Printed on September thirtieth, 2025 by Bob Ciura

The S&P 500 has been traditionally overvalued (in hindsight) continuous since 2010 utilizing the Shiller P/E ratio.

The Shiller P/E ratio makes use of a mean of 10 years of earnings for the “E” (earnings) within the P/E ratio to clean out outcomes and make the metric related when earnings short-term flip destructive, throughout recessions.

The historic common Shiller P/E ratio is 17.3. It’s presently at 40.0. Subsequently, the S&P 500 is 131% overvalued in line with the Shiller P/E ratio.

When the market is overvalued, traders ought to look to high quality dividend progress shares, notably these which can be undervalued.

For instance, the free excessive dividend shares listing spreadsheet beneath has our full listing of particular person securities (shares, REITs, MLPs, and so on.) with with 5%+ dividend yields.

Fortuitously, there are nonetheless loads of sturdy dividend shares which can be moderately valued.

The next article will rank 10 dividend shares primarily based within the U.S., which can be presently buying and selling at or beneath the Shiller P/E of 17.3.

As well as, they’ve Dividend Danger Scores of ‘C’ or higher within the Positive Evaluation Analysis Database, and dividend yields above 2%.

The listing is sorted by annual anticipated returns over the following 5 years, from lowest to highest.

Desk of Contents

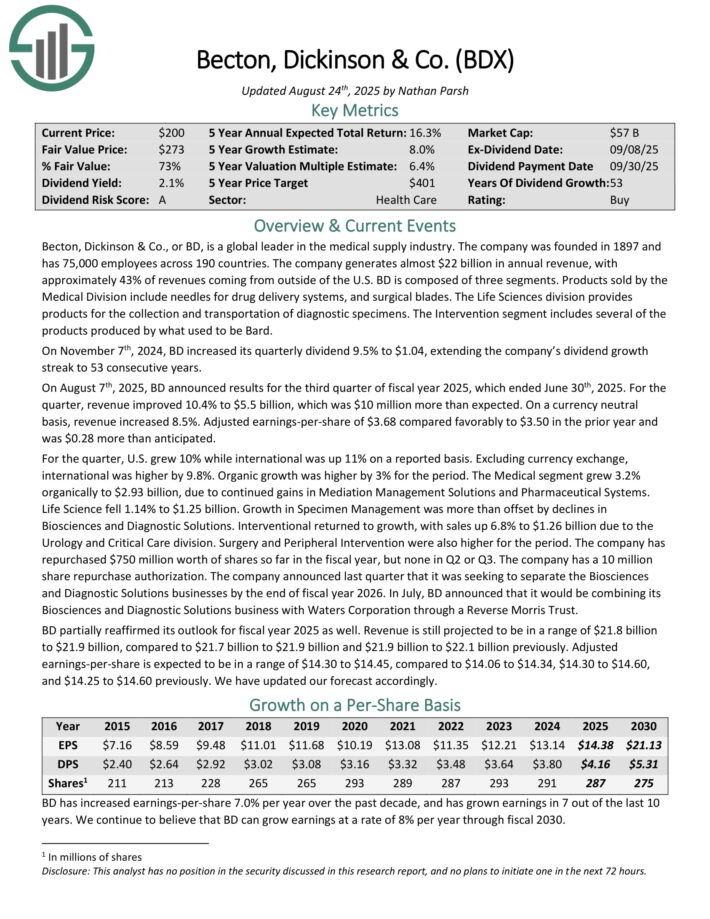

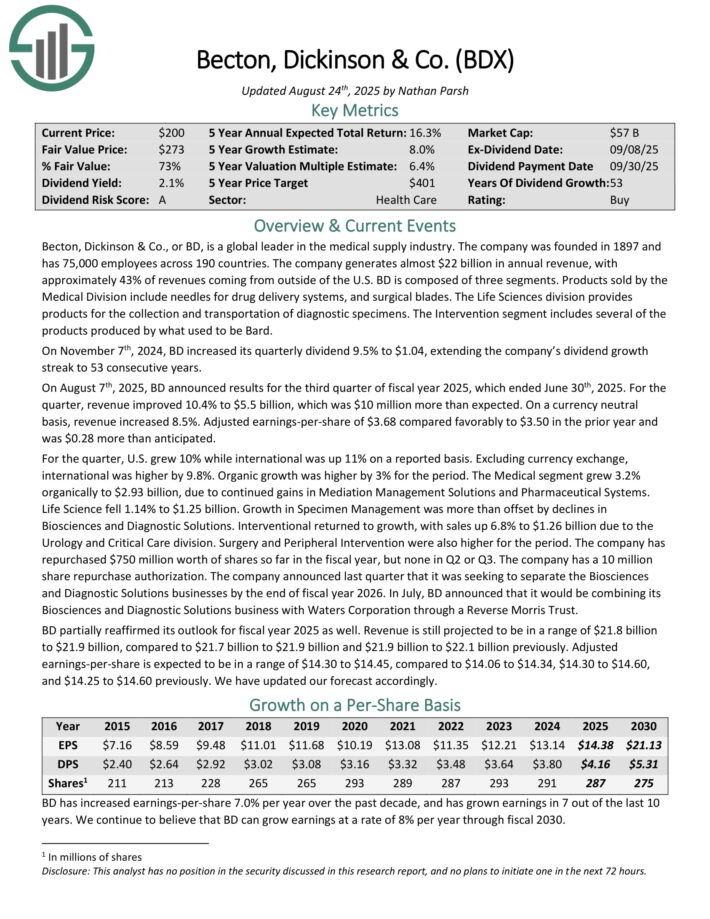

Cut price Dividend Inventory #10: Becton, Dickinson & Co. (BDX)

- Annual Anticipated Returns: 18.3%

Becton, Dickinson & Co. is a world chief within the medical provide trade. The corporate was based in 1897 and has 75,000 workers throughout 190 international locations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

Becton, Dickinson & Co., or BD, is a world chief within the medical provide trade. The corporate generates virtually $22 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

BD consists of three segments. Merchandise bought by the Medical Division embrace needles for drug supply methods, and surgical blades. The Life Sciences division supplies merchandise for the gathering and transportation of diagnostic specimens. The Intervention section consists of a number of of the merchandise produced by what was Bard.

