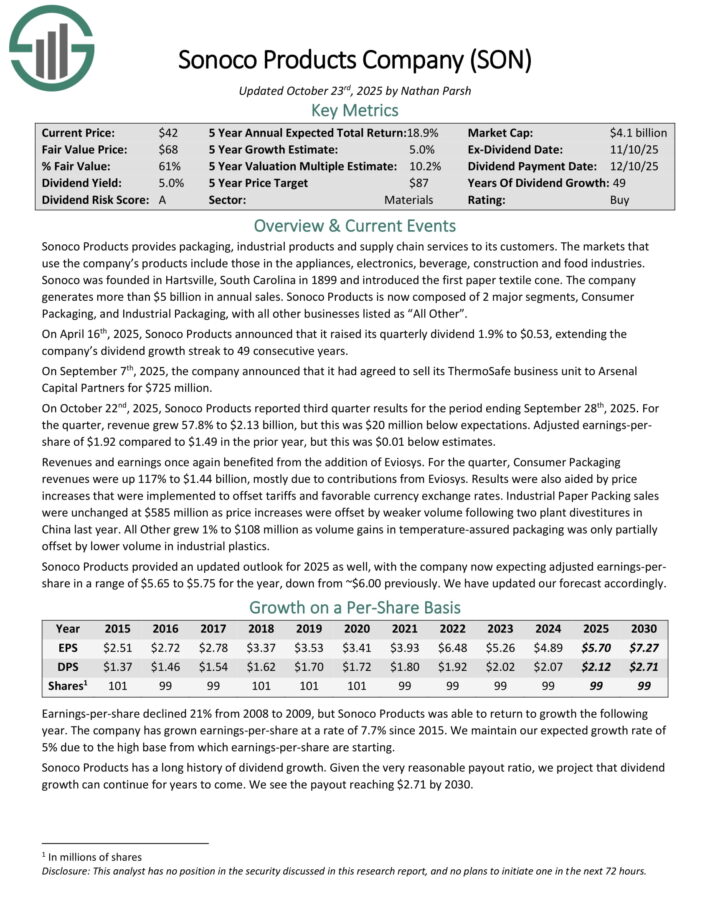

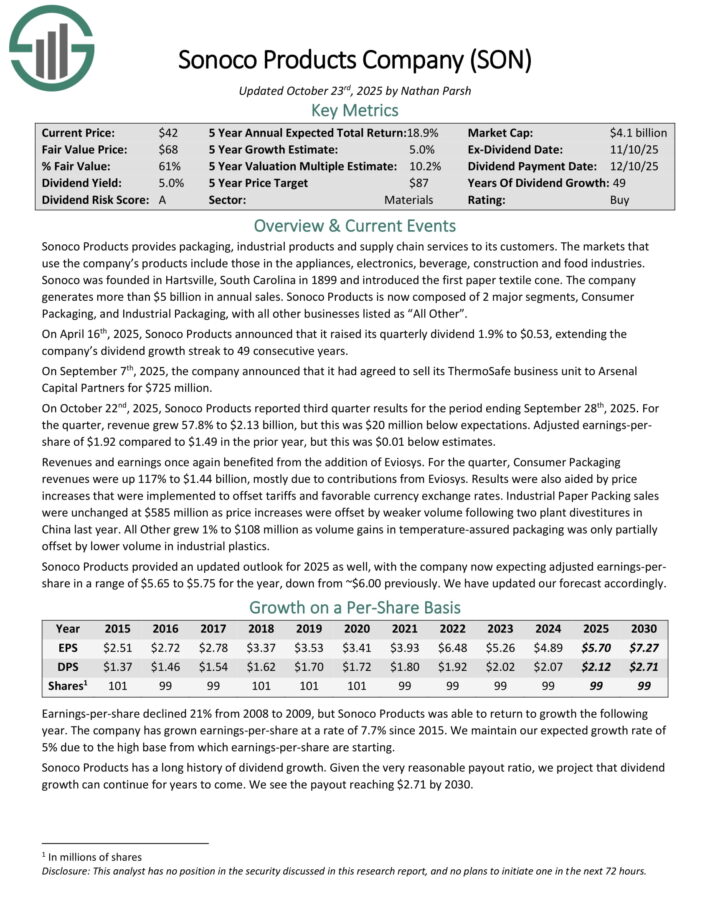

Dividend Inventory To Cut back Danger: Sonoco Merchandise (SON)

Sonoco Merchandise offers packaging, industrial merchandise and provide chain companies to its clients. The markets that use the corporate’s merchandise embody these within the home equipment, electronics, beverage, development and meals industries.

The corporate generates greater than $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On October twenty second, 2025, Sonoco Merchandise reported third quarter outcomes for the interval ending September twenty eighth, 2025. For the quarter, income grew 57.8% to $2.13 billion, however this was $20 million beneath expectations. Adjusted earnings-per-share of $1.92 in comparison with $1.49 within the prior 12 months, however this was $0.01 beneath estimates.

Revenues and earnings as soon as once more benefited from the addition of Eviosys. For the quarter, Shopper Packaging revenues had been up 117% to $1.44 billion, principally attributable to contributions from Eviosys. Outcomes had been additionally aided by value will increase that had been applied to offset tariffs and favorable forex change charges.

Industrial Paper Packing gross sales had been unchanged at $585 million as value will increase had been offset by weaker quantity following two plant divestitures in China final 12 months. All Different grew 1% to $108 million as quantity positive aspects in temperature-assured packaging was solely partially offset by decrease quantity in industrial plastics.

Sonoco Merchandise offered an up to date outlook for 2025 as nicely, with the corporate now anticipating adjusted earnings-per-share in a spread of $5.65 to $5.75 for the 12 months, down from ~$6.00 beforehand.

Click on right here to obtain our most up-to-date Certain Evaluation report on SON (preview of web page 1 of three proven beneath):

Extra Studying

In case you are all in favour of discovering different high quality dividend progress shares, the next Certain Dividend assets could also be helpful:

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].