On August seventh, 2025, BD introduced outcomes for the third quarter of fiscal yr 2025, which ended June thirtieth, 2025. For the quarter, income improved 10.4% to $5.5 billion, which was $10 million greater than anticipated.

On a foreign money impartial foundation, income elevated 8.5%. Adjusted earnings-per-share of $3.68 in contrast favorably to $3.50 within the prior yr and was $0.28 greater than anticipated.

For the quarter, U.S. grew 10% whereas worldwide was up 11% on a reported foundation. Excluding foreign money change, worldwide was larger by 9.8%. Natural progress was larger by 3% for the interval.

The Medical section grew 3.2% organically to $2.93 billion, on account of continued beneficial properties in Mediation Administration Options and Pharmaceutical Programs.

Life Science fell 1.14% to $1.25 billion. Progress in Specimen Administration was greater than offset by declines in Biosciences and Diagnostic Options. Interventional returned to progress, with gross sales up 6.8% to $1.26 billion as a result of Urology and Crucial Care division. Surgical procedure and Peripheral Intervention have been additionally larger for the interval.

BD partially reaffirmed its outlook for fiscal yr 2025 as effectively. Income continues to be projected to be in a spread of $21.8 billion to $21.9 billion, in comparison with $21.7 billion to $21.9 billion and $21.9 billion to $22.1 billion beforehand. Adjusted earnings-per-share is predicted to be in a spread of $14.30 to $14.45.

Click on right here to obtain our most up-to-date Positive Evaluation report on BDX (preview of web page 1 of three proven beneath):

Cut price Dividend Inventory #9: KBR, Inc. (KBR)

- Annual Anticipated Returns: 18.4%

KBR is a world expertise and engineering options supplier specializing in mission-critical protection, aerospace, and sustainable vitality initiatives.

The corporate operates in two segments: Mission Know-how Options, which supplies protection, intelligence, area, and labeled mission help for presidency companies, and Sustainable Know-how Options, which focuses on clear vitality, digital options, and superior engineering providers.

KBR operates in over 29 international locations and employs roughly 35,000 individuals. The agency generated $7.7 billion in income in 2024.

On July thirty first, 2025, KBR, Inc. introduced its second-quarter 2025 monetary outcomes for the interval ending July 4th, 2025. The corporate reported web revenue of $73 million for Q2 2025, down from $106 million in Q2 2024, primarily impacted by the HomeSafe Alliance JV contract termination, partially offset by progress in protection and sustainable expertise segments.

Diluted earnings per share (EPS) declined to $0.56, in comparison with $0.79 within the prior-year quarter. Quarterly web gross sales reached $1.95 billion, a 6% enhance year-over-year. The Mission Know-how Options (MTS) section grew 7% to $1.412 billion, supported by new and current U.S. Division of Protection contracts and contributions from the LinQuest acquisition.

The Sustainable Know-how Options (STS) section noticed a 2% enhance to $540 million, pushed by growing demand for sustainable applied sciences and robust LNG venture execution. Adjusted EBITDA totaled $242 million, up 12% from $216 million a yr in the past, with an adjusted EBITDA margin of 12.4%.

Administration now expects full-year 2025 income between $7.9 billion and $8.1 billion, revised down from the prior $8.7 billion to $9.1 billion vary, in comparison with $7.7 billion in 2024. If income reaches the higher finish of steering, 2025 would nonetheless mark a brand new all-time excessive.

Click on right here to obtain our most up-to-date Positive Evaluation report on KBR (preview of web page 1 of three proven beneath):

Cut price Dividend Inventory #8: Sonoco Merchandise (SON)

- Annual Anticipated Returns: 19.5%

Sonoco Merchandise supplies packaging, industrial merchandise and provide chain providers to its clients. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend progress streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior yr, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Shopper Packaging revenues surged 110% to $1.23 billion, largely on account of contributions from Eviosys.

Quantity progress was sturdy and favorable foreign money change charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million as a result of affect of international foreign money change charges and decrease quantity following two plant divestitures in China final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

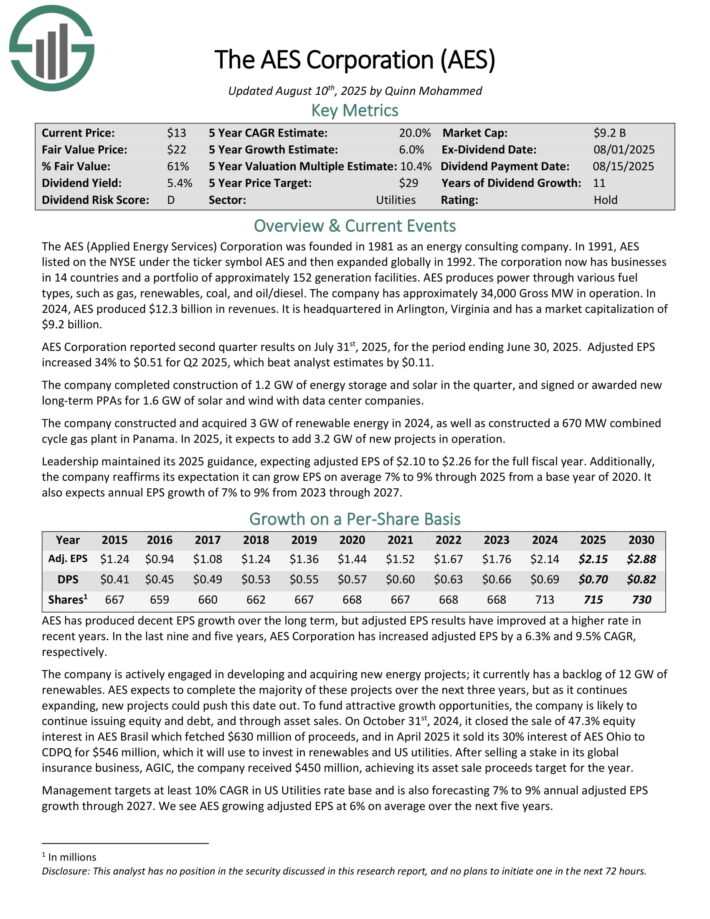

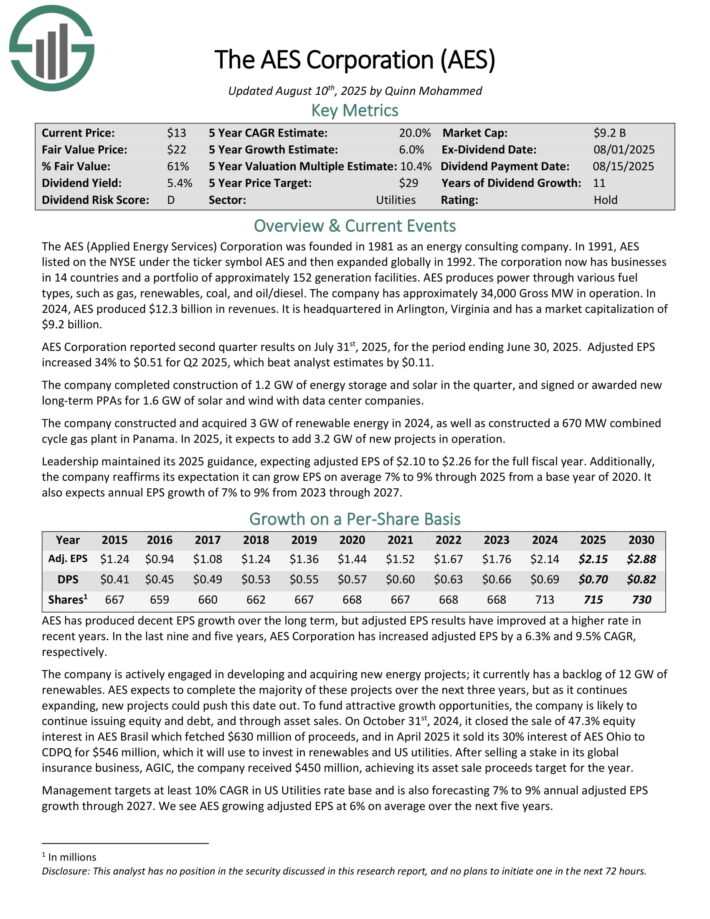

Cut price Dividend Inventory #7: AES Corp. (AES)

- Annual Anticipated Returns: 20.5%

The AES (Utilized Vitality Providers) Company has companies in 14 international locations and a portfolio of roughly 160 era services. AES produces energy by way of varied gasoline sorts, comparable to fuel, renewables, coal, and oil/diesel.

The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported second quarter outcomes on July thirty first, 2025, for the interval ending June 30, 2025. Adjusted EPS elevated 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The corporate accomplished building of 1.2 GW of vitality storage and photo voltaic within the quarter, and signed or awarded new long-term PPAs for 1.6 GW of photo voltaic and wind with knowledge middle corporations.

The corporate constructed and purchased 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle fuel plant in Panama. In 2025, it expects so as to add 3.2 GW of latest initiatives in operation. Management maintained its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the total fiscal yr.

Moreover, the corporate reaffirms its expectation it could possibly develop EPS on common 7% to 9% by way of 2025 from a base yr of 2020. It additionally expects annual EPS progress of seven% to 9% from 2023 by way of 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven beneath):

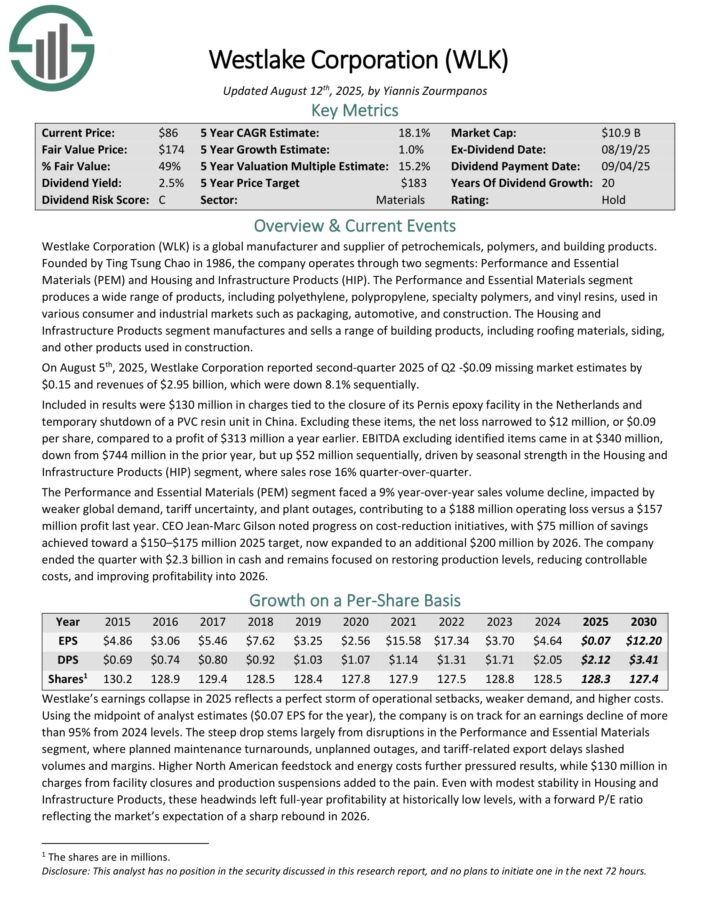

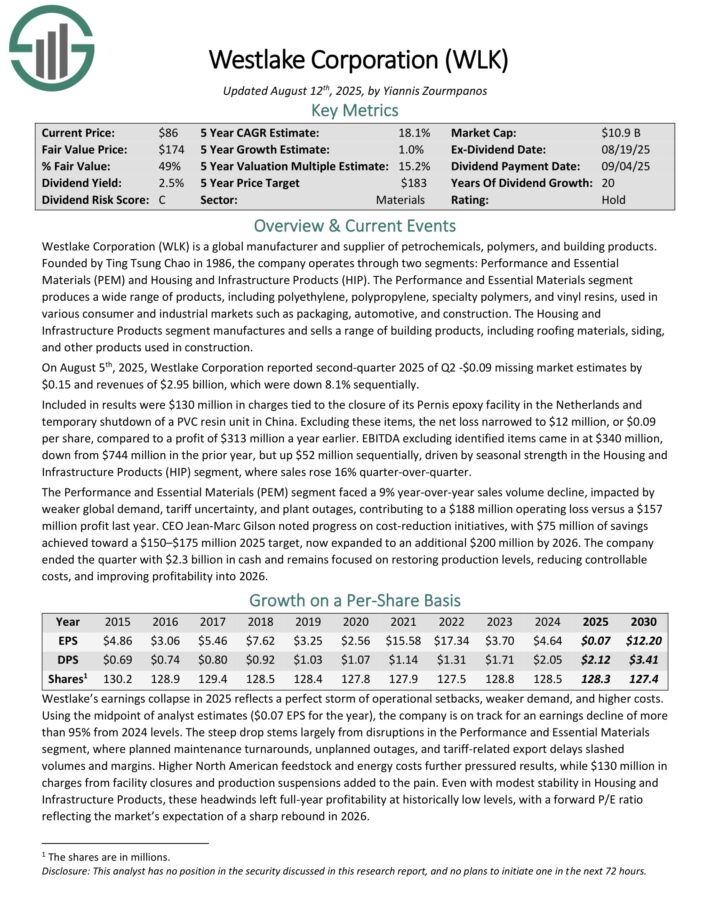

Cut price Dividend Inventory #6: Westlake Company (WLK)

- Annual Anticipated Returns: 20.7%

Westlake Company is a world producer and provider of petrochemicals, polymers, and constructing merchandise. Based by Ting Tsung Chao in 1986, the corporate operates by way of two segments: Efficiency and Important Supplies (PEM) and Housing and Infrastructure Merchandise (HIP).

The Efficiency and Important Supplies section produces a variety of merchandise, together with polyethylene, polypropylene, specialty polymers, and vinyl resins, utilized in varied client and industrial markets comparable to packaging, automotive, and building.

The Housing and Infrastructure Merchandise section manufactures and sells a spread of constructing merchandise, together with roofing supplies, siding, and different merchandise utilized in building.

On August fifth, 2025, Westlake Company reported second-quarter 2025 of Q2 -$0.09 lacking market estimates by $0.15 and revenues of $2.95 billion, which have been down 8.1% sequentially.

Included in outcomes have been $130 million in expenses tied to the closure of its Pernis epoxy facility within the Netherlands and short-term shutdown of a PVC resin unit in China. Excluding this stuff, the web loss narrowed to $12 million, or $0.09 per share, in comparison with a revenue of $313 million a yr earlier.

EBITDA excluding recognized gadgets got here in at $340 million, down from $744 million within the prior yr, however up $52 million sequentially, pushed by seasonal energy within the Housing and Infrastructure Merchandise (HIP) section, the place gross sales rose 16% quarter-over-quarter.

The Efficiency and Important Supplies (PEM) section confronted a 9% year-over-year gross sales quantity decline, impacted by weaker world demand, tariff uncertainty, and plant outages, contributing to a $188 million working loss versus a $157 million revenue final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on WLK (preview of web page 1 of three proven beneath):

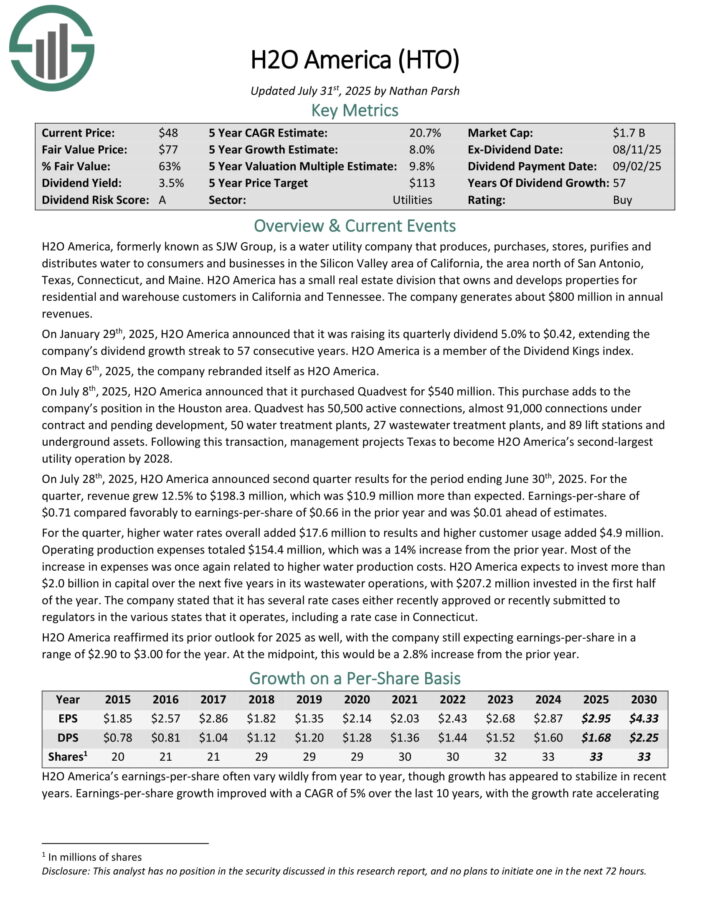

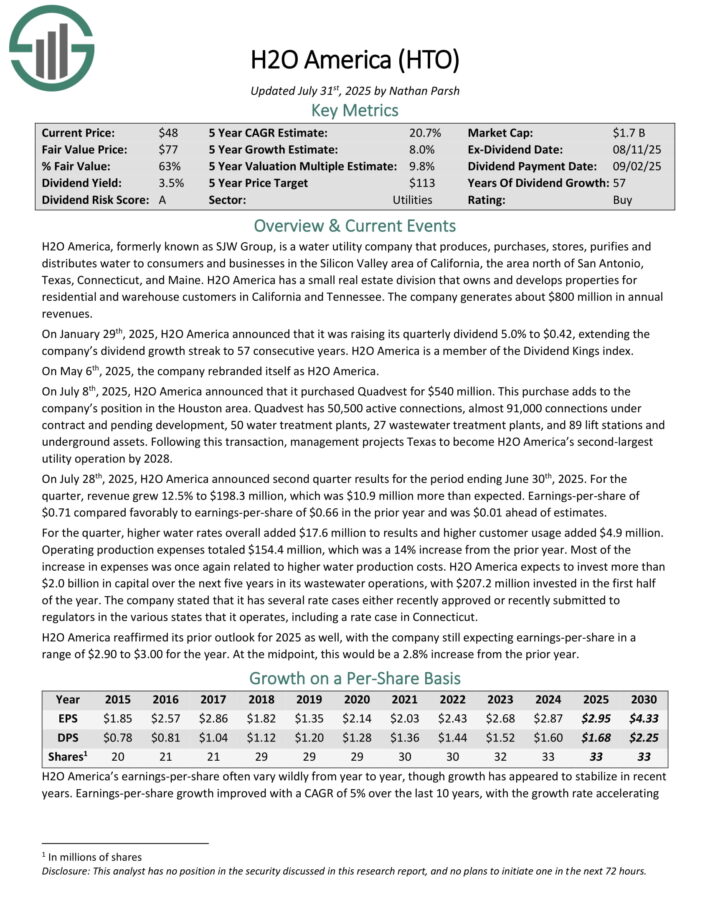

Cut price Dividend Inventory #5: H2O America (HTO)

- Annual Anticipated Returns: 20.8%

H2O America, previously often known as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the world north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 energetic connections, virtually 91,000 connections beneath contract and pending growth, 50 water remedy crops, 27 wastewater remedy crops, and 89 raise stations and underground belongings.

On July twenty eighth, 2025, H2O America introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 12.5% to $198.3 million, which was $10.9 million greater than anticipated.

Earnings-per-share of $0.71 in contrast favorably to earnings-per-share of $0.66 within the prior yr and was $0.01 forward of estimates.

For the quarter, larger water charges general added $17.6 million to outcomes and better buyer utilization added $4.9 million. Working manufacturing bills totaled $154.4 million, which was a 14% enhance from the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on HTO (preview of web page 1 of three proven beneath):

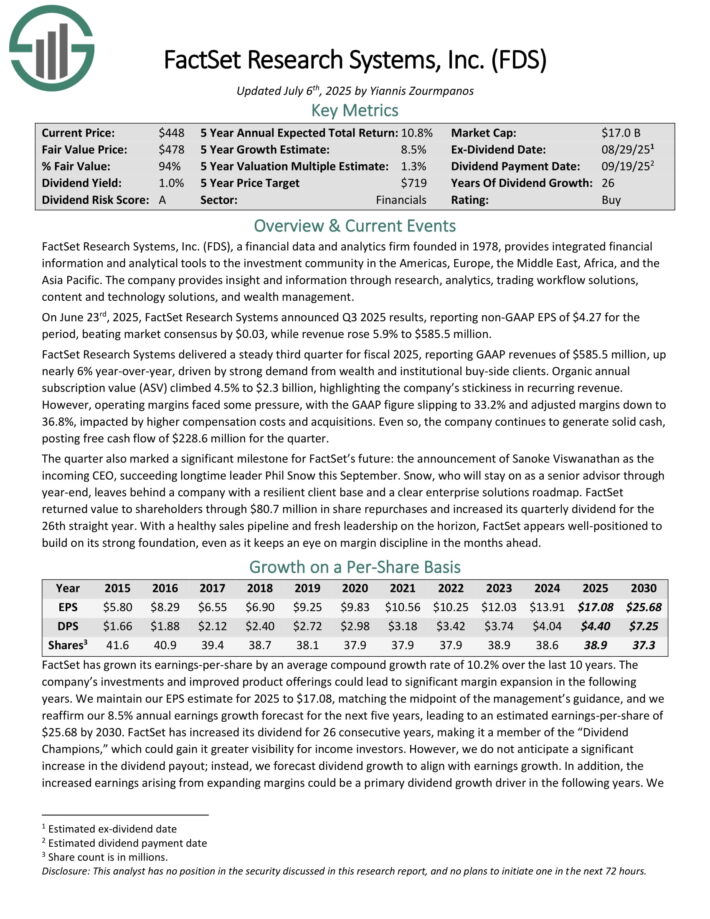

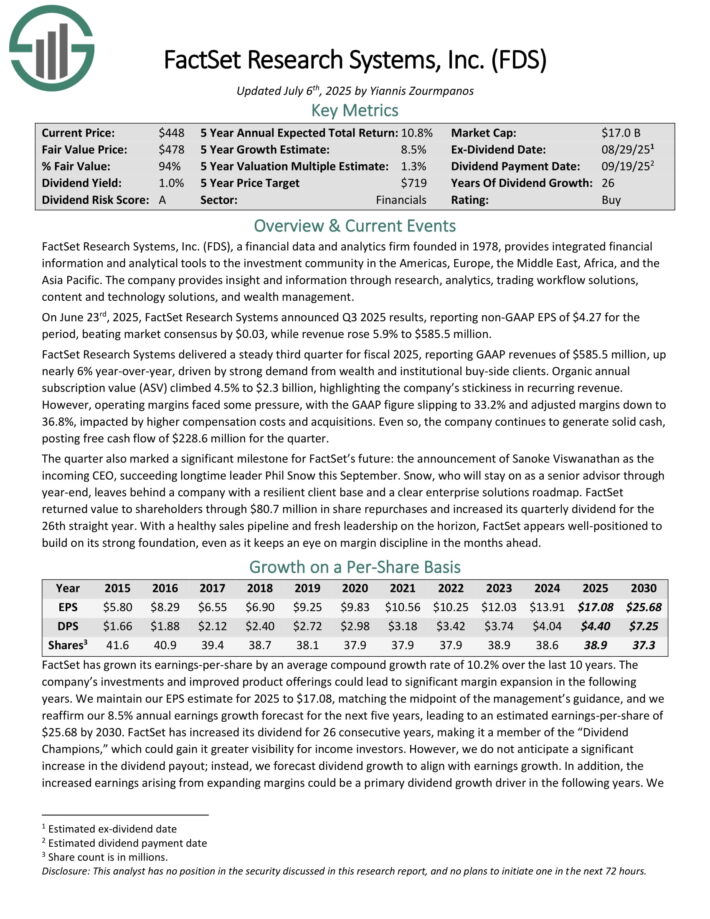

Cut price Dividend Inventory #4: FactSet Analysis Programs (FDS)

- Annual Anticipated Returns: 20.8%

FactSet Analysis Programs, a monetary knowledge and analytics agency based in 1978, supplies built-in monetary data and analytical instruments to the funding group within the Americas, Europe, the Center East, Africa, and Asia-Pacific.

The corporate supplies perception and knowledge by way of analysis, analytics, buying and selling workflow options, content material and expertise options, and wealth administration.

On June twenty third, 2025, FactSet Analysis Programs introduced Q3 2025 outcomes, reporting non-GAAP EPS of $4.27 for the interval, beating market consensus by $0.03, whereas income rose 5.9% to $585.5 million.

It delivered a gentle third quarter for fiscal 2025, reporting GAAP revenues of $585.5 million, up practically 6% year-over-year, pushed by sturdy demand from wealth and institutional buy-side shoppers.

Natural annual subscription worth (ASV) climbed 4.5% to $2.3 billion, highlighting the corporate’s stickiness in recurring income.

Nonetheless, working margins confronted some stress, with the GAAP determine slipping to 33.2% and adjusted margins right down to 36.8%, impacted by larger compensation prices and acquisitions.

Even so, the corporate continues to generate stable money, posting free money move of $228.6 million for the quarter.

FactSet returned worth to shareholders by way of $80.7 million in share repurchases and elevated its quarterly dividend for the twenty sixth straight yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on FDS (preview of web page 1 of three proven beneath):

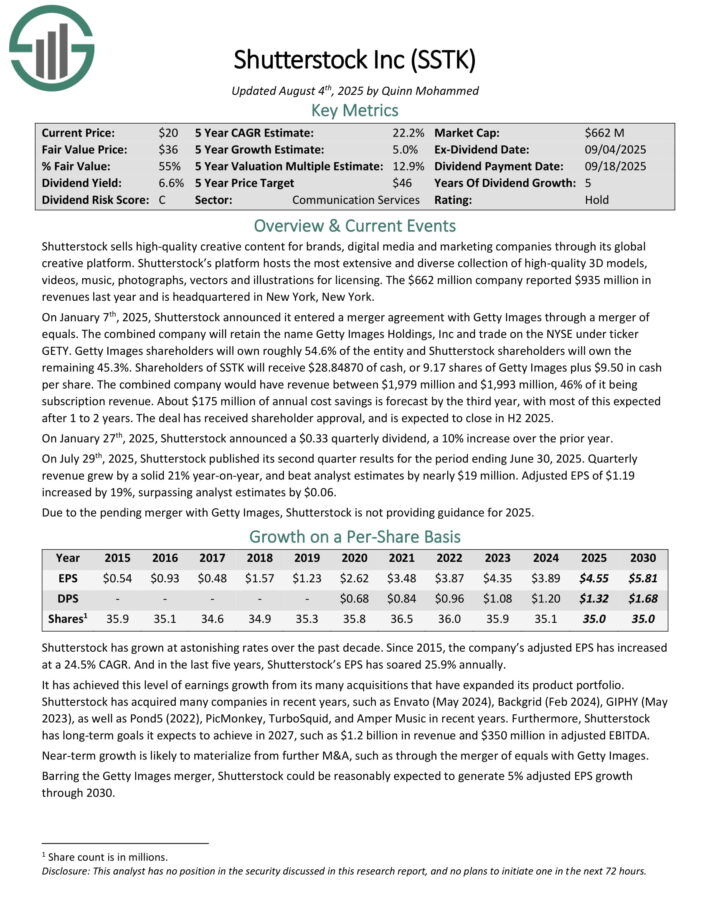

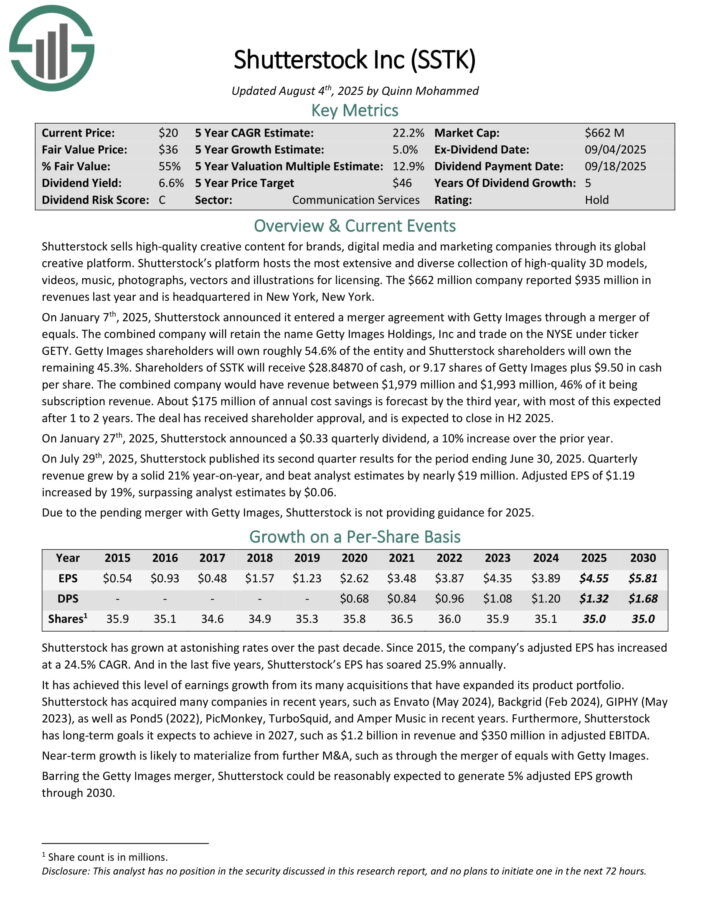

Cut price Dividend Inventory #3: Shutterstock, Inc. (SSTK)

- Annual Anticipated Returns: 21.0%

Shutterstock sells high-quality artistic content material for manufacturers, digital media and advertising and marketing corporations by way of its world artistic platform.

Its platform hosts essentially the most in depth and numerous assortment of high-quality 3D fashions, movies, music, images, vectors and illustrations for licensing. The corporate reported $935 million in revenues final yr.

On January seventh, 2025, Shutterstock introduced it entered a merger settlement with Getty Pictures by way of a merger of equals. The mixed firm will retain the identify Getty Pictures Holdings, Inc and commerce on the NYSE beneath ticker GETY.

Getty Pictures shareholders will personal roughly 54.6% of the entity and Shutterstock shareholders will personal the remaining 45.3%. Shareholders of SSTK will obtain $28.84870 of money, or 9.17 shares of Getty Pictures plus $9.50 in money per share.

The mixed firm would have income between $1,979 million and $1,993 million, 46% of it being subscription income. About $175 million of annual value financial savings is forecast by the third yr, with most of this anticipated after 1 to 2 years.

On July twenty ninth, 2025, Shutterstock revealed its second quarter outcomes for the interval ending June 30, 2025. Quarterly income grew by a stable 21% year-on-year, and beat analyst estimates by practically $19 million. Adjusted EPS of $1.19 elevated by 19%, surpassing analyst estimates by $0.06.

Click on right here to obtain our most up-to-date Positive Evaluation report on SSTK (preview of web page 1 of three proven beneath):

Cut price Dividend Inventory #2: Constellation Manufacturers (STZ)

- Annual Anticipated Returns: 21.5%

Constellation Manufacturers was based in 1945. The corporate produces and distributes alcoholic drinks together with beer, wine, and spirits. It’s the third largest beer firm within the U.S., and imports and sells beer manufacturers comparable to Corona, Modelo Especial (the #1 Beer in U.S.), Modelo Negra, and Pacifico.

As well as, Constellation has many wine manufacturers together with Robert Mondavi and Kim Crawford, in addition to spirits manufacturers together with Casa Noble Tequila, and Excessive West Whiskey. The corporate additionally has a stake in hashish firm Cover Progress.

In June 2025, Constellation accomplished its divestiture of a few of its wine and spirits manufacturers to The Wine Group. The manufacturers divested embrace Woodbridge, Meiomi, Robert Mondavi Personal Choice, Prepare dinner’s, SIMI, and J. Roget glowing wine, in addition to its stock, services, and vineyards. Constellation retained its high-end wine and spirits manufacturers.

On July 1st, 2025, Constellation Manufacturers reported first quarter fiscal 2026 outcomes for the interval ending Could 31, 2025. For the quarter, the corporate recorded $2.52 billion in web gross sales, down 6% in comparison with the identical prior yr interval. Beer gross sales fell 2% year-over-year, whereas wine and spirits gross sales plunged 28%.

Comparable earnings-per-share equaled $3.22 for the quarter, which was 10% decrease in comparison with Q1 2025, and $0.07 behind analyst estimates.

Within the first quarter, Constellation Manufacturers repurchased $306 million of its shares and paid $182 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on STZ (preview of web page 1 of three proven beneath):

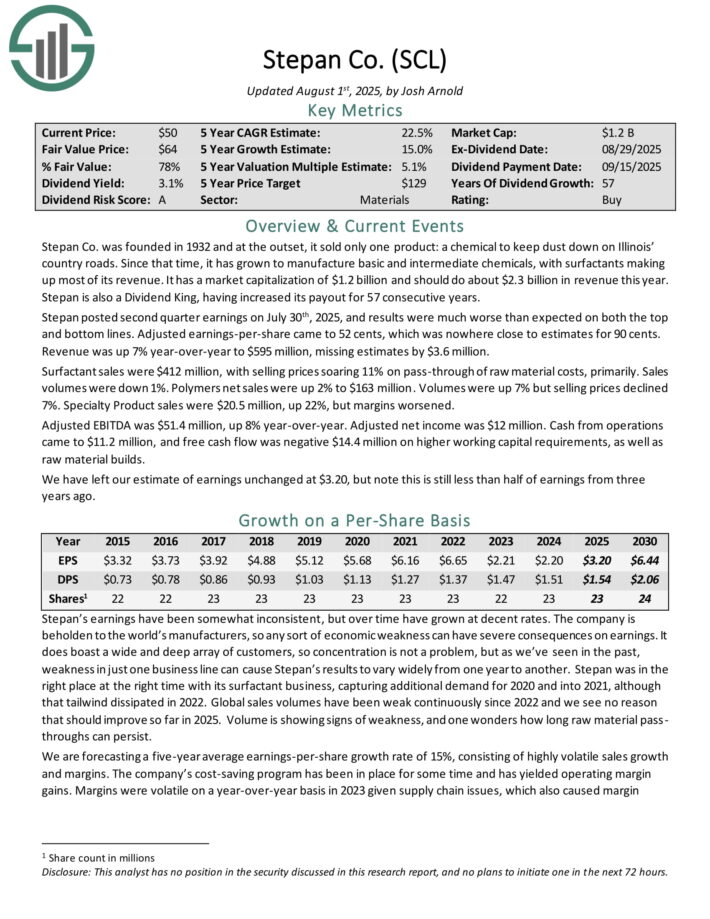

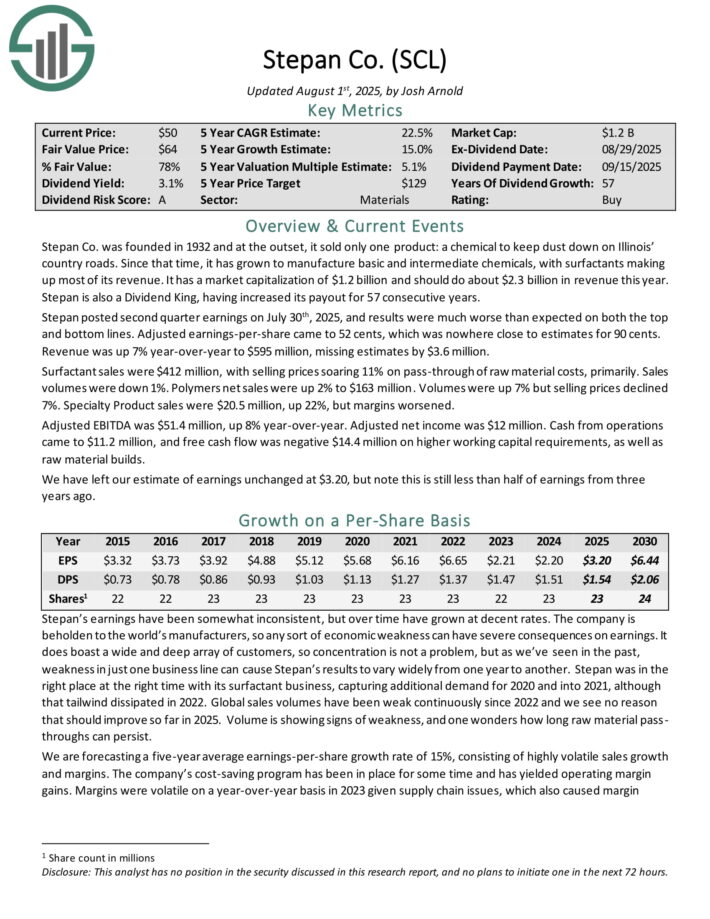

Cut price Dividend Inventory #1: Stepan Co. (SCL)

- Annual Anticipated Returns: 23.9%

Stepan manufactures fundamental and intermediate chemical compounds, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular substances for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets.

The surfactants enterprise is Stepan’s largest by income. A surfactant is an natural compound that incorporates each water-soluble and water-insoluble elements.

Stepan posted second quarter earnings on July thirtieth, 2025, and outcomes have been a lot worse than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 52 cents, which was nowhere near estimates for 90 cents. Income was up 7% year-over-year to $595 million, lacking estimates by $3.6 million.

Surfactant gross sales have been $412 million, with promoting costs hovering 11% on pass-through of uncooked materials prices, primarily. Gross sales volumes have been down 1%. Polymers web gross sales have been up 2% to $163 million. Volumes have been up 7% however promoting costs declined 7%. Specialty Product gross sales have been $20.5 million, up 22%, however margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted web revenue was $12 million. Money from operations got here to $11.2 million, and free money move was destructive $14.4 million on larger working capital necessities, in addition to uncooked materials builds.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCL (preview of web page 1 of three proven beneath):

Last Ideas

The U.S. inventory market, as measured by the S&P 500 Index, has been on a virtually uninterrupted bull market for the reason that Nice Recession resulted in 2009, aside from transient downturns occasionally.

Because of this, the market’s valuation a number of has reached a historic file.

Cautious traders can nonetheless discover high quality dividend shares with engaging yields which can be undervalued, comparable to the ten cut price dividend progress shares on this article.

In case you are keen on discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